Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Trinity Debt Management: Reviews and Ratings

Logo of Trinity Debt Management.

This nonprofit credit counseling agency helps consumers manage unsecured debt through structured repayment plans and financial education.

For many people, debt isn’t the result of reckless spending — it stems from medical bills, job loss, or simply trying to stay afloat. Trinity Debt Management offers a realistic way forward, negotiating with creditors to reduce interest rates and consolidate payments into one monthly plan. As a nonprofit, it avoids the high-pressure sales tactics often found in for-profit debt relief.

Best for: Consumers with steady income who want to repay debt without filing for bankruptcy.

What Trinity actually does

Homepage of Trinity Debt Management.

Trinity offers debt management plans (DMPs), credit counseling, financial education and even bankruptcy and student loan guidance. But its bread and butter is the DMP: a structured, long-term repayment strategy for unsecured debts like credit cards or medical bills.

It doesn’t erase your debt, but it makes it manageable. Think of it as rehab for your finances.

After a free consultation, Trinity builds a custom repayment plan. The agency talks to your creditors, negotiates lower interest rates (think 6 percent to 10 percent instead of the 18 percent to 25 percent norm), and consolidates your payments. Then you make one monthly payment to Trinity, and it handles the rest. The whole process usually takes three to five years.

What makes Trinity different

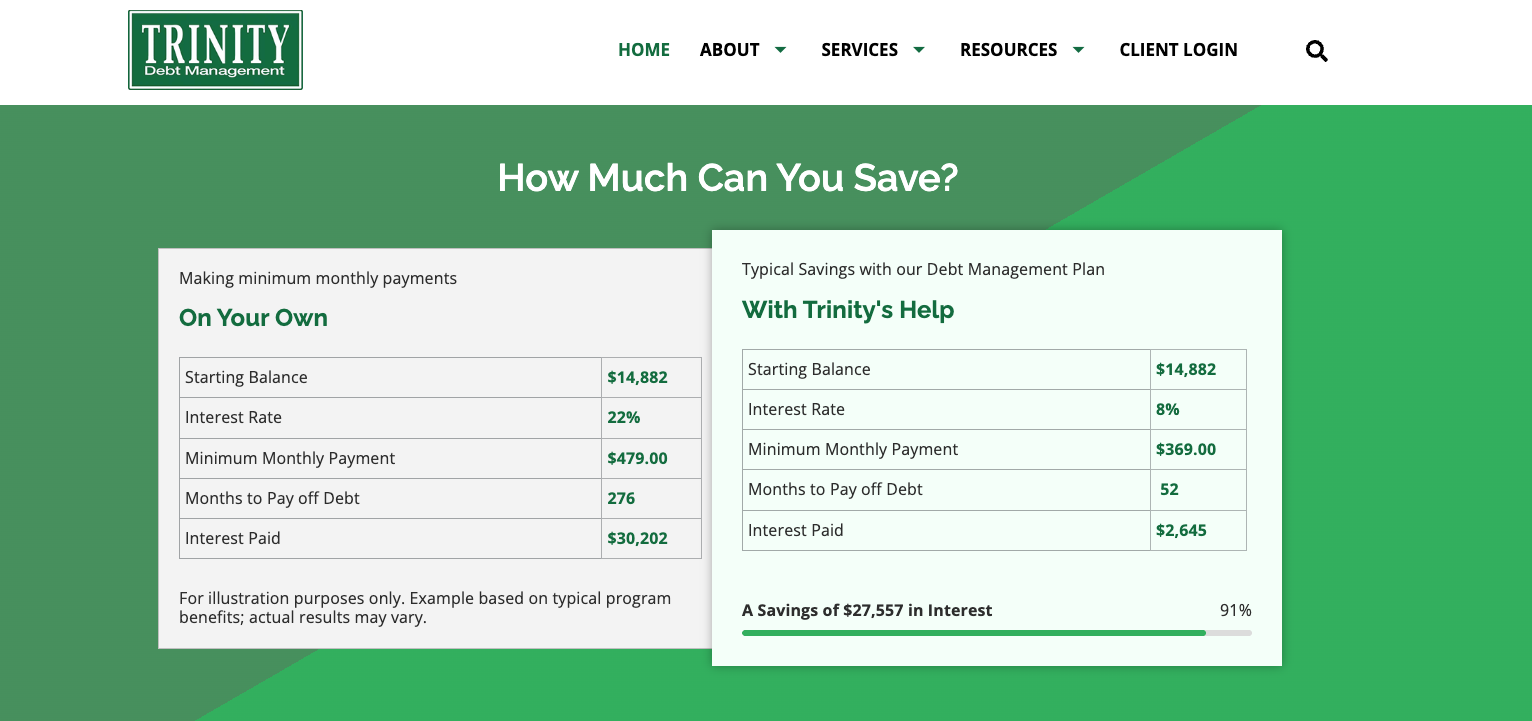

Trinity Debt Management example showing potential savings

Three things:

- Nonprofit status. It’s a 501(c)(3) organization. That means lower fees and no upselling nonsense.

