The Best Credit Card Debt Calculator

Most consumers struggle to pay off their credit card debt in today’s economy. With this, a credit card debt calculator is a great tool that can help you pay off your debt. This calculator can guide you in figuring out how much you need to pay each month to eliminate your debt.

Using a debt payoff calculator is the best way to eliminate your debt. This tool can help you create a plan and stick to it. After reviewing online, there are many calculators that you can use to find how much money you need to pay each month and when you will be able to pay off your debt completely.

According to the most recent data, Americans owe $1.07 trillion in outstanding debt from credit card companies as of the first quarter of 2022, as per the New York Federal Reserve’s Q2 Household Debt and Credit Report. Learn more about the best credit card payoff calculator below.

Purpose of a Credit Card Debt Payoff Calculator

An excellent way to ensure that you stay out of debt on your existing credit cards is to use an online debt repayment calculator. Also, the website computes how long it will take to pay down all of your debt from your credit cards. Moreover, you may enter the information into the provided fields.

These are titled “interest rate,” “balance owed,” “expected minimum required payment,” and “desired payoff time-frame.” Furthermore, the debt calculator will consider these financial considerations and provide you with a plan for paying off your debt to a credit card company. In addition, the calculator will help make your existing debt more manageable or allow you to plan for future credit card expenses.

Different strategies to be debt-free with your credit card

The debt repayment plan is complicated. You have to speed up payments to get free and clear. You can settle outstanding balances using the debt avalanche method and the debt snowball method. Then, you can use the calculator.

Each option asks you to list your debts and make the minimum payment on all but one. Once that card is paid off, you go on to the following credit card balance until all of your debts are gone. Furthermore, you can even utilize both approaches simultaneously.

To begin, choose smaller debts (as in the snowball method) yet has a high-interest rate (as in the avalanche method). If neither strategy appears to be adequate, you may wish to pursue debt relief instead. The two approaches differ in terms of which is the targeted first debt. The avalanche strategy entails making more payments toward the personal loan with the highest interest rate.

You May Also Like: Credit counseling Will Help You Improve Your Finances, This Is Why

The Debt Snowball

The debt snowball strategy is paying off the smallest debts first to get them out of the way before moving on to larger ones—sort of a “do the easy jobs first” approach. You list all of your outstanding debts in increasing order of size.

You prioritize the first one, putting as much money into each payment as you can afford. On the other, you only give the bare minimum amount. When the initial debt is paid off, you target the next-smallest one for the extra-payment treatment.

The Debt Avalanche

This approach entails making minimum payments on all outstanding accounts, then utilizing any remaining funds set aside for debt repayment to a credit card issuer to pay the bill with the highest interest rate. The avalanche strategy will still save you the most money on credit card interest charges.

Be Debt-Free by Refinancing Your Credit Cards

One option to help improve your current credit score is refinancing your cards for a lower annual fee. Also, lowering your total credit spending limit will help reduce your monthly payments. In addition, these financial tactics can help you build your credit score for future business ventures.

What Factors into a Credit Score?

First, let’s discuss the differences between different credit scores. A credit score can range from around 300 to 850 points. A score of 700 and higher is considered a good credit score and will generally allow you to obtain a personal loan without being denied.

Also, obtaining a high credit score can help to lower interest rates. In addition, an online credit card debt payoff calculator will give you financial recommendations to help you achieve a higher credit score. Furthermore, these suggestions may relate to changes in your credit limitations and other account-relevant variables.

You May Also Like: Debt Management Methods: Successful Strategies for Your Debt

What are the Best Credit Card Debt Calculators?

Don’t let your debt from credit card companies take control of your life. Also, getting a handle on your debt is simple with the Payoff Calculator. Enter your current card amount, credit card interest rates, and monthly payment.

These websites will assist you in determining how long it will take to get out of debt. Moreover, you can also place on this website how many months you want your debt from a credit card company addressed. In addition, the sign-up process is quick to complete and will not result in charges against your credit.

Here are my top 3 credit card payoff calculators:

- Decreasemypayments.com

- Credit karma

- VantageScore

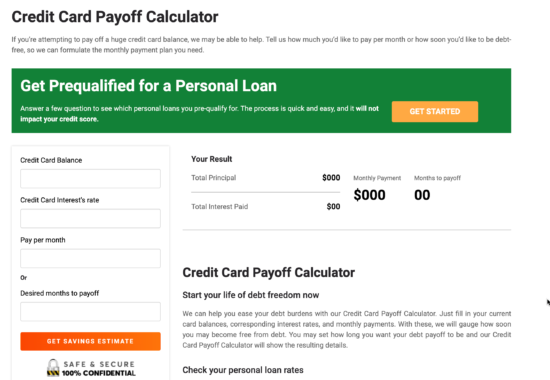

Decreasemypayments.com

With its Payoff Calculator, Decrease my Payments can assist you in finding the best ways to reduce your debt obligations. Enter your available credit card balances, credit card interest rates, and monthly payment. Also, they will use this to determine how soon you will be free from debt.

Assume you have a $20,000 credit card bill, a 25% credit card interest rate, and a $1,000 monthly payment. According to our Payoff Calculator, it will take you 27 months to pay off the sum ultimately. It does.

However, recommend $877 monthly payments for 27 months. In that way, you may have lower monthly payments and rates. A balance transfer card allows you to pay $1,112 monthly for 18 months at 0% APR.

Key Features of Decrease My Payments

With this site’s many features, you can specify how long you want your debt paid off, and their Payoff Calculator will provide the results. Here are its key features:

- Calculator for Credit Card Repayment: Decrease my payments may indeed be able to assist you if you’re attempting to pay off a large credit card bill. In addition, tell them how much you want to pay each month or when you want to be free from the smallest debt so they can create the monthly payment plan you require.

- Examine the terms of your personal loans: The Credit Card Payoff Calculator may present various options depending on your debt payment goals. It may recommend options that reduce your monthly payment and interest charges or indicate the quickest path to debt repayment.

- Balance Transfer Credit Cards Calculator: An important feature is an introductory rate of 0% on many balance transfer cards. Moreover, this calculator allows you to pay off your debts without incurring interest for several months or a year. The Credit Card Payoff Calculator defaults to an 18-month introductory APR, but certain cards may only provide six months.

Also, you may use the Balance Transfer Credit Card Calculator to see if you can pay off your debt before the promotional period ends. While most transfer cards provide 0% intro periods, you may be charged a high-interest rate once they expire.

Furthermore, you must restrict any increase in credit card expenses, which our Home Budget Calculator may assist you with. It, along with the Credit Card Payoff Calculator, can assist you in allocating funds, prioritizing expenditure, and avoiding impulsive purchases.

You May Also Like: Secured vs. Unsecured Loan: How Do I Know Which Is My Best Option?

My Take

If you have debt from single or multiple credit cards, remember that you are not alone. Making a strategy to pay off your debt is a wise financial decision. In addition, you can use a credit card debt payoff calculator like Decrease My Payment to discover how long it will take to pay off your debt and how changing your monthly payment would affect that objective.

You may then adjust your monthly payments and choose various payment strategies. This calculator will show the differences in your interest, total cost, and eventual debt-free date. Include additional data such as your medical expenses and student loans for a more detailed analysis.

Other features may help in your credit card payments. You may drag the calculator’s sliding scale to adjust the amount you’ll dedicate to your debt. In addition, you may choose what payoff order to consider: the debt snowball or the debt avalanche. You can visit their site by clicking here.

Credit Karma

Credit Karma also offers a Credit Score Stimulator. Moreover, this online tool will help determine what would happen if you opened a new credit card or how significant expenses would affect your credit score. Also, this calculator is an excellent option if you’re looking for a reliable and effective credit card payoff calculator.

Furthermore, the recommendations provided by the debt calculators will help customers make the most of their credit situation. In addition, the website is designed to be ultimately secure using your financial information and is highly accessible across your electronic devices. Additionally, the site provides an abundance of finance-related reading to help you better understand how your money can start working for you.

Key Features of Credit Karma:

The resources and calculators provided by Credit Karma are valuable tools that everyone can benefit from. Here are some of its features:

- Direct Dispute: If you see any errors on your existing credit report, you can dispute it directly through the Credit Karma platform.

- Approval Odds: Credit Karma will estimate the likelihood of approving any new debt or credit cards.

- Credit Monitoring: Credit Karma can assist in monitoring your current credit-related status.

- Notifications: This company will alert you if any significant changes appear on your credit report, including any potential fraudulent activity.

- Credit Karma Mobile App: This website offers an easy-to-use mobile app to pull information in real-time.

- Recommendations: Credit Karma will generate recommendations for credit cards or loans that could help save you money compared to your current credit payments.

My Take

Credit Karma is not only a great resource for viewing your credit score and exploring ways to improve it; the website also offers an excellent Credit Score Stimulator. This online tool can help you determine what would happen if you opened a new credit card or how significant expenses would affect your credit score.

Additionally, the calculator is reliable and easy to use- perfect for those looking for a dependable and effective credit card payoff calculator. If you’re looking for more information on managing your finances, check out Credit Karma’s blog for helpful tips and advice!

You May Also Like: Should I Get a Credit Card: Things You Should Know

VantageScore

Many Americans complain about the lack of scoring consistency they receive for their credit scores. All three credit bureaus have designed a model called “VantageScore” to obtain a more consistent standard of credit scoring across the board. Also, when you use a card debt payoff calculator, you’ll be able to see how to get debt better managed and financed.

Scoring Models of VantageScore

A VantageScore has three scoring models. They calculate your scores based on the following:

- Your payment history: They will look at the consistency of payments made and look for any late payment fees in your account. They will look to see how many lines of credit you have open and have had open in the past.

- How long you’ve had credit: They will look at the duration of the lines of credit you currently have open.

- Which types of credit lines do you have: The different types of credit lines can be anything from home loans, personal loans, auto loans, student loans, refinances, home improvement loans, etc.

- Current credit limits: These figures are contingent upon several factors, including your credit score.

- The amount of debt: This factor is the price owed for your purchases. Also, this amount is often called the “debt-to-income” ratio, or how much you bring in (gross annual income) compared to how much you owe in debt.

- Any hard inquiries on your credit report: This is the act of “pulling” credit when visiting a lender. This factor is particularly scrutinized when applying for an auto or home loan.

My Take

Americans complain about the inconsistency of their credit scores. This pay-off calculator is known to be more consistent regarding figures. A VantageScore calculator has three models that calculate scores based on various factors to ensure conciseness of results, including payment history and how long you’ve had credit. This good calculator will help you if you are not comfortable using the first two calculators.

Read More: Credit Card Limit: An Ultimate Guide

How To Calculate Credit Card Interest Rate

Your bank will determine the interest rate of your credit cards. You can classify the interest rate into three types: variable, fixed, and promotional.

- Variable: You can specify the variable rates using various benchmarks, including prime interest rate, US Treasury Bill interest, and many other indexes. Additionally, you will have to pay a ‘margin’ to the bank, an amount based on your credit rating.

- Fixed: As the name suggests, fixed rates do not fluctuate like variable rates. These are larger than variable rates, though. A card issuer may change it after a 45-day notice, but the cardholder may refuse the new rate. Also, the rate may change if you paid late, completed a debt management program, or exhausted your promotional fixed rate’s duration.

- Promotional: These rates are available during a limited-time promotion. These can be quite advantageous in certain situations. However, you must read the fine print carefully and expect a lower credit score due to the risk to lenders.

To know how much your rate will cost, look for your card’s annual percentage rate and divide it by 365 days. This amount is your daily periodic rate. Then, add all your card purchases and divide them by your credit card’s billing period. The result is your average daily balance.

Next, multiply your daily periodic rate and your average daily balance. Finally, multiply that by the days in your billing cycle to get your interest balance.

You May Also Like: Types of Credit Cards: Which Should You Get?

Know your results after using the credit card debt payoff calculator

After placing all the necessary details on the calculator, you should check the following and know its purpose. Also, this will help you determine your next step or the points you need to check for your credit score improvement.

- Payment strategy: Create a budget to estimate how much extra cash you could put into your monthly debt and the minimum monthly payment. You can use that money will be used to expedite your debt repayment. Adjust the amount you’ll pay toward your debt using the sliding scale.

- Payoff order: The debt outstanding balance calculator allows you to choose between the debt snowball and debt avalanche method approaches to see how much interest you’d pay each.

- Total monthly payments: You’ll notice your current monthly charges and new fees with the additional funds you contributed to your debt.

- Total interest: This price is the interest you’d pay while repaying the debt. Compare the interest rate with your current strategy and the new plan with your extra payment amount.

- Debt-free month: This term is the month you will be free from the outstanding balance. The more you pay each month, the sooner you will be able to pay the minimum amount and be free from debt faster.

- Debt payoff order: Under your existing minimum payments and the new plan with the additional funds toward your debt, you’ll see a list of your account with the principal, total interest rate, and a free from debt date. This order could alter based on whether you use the debt avalanche or debt snowball payoff approach.

How Can You Improve Your Credit Scores?

Credit scores are one of the most crucial indicators of financial wellness and reveal how sensibly you use credit. The higher your credit scores, the easier it will be authorized for additional loans or lines of credit. A higher credit score may help you get the best interest rates when borrowing.

There are some basic things you may take to boost your credit scores. It requires some effort plus, of course, time. Here is a step-by-step method to improve your credit score.

- You should pay your bills on time. Late or missed payments can significantly affect your credit score.

- Never close old credit cards. In this way, you can lower your credit score significantly.

- Pay down debts. Keeping your overall credit card utilization below 30% will leave you in good shape.

- Don’t open too many credit cards at once. Having too much credit can go against your credit score.

- Diversify your credit mix. Lenders like to see a mix of existing credit.

You May Also Like: What Are the Advantages of Credit? Save Money and Time Now

Conclusion

A credit card payoff calculator is a helpful tool for managing multiple credit cards. By inputting your credit card balances, interest rates, and desired monthly payment, you can determine how long it will take to pay off your credit card debt.

If the interest rates are high, consider using the debt avalanche method or transferring balances to a balance transfer credit card with lower interest rates.

Be aware of cash advances and their impact on interest savings. Additionally, monitor your credit card usage, daily balance, available credit, and credit limit to ensure efficient debt management and pay off your debts faster, saving on total interest paid.

Make sure you know how to manage because having a bad credit history will lower your score and prohibit you from getting other debt when needed. Also, check your credit card balance before purchasing anything.

Your financial well-being is paramount, and you should not worry about every billing period. As long as you pay your annual fees and manage your debt by remembering the payoff date, you will not have any problems.

You will be able to see your progress and know when you have paid off your debt. Decreasemypayments.com offers a free online credit card payoff calculator that can help you achieve your goal of becoming debt-free!

FAQs

What is the credit card payoff formula?

Subtract the interest and fees from your total cost to determine how much principal you pay each month. For example, your payment is $210, and the interest is $70. Subtract 210 from 70 to get 140, which means you pay down $140 of your debt this month.

How much more would my credit score improve when I pay off my credit cards?

If you’re close to maxing up your credit cards, paying off credit card balances fully could boost your credit score by 10 points or more. When you pay off credit card debt, you may only receive a few points if you haven’t used all of your available credit. Know your results after using the credit card debt payoff calculator

After placing all the necessary details on the calculator, you should check the following and know its purpose. Also, this will help you determine your next step or the points you need to check for your credit score improvement.

Can you find spare cash for your debt payments?

Make a budget to determine whether you have extra money to add to the minimum payments. That money will accelerate your debt payoff. Adjust the sliding scale to match how much extra money you’ll put toward your debt.

While this calculator can help you chart a debt repayment plan, it won’t hurt to set aside extra cash for your monthly payments.

Article originally published on 03/20/2020, updated on 06/28/2022, updated on 6/15/2023.

This article is the author’s personal opinion, which may differ from the “official” statements or facts. All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by Inquirer.net constitutes an investment recommendation, nor should any data or Content published by Inquirer.net be relied upon for any investment activities.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.