How to Pay Off Debt: 10 Ways to Kill Debt with a Low Income

Do you feel weighed down by debt? You are most certainly not alone. To pay off credit card debt with a low income is extremely difficult.

Fortunately, there is still hope if you want to get out of debt. This article outlines ten debt-reduction suggestions and strategies which are extensively discussed below.

What Is the Status of Household Debt in the Country?

The New York Federal Reserve’s Quarterly Report on Household Debt and Credit for the first quarter of 2022 shows that household debt increased by $266 billion to $15.84 trillion. Balances are now $1.7 trillion greater than they were at the end of 2019, before the COVID-19 pandemic.

The most recent report from the US Census Bureau states that America is estimated to have an official poverty rate of 11.4%. Over 37.2 million Americans live in poverty. These stats show that the American dream is down the drain.

Though America is performing better when compared to African and Asian countries, we’re yet to attain heaven’s economy or a state that lacks nothing.

Providing these stats and data allows you to understand the situation and the relevance of the tips in this guide. Even if you’re not affected, this guide will help you advise your friends or colleagues who might be owing banks.

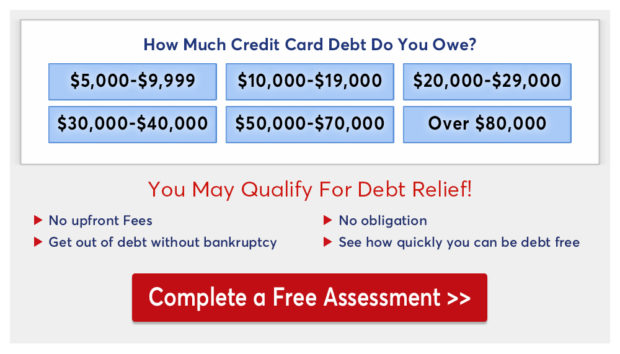

Take this 60-second quiz to check if you qualify for credit card payment reduction

How Can Debt Harm Your Life?

Being in debt may make it extremely difficult to qualify for other loans. For example, most lenders want a debt-to-income (DTI) ratio of 43 percent fewer to buy a house, including future mortgage payments. The DTI ratio is computed by adding your existing monthly debt expenses and dividing them by your monthly gross income.

If your DTI currently reaches 43 percent with a mortgage payment, you may be able to obtain a loan. Too much debt can make saving for retirement, your child’s college tuition, or other objectives are difficult.

Furthermore, your company may run a credit check when you apply if you work in law enforcement, finance, or the military. You may be turned down if you have several debts because your financial condition puts you at risk of taking bribes.

You May Also Like: Just Graduated? 10 Tips to Pay Off Student Loans Fast

Sort Through Each of Your Credit Card Debt and Bills

Before you can develop a debt management plan, make a list of all of your existing expenses and loans. Examine your most recent bank and credit card accounts and list recurring loans, invoices, and other fixed charges.

Include the monthly minimum payments, total balance, interest rate, period, and other pertinent information on your list. For example, remember whether debts are suspended or on a repayment plan.

Review your credit reports to see all current loans and lines of credit to ensure you have noticed everything. Consolidate debt before you can decide on which strategy to use. You may also use a debt payoff calculator for easier reference and to pay off debt quickly with a low income.

10 Ways to Kill Debt for Good

Begin your journey to a loan-free lifestyle. When debt relief is a top goal, there are various things you may do to eliminate debt — or at least pay off the majority of it — in 12 months or less. You can pay off debt fast with a low income by following the tips below. Here are ten debt-reduction suggestions and strategies to get you started:

1. Begin with a minimum needs budget

Drafting a minimum needs budget is the first step toward paying off debt regardless of income. Cut unnecessary expenses by looking deeply at your household budget, car expenses, tax, and food costs.

This step is best done by reviewing your monthly bills and detecting the loops in your spending habits. Devise a better way of saving costs on all your fees to squeeze extra money. If cutting down on food costs, getting a roommate, or selling your car for a cheaper one would help you get rid of debt, do it.

However, no matter how reasonable cutting costs is, it could be a threat if done incorrectly. Do not make your life miserable because you want to pay off debts quickly. Give yourself breathing space, and don’t overdo this step.

If you don’t satisfy yourself occasionally, you might spend all the money on unnecessary things out of frustration. Decide how much you can hold back without living in misery. And use the extra cash for whatever you want after settling the monthly payment.

2. Refrain from placing minimum payments

Maximize your monthly debt payments. Pay a large amount instead of making minimum payments.

Many people think paying their debts bit by bit is a great idea. But the reverse is true. If you make the minimum payment, a minor part is added to the credit card balance, while most of it goes to the loan interest rate.

