You just need extra cash immediately for various reasons. Perhaps you got a terrible sickness and need to cover medical bills, or another emergency came up. In those situations, you could try using the best apps for instant money.

You can find numerous mobile tools that can help you get the amount you need as quickly as possible. However, you can’t just pick the first one that comes up. Otherwise, you may encounter hidden costs or get into more financial trouble.

That’s why we will go through the top-rated apps that can get you extra money before the paycheck arrives. After that, we will talk more about their pros and cons, so you can choose the right one. More importantly, we will discuss alternatives to cash advance apps.

10 of the Best Cash Advance Apps

- Empower – Best cash advance app with low fees

- Earnin – Best cash advance app for hourly wages

- Varo – When you need to get paid quickly

- Possible Finance – For large cash advances

- Brigit – When you want zero hidden fees

- Moves – Best early payday app for freelancers

- Dave – Best app for improving your credit

- Current – For using that cash advance effectively

- PayDaySay – When you need to borrow ASAP

- PayActiv – Helping businesses provide cash advances

1. Empower: Overall Best App for Instant Money

Photo Credit: empower.me

There are two reasons why Empower is my number one early payday app: it lets you spend a part of your paycheck early, and it helps you keep track of your expenses.

Empower is a debit card with a mobile app that lets you take out up to $250 two days before your paycheck comes. Also, it does this without charging interest and late fees.

What’s more, the Empower card lets you spend at retail stores while earning up to 10% cashback. It also lets you withdraw funds at more than 37,000 ATMs across the United States.

The FDIC insures up to $250,000 of the funds deposited in Empower accounts. Even better, the Empower app has various personal finance features, such as:

- AutoSave – Empower’s Automatic Savings features let you assign weekly savings goals. Then, the app will keep track of your checking account’s daily activities, such as the money coming in and out of it. The Empower app will also set aside extra money as savings based on your preferences.

- Budget planning – You may assign spending trackers for various types of expenses, so you could place a limit on how much money you’ll use. For example, you may set a $300 limit for your monthly online shopping.

- Monthly reports – Empower boosts personal finance even more by giving a breakdown of your expenses for each month, so you can see other ways to improve your budget.

- Smart recommendations – You don’t even have to check the budget yourself, as Empower may suggest ways to improve it.

Empower isn’t just an app for instant money, but it’s also a nifty personal finance app. Many of my articles teach financial literacy, so that feature is a great plus for me.

You may also like: 6 Indicators That Your Business Is Financially Healthy

2. Earnin: Best Cash Advance App for Hourly Wages

Photo Credit: nypost.com

What if you get paid per day? That’s how work is for many people, but there aren’t enough cash advance apps for their needs. Fortunately, that’s where the Earnin app can help you.

This credit card cash advance app lets you get the money you’ve earned right away, even if it isn’t your payday yet. Using Earnin is pretty easy and simple, too.

Make an account, download the app, link your checking account, and you’re set. You don’t have to worry about credit scores, interest rates, or hidden charges.

You can even get 10% cashback if you link certain credit cards from participating locations. As a result, you get even more bang for your buck with Earnin.

It even helps you avoid going overboard with spending, as you can set alerts. This cash advance app will send a notification if your funds drop beyond a specified amount.

If you’re worried about overdraft fees, the Earnin app can send an automatic $100 cash advance to your account. This could keep you from going below zero.

Similar to most cash advance apps, you can download and use this for free. Yet, you may want to send a tip if you’re satisfied with Earnin. There are a few problems with this, though.

You should be receiving your paychecks every month or every two weeks. This makes the Earnin app not suitable for freelancers who typically have irregular pay periods.

While it has high ratings on app stores, many of the recent reviews are negative. Most of them are complaints about how the Earnin app has become less functional compared to its initial launch.

Of course, it still has positive reviews, and your experience with this cash advance app may vary. Nevertheless, feel free to try the Earnin app for free.

