BlackBerry stock price – is this stock worth picking?

Have you ever wondered about the BlackBerry stock price? After all, you may have thought the cellular phone company had gone away. BlackBerry is still here, though, and you might want to consider its shares for your portfolio.

First, let’s talk about the history of BlackBerry and its recent moves. Then, we’ll explain why the phone company’s stock price went up briefly before tumbling down tremendously. Could this be your signal to purchase BlackBerry shares?

BlackBerry was the phone of choice for on-the-go professionals back then. When the iPhone came out, it seems the company went away from public view. Yet, its recent developments may convince you to invest in this tech stock.

From phones to cars and everything else that’s cyber

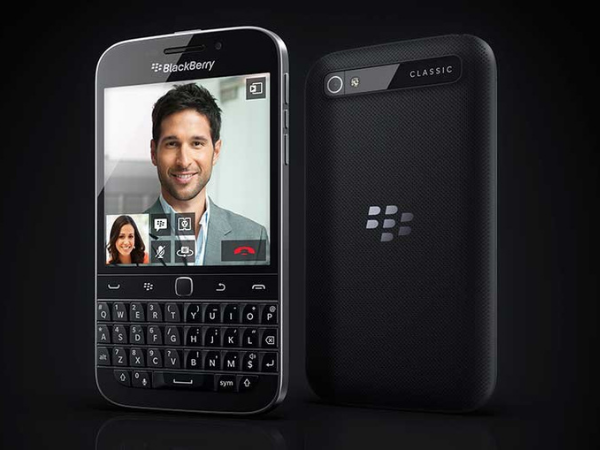

Several years ago, cellular phones didn’t have touchscreens. Instead, they had a Numpad and a few other buttons for the menu. BlackBerry phones were different, though.

They often had a mini keyboard. If you see lots of buttons under the screen, it’s probably a BlackBerry. Back then, it was a status symbol. Most of the owners were business leaders.

The BlackBerry company’s roots were quite humble, though. In 1984, Research In Motion launched the brand in a Canadian strip mall. 23-year-old Mike Lazaridis was its leader.

He was an engineering genius who wanted big changes to wireless communication. His first product was the Budgie. It displayed text from a wireless remote to a TV.

BlackBerry was doing great by 1990. It had a million dollars in annual revenues at the time. Lazaridis wanted something more, though. He aimed for a portable email gadget.

Then in 1999, the company released the first-ever BlackBerry device. It was the 950, and it used one AA battery. More importantly, it allowed users to send emails on the go.

In the same year, BlackBerry became publicly traded. It has released more products since then. These included the 6200 series and the 7100. The latter didn’t have QWERTY keys.

Unfortunately, Apple released the iPhone in 2007. BlackBerry tried to keep up, but it wasn’t able to beat its fruit-themed competitor. As a result, BlackBerry slowly faded from the public’s eye.

Yet, the company continued to grow. It ventured into different fields. Specifically, it went into cybersecurity and embedded tech. You might own devices that use BlackBerry tech!

Why was the BlackBerry stock price rising then?

BlackBerry bought QNX, a software company by grads from the University of Waterloo. It was a real-time operating system. You’ll see it in various gadgets like cars and medical devices.

What’s more, it now offers cybersecurity. It uses Cylance tech to provide Unified Endpoint Security (UES). Simply put, it helps companies fight against cyberattacks.

BlackBerry’s solutions enabled its recent projects. For example, the US Federal Government announced its tech would improve its communication systems.

On the other side of the world, Chinese EV company Xpeng wanted BlackBerry tech as well. Its Xpeng P7 uses QNX as its operating system.

Here’s a big reason why the BlackBerry stock price went up: WallStreetBets. The online group wanted to pump it as they did with GameStop and AMC stock.

It believed Wall Street and other rich people profited from failing companies. Specifically, they would short sell to gain money as the stocks tanked.

That’s why WallStreetBets bought a lot of their stocks. Short sellers bet these will go down. This would increase the stock prices. But they went up, causing short sellers to lose money.

As a result, the BlackBerry stock price got a 30% gain last month. It closed at $15.88. BB stocks hit $20.17 at the highest level and $13.56 at the lowest.

The BlackBerry stock price increase was short-lived.

The value of BB stock seems to be going down steadily. At the time of writing, the stock quote for Blackberry (NYSE: BB) is at $12.00. Current ratings have pulled the price down.

Analysts knew that the growth of these “meme stocks” came from hype. It didn’t reflect the actual performance of their companies. You may say the same for BB stocks.

Compared to BlackBerry’s actual performance, the stocks were overvalued. The company’s Q1 Earnings Press Release for Fiscal Year 2022 may explain why.

On May 31, 2020, its revenue was $206 million. For May 31 this year, it earned only $174 million. When revenue goes down, it tends to pull down stock prices with it.

This could be one of the reasons why BlackBerry stocks got a lower rating. From a “hold” rating, analysts downgraded it to a “sell.” This may signal retail investors to get rid of their BB stocks.

The chip shortage could pull it down further.

There could be a bigger reason why BlackBerry stock prices. All of its solutions rely on semiconductor chips. These are the tiny processors found in many gadgets and cars nowadays.

Unfortunately, the lockdowns around the world caused a chip shortage. Companies are having trouble getting enough supplies. Even Apple CEO Tim Cook admitted it would affect sales.

Those will use BlackBerry tech to enable their gadgets. Without the chips, though, they can’t produce the devices. This may cause problems for their projects.

In turn, people will have a hard time buying them. This means reduced sales for BlackBerry’s projects and products. Eventually, this might pull down the stock price further.

Related Articles

Final thoughts

The BlackBerry stock price isn’t worth it even when it’s low. It isn’t likely to show growth considering the current situation. The stock’s low rating may turn off investors.

It’s even worse when you take the chip shortage into account. This will make it harder for BlackBerry to produce devices. Other companies using BB tech may have a hard time too.

You might want to look elsewhere for better investments. For example, blockchain stocks are a great choice nowadays. As the cryptocurrency trend rises, their prices will also go up.

Learn more about the Blackberry stock price

Is BlackBerry dead?

Believe it or not, BlackBerry is still with us. Its mobile phone lineup isn’t as popular nowadays. Instead, you may find its tech in various devices. They also provide cybersecurity.

Does BlackBerry pay a dividend?

According to its website, BB stocks don’t pay dividends. If you need a fixed income, look to other stocks. Some are in sectors that are doing well despite the pandemic.

Why is BlackBerry stock dropping?

It got a low rating from stock analysts. It went from a “hold” to a “sell.” Also, the chip shortage may have played a huge part. It’s hurting supplies for tech companies across the globe.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.