Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Republic Finance Reviews and Ratings

Republic Finance logo

If you’ve been denied a loan due to poor credit, Republic Finance might seem like a lifeline. This lender promises fast cash, secured options, and no hard credit checks—appealing to those in urgent need.

But behind the friendly service and branch convenience, customer reviews tell a different story. Some borrowers report aggressive collections, unclear terms, and fees that add up fast.

Read on to see if they are the right lender or a risk you can’t afford to take.

What is Republic Finance?

Republic Finance homepage

Founded in 1952 and headquartered in Baton Rouge, Louisiana, Republic Finance is a privately held consumer loan company. The lender operates over 250 branch locations across the southern and midwestern United States, including Alabama, Arizona, Florida, Georgia, Indiana, Kentucky, Louisiana, Mississippi, Missouri, North Carolina, Ohio, South Carolina, Tennessee, Texas, and Virginia.

The company specializes in personal loans for subprime borrowers, offering a mix of secured and unsecured options. They report serving more than 350,000 customers since 2015 and currently hold an A rating from the Better Business Bureau (BBB).

Republic Finance loan products and services

Image courtesy of Republic Finance

Republic Finance offers several types of installment loans that can be used for various personal expenses. Loan amounts, terms, and rates vary by state and borrower profile.

Loan types available:

- Personal loans (unsecured): Up to $10,000

- Secured loans (collateral required): Up to $25,000

- Special-use loans, including:

- Emergency loans

- Vacation loans

- Home improvement loans

- Holiday loans

- K–12 school expense loans

- Debt consolidation loans

- Vehicle purchase or refinance loans (must be secured)

Note: Secured loans require in-person applications and may involve insurance and lien documentation.

Loan terms and conditions

- Terms: Typically 12 to 60 months

- Payment frequency: Monthly

- Collateral: Required for secured loans only

- Online access: Prequalification, payment portal, and limited online closing

Payment methods include automatic debit (ACH), debit card payments and in-person payments at branch locations. Setting up auto-pay may help reduce the risk of late fees.