3. Varo: When You Need to Get Paid Quickly

Photo Credit: overdraftapps.com

The Varo app has all that you expect from a payday advance app. Unlike these brick-and-mortar locations, you don’t have to wait several days to receive your money.

Specifically, this online tool lets you get the funds two days before it appears in your bank account. Take a look at how the Varo app works:

- Before the next pay period, your employer will submit payroll documents to the Fed, so it can start the direct deposit process.

- Then, the Federal Reserve notifies the Varo app of how much money you should receive in your next paycheck.

- Once it receives the direct deposit alert, the app will wire the funds to your account. The Varo app often receives notifications for Friday paydays on Wednesdays.

What’s more, the Varo app lets you access tax refunds early using direct deposits. It doesn’t perform credit checks, and it doesn’t require a minimum bank account balance.

Similar to the other cash advance apps, it doesn’t charge interest or hidden costs. Still, the Varo app sets itself apart from competitors as it’s a full-service online bank.

This means you can have a bank account with Varo. Moreover, it has a savings feature that automatically uses a portion of your next paycheck and changes from transactions.

Each time you get a cash advance or buy something, you can allocate funds for a savings account. Your accumulated savings could serve as another source of instant money.

Still, the Varo app has a few issues. First, you need to have an active bank account that is at least a month old, and it should have made monthly direct deposits worth a total of $1,000.

4. Possible Finance: For Large Cash Advances

Photo Credit: possiblefinance.com

Most cash advance apps will let you take $100 from your paycheck early. What if you need a larger amount? Then, the Possible app might just be the tool for you.

It’s a payday advance app that lets you borrow up to $500 within a few minutes. That can come in handy if you need to cover a medical emergency or similar matters.

The Possible app lets you pay over time in four monthly installments. Also, it won’t charge late fees, origination fees, or penalty fees. You can even earn a reward the more you use it.

Specifically, you can become eligible for the Possible Card, which lets you have a credit limit of $400 or $800. Similar to the mobile app, this plastic swiper doesn’t charge fees or interest.

You don’t have to go through a credit check, either. This can come in handy if you need to raise your credit score. After all, this allows you to take a huge sum from your pay before the paycheck arrives.

This means you can cover debt payments on time. Since payment history is 30% of your credit score, on-time payments can be a huge boost to your rating.

Of course, the Possible app has a few issues too. For example, you can only use this mobile app in 15 states. The instant cash advances also depend on your location.

This means the amount you can take out early may change based on that. You could use it as an instant loan app, but the terms will depend on your state as well.

5. Brigit: When You Want Zero Hidden Fees

Photo Credit: play.google.com

Getting cash advances from a mobile app sounds neat, right? That is until you remember that some of them have hidden fees. If you’d like to make sure that doesn’t happen, you might want to try Brigit.

Visit the homepage, and it immediately tells you that you can take out $250 from your paycheck instantly. You don’t need to go through a credit check or pay interest.

As mentioned, you can pay your borrowed amount as is without tips, interest, or hidden payments in the way. Brigit even gives you free resources about financial literacy.

Similar to Possible Finance, this instant loan app can help you improve your credit health. You can get even more perks by signing up for the Brigit Plus plan.

For just $9.99 a month, it can automate your advanced cash withdrawals. This paid plan can set Brigit apart from other cash advance apps by letting you extend the deadline on your first loan.

Brigit Plus also includes credit monitoring, instant deposits, and identity theft insurance. Still, this instant money app has a few flaws, such as its many requirements:

- You need to get at least a 70/100 on Brigit’s scoring system, or it won’t let you get your next paycheck early.

- You have to prove that your employer gave you more than three direct deposits in a row.

- Also, you need an active checking account with a positive balance.

6. Moves: Best Early Payday App for Freelancers

Photo Credit: movesfinancial.com

Millions of Americans had to shift to remote work due to recent events. Nowadays, more companies allow them back into their offices, but they want to keep working from home.

Many of them saw the benefits of remote work, such as achieving work-life balance. However, being a freelancer brings a lot of complicated issues as well.

