Silver Swept Up by GameStop Retail Frenzy and Prices Soar

Silver broke above $30 an ounce for the first time since 2013 on Monday as an army of retail traders stormed into the metal, switching their focus from mission “Gamestonk” and triggering fears of a multi-asset melt-up in global markets.

An employee places ingots of 99.99 percent pure silver on a cart at the Krastsvetmet non-ferrous metals plant, one of the world’s largest producers in the precious metals industry, in the Siberian city of Krasnoyarsk, Russia September 22, 2017. REUTERS/Ilya Naymushin/File Photo

As traders turned their attention to silver – a bigger and more liquid market than the individual stocks targeted until last week – shares in video game retailer GameStop slipped 4% in premarket trade after closing Friday at $325.

Shares in the company, whose intentionally misspelled name earned the trend the social media moniker of ‘Gamestonk,’ have soared 1,600% this year as small-time investors scooped up assets big fund managers had bet against or ‘shorted.’

Another retail favorite, AMC Entertainment, was up 18%, having risen more than 500% this year.

But these are relatively small moves compared to multi-fold swings last week when small-time traders, who organized in online forums and traded with fee-free brokers such as Robinhood, saddled several powerful hedge funds with losses on their short positions.

Instead, the frenzy was more apparent in spot silver, which headed for its biggest one-day rise since 2008 with an 11% gain.

Silver’s Rise

Silver’s almost 20% increase since Wednesday has ignited a rally in silver-mining stocks globally, with Fresnillo shares soaring 20.5% to top the UK blue-chip FTSE 100 index. Shares Silver Trust ETF, the largest silver-backed ETF, was up 9% in U.S. premarket trading.

The rise in physical silver prices, which follows thousands of Reddit posts and hundreds of YouTube videos, suggests investors bearish on silver could be about to take a hit.

“I would look at the silver rally the same way as I would the GameStop saga – from the point of view of market stability, for now, it’s not an immediate concern, but if we see sharp moves, we could see some deleveraging in markets,” said Antoine Bouvet, a strategist at ING.

“This reducing of risk through deleveraging could potentially boost demand for bonds if it is causing excess volatility.”

Already, Goldman Sachs said the amount of position-covering last week by U.S. hedge funds, buying and selling, was the highest since the financial crisis more than a decade ago.

The trend has drawn the ire of hedge funds, with global industry body AIMA calling it “dangerous.”

Silver Lining

Ingots of 99.99 percent pure silver are seen at the Krastsvetmet non-ferrous metals plant, one of the world’s largest producers in the precious metals industry, in the Siberian city of Krasnoyarsk, Russia November 22, 2018. REUTERS/Ilya Naymushin

Some on the online Reddit WallStreetBets group, or WSB, urged followers to focus on GameStop.

“We have to stick to the same plan we’ve had all along, HOLD!! We didn’t go through the blood bath last week for nothing. Keep it up, boys!!” a user posted, referring to GameStop’s decline from nearly $500.

But the moves into silver continued after online discussions turned to silver late last week.

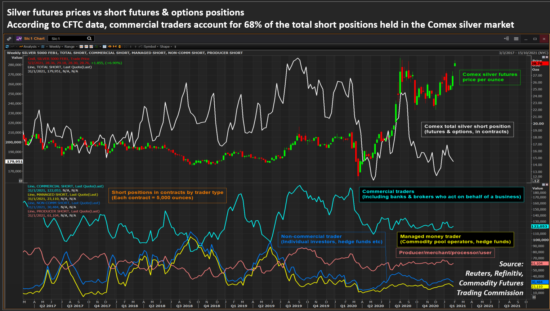

Reddit posts suggested higher prices could hurt banks with large short positions and that buying easy-to-access exchange-traded silver funds could quickly ramp up the metal’s value.

“Get out there and buy at least 4 ounces of silver as soon as you can,” one forum participant posted.

Retail traders poured a record A$40 million($30.6 million) into Australian ETF Securities’ Physical Silver fund by the afternoon. A silver ETF in Japan surged 11%.

Global short interest in silver, or the cumulative value of bets it falls in price, is equivalent to about 900 million ounces, just short of annual global production.

Banks and Brokers

Banks and brokers hold most of that – about 610 million ounces – but it is not clear whether they are net short on the metal or whether their bets offset very big physical holdings.

Commerzbank analyst Eugen Weinberg said the amateurs could find silver, a very different proposition to GameStop.

“We see little chances of any tightening of the silver market,” he said. “After all, the market is not only large and difficult to manipulate; unlike with shares, there is no excessive short selling with silver.”

JPMorgan analysts said fundamentals did not justify a sustained decoupling of silver prices from gold. Gold prices rose less than 1% on Monday.

But they warned, “the frenzy of retail buying has rebased silver prices higher for the time being.”

The rush tested limitations in newer trading platforms and processing venues, with U.S. broker Apmex warning of processing delays while it secured more silver bullion.

The Money Metals exchange, meanwhile, suspended trade until mid-morning Monday.

Similar hiccups were seen last week when GameStop, AMC, and a few other volatile stocks faced temporary buying restrictions in trading apps like Robinhood.

Photo Credit: Reuters

Roll on Reddit

Meanwhile, the Redditers are rolling on. Several renegade traders are millionaires on paper, and their hedge fund adversaries are nursing their wounds. Melvin Capital, which bet against GameStop, lost 53% in January.

Robinhood, the Redditers’ main broker, has also backed down and lifted some of the buying restrictions it imposed last week. However, limits remain on eight companies, including GameStop, AMC, and BlackBerry.

However, with regulators circling both Robinhood and the Redditers’ forums, the battle is far from over.

“I’ll tell you one thing, guarantee this ends in tears. I don’t know when,” said CMC’s Michael McCarthy.

($1 = 1.3072 Australian dollars)

(Reporting by Tom Westbrook and Thyagaraju Adinarayan; Additional reporting by Gavin Maguire in Singapore, Luoyan Liu in Shanghai and Abhinav Ramnarayan, Sujata Rao and Karin Strohecker in London; Editing by Daniel Wallis, Lincoln Feast, Shri Navaratnam and Jan Harvey)