Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Ladder Loans: Reviews and Ratings

High-interest debt can pile up fast, and it often feels like you’re drowning. You’re not alone. Millions of Americans face the same financial pressure, often through no fault of their own.

The good news: help is out there. Debt consolidation companies and lenders offer a range of options, depending on your needs. And if you’re looking for funding, chances are you need it quickly.

Ladder Loans promotes fast access to cash—advertising loan amounts up to $100,000 and funding in as little as 24 hours. But is it the real deal or just another flashy promise?

What is Ladder Loans?

Ladder Loans homepage.

Ladder Loans is a rebranded version of Money Ladder, founded in 2006 and based in Lake Forest, California. Founded by Navin Narang, the company is not a direct lender. Instead, it connects borrowers with third-party lenders.

The company offers unsecured installment loans, meaning no collateral is required. These loans are often used to consolidate credit card debt or pay off other high-interest balances. Terms range from 12 to 60 months. Annual percentage rates vary from 5.49 percent to 26.99 percent, depending on credit.

How it works

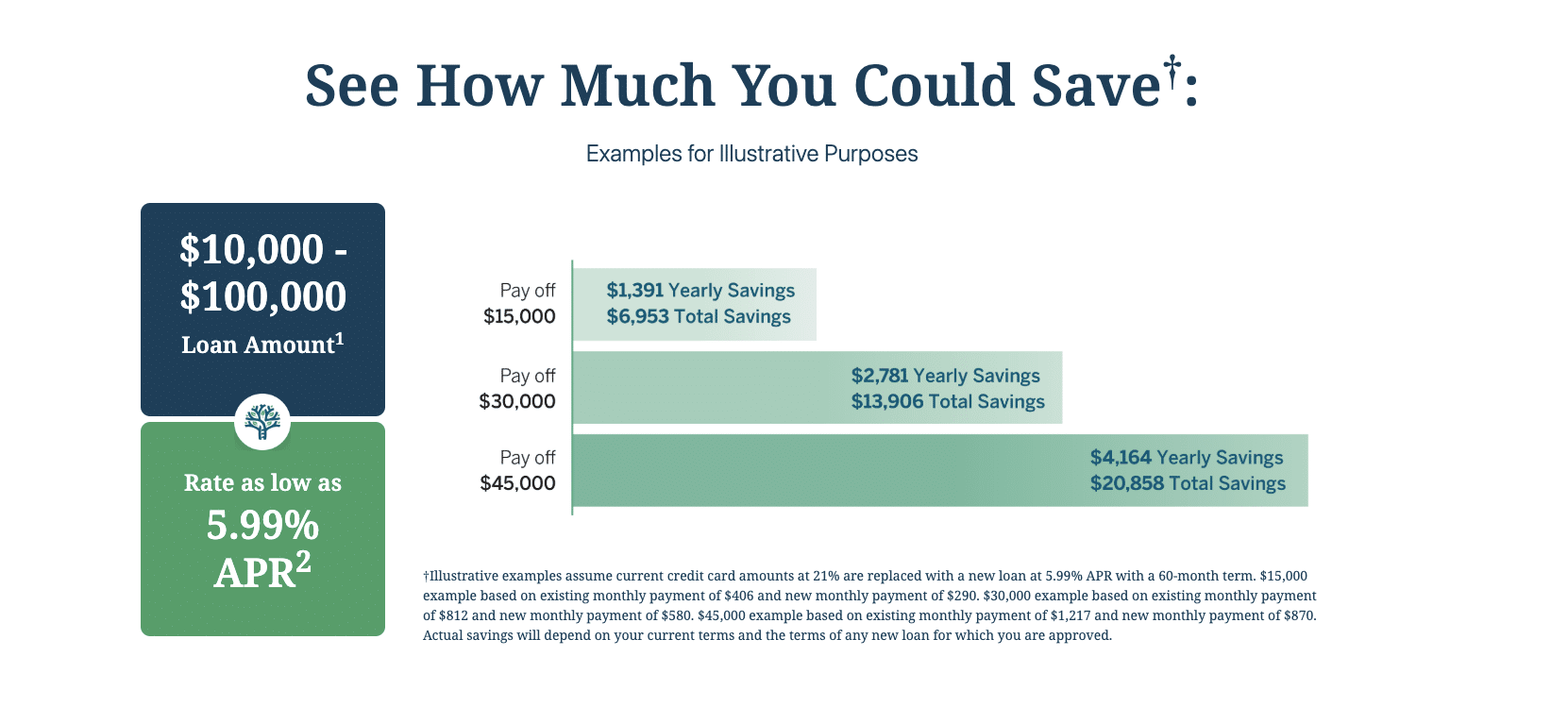

Estimated savings chart based on loan amounts and APR.

- Prequalification: You can check your eligibility with a soft credit pull, which doesn’t affect your score.

- Fast approval: If you proceed, a hard inquiry is required. If approved, funds may arrive the next business day.

- No collateral: Employment is required, but there is no stated minimum credit score or income.

- Clear terms: Ladder promotes transparent repayment plans with no hidden fees.

What sets Ladder apart

Ladder emphasizes access and speed. According to reviews from Bullish Bears and SuperMoney, the company appeals to borrowers who may not qualify elsewhere. It’s also accredited by the Better Business Bureau.

Ladder Loans Better Business Bureau profile.

The process is digital, streamlined and designed to feel more like a tech platform than a traditional lender. This appeals to people who want a fast solution and prefer to avoid bank visits and paperwork.

What customers are saying

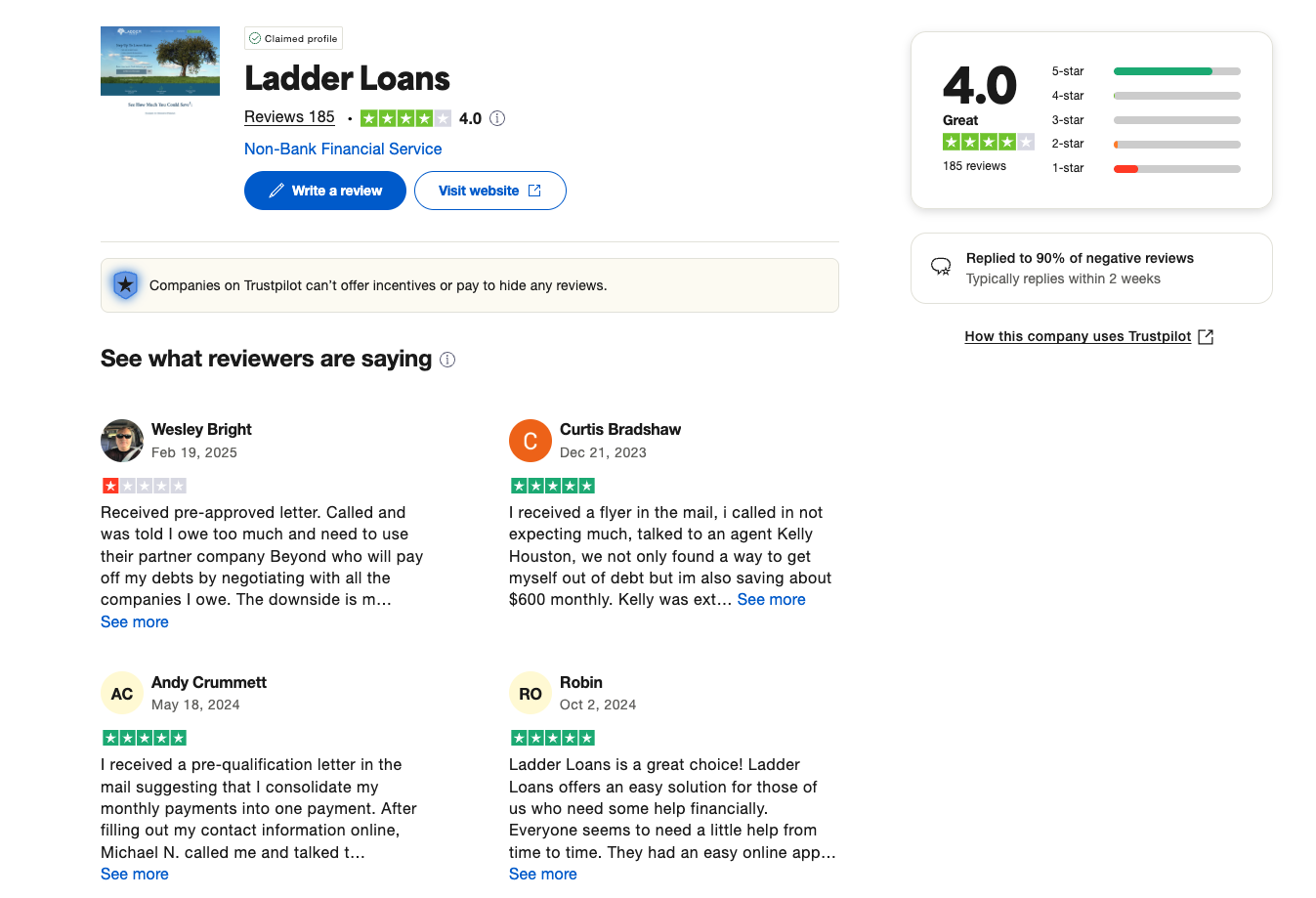

Reviews are mixed. Some borrowers report fast service, easy applications and helpful support. Others mention aggressive follow-up calls, unclear terms and unexpected credit score drops.

Reviews of Ladder Loans on Trustpilot.

Some users may unknowingly enter a debt settlement program instead of receiving a loan, which could negatively affect credit.

Pros

- Fast funding, sometimes in 24 hours

- Loan amounts up to $100,000

- No stated minimum credit score or income

- Transparent repayment terms

Cons

- APRs can reach 26.99 percent

- Aggressive follow-up from sales staff

- Confusion between loans and settlement programs

- Potential negative impact on credit if enrolled in a relief program

Should you use Ladder Loans?

If you’re managing high-interest balances and want fast funding, Ladder Loans could be a strong option—especially if you qualify for a lower APR and understand the terms.

If your credit is lower, higher interest rates could keep you in a debt cycle. Be sure to confirm whether you’re applying for a personal loan or enrolling in a debt settlement program.

Bottom line: Ladder Loans isn’t a magic fix, but it can be a helpful tool. Use it wisely and it may help you climb out of debt. Use it carelessly and you may find yourself stuck on the same financial rung.

Ladder Loans FAQ

1. Is Ladder Loans a legit company or just more false advertising? Ladder Loans is a legitimate marketplace lending platform based in Lake Forest, California. They’ve been around since 2006 (originally as Money Ladder) and are accredited by the Better Business Bureau. That said, some negative reviews mention aggressive sales follow-ups and confusion about whether they’re offering personal loans or enrolling you in a debt settlement program. Read all the information upfront and double-check what you’re signing up for.

2. How does the Ladder Loans application process work? The process starts with a soft credit pull to prequalify—no impact on your credit score. If you move forward, a hard credit pull is required. You’ll need basic info like your driver’s license and bank details. Once approved, funding can happen in as little as 24 hours. Many borrowers say the easy process and experienced customer service team made what’s normally a stressful process feel surprisingly stress free.

3. What loan options does Ladder Loans offer? Ladder Loans offers unsecured installment loans up to $100,000, with terms from 12 to 60 months and interest rates ranging from 5.49% to 26.99%. There are no prepayment fees or hidden fees, which is a big plus. Whether you’re looking to consolidate debt, cover bills, or just want an easy solution for short-term financing, they position themselves as a flexible alternative to other lenders.

4. Will using Ladder Loans affect my credit or show up on credit bureaus? Yes—if you proceed with a loan, the hard credit pull will show up on your credit report, and the loan itself will be reported to the major credit bureaus. Some customers have complained that entering what they thought was a loan program actually led them into a debt settlement arrangement, which can impact credit negatively. Make sure you’re clear on whether you’re getting a personal loan or being placed into a debt settlement program.

5. Can I pay off a Ladder Loan early without penalties? Yes. Ladder Loans does not charge prepayment penalties. If you’re able to pay off your loan early, you can save money on interest without facing any additional fees. Just make sure you confirm the total payoff amount with your lender before submitting a lump-sum payment.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.