Fortunately, the Moves app is one of the few cash advance apps for freelancers. What’s great about it is that it lets you access money instantly up to $1,000 without charging interest.

You may also like: How to Do the 52-Week Money Challenge Successfully

The Moves app understands the flexibility of remote work, so it lets you have a flexible payment schedule. That way, you can adjust the repayment terms whenever you need them.

As you’ll notice, this instant loan app works a bit differently from the others we’ve mentioned. Yet, applying for the Moves app is as simple as one, two, and three:

- Create an account and verify how much you earn from your gig.

- The Moves team will review your income history to see how much it could lend.

- Expect to receive the results within a day. If you’re approved, you’ll see the approved amount show up in your bank account within 1 to 3 business days.

Whether you have a gig business or a freelance role, the Moves app is here to help. It doesn’t require paperwork or credit checks, and it won’t charge fees for maintenance or overdraft.

If you’re not self-employed, you might want to check the other entries on this list, such as Empower and Dave. Those have features that you may not find in the Moves app.

7. Dave: Best App for Improving Your Credit

Photo Credit: beebom.com

Some people just want their app to help them get their money instantly, but what if you want to also improve your credit score? After all, good credit helps you access extra cash when you need it.

Fortunately, the Dave app has those features. What sets it apart from other cash advance apps is LevelCredit. It’s a free subscription service that makes sure credit bureaus get your payment history on time.

You could build your credit in other ways, but credit bureaus may not apply your efforts to your credit record on time. That’s because banks may sometimes take time to send your updated info to these institutions.

LevelCredit can make that a thing of the past by compiling qualified debit purchases. The service will compile that into your latest credit history and send it to the credit bureaus every month.

Payment history takes up 30% of your credit score. It goes up with on-time payments and drops with late ones. If you improve this factor, you could drastically boost your rating.

You’ve seen instant loan apps that allow large cash withdrawals, but how about small ones? Fortunately, the Dave app allows cash advances of up to $5.00.

This is great if you don’t have huge overdraft fees since it keeps your withdrawals to a minimum. Similar to the other cash advance apps, Dave doesn’t require credit checks, interest payments, or a specific account balance.

Sadly, there are a few things that keep the Dave app from being higher on this list. The biggest factor is that you will have to pay a monthly membership fee to use this app.

That’s a dollar per month plus tips if you’d like to add some. Most of the direct deposit apps on this list provide nearly all the features of the Dave app, but they don’t require a monthly payment.

It also takes money from your bank account automatically, so it can repay your advanced paycheck. Some users aren’t too keen on such a feature, especially if they’re closely tracking their budgets.

As mentioned, the credit-building feature sets it apart from most cash advance apps. You can’t use it if you don’t have a Dave Spending account and direct deposits.

8. Current: For Using Cash Advance Effectively

Photo Credit: wellkeptwallet.com

You’ve seen a lot of mobile services that can help you get the next paycheck sooner than usual. What about an instant loan app that helps you manage your expenses?

That’s where the Current app can help you. It’s designed to help users spend less money on fees and learn ways how to manage a budget more efficiently.

Similar to the other cash advance apps, this one lets you take a portion of your paycheck before it arrives. The Current app also doesn’t require credit checks. Also, it has instant gas hold refunds.

Let’s say you just filled up your tank, and you needed to buy something. That can be frustrating since you might not have enough balance in your bank account.

If you make more debit purchases, you might incur overdraft fees. Aside from providing overdraft protection, the Current app lets you make such purchases without your recent gas purchase in the way.