Reducing the interest rate on the lowest balance is essential for low-income people to save money. Lower interest rates, and you’ll be able to add more money to the actual debt instead of interest rates. Reducing your interest rate by half would go a long way in catalyzing the repayment process.

Examine your budget and determine how much more you can spend on your debt. Paying more than the minimum will help you save money on interest and get out of debt faster.

Assume you have a $15,000 credit card bill with a 17 percent APR and a $450 payment. If you make the minimum payment, it will take nearly four years to repay the debt.

Total interest will be around $5,500. If you paid $550 each month or $100 more than the minimum, you could repay the loan in less than three years and pay just $4,100 in total interest. To understand more, use a credit card payment calculator.

Take this 60-second quiz to check if you qualify for credit card payment reduction

3. Use the debt snowball method

You can also use the debt snowball method to reduce debt if you pay more than the minimum. This debt repayment plan urges you to lower monthly payments on all your debts except for the lowest one, which you’ll pay more than you can toward.

By “snowballing” payments toward your smallest debt, you’ll soon eradicate it and move on to the following slightest obligation while paying the minimum on the rest. Assume you owe $6,000 on a credit card, $2,000 on a vehicle loan, and $11,000 on college loans. You would use the debt snowball strategy to pay off the auto loan first because it has a minor overall balance.

The debt snowball strategy might drive you to focus on one debt at a time rather than several, allowing you to create momentum and stay on track. You should avoid using the debt snowball strategy only if you have a payday or title loan. These loans often have higher interest rates and should be paid off soon.

Take this 60-second quiz to check if you qualify for payment reduction

4. Try using the debt avalanche method

When using the debt avalanche method, you prioritize paying off your highest-interest debt first. So, if your highest interest debt is a credit card amount with an annual percentage rate (APR) of 18.99 percent, you prioritize that obligation while still paying the minimum monthly debt expenditures.

Any extra money in your budget is directed toward your highest-interest debt. In this case, a credit card with an APR of 18.99 percent. After paying off the 18.99 percent APR credit card debt load, you move on to the following highest interest rate obligation. Assume these are personal loans with a 10.99 percent APR. At this moment, you apply the funds from your credit card.

At this point, you apply the money you were paying on the 18.99 percent APR debt to the 10.99 percent APR personal loan, adding the extra amount to the personal loan’s minimum monthly payment. You continue making at least the minimum monthly payments on all your other loans.

If you follow this plan, you should be able to eliminate all of your loans while also lowering your total interest payments. To be clear, this debt repayment technique’s “avalanche” component refers to your higher interest rate debt collapsing swiftly, much like an avalanche on a mountainside.

You May Also Like: Credit counseling Will Help You Improve Your Finances, This Is Why

5. Increase your monthly income

If you are determined to pay off your debt within a year, you should seek ways to boost your income and utilize that extra money to pay off your debt with low income as soon as feasible. Consider taking up a part-time job or negotiating a raise with your boss to earn additional money for at least a few months while prioritizing debt settlement.

The best way to pay off debt is to make more money. One way of doing this is by freelancing. A freelancer could be a full-time self-employed pro or a regular worker with a side hustle. In your case, we’d recommend adopting freelancing as a side hustle. Some sites would pay you cash via PayPal for completing a survey.

For instance — Survey Junkie, InboxDollars, mySurvey, Swagbucks, and many more. If you don’t like surveys, there are freelancing platforms that have clients searching for professionals in other niches. Fiverr, Upwork, and PeoplePerHour are the most popular sites. We recommend these freelancing sites because they might help you free up funds to swing at your debt.

6. Check and revamp your budget

You should budget to pay off debt with a low income because it will help you settle it quicker. Track daily spending for a few weeks and then assess the matter objectively. Identify the products costing you money and eliminate them from your budget. The savings should then be applied to debt repayment. You may be astonished at how quickly your loan balances vanish.

Make sure to check your debt to income ratio and debt balances. All the extra money should be funneled to your debt relief options.

7. Create a debt settlement plan

Once you’ve determined that you need to pay more than the minimum and identified the waste in your budget, you may devise a debt repayment strategy. An intelligent process helps keep you on track while also providing you to strive for.

Two of the most common debt-reduction tactics are the debt snowball and the debt avalanche. These strategies recommend attacking one debt at a time with all of your extra cash while paying the bare minimum on your multiple debts.

The distinction is in the order in which you address the debt. The snowball method starts with the tiniest balance, which provides a psychological boost and a quick win. In contrast, the debt avalanche proposes beginning with the highest interest balance. It may take longer to achieve that first win of retiring a sum.

However, in the long run, the avalanche will likely pay off the debt faster and save more in interest. You can also learn how to pay off credit card debt using a fast calculator. Whatever strategy you use. The essential thing is to develop a plan and stick to it. Hire a debt settlement company if you need assistance managing your program.

You May Also Like: Everything you need to know about a credit card limit

8. Apply for debt relief programs

As the name suggests, Debt relief programs are aimed at helping government workers pay their student loans. The difference between private and government relief programs are;

- Private programs convert government debt to private, nullifying your right to government debt relief programs pending your debt-free period.

- Though your credit score is critical, private debt relief programs are more straightforward than PSLF.

- Private interest rates are relatively higher.

- Most private companies offer refinancing instead of loan consolidation. Loan refinancing and loan consolidation are two different programs. Loan refinancing allows you to renegotiate the loan terms, such as interest rates and duration.

Your credit score must be on par to qualify for government aid. Every debt relief company (private or public) has its own rules and regulations. Ensure you read the terms and conditions before applying.

9. Debt consolidation loan

Debt consolidation loans occur when borrowers obtain new debt and utilize the proceeds to pay down their debts. Examples are credit card balances, vehicle loans, student debt, and other personal loans. When debtors consolidate their debt, they apply for a personal loan, a balance transfer credit card, or another debt consolidation tool through their bank or lender.

In a debt consolidation loan, the lender may directly pay down the borrower’s other liabilities, or the borrower may take the money and pay down their existing bills. Similarly, many debt transfer credit cards feature a preferred method for consolidating a cardholder’s current cards.

Once the borrower settles the debt with the new loan funds, the borrower will create a specific payment on the new debt. While debt consolidation frequently reduces the amount a borrower owes each month, it extends the repayment length of the merged loans.

While debt consolidation frequently reduces the amount a borrower owes each month, it does so by extending the term of the merged loans. If you are still thinking of paying off debt fast with a low income, this step is one of the best ways. Consolidating loans also streamlines payments and makes financial management more manageable, especially for borrowers who struggle with money management.

10. Saving money will help you with debt payments

The primary reason for cutting all expenses is to increase your savings. Though it may sound complicated, it’s simple when done correctly and if you want to be debt-free. Always set aside money from your paycheck before spending or giving out money. Saving keeps the credit card away during emergencies.

A savings account helps you automate your savings with no minimum balance requirement. Open such a bank account and statement in any bank you choose and save money, no matter how small. You can also seek guidance from a credit counselor if needed.

Also, triggers are the weak points that force you to spend unnecessarily, especially when you’ve got loans to pay off. You must discover your triggers and set up a system to nullify them. This requires a lot of energy, but it’s worth the stress. You should always think that if you successfully pay your debts, you will also have a good credit score.

Final Thoughts

Marking your progress is essential for keeping motivated to get out of debt faster. Maintain a chart and see whether you can accelerate the process. When you accomplish payoff milestones, celebrate. Your best outcomes will come from understanding the process and striving to pay off your debt faster than you had intended.

You can make minor changes to improve your financial situation, whether you want to pay off your credit card or remove student loan debt. You might be shocked at how quickly you can pay off your debt with a low income using these tactics. If you want to pay off your debts with a low income, there are ways to do it.

You need to be creative and willing to change your spending habits. We’ve outlined different methods above to help you eliminate your debt. Have you tried any of these techniques? What works best for you in terms of debt elimination? Please let us know in the comments!

Frequently Asked Questions

How can I pay off my credit card monthly payment?

Create a debt payoff plan to pay off credit card bills. Allocate extra money toward debt, prioritizing high-interest debts first. Pay more than the minimum amount due each month. Consider a balance transfer card with lower interest rates if you have multiple credit cards. Start by tackling the smallest debt and gradually work on other obligations. Assess how much debt you owe and set financial goals. Avoid carrying debt and be aware of any prepayment penalties. Use any extra cash to quickly pay off debt and avoid accumulating more debt.

Can a balance transfer card help with debt consolidation?

Yes, a balance transfer card can be useful for debt consolidation. It allows you to transfer high-interest debts from multiple credit cards to one with a lower interest rate. This simplifies your payments and can save you money on interest charges. Be mindful of any transfer fees associated with the balance transfer card.

How does debt relief work?

Debt relief refers to various strategies and programs aimed at reducing or eliminating debt burdens. It can involve negotiating with creditors to lower interest rates or settling debts for less than the full amount owed. Debt relief programs, such as debt consolidation or debt settlement, provide structured plans to help individuals regain control over their finances.

Originally published on 5.19.2019; Updated on August 5, 2022; Updated on June 16, 2023.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.