Republic Finance application process and approval timeline

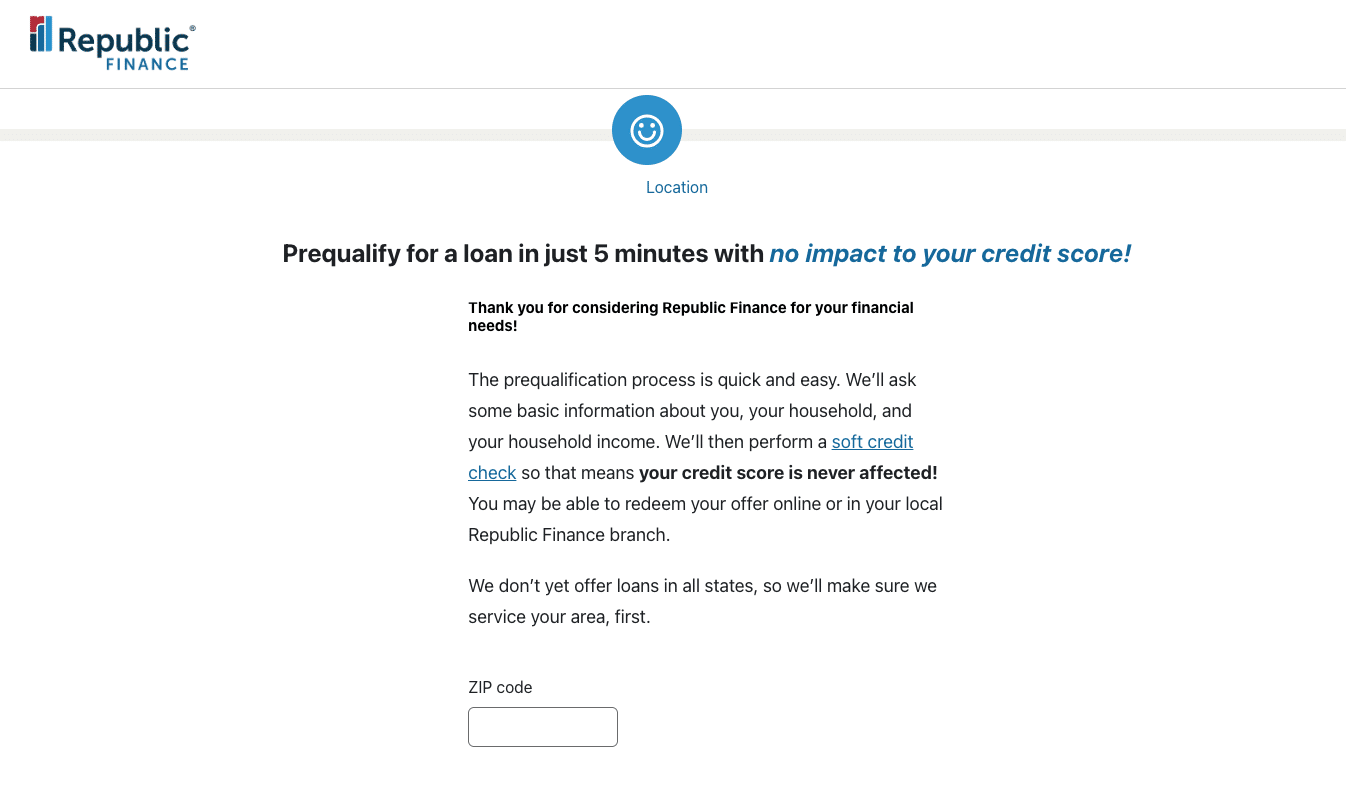

Republic Finance offers a fast prequalification process with no impact to your credit score.

You can start a loan application online or at a branch. Here’s how the process works:

How to apply for a Republic Finance loan

- Prequalify online: Submit basic information to receive estimated loan terms with no credit impact.

- Choose your loan offer: Select from the terms you prequalify for.

- Submit documents: Provide proof of identity, income, and (for secured loans) collateral.

- Get approved and funded:

- Unsecured loans can be funded in 1 to 2 business days

- Secured loans require a branch visit and may take longer

Not all loans can be completed online. In-person visits may be required, especially for secured products.