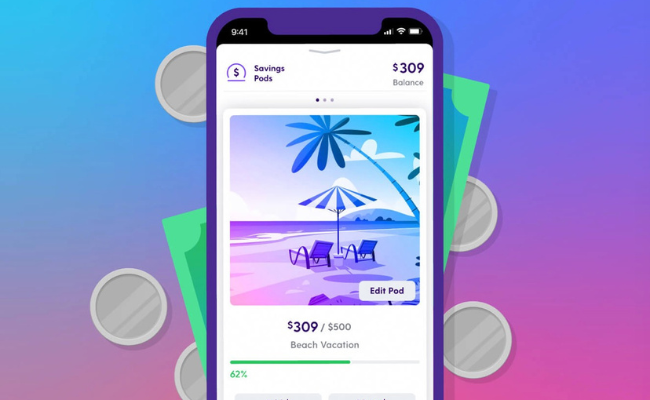

You can also apply for a Current premium account, so you can have Savings Pods. It lets you allocate funds to specific goals, such as building an emergency fund.

Just adjust the settings, and the Current app will automatically send a direct deposit to each Pod. Just sit back and let the app build your financial goals.

That is if you have a debit card. The Current app will not accept your checking account. Also, you will need a Premium account if you want overdraft protection.

It costs $4.99 a month even though other paycheck advance apps provide the option for free. That’s why the Current app is lower on this list.

9. PayDaySay: When You Need to Borrow ASAP

Photo Credit: fitmymoney.com

Let’s say you don’t have time to process advanced payouts. You just need money right here and now. In that case, perhaps you need PayDaySay.

It’s an instant loan app, but it’s more accurate to call it a peer-to-peer (P2P) lending app. PayDaySay just connects you with various lenders.

It has a list of banks that may give you a personal loan, provided that you meet their requirements. Similar to the other paycheck advance apps, PayDaySay doesn’t require a credit check.

You just need to provide your full name, active credit or savings account, and your phone number. After that, PayDaySay will recommend a list of lenders based on your current financial situation.

Unlike some of the cash advance apps, you don’t have to pay membership fees. However, your loan terms will depend on the lender you’ve chosen.

You will have to be careful when choosing lenders, as you may miss out on certain details. Look out for any hidden costs that you may have missed, or you may increase your debts.

Just like the other cash advance apps, PayDaySay can help you get money before your paycheck arrives. It’s just that you’ll be borrowing the funds instead of taking them from your next paycheck early.

It can be one of the best apps for instant money, but you just have to make sure you use it responsibly. Otherwise, you may create more financial problems in the long run.

10. PayActiv: Helping Businesses Provide Cash Advances

Photo Credit: play.google.com

We’ve gone through several cash advance apps that help employees, but are there others for employers? There are, and PayActiv is one of them. It might be a good idea to consider this service if you’re a business owner.

You can offer cash advances as a sort of perk in your company. Workers will appreciate this feature in the company, so it could increase worker retention and productivity in the long run.

The app can also facilitate distributing the payroll. PayActiv can enable access to paychecks, wages, tips, and reimbursements in one convenient platform.

What’s more, the app provides earned wage access, meaning they can transfer earnings straight to their savings or checking account. They can even get discounts with PayActiv.

It’s at the bottom of the list because it’s much more suitable for employers. Most people who use these cash advance apps are employees or gig workers, so PayActiv may not be for this majority.

What Are the Qualities I Should Check in These Apps?

You just have to be careful when selecting them. That’s why you should know the qualities that a great loan instant app should have. Let’s take a look at each one:

Qualifications

You have to create an account for each of these apps if you want to use them. However, they can have different requirements. Some only need a minimal amount of information.

For example, PayDaySay requires a full name, phone number, and active bank account from each of its users. Some, like Brigit, may have additional criteria.

As mentioned above, this app has a unique scoring system. If you want a paycheck advance from this tool, you’ll need to earn a 70/100 from it.

You may also like: Save Money on Fuel with the 6 Best Gas Apps

Bank Account Fees

Many of the apps on the previous list don’t require fees and other payments. Some let you give tips should you feel like doing so. Yet, not all instant cash apps are like this.

Some of them may charge exorbitant interest rates. Others could make a direct deposit from your bank account to your app account when you have an outstanding balance.

It can be hard to follow this factor when choosing an advanced payday app since you’ll have to perform some math. Yet, this is worth it if it means avoiding the potential hassle of a bad app.

Membership Problems

Just registering for an instant cash app can be risky since some of them have terms you may not expect. For example, an app may not have interest fees, but it could make it hard to cancel a membership.

Then, you might find out that it automatically takes direct deposit funds from your bank account to pay for “tips.” You can’t escape such terms, even if you delete the app.

That’s why you should ask how to cancel your subscription before signing up. It’s also a good idea to ask if you could pause your membership and find out what happens if you do so.

Overdrafts and Debit Dates

Remember how some of the apps on the list allow you to change the payment deadlines? Only the best has that feature, so you have to keep an eye out for it when choosing such an app.

Some will only let you make adjustments for a certain number of times. Others may only let you extend the payment period. Also, you have to look out for overdraft protection.

The best apps for instant money can keep you from spending beyond your current balance. Others may not, so you’re more likely to incur huge debt by using these apps.

What Are the Benefits of Cash Advance Apps?

As the name suggests, instant loan apps allow you to get funds within minutes. This is crucial for people who need to take care of emergencies as soon as possible.

Unlike banks, these apps don’t have a lot of requirements. This usually means no hidden costs or registration fees, but some don’t even require a credit check.

This is important if you’re trying to boost your credit score. A credit check could damage your rating, so people building credit would want to avoid credit inquiries as much as possible.

You may find this useful if you have poor credit right now. A low credit score keeps people from getting approved for personal loans and other debt instruments.

What’s more, you’re not limited to the limited offers provided by banks. Nowadays, the internet provides so many more options for nearly everything, specifically instant loan apps.

You can choose from a huge selection of such mobile services. Then, each of these apps has a wide range of lending options. As a result, you’re bound to find one that suits your current situation.

Do the Best Instant Money Apps Have Risks?

As mentioned earlier, some of them don’t have such a feature, so you’re more likely to build up a lot of overdraft payments. You should be especially wary of the terms if you’re getting advanced paychecks from lenders.

Make sure you follow their terms and repay them on time. Otherwise, these lenders may press legal charges. This can be difficult since most of their loans have short repayment periods.

In other words, they won’t give you a lot of time to give their money back. Such short-term loans need repayment within two weeks, which can be an unrealistic period for some folks.

Then, you may face problems if your loan instant app requires a credit card. This type of online platform may charge a higher interest rate than your plastic swiper.

As a result, you might have trouble repaying your advanced payout. This could bring more problems than it solves if you’re looking for a way to cover an emergency expense.

Are There Better Options Than a Cash Advance?

You may end up just taking out your future paycheck every month. That could be a sign that you’re not earning enough or spending too much.

Frequent cash advances won’t solve such an issue, but proper money management will. Start by planning a budget using the following steps:

However, this long-term plan may not help you if you truly need money immediately. In that case, you might want to just get a short-term loan from your local bank or credit union.

There are many other ways of managing your money aside from budgeting. Let’s take a look at the ways you can avoid relying on cash advances:

Use Fewer Credit Cards

If you have more than five credit cards, then those could be causing your financial problems. Perhaps you put balances on them regularly, so you end up paying high monthly payments.

Having that many sources of credit can lead to overspending. If one of them hits their credit limit, you could just pick another plastic swiper. You might even accumulate overdraft fees.

If you have multiple credit cards, be careful in canceling them. Your credit limit is a component of your credit utilization, which makes up 30% of your credit score.

Closing several credit cards will reduce your credit limit, causing a temporary increase in your credit score. Instead, you may want to set a few aside as backups and then stick to two cards.

Increase Your Income

Thanks to the remote work trend, you have more ways to earn money without going to another office. You could try applying for additional remote jobs that you can do after your full-time role.

For example, you could take freelance writer jobs after you’ve done your office work. Now that there are so many options, you’re likely to find one that suits your current situation.

Of course, you might find side gigs outside of the internet. If you have the time, perhaps you could try some of them. The extra cash could help you build an emergency fund.

Decrease Debts

Unpaid credit balances require you to send monthly payments. As a result, you have less money every month, so you’re more likely to use a cash advance.

It would be better to pay all the credit card balances you have as soon as possible. Fortunately, there are several ways you can do this:

- Consolidation – Banks can replace multiple credit card debts with one that has a lower interest rate. This is called debt consolidation, and it could help you meet monthly payments on time. As a result, you’re more likely to complete your installments.

- Snowball & Avalanche – You can perform do-it-yourself debt reduction methods, such as the debt snowball and the debt avalanche. The former is great if you’re having trouble sticking to a debt repayment plan. On the other hand, the debt avalanche can help you repay debts faster, but you’ll need more discipline to pull it off.

Build an Emergency Fund

You’re unlikely to use a cash advance if you have money set aside. In case something happens, you could simply take it from your savings.

This is by far one of the best alternatives to a cash advance. You could keep it as cash in your room, or you may deposit it in a separate bank account.

The next time you encounter an emergency, you could skip the cash advance. Instead, pull from savings.

Payday Loans vs. Personal Loans

Photo Credit: consumerfinance.gov

You may have considered borrowing money from payday lenders. After all, you may have seen several around your neighborhood. Their services seem appealing at first.

Payday lenders often market themselves as places where you can get personal loans or payday loans without hassles. Unlike personal loans from a bank or credit union, you don’t need to meet a minimum credit score.

Enter their office, sign the payday loan agreement, and get your money. It is an appealing prospect for people who can’t meet the minimum credit score.

Why You Should Not Borrow Money from Payday Lenders

Photo Credit: rosgrady.com

People usually take out a payday loan whenever they are in dire financial need. However, the benefit of payday loans has significant disadvantages:

- Payday loans have massive interest rates, which reach as high as 500% to 600%, according to the Center for Responsible Lending! That is a hundred times higher than the APRs of most personal loans. As a result, you are more likely to miss a pay period.

- States have different rules for payday loans. Some states have strong rate caps that prevent exorbitant payday loans. Others have payday lenders that have three-digit interest rates.

- If you miss a pay period, you will likely receive exorbitant penalties, increasing your debts further.

- Eventually, you may want to extend your pay period, which likely boosts your payday loan delinquency. This trend usually traps people into a cycle of repayments and extensions. As a result, payday loans may lead them into a debt trap.

- Borrowing money as payday loans may require you to share your checking or debit account. If you fail to meet your pay period, your payday loan provider may withdraw from your account, causing you to have overdraft fees. Also, this activity may make it difficult for you to save money.

- Some people think payday loans don’t appear on credit reports. If you miss your payday loan pay period, your delinquency may affect your credit standing. Eventually, you may fall below the minimum credit score for a debit or checking account, harming your financial health further.

The biggest reason why you should not get a payday loan is it incentivizes bad money habits. You should not rely on borrowing money to maintain your finances.

Avoid payday loan providers, and reduce your debts. Also, pay your existing loans on time to exceed the minimum credit score eventually. Most importantly, save money!

Final Thoughts

No matter which app you choose, it’s important to read the fine print and be aware of all the features each offers. We hope this article has helped you learn more about your options for instant money.

Remember, none of these apps are meant to provide investment advice; please consult a financial advisor if that is what you need.

With careful research and by choosing an app that fits your needs, you can feel confident in taking control of your personal finances.

Frequently Asked Questions (FAQs)

What app gives you $100?

You could try apps like Earnin to get $100 to your bank account in minutes. Just make sure you read the fine print, or you may end up in more financial trouble. Check out the options above.

How can I borrow money online instantly?

You could try a cash advance app since you can find many options right now. You might also try digital banks since many of them send money faster than traditional ones. Most do not require a minimum credit score but will perform soft credit pulls instead.

Should I take out a payday loan?

You may feel tempted to take out a payday loan because it is convenient. However, these services are more likely to trap you in debt and ruin your credit. Instead, focus on repaying existing debts and saving money.

Editor’s Note: This post was originally published on December 20, 2021, and has been updated on June 11, 2023.

If you are interested in content marketing, please email Anthony@Inquirer.net

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.