What Is a Good Debt to Asset Ratio?

The debt-to-asset ratio is a crucial financial metric that provides valuable insights into an individual’s or company’s financial health and stability.

Whether you are an individual looking to manage personal finances or a business aiming to optimize financial performance, grasping the concept of debt-to-asset ratio is key to achieving long-term financial well-being.

Here is your guide to the debt-to-asset ratio.

Take this 30-second quiz to check if you qualify for a credit card payment reduction.

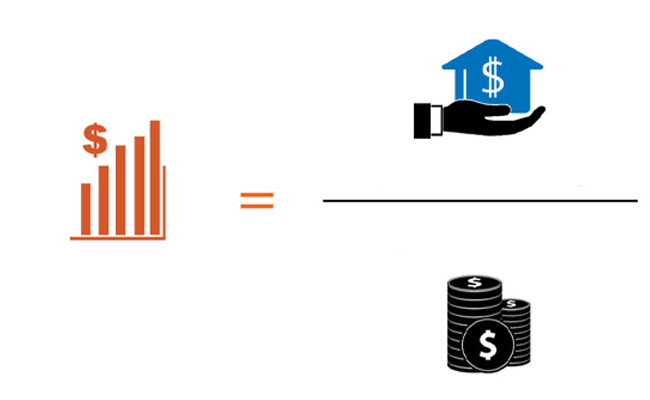

Calculating Your Debt-to-Asset Ratio

You may also refer to the debt-to-asset ratio as the debt ratio. It is the relationship between your total debt and your total assets. The debt-to-asset ratio helps companies assess their financial health, but it is also useful for personal finance.

To calculate your debt ratio, you would first determine your total long-term debt. This consists of all monthly payments, including credit card payments, payments for the car, personal, mortgage, and student loans, and other monthly bills.

The asset ratio formula does not include insurance payments and living expenses since these are expenses rather than debts and are never paid off.

Related Articles

How to Get out of Debt with the Debt Snowball Method

Calculator Mortgage Rates Today

Next, you would calculate your total assets. You should include your gross monthly income, and the money you make before you take out the taxes. It could also include your company’s assets like stocks, bonds, and other assets.

Now divide your debts by your assets. You should arrive at a percentage that represents the percent of your income and assets taken up by debt. This is your debt-to-asset ratio.

For example, if your debt ratio is 50 percent, this means that for every dollar of assets, you have 50 cents of debt. People usually express it as a decimal, so you write 50 percent as 0.5.

A higher ratio than 1.0 would mean that you have more debt than assets to cover it, putting you at greater overall risk. This usually is indicative of someone who is barely keeping their head above water, so to speak.

Debt Ratio – What Does It Mean?

To lenders, your debt ratio indicates your degree of leverage, which in turn indicates your level of risk. A very high debt-to-asset ratio would mean you are highly risky for lenders, so they’re more likely to reject your loan applications.

Even if a lender accepts you because of your good payment history on your credit report or another factor, you will likely have to pay a high-interest rate. It’s always better to keep your debt-to-asset ratio low.

Especially if you are looking into what is a good debt-to-equity ratio or short-term debt-to-worth ratio. Not only will this guarantee acceptance by lenders, but it will also provide you with lower interest rates, which will lower the cost of the loan overall.

You May Also Like: How Can Your Debt Equity Ratio Impact Your Overall Finances?

Strong Debt Ratio

Despite having a good debt-to-asset ratio, you may still have a difficult time receiving a loan. The lender will be looking at how you will handle the loan.

They will consider what may happen if you suddenly find yourself with medical bills or out of work. They will want to make sure that you will still be able to keep up with your short-term liabilities.

When lenders calculate your debt-to-asset ratio, they will likely include the potential costs of the loan you’re applying for and your total debt. This will give them an accurate picture of your ability to repay the loan.

They want to see a “cushion”, meaning you have plenty of breathing room. If your financial situation changes or interest rates were to rise, this cushion will help you stay afloat. A “good” debt ratio could vary, depending on your specific situation and the lender you are speaking to.

Generally, though, people consider a 40 percent or lower ratio as ideal. Meanwhile, they often see a high ratio of 60 percent or above as poor. You may notice a struggle to meet obligations as your debt-to-asset ratio gets closer to 60 percent.

Understanding the Equity-to-Asset Ratio

The equity-to-asset ratio is another debt-income ratio that people use to measure financial leverage. Others often measure the health of their company’s balance sheet with this financial ratio.

It is the difference between net worth or equity and total assets.

The total assets cover all the resources that hold economic value. This would include cash, property, equipment, inventory, and materials.

Equity is the difference between total assets and total liabilities. Liabilities are debts and would include business loans, company credit cards, vehicle loans, and others.

Equity is typically used to determine a company’s net worth by subtracting total liabilities divided by total assets from assets. This will give you a figure that represents assets that debt doesn’t take up.

You May Also Like: Quick Cash Loan Online: 5 Ways to Secure Quick Funds

Equity-To-Asset Ratio Formula

Divide equity by total assets, and you get the equity-to-asset ratio. This will give you a percentage, which indicates the percentage of the company that investors own.

For example, if the equity-to-asset ratio comes out to 25 percent, then that means that the company and its investors own a quarter of the company outright.

Debt holders control the other 75 percent. In the event of bankruptcy, this is the portion of the company that debt holders could claim.

Contrary to a debt ratio, which should be as low as possible, an equity-to-asset ratio should be as high as possible. 100 percent would be ideal, but there isn’t a set number that indicates trouble for a company.

The key thing to remember is that this ratio isn’t about the number itself, but how it relates to others in the same industry. This is because some assets could carry higher leverage.

This usually applies to assets that continually generate value and income, such as real estate and pipelines. So a low equity-to-asset ratio is not necessarily a cause for alarm since you have to take into account varying levels of value.

You May Also Like: How Do I Avoid Bankruptcy?

Conclusion

Your debt-to-asset ratio, or simply debt ratio, is a strong indicator of your financial health. You should strive to keep it as low as possible, shooting for 40 percent or lower. This will keep you from falling behind on debts, and will also make you look more attractive to lenders.

To lower your debt ratio, you can work on reducing your debts, perhaps by paying off smaller ones, and increasing your income – perhaps a raise or higher-paying job is in your future.

Even if you are not planning to apply for new loans, getting a handle on your debt will always help you in the long run.

Check if you qualify in two simple steps

- Step 1 – Select your debt amount below to see if you’re eligible

- Step 2 –Answer a few quick questions & join hundreds of thousands of Americans on the path to becoming debt-free

Frequently Asked Questions

Why is the debt-to-income ratio important?

The debt-to-income ratio is important because it provides insight into an individual’s financial health and their ability to take on additional debt responsibly. Lenders use this ratio as a key factor in determining creditworthiness and loan eligibility. A lower debt-to-income ratio indicates a healthier financial position and a greater capacity to handle debt obligations.

Can a high debt-to-income ratio impact credit scores?

While the debt-to-income ratio itself does not directly impact credit scores, it can indirectly influence them. If the ratio is too high, it may lead to difficulty in making timely debt payments, which can result in late payments, defaults, or even bankruptcy. These negative credit events can significantly lower credit scores over time.

Can I include future income or bonuses in my debt-to-income ratio calculation?

When calculating the debt-to-income ratio, it is generally advisable to only consider stable, regular income sources. Future income, such as bonuses or expected salary raises, should not be included as they are not guaranteed. It’s important to base the calculation on reliable and consistent sources of income.

Published on January 26, 2019; Updated on February 21, 2022; Updated on June 22, 2023.