Republic Finance interest rates, fees and transparency

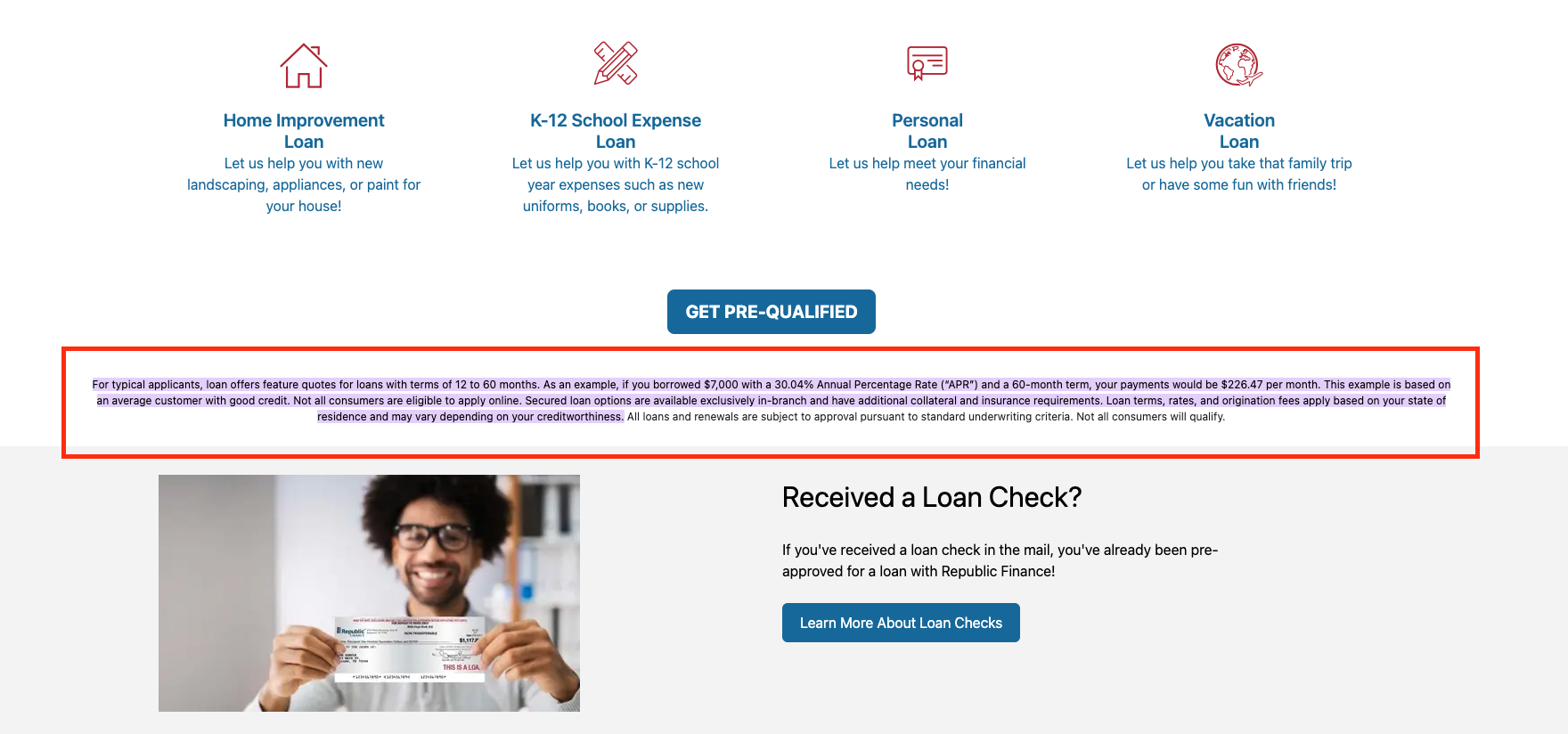

Example loan terms from Republic Finance showing a $7,000 loan at 30.04% APR.

Republic Finance loans come with fixed interest rates, but the overall cost can be steep, especially for borrowers with subprime credit. Understanding the APR range and potential fees is essential before committing to a loan.

APR and rate structure

Republic Finance offers fixed-rate personal loans, so your payments stay the same each month. However, their rates are typically higher than those of banks or credit unions.

- APR range: 18 to 35.99 percent

- Example: A $6,000 loan at 27.33 percent APR over 60 months = ~$300 per month

Rates are based on your credit, income, loan amount, and state regulations.

Republic Finance fees

- Origination fee: Deducted from the loan upfront; amount varies by state

- Late payment fee: Charged after a missed payment

- NSF fee: Assessed if your payment bounces due to insufficient funds

All fees are disclosed in your loan agreement. Read carefully before signing.

Republic Finance customer reviews and complaints

Customer feedback across multiple review platforms highlights serious concerns about Republic Finance’s loan practices, customer service, and transparency.