- Faith-based foundation. Trinity takes a Christian-informed approach to financial stewardship, though you don’t need to be religious to work with it.

- Accreditation and oversight. Trinity is certified by the Partnership for Financial Education and holds an ISO 9001:2015 quality management certification. It’s licensed in Michigan, Virginia, Oregon and Maryland, but not in Kansas, Montana, Nevada, New York or Rhode Island.

The agency also offers a wide range of free tools and educational materials — real financial literacy, not fluff. If you’re looking for integrity in a world full of scams, this is it.

Real customer reviews

Clients praise Trinity for its personable, knowledgeable counselors and the relief of seeing interest rates drop. One reviewer said they felt they were treated like a person, not a problem. That’s rare in this industry.

But no company is perfect. Some complaints cite late or missed payments to creditors on Trinity’s end or a lack of transparency around fees. That tracks with most nonprofit DMP providers: the system works if everyone does their part. If Trinity fumbles a payment, your credit could take a hit. Stay sharp.

On Trustpilot, Trinity has a 1.3 out of 5 rating, which is considered low. It is also not rated by the Better Business Bureau and lacks accreditation from the American Fair Credit Council and the International Association of Professional Debt Arbitrators.

Trinity’s Trustpilot page with 1.3-star rating and customer reviews

Who Trinity works best for

If you:

- Have unsecured debt (like credit cards, personal loans or medical bills)

- Have steady income but can’t keep up with high-interest payments

- Want to pay what you owe without bankruptcy or sketchy settlement companies

Trinity might be your lane. It doesn’t care about your credit score, but you do need to be able to make consistent monthly payments.

And remember: you’ll have to stop using your credit cards during the program. That’s nonnegotiable.

What it might look like

Say you have $20,000 in credit card debt. At a 22 percent annual percentage rate, you’ll drown. Trinity might get that down to 8 percent and set you up on a 48-month plan. You make one manageable monthly payment, stop the bleeding and save thousands in interest.

Real-life users report this kind of outcome. It’s not a miracle, but it works.

The drawbacks

- No principal forgiveness (you still pay the full amount owed)

- Missed payments can damage your credit

- Not all creditors will participate

- Small setup and monthly fees (lower than most, but still present)

-

Limited availability (not in Kansas, Montana, Nevada, New York or Rhode Island)

The bottom line

Trinity isn’t for everyone. But if you’re looking to take ownership of your debt, get off the treadmill and stop handing interest to the banks, it’s one of the better options out there.

It doesn’t promise magic. It promises a plan — one that’s worked for thousands.

You don’t need to be perfect to take back control. You just need a system that isn’t working against you. And that’s where Trinity might come in.

Trinity Debt Management FAQ

What is Trinity Debt Management, and how does it actually help people like me?

Trinity Debt Management is a non-profit agency that offers debt management services for folks struggling with unsecured debt like credit cards or medical bills. Through their non profit debt management plans, you get one manageable monthly payment and access to Trinity’s certified credit counselors absolutely free. These aren’t call-center bots—they’re real people who listen, help you plan a monthly budget, and negotiate with creditors for lower payments and interest rates, so you can start moving forward with your debt instead of drowning in it. If you’re feeling overwhelmed, like a lot of us do, Trinity can help with a free debt analysis to show you what’s possible.

Can working with Trinity actually save me money, or is it just reorganizing debt?

This isn’t some shell game. Their debt management program is designed to save thousands on interest—sometimes cutting rates from 20%+ down to single digits. That means real money back in your pocket and an actual path toward becoming debt free, not just shifting numbers around. Many clients say they couldn’t have dreamed such a benefit existed anywhere else, and for good reason. You’re not just getting help—you’re getting strategy, stability, and that crucial first step toward a stable and fulfilling financial life.

How personal is the support from Trinity’s counselors?

Trinity’s team is known for showing up with grace and kindness. Real reviews call them attentive to my needs, heaven sent, and a great organization to work with. If you’ve ever felt judged or dismissed by other financial institutions, Trinity flips the script. They’re there to walk you through not just the math but the emotion of it—helping you take control of your spending, learn money management, and become a better steward of your finances. That kind of kindness you have shown energy goes a long way when you’re picking up the pieces.

What does the process look like, and how fast can I find relief?

It starts with a free debt analysis, which lays out your situation clearly. Then you’ll work with a counselor to build a plan that consolidates your eligible debts into one manageable monthly payment. From there, Trinity negotiates directly with your creditors. Most clients report seeing a shift quickly—debt relief in 3 easy steps is the idea, though timelines vary. What’s constant is the hope that comes with seeing the way forward. Like one client said, “I was overwhelmed but after speaking with Trinity, I had hope for moving forward and was finally able to focus on our budget with confidence.”

Is Trinity available in every state?

No. Trinity Debt Management is not available in Kansas, Montana, Nevada, New York or Rhode Island. Before starting the process, it’s important to confirm that services are offered in your state. If you live in a state where Trinity isn’t licensed, you’ll need to explore other debt management or credit counseling options.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.