Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Best Debt Settlement Companies: Expert Reviews and Top Picks

Debt can really pile up these days. With rising costs of living, unexpected financial emergencies, and the ease of credit card swipes, more and more folks find themselves drowning in credit card debt, medical costs, student loans, and personal debts they can’t imagine paying off. If this sounds all too familiar, you’re not alone—over 60% of Americans now carry some form of debt, according to a recent study.

The pressure of monthly minimum payments compounding out of control can truly wreck your peace of mind. But have no fear—there is light at the end of the tunnel. Debt settlement may offer the perfect solution to consolidate your payments into one affordable monthly amount and eliminate your obligations for a fraction of what you owe.

Alternatively, a debt consolidation loan can help manage multiple debts by transforming them into a single, manageable monthly payment with a fixed interest rate. Top debt settlement companies know just how to strong-arm stubborn creditors into deals that save thousands for their clients.

In this detailed guide, we break down everything you need to know about choosing the right debt settlement partner. We evaluate the nation’s leading providers based on reputation, results, value, and customer service. After reading this, you’ll be well-equipped to pick a program perfectly tailored to your financial needs, including various debt relief services that can help manage and reduce your overall financial burdens.

What Is Debt Settlement and How Does It Work?

Debt settlement is a process where a third-party company negotiates with your unsecured creditors to settle your credit card debts and other unresolved bills for less than the full balance owed. The fees for debt settlement are often based on the amount of enrolled debt. It provides an alternative to bankruptcy by allowing folks who are deep in debt to resolve their obligations for a fraction of the price—typically saving clients 30-50% off their total balances.

Understanding the Debt Landscape

Before diving into debt resolution strategies, let’s gain context on what led here. High living costs, an unpredictable economy, and social media normalizing impulse spending all cultivate an acceptance of ongoing monthly payments. However, balances pile up fast when life happens, as over 60% of citizens now sport some form of debt, according to a recent TransUnion study.

As per the US Government, medical costs alone fuel nearly half of personal bankruptcies annually and average over $400 per month for covered Americans – a burden in itself, let alone for the uninsured. On top of it all, credit card issuers profit immensely off user interest charges that can total thousands in extra payments. Is it any wonder debt settlement has steadily grown into an $8 billion industry over the years?

When minimum obligations swallow a paycheck or job loss, drowning is inevitable, and acting to guarantee long-term stability becomes paramount. Debt settlement may be the optimal compromise between bankruptcy’s enduring scars versus financial suffocation under a never-ending pile of red ink. The key is identifying a reputable partner to optimize results.

Here’s a quick overview of how the debt settlement process typically plays out:

- You contact a debt settlement company and provide details on your total balances, minimum monthly payments, and disposable income. They evaluate if you’re a good candidate.

- Once approved, you’ll make a series of monthly payments into an escrow account controlled by the settlement company instead of paying creditors directly.

- As your escrow balance grows, the company begins negotiations with your lenders—going back and forth until they agree to settle for a reduced lump sum amount.

- When an agreement is reached, they pay off that account from escrow on your behalf once you authorize the settlement.

- The process continues account by account until all your debts are resolved—typically within 2-4 years, depending on your situation.

While debt settlement definitely involves short-term damage to your credit that can last 1-2 years, it prevents lasting scars of bankruptcy and may ultimately save you thousands more over the long run. Just be sure to vet providers thoroughly to avoid scams.

You May Also Like: Debt Settlement vs. Bankruptcy: Which Is Right For You?

Definition of Debt Relief

Debt relief refers to the process of reducing or eliminating debt through various methods, including debt settlement, debt consolidation, and credit counseling. It is designed to help individuals or small businesses manage their debt and regain control over their finances. Debt relief can be achieved through working with a debt relief company, credit counseling agency, or by negotiating directly with creditors.

Benefits of Debt Relief

Debt relief can provide numerous benefits, including:

- Reduced Debt Burden: Debt relief can help reduce the amount of debt owed, making it more manageable and easier to pay off.

- Lower Monthly Payments: Debt relief can result in lower monthly payments, freeing up more money in your budget for other expenses.

- Improved Credit Score: By paying off debt and reducing the amount owed, debt relief can help improve your credit score over time.

- Reduced Stress: Debt relief can provide a sense of relief and reduce stress caused by overwhelming debt.

- Increased Financial Stability: Debt relief can help individuals or businesses achieve financial stability and security.

Understanding Debt Programs

If all-consuming debt resonates with your situation, now’s the time to get grounded in options. Let’s compare resolution strategies:

Debt Settlement

A third party negotiates directly with lenders on your behalf to settle unsecured debt, such as credit card, medical, and other bills, for less than the full balances owed—typically 30-50% off your total for lasting relief within 2-4 years.

Debt settlement companies often help clients manage and settle significant amounts of unsecured debts.

Debt Consolidation

Securing a debt consolidation loan allows repaying multiple existing balances into a single lower-rate monthly payment. However, interest still applies, and your debt term may stretch longer overall.

Debt Management Plans

Credit counseling enrolls qualifying borrowers in structured arrangements where creditors agree to reduced interest rates in exchange for on-time automatic payments over 3-5 years.

Bankruptcy

A last-ditch status intended for cases well beyond hope enables legal protection from collectors via financial reorganization (Chapter 13) or balance discharge (Chapter 7), though it carries lasting credit scars.

In general, debt settlement strikes the optimal compromise for qualified clients by providing professional settlement clout at a fraction of the full balance’s eventual tally. Just be sure to vet providers so thoroughly that shortcuts don’t compromise results. A tailored match leads to lasting wins.

Read More: How To Analyze Your Credit Score, and How Can You Improve It?

Who Should Consider Debt Settlement?

Debt settlement is most suitable when you’re deep underwater, have largely fallen behind on payments, and can’t realistically see yourself becoming debt-free any other way. In general, the following scenarios make you a prime candidate:

- Your minimum payments comprise over 40% of your take-home pay.

- Your balances keep growing at an alarming rate due to compounded interest charges on credit card debt and personal loans.

- You’ve exhausted all options to consolidate at a lower rate or negotiate directly with creditors to no avail.

- One emergency expense or job loss would send your finances spiraling out of control.

- Your income has declined substantially, or medical costs have skyrocketed unexpectedly.

- Bankruptcy should be avoided if at all possible due to long-term negative consequences.

- You have a sincere commitment to resolving your obligations promptly through a structured program.

- You have private student loans that make you a candidate for debt settlement.

Weighing risk versus reward, many folks in dire circumstances find debt settlement the optimal compromise between bankruptcy and disappearing under a lifetime of debt slavery. The key is thorough vetting of reputable providers.

Crafting the Perfect Match

Once debt settlement is your optimal path forward, choose your new partners carefully. Top performers stand out through their superior reputation, transparency, specialized services, and demonstrated results. Here’s a quick rundown of the selection criteria:

- Reviews, Ratings, and Reputation: Browsers transparently reveal volumes about character, results, and real client experiences. TopDog, BBB, and TrustPilot reviews eliminate the uncertainty of navigating alone.

- Settlement Success Statistics: Leaders prove repeat results over hype. Glean financial fitness lessons from multi-million dollar, multi-year debt elimination of numerous satisfied consumers nationwide.

- Pricing Clarity: Reputable players always recognize true costs, which commonly fall between 20% and 30% of balances negotiated. Demand upfront fee transparency to avoid hidden extras down the road.

- Customization: Rigidly generalized programs suit few. Prioritize companies that prioritize personalization with monthly deposit options, debt-type expertise, and individualized attention.

- Specializations: From tax resolution to healthcare billing help, niche strengths accommodate diverse troubles. Match problems to a company’s proven area of finesse.

- Ongoing Support: The best way to ease ongoing anxieties is through client portals, educational resources, and friendly check-ins until completion, which leaves you permanently debt-free.

With these criteria in mind, let’s evaluate industry leaders maximizing customer success rates for lasting debt freedom.

Top 7 Best Debt Settlement Companies in 2024

After extensive research analyzing reputation, transparency, results, value, and customer care, here are our picks for the top debt settlement companies in the nation:

National Debt Relief: Best for Fee Transparency

Known for upfront fees that are easy to understand, National Debt Relief has settled over $6 billion in debt for hundreds of thousands of satisfied customers with success rates of nearly 70%. Their simple 3-step program features an affordable monthly deposit-based model and specialists dedicated to your case from start to finish. Plus, top marks from BBB, Customer Affairs, and Trustpilot users confirm their commitment to transparency and service.

As a debt relief pioneer since 2009, National Debt Relief has worked magic resolving $6B for over 700,000 families through integrity, personability, and steadfast program transparency – reflected in stellar third-party reviews. National Debt Relief receives nods from industry experts for the balance of care, clout, and education.

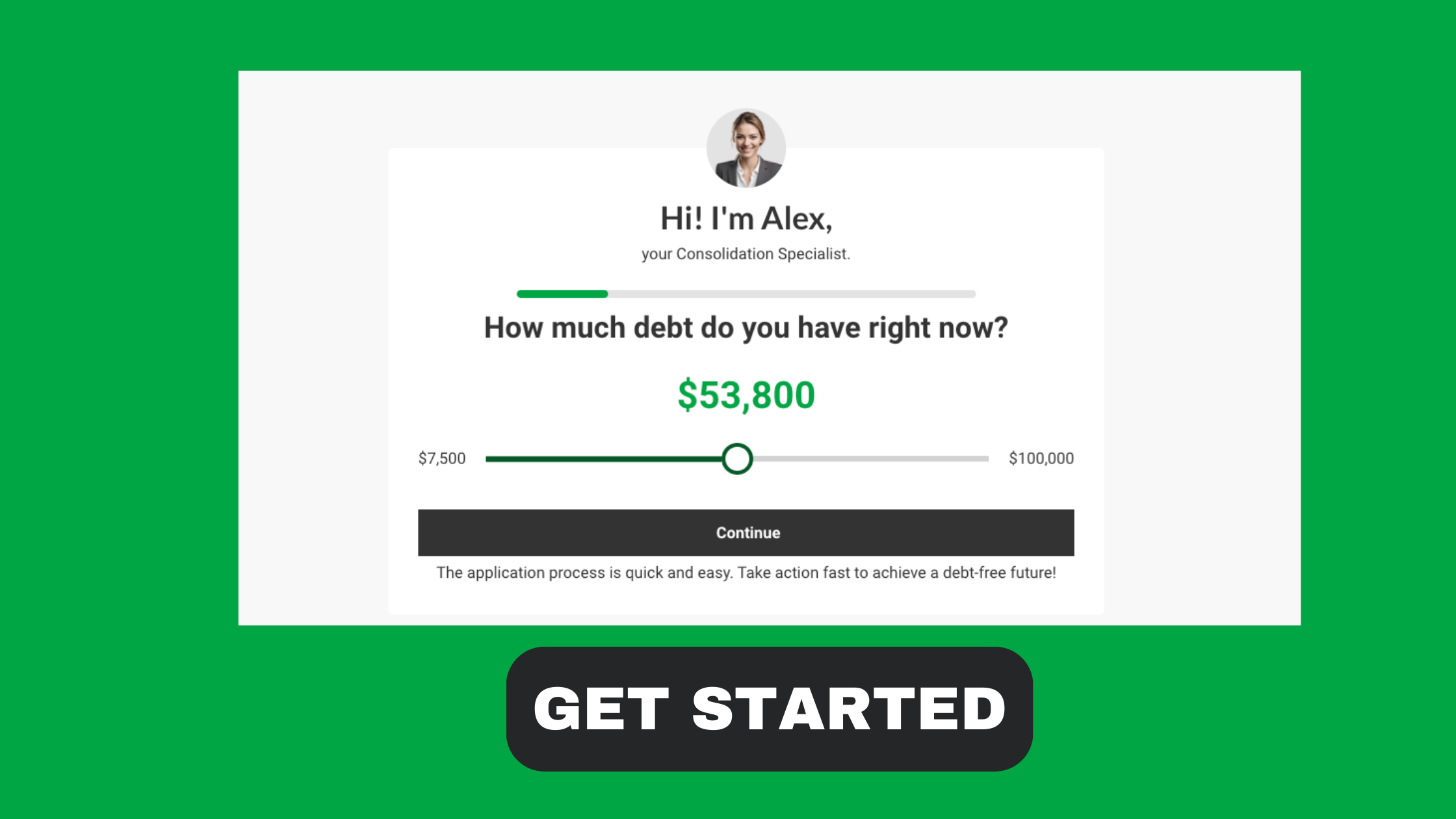

Better Debt Solutions: Personalized Debt Relief Programs

With customized consultation sessions, personalized client portals for monitoring progress, and free debt analysis without obligation, Better Debt Solutions helps debt-weary clients regain control of their finances.

Their commitment to understanding each client’s unique financial past, present, and goals makes them stand out for genuinely tailoring programs based on real needs – not slogans. Honest pricing and flexible payment options empower success.

From intuitive client profiles offering downloadable tools and financial education materials to customized deposit timelines, Better Debt Solutions prioritizes client wellness through customized care. Multilingual representatives accommodate all citizens through sensitivity training and dedication to nuanced understanding that empowers autonomy for life beyond debt’s shackles. Money stress dissolves under compassionate guidance here.

Debt Care Plus: Trusted Solutions with Proven Results

Specializing in quick yet comprehensive debt settlements, Debt Care Plus boasts a customer satisfaction rating of over 95%. Their team’s wealth of experience shows personalized service, upfront fee estimates, and savings milestones achieved in as little as 24 months for many clients. Join over half a million families who’ve trusted Debt Care Plus to tackle debt with unmatched expertise and empathy.

Their savants study debts like detective novels to design meticulous savings roadmaps tailored sharply to every personality and pocketbook. Factor in top online reviews and a positive reputation among referrers, and DebtCarePlus is a go-to for resolution without delays.

Pacific Debt Relief: Best for Established Track Record

In the debt relief game since the late 1990s, Pacific Debt Relief has helped resolve over $4 billion for one million families through individualized service plans that get to the root of financial troubles. Their vast experience is clear in an intuitive program addressing everything from credit counseling to tax issues as part of whole-person wellness.

Pacific Debt Relief remains a beloved staple of the debt settlement sphere. By negotiating fundamentals like tax debts, payroll oversights, and more beyond surface-level charges, they gain loyalty through whole-person wellness guidance. Pacific Debt Relief’s multi-million dollar results inspire confidence in enduring solutions for complex landscapes.

Accredited Debt Relief: Best for Quick Resolution

For time-conscious clients, Accredited Debt Relief’s powerful network minimizes settlement periods to 12-36 months on average. While results still depend on individual factors, they get kudos for swift action plans and upfront transparency in pricing. Customer-focused agents stand out with caring check-ins that uphold integrity throughout the process and well after debts vanish. Their can-do spirit energizes solutions.

Additionally, they surpass transparency expectations by proactively connecting clients with multiple programmatic alternatives to ensure the ideal fit. Industry-leading reviews solidify Accredited’s prominence in steering indebted folks to solvency as rapidly as responsibly possible.

Freedom Debt Relief: Best for Monitoring Progress with an Online Dashboard

Committed to client autonomy, Freedom Debt Relief provides 24/7 visibility into debt resolution through easy online profiles. Chatty case managers guide customized processes focused on rebuilding finances from the inside out to establish long-term stability. Online profiles empowering real-time debt status tracking and communication uphold Freedom Debt Relief’s commitment to financial empowerment through visibility.

Coupled with caring consultations tailored for recharging independence, their strategy nurtures lasting money smarts. Over 16 years, Freedom Debt Relief has gained legions of appreciative advocates through attentiveness that safeguards dignity through every step.

CuraDebt: Best for Negotiating Tax Debt

With an expert tax division primed to tackle even the gnarliest IRS complications, CuraDebt proves a haven for citizens battling backdated tax bills, penalties, and wage garnishments.

Their prudent guidance untangles the red tape that plagues many debt relief seekers through customized programs incorporating negotiation, audit defense, payment plans, and more. There are no strings attached. Consultation unveils personalized tax debt cures.

The debt settlement realm remains largely unregulated, emphasizing the importance of researcher scrutiny, multi-source intel gathering, and considering nuanced client reviews when opting for help. All firms here prove capable, yet individual situations deliver unique demands – so thorough due diligence ensures joyous endings down the road.

Key Debt Settlement Considerations

Be an informed consumer – educate yourself enough to ask the right questions and avoid pitfalls. Here are some additional debt settlement factors experts weigh carefully:

Fees and Pricing

Industry standard charges 20-25% of settled balances, though some players demand upfront fees. To avoid unpleasant surprises, opt for transparent fee schedules that respect your capacity to succeed. Compare quotes logically.

Customer Services

Reach out to determine the tone of interaction—are representatives helpful, honest, yet upbeat? Quality client care keeps momentum flowing during difficulties. Communicate comfort levels to build confidence in decisions.

Specialized Programs

Are offerings too general or tailored for your specific needs, such as tax debts, state regulations, or other unique terrain? Find specialists well-versed in optimizing results for your unique mountains and valleys.

Settlement Speed

While 24-48 months reflects typical completion timeframes, debt relief companies can help expedite the debt settlement process, sometimes simplifying it within 18 months or even faster. Gather program specifics plus client testimonials to gauge reasonable expectations based on factors affecting your potential.

Accreditation

Only reputable companies belonging to AADR, IAPDA, and other independent regulating bodies should be retained, holding them accountable should issues ever arise during negotiation processes or beyond in further restoration pursuits.

Flexible Control

You should prefer programs that enable customized savings schedules and deposit arrangements that fit your personal resource capacities better than rigid requirements. Autonomy breeds confidence and success.

With due diligence and support from the right debt settlement partners, light emanates even from financial darkness. Focus on the uplifting road ahead—your resilience will deliver the promised freedom.

Applying for Debt Relief

Applying for debt relief typically involves several steps, including:

Eligibility Requirements

To be eligible for debt relief, you typically need to meet certain requirements, such as:

- Having a minimum amount of debt, usually $7,500 or more

- Being behind on payments or struggling to make payments

- Having a steady income and being able to make monthly payments

- Being a resident of the United States

Application Process

The application process for debt relief typically involves:

- Contacting a Debt Relief Company or Credit Counseling Agency: Reach out to a reputable debt relief company or credit counseling agency to discuss your financial situation.

- Providing Financial Information: You will need to provide detailed information about your income, expenses, and debt.

- Reviewing and Signing a Debt Relief Agreement: Once your financial situation is assessed, you will review and sign an agreement outlining the terms of the debt relief program.

- Setting Up a Payment Plan: A payment plan will be established, and you will begin making monthly payments as agreed upon in the debt relief program.

Documentation Needed

To apply for debt relief, you will typically need to provide documentation, including:

- Proof of Income: Such as pay stubs or tax returns.

- Proof of Debt: Including credit card statements or loan documents.

- Identification: Such as a driver’s license or passport.

- Bank Statements or Other Financial Records: To provide a complete picture of your financial situation.

By following these steps and providing the necessary documentation, you can take the first step toward achieving financial freedom through a structured debt relief program.

Conclusion

If debt has you drowning, don’t lose hope—help is out there. Choosing a reputable settlement company stands between you and freedom from your obligations, but thoroughly vet providers to optimize value. Remember, successful programs take effort but prove worthwhile for savings that can amount to thousands restored to your pocketbook.

Reach out for a free consultation today and regain control of your money through customized assistance tailored to your needs. You’ve got this—the first step is yours to take!

While standard debt management plans can provide simple interest rate reductions, debt settlement goes the extra mile to knock balances down with a permanent solution. Both have merit depending on circumstances, so discuss programs transparently with a professional counselor. With care and diligence, you can and will be debt-free once more—courage and commitment will see you through this. Your future financial wellness awaits!

Final Thoughts

By this point, you’ve gained deep insight into debt settlement and relieved at least some worries by answering top concerns. With focused research, ask follow-up questions of specialists until you feel wholly confident in the next steps.

Never hesitate to double-check ambiguous terminology or considerations, either. Your role in the decision impacts results tremendously, so stay informed and trust your intuition once armed with facts. Finally, keep sight of your goals through temporary money stresses—freedom lies ahead, friend, so march boldly on towards sunnier financial skies!

FAQs About Debt Settlement

To bring this guide full circle, here are answers to additional commonly asked debt settlement questions:

Will settling debts impact my credit report and score?

In the short term, stopping payments to settle balances usually makes accounts delinquent, triggering a score dip of 50-150 points, depending on other factors. Derogatory marks depart within 2 years as ongoing responsible financial conduct is restored.

How long does the settlement process last?

Well-documented average program lengths run 24-48 months, depending on engaged participants’ individual debt levels, incomes, and settlement readiness. Rushing impedes results, while diligence promotes prosperity.

Is debt settlement suitable despite the current income level?

As long as funds exist enabling sizable regular deposits that build settlement reserves proportionate to debt loads, programs accommodate diverse incomes, both high and low. Professionals assess true affordability.

What debts can and cannot be settled through providers?

Unsecured credit card charges, medical outstanding, utility, cable, and other collections with a legal right to the collection are viable candidates. Excluded categories include taxes, private education loans, secured debts, and judgments from legal actions.

Will choosing debt settlement impact future access to credit?

While rebuilding credit requires perseverance post-program, debt-free lives eventually restore opportunities underpinned by freshly established FICO scores reflecting responsibly handled new accounts or potential loans over time. Careful planning achieves goals.

What are the alternatives to debt settlement?

The primary options include debt consolidation loans, debt management plans through credit counseling, and, as a final resort, various types of consumer bankruptcy protection. Each presents pros and cons for your scenario, depending on balances, income, and responsibilities.

With diligence, commitment, and the right guidance, debt settlement provides a proven resolution for millions enslaved to financial woes each year. Don’t suffer needlessly when professional help may throw you the debt lifeline you need to emerge from your struggles as a stronger, more financially fit person. Your future is within reach—now is the time to take that all-important first step towards the stable shores of solvency.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.