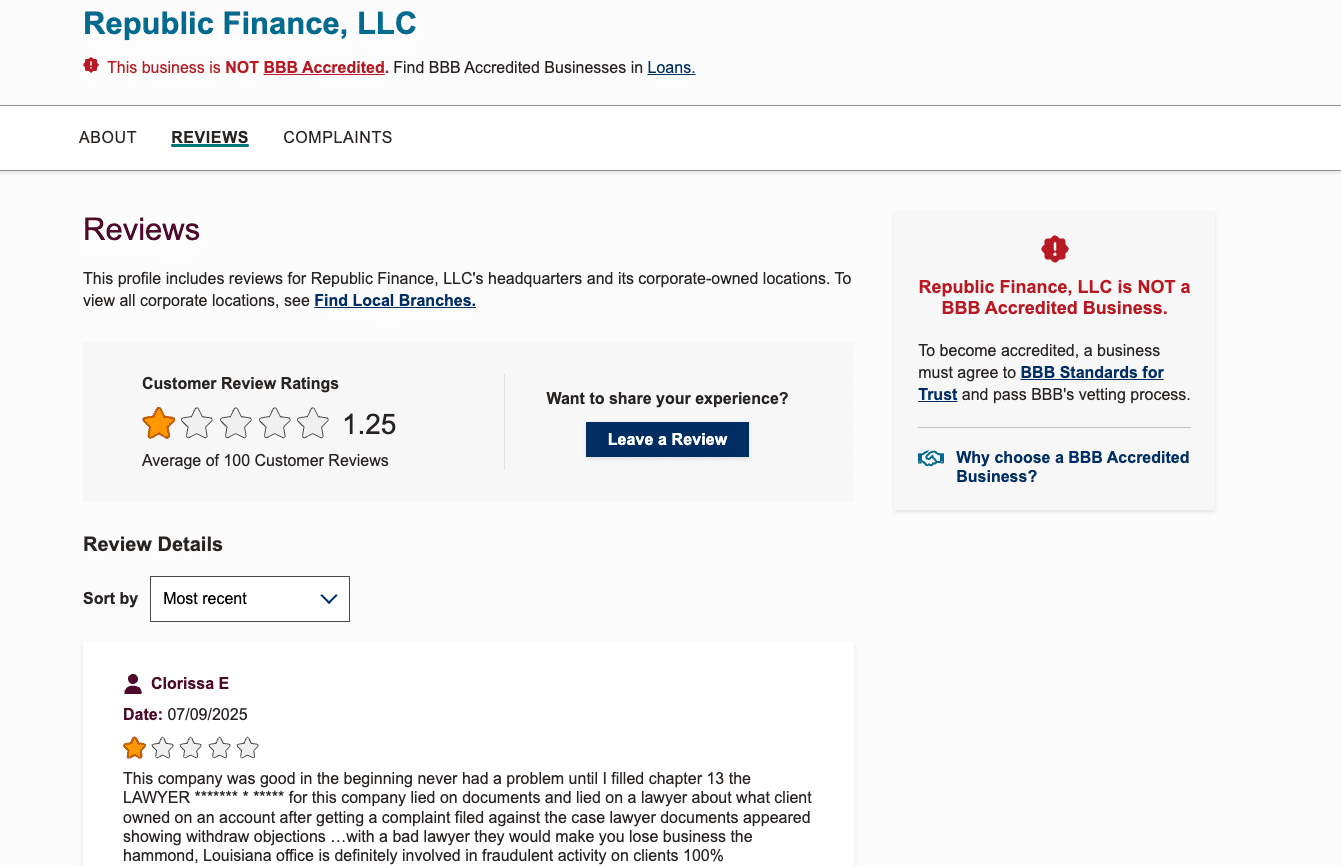

Better Business Bureau (BBB) reviews

Republic Finance holds a 1.25-star customer review rating on the Better Business Bureau.

- Rating: 1.25 out of 5 stars

- Total reviews: 100+

- Accreditation: Not BBB accredited

Key complaints:

- Alleged fraudulent loan documentation during bankruptcy filings

- Consumers claiming class action-worthy behavior, such as post-payoff charges

- Reports of multiple lawsuits filed without proper warning

- Lack of professionalism in branch staff and legal representatives

“I filed Chapter 13 and they still sued me with falsified documents. Stay away from the Hammond, Louisiana location—completely unethical.” – Clorissa E., July 2025

“I was sued twice after being told I could set up auto-payments. They never sent the paperwork, then served me again!” – April B., July 2025

Noteworthy themes:

- Predatory loan structure

- Poor communication around renewals, balances, and fees

- Reports of identity fraud and privacy concerns

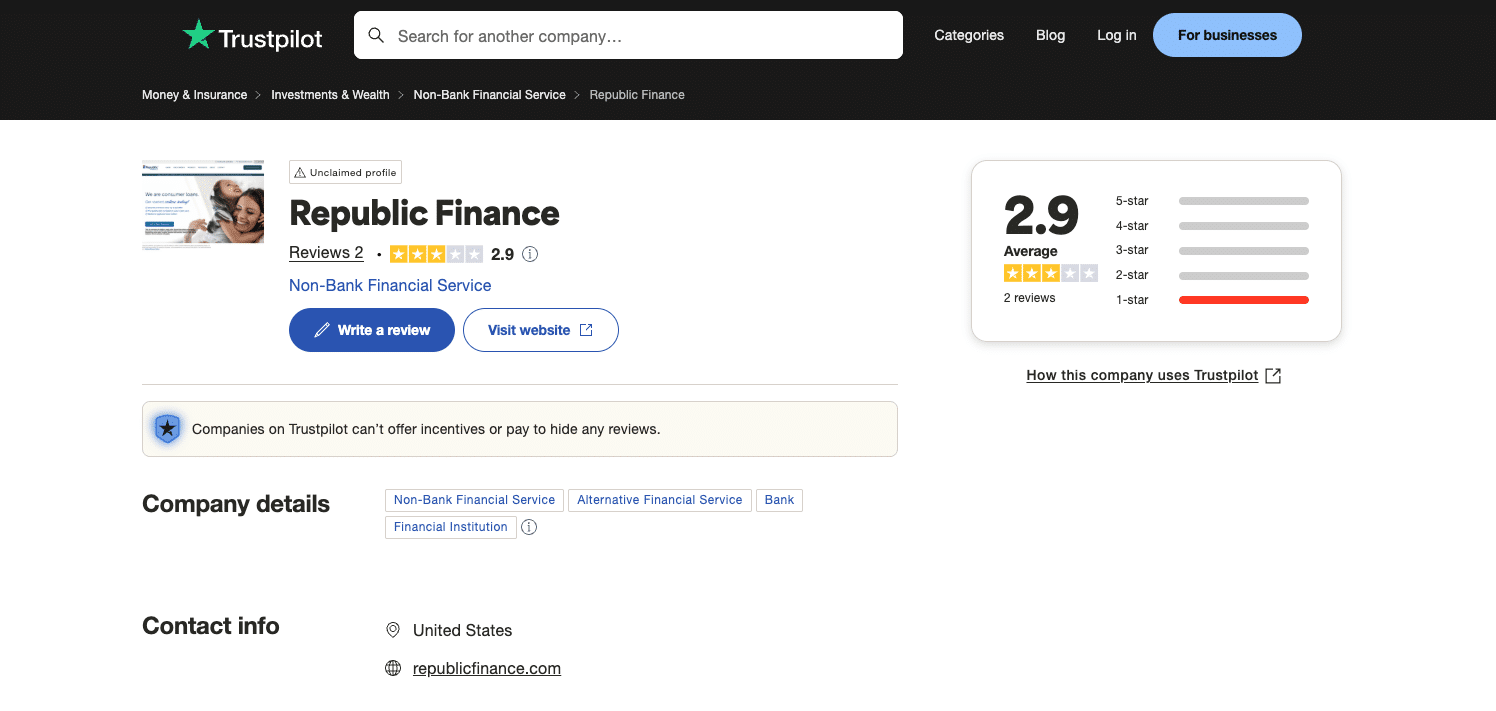

Trustpilot reviews

Republic Finance has an unclaimed Trustpilot profile with mixed customer feedback.

- Rating: 2.9 out of 5

- Review count: 2 (as of 2025)

- Profile status: Unclaimed

Highlighted Trustpilot reviews:

“I paid off my loan early, then they said I owed 73 cents. Later, they added $18 in fees for it. Absolutely outrageous.” – Beverly D., 1 star

“They don’t report to the credit bureaus, but if you’re late by a day, they harass you constantly. Terrible for credit building.” – Bori Luz, 1 star

Bottom line: Customers cite unfair balance handling, collection harassment, and lack of credit reporting as top issues on Trustpilot.

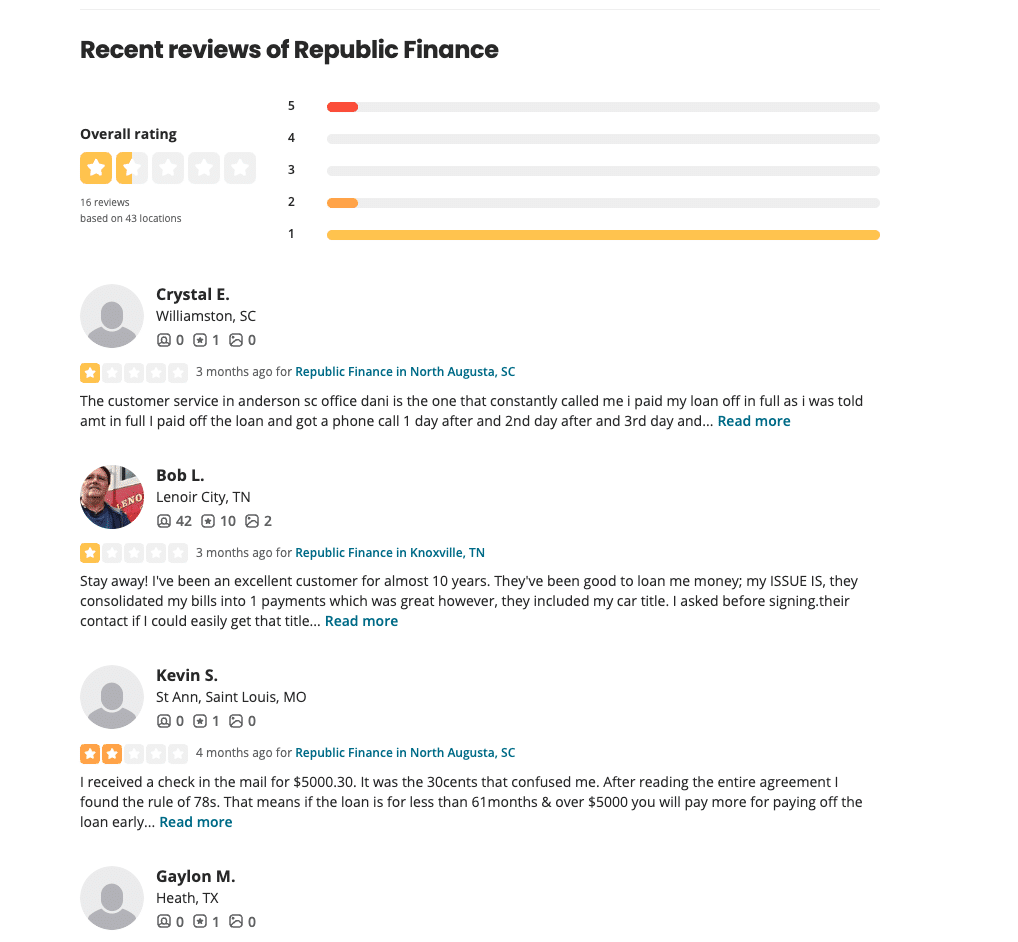

Yelp reviews

Yelp reviewers report poor service and confusion around loan terms and fees.

- Rating: 1.3 out of 5 stars

- Based on: 16 reviews across 43 locations

Yelp user complaints:

- Aggressive phone calls and mail harassment (up to 7 calls per day reported)

- Loans containing junk fees, including insurance add-ons and pre-calculated interest (Rule of 78s)

- Unsolicited checks being sent and converted into binding loan agreements

- Claims of data breaches and misapplied loans, especially during medical hardship or identity theft

“I was off due to surgery, had insurance on the loan, and they never sent the paperwork. Then they sued me while I was recovering.” – Jennifer H., Gulfport, MS

“They included my car title in a consolidation loan without properly explaining it. I feel manipulated.” – Bob L., Knoxville, TN

“I’ve never been treated so poorly. Constant harassment, sky-high fees, and a rude staff. Go anywhere else.” – Caroline N., Gainesville, GA

Republic Finance debt collection practices

Several customers across BBB and Yelp have reported aggressive collection efforts, including wage garnishment, lawsuits and receiverships. These actions are typically legal only after a court judgment, but the company’s approach has raised red flags. Borrowers should read the loan agreement carefully and maintain communication if facing hardship.

Are there any legal or regulatory issues with Republic Finance?

Republic Finance is not currently involved in any major federal enforcement action. However, customer reviews cite cases of lawsuits and post-bankruptcy collection attempts, particularly in states like Louisiana and Texas. As with any lender, it’s important to understand your rights under the Fair Debt Collection Practices Act (FDCPA).

Republic Finance outcomes and success rates

Image courtesy of Republic Finance

Republic Finance does not disclose approval rates or customer success benchmarks publicly. