Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Arrowhead Advance: Reviews and Ratings

There are few worse feelings than needing emergency money and having no means of acquiring it. For example, someone involved in a serious car accident that will cost thousands of dollars and is rejected by multiple lenders may find themselves in a place of despair.

This is not an uncommon position. Millions of Americans are in similar financial holes. First, it’s important to understand that there are still options. Even if credit is poor, some lenders will still accept business.

One such lender is Arrowhead Advance. While it may offer a way out of a financial emergency, borrowers should carefully consider the risks before moving forward. The following is an in-depth look at Arrowhead Advance to help determine whether it is a viable lending option.

What is Arrowhead Advance

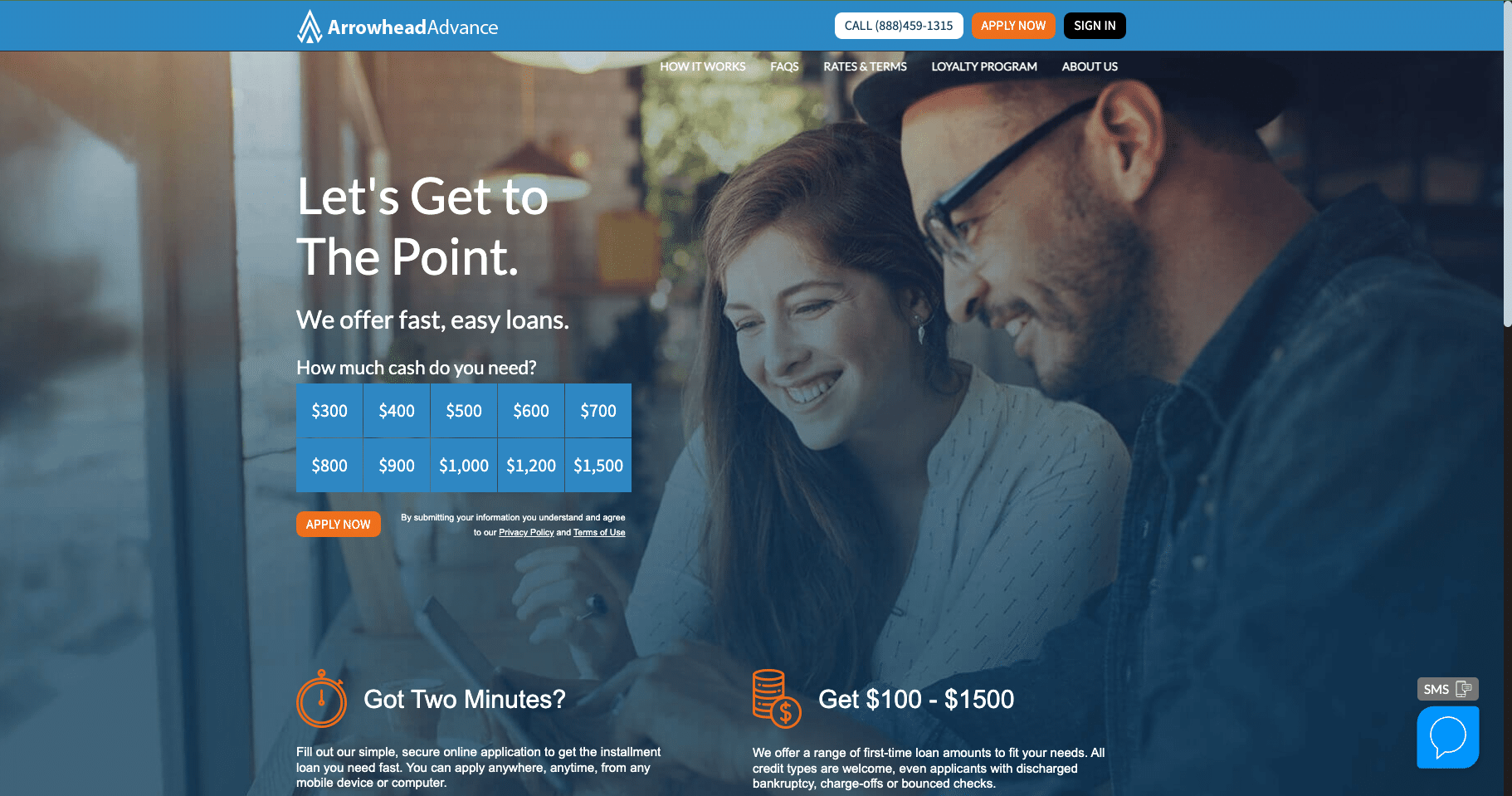

Arrowhead Advance homepage promoting fast, unsecured loans.

Arrowhead Advance is a tribal lender, meaning it operates under tribal law rather than state or federal regulations. This status allows it to accept borrowers who may be rejected by traditional financial institutions.

The company is based in Batesland, South Dakota, and is owned by the Wakpamni Lake Community of the Oglala Sioux Tribe. It has issued loans since 2017, targeting borrowers with poor credit, prior bankruptcies or bounced checks.

Arrowhead Advance presents itself as a fast, no-fuss solution for emergency expenses.

What they offer

Loan amounts start at $100 and go up to $1,500 for new borrowers. Those who make on-time payments may qualify for up to $2,500 through the Loyalty Program, which also unlocks discounts of up to 47 percent on future loans.

Terms are up to seven months. No collateral is required, and early payoff is allowed without penalty.

The application process takes place entirely online and includes a phone verification step. Once approved, funds are typically deposited by the next business day.

What’s the catch

The most important detail to understand is the annual percentage rate, or APR, on Arrowhead Advance loans. Rates range from 200 percent to 830 percent.

For example:

- A $500 loan repaid over 14 payments could cost $1,481.30, with an APR of 518.2 percent.

- A $400 loan might cost $1,118.41, with an APR of 440.4 percent.

These rates are in line with payday lenders and significantly higher than traditional personal loans, which typically carry APRs of up to 36 percent.

Who qualifies

The qualifications to apply are relatively straightforward:

- A minimum income of $1,000 per month

- At least 18 years old

- U.S. resident with a valid Social Security number

- Steady income and an open checking account

Arrowhead Advance loans are not available to active-duty military members or their dependents due to federal restrictions. The company also does not operate in all states.

Pros: Why some people use it anyway

Despite the high APRs, some borrowers turn to Arrowhead Advance for a few key reasons:

- Fast funding, often by the next business day

- No traditional credit check requirements

- No collateral required

- Loyalty Program benefits for returning customers

- No prepayment penalties

These features may appeal to borrowers in urgent need of cash who have few other options.

Cons: What to watch out for

This type of loan comes with major drawbacks:

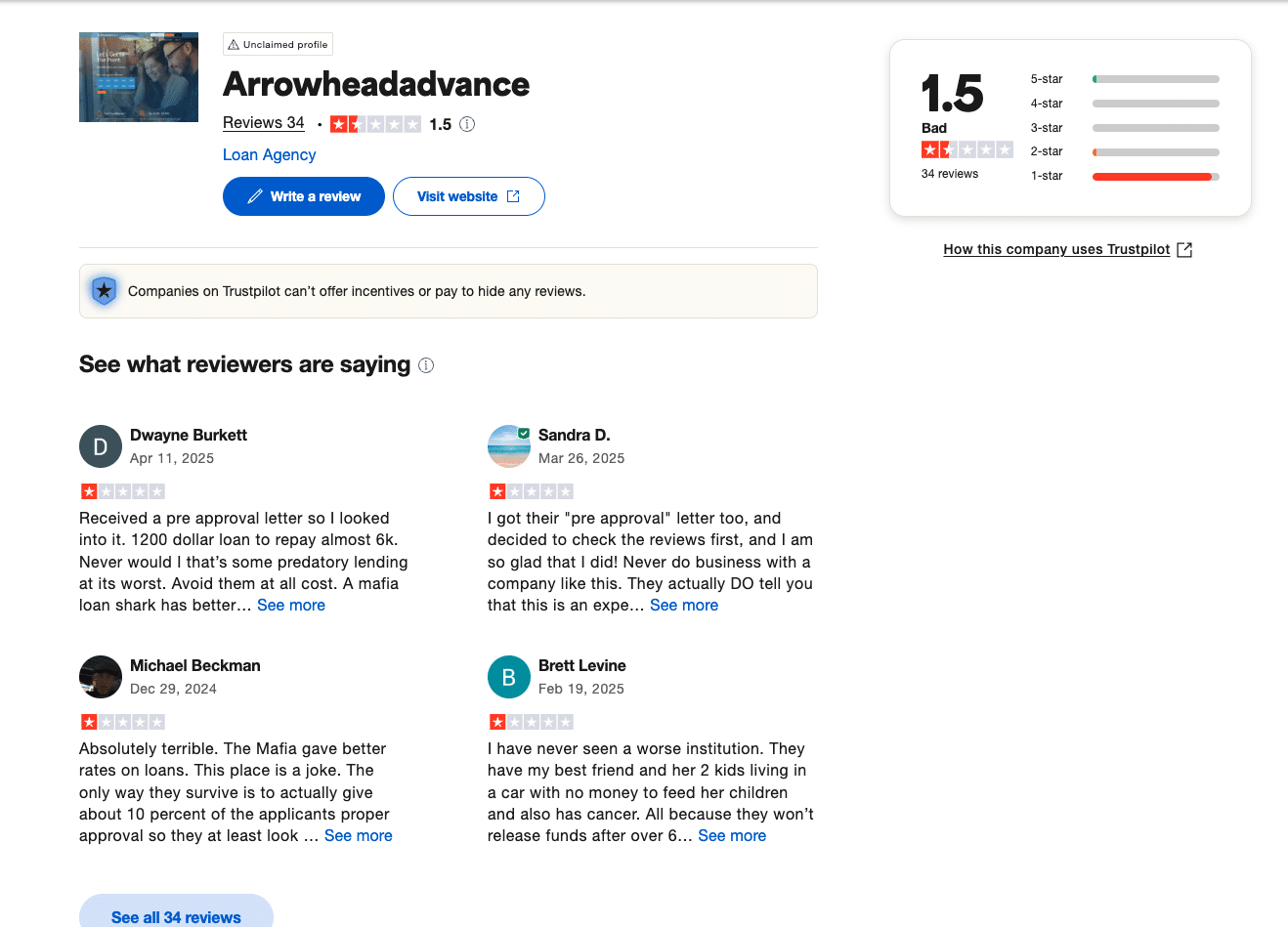

Arrowhead Advance holds a 1.5-star Trustpilot rating.

- Extremely high interest rates that can trap borrowers in a cycle of debt

- No state oversight, meaning fewer consumer protections

- Limited dispute resolution options, often restricted to tribal complaint processes

- Mixed customer reviews, with some praising fast service and others reporting confusing terms and ballooning balances

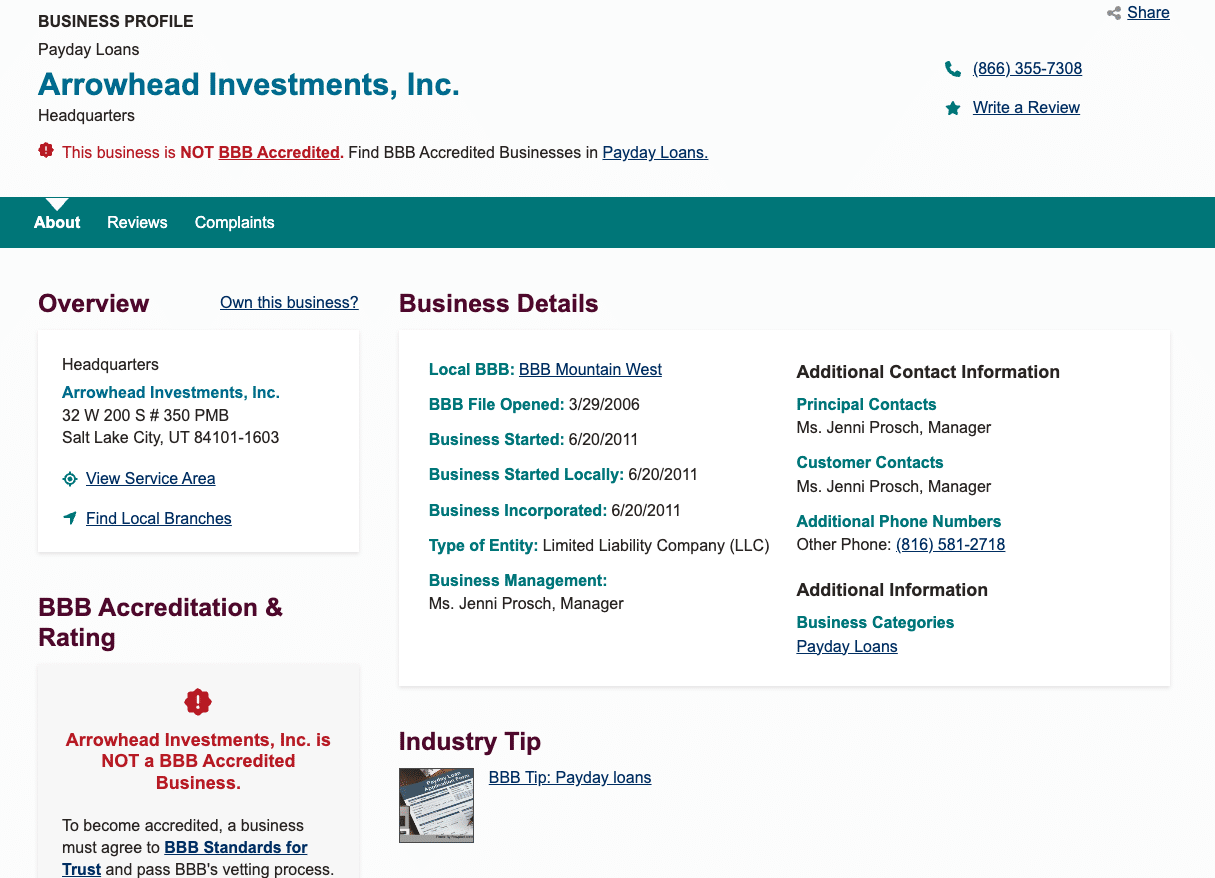

Arrowhead Investments is not BBB accredited.

Is Arrowhead Advance legal

Yes. Arrowhead Advance operates legally under tribal law as part of a sovereign Native American nation. This allows it to bypass many state lending regulations, including interest rate caps and licensing requirements.

However, a pending class-action lawsuit alleges that Arrowhead Advance participates in a “rent-a-tribe” arrangement, where non-tribal entities partner with tribes to evade state laws. The case is ongoing, and the allegations have not been proven in court.

Bottom line: Should borrowers use it

Arrowhead Advance may offer a fast solution for those in financial distress who have been denied elsewhere. But the high cost means it should only be considered as a last resort.

Borrowers are strongly encouraged to explore alternatives, such as:

- Credit unions

- Paycheck advance apps

- Negotiating directly with creditors

- Accredited credit counseling services

Arrowhead Advance delivers speed and accessibility, but the APR can be four to eight times higher than that of traditional lenders. Anyone considering this option should read the terms carefully, calculate the total repayment cost and, if possible, pay the loan off early to avoid runaway interest.

Arrowhead Advance FAQ: What to know before applying

Is Arrowhead Advance a legitimate company?

Yes. Arrowhead Advance is a tribal corporation owned by the Wakpamni Lake Community, a subdivision of the Oglala Sioux Tribe. It is a legal entity operating under tribal law, not state or federal regulation. While some customers describe the process as quick and helpful, others have reported unclear terms or unexpectedly high costs.

What are the interest rates and terms like?

Arrowhead Advance loans typically carry APRs from 200 percent to 830 percent. A $500 loan can end up costing over $1,400 across a seven-month term. While early repayment may reduce interest owed, the structure still makes the loans expensive.

Who can apply for a loan?

Applicants must be at least 18 years old, earn $1,000 or more per month, and have a valid checking account. The lender does not serve residents of Illinois or active-duty military members due to legal restrictions. Most applicants receive a decision within one business day.

Are there risks involved?

Yes. If a borrower cannot repay on time, additional fees, credit damage and collections are possible. Since Arrowhead Advance is a tribal lender, disputes generally cannot be brought to state courts. Instead, they are handled through internal or tribal channels, which may be less familiar to consumers.

Is it recommended for financial emergencies?

It depends on the situation. For someone in a genuine emergency — such as losing heat in the winter or needing urgent car repairs — and who has exhausted other resources, Arrowhead Advance may provide a short-term fix. However, it is not a long-term financial strategy, and repeated use can lead to serious debt.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.