U.S. Fed to let leverage exemption expire on March 31

Big U.S. Fed banks will have to resume holding an extra layer of loss-absorbing capital against U.S. Treasuries and central bank deposits from next month after the Federal Reserve said it would not extend a temporary waiver that had exempted those assets from a key bank leverage rule.

On Friday, the Fed said it would, however, review the “supplementary leverage ratio” rule due to concerns it is no longer functioning as intended as a result of the central bank’s emergency pandemic monetary policy measures.

Shares of the largest U.S. banks dropped in pre-market trading on Friday immediately following the Fed’s announcement. JPMorgan Chase & Co was down nearly 2%, while shares of Wells Fargo & Co, Bank of America Corp and Citigroup Inc tumbled roughly 1.5% each.

To ease stress in the Treasury market sparked by the COVID-19 pandemic and to encourage bank lending as American households and businesses struggled amid lockdowns, the Fed last April excluded U.S. Treasuries and central bank deposits from the leverage ratio until March 31 this year.

Uncertainty over whether the Fed would stick to that expiration date has added to recent anxiety in fixed income markets. Analysts have said allowing the rule to expire could push banks to cut back on government debt and reduce the funding for other investors to buy bonds.

But on Friday, Fed officials said they were confident that allowing the exemption to expire would not impair Treasury market liquidity or cause market disruption because the Treasury market had stabilized and big banks have high levels of capital.

The U.S. 10-year Treasury yield rose slightly Friday morning to 1.7353%, indicating some initial concern over the news.

Related Articles

How to Get Out of Debt

How Does Rent to Own Work?

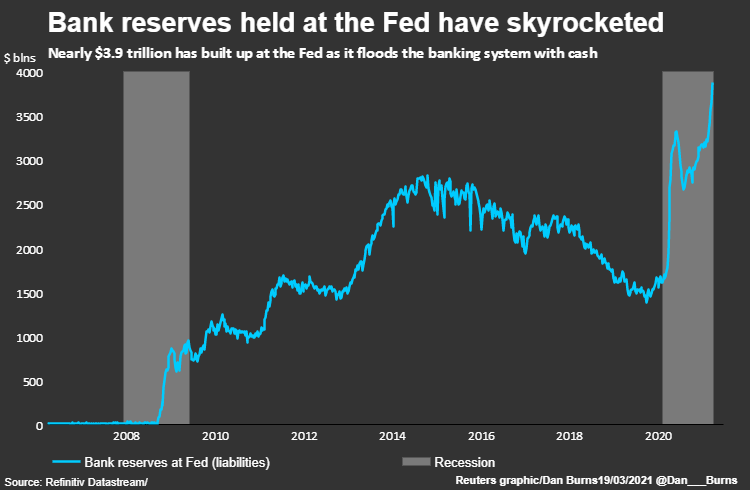

The leverage ratio was adopted after the 2007-2009 financial crisis as a backstop to other capital rules. But it is rapidly becoming the primary limit on banks’ businesses as their balance sheets have swelled with funds from COVID-19 emergency stimulus programs.

Bank deposits at the Fed, also known as reserves, have sky-rocketed to $3.9 trillion since the pandemic began, according to Fed data from Thursday, and are expected to increase by another $2 trillion before the Fed pares back stimulus efforts.

Photo Credit: Reuters

Due to that growth in the supply of central bank reserves and the issuance of Treasury securities, the Fed said on Friday it may need to change the calibration of the ratio “to prevent strains from developing that could both constrain economic growth and undermine financial stability.”

However, it pledged that any changes to the rule would not erode the overall strength of bank capital requirements.

(Reporting by David Henry and Michelle Price; Editing by Andrea Ricci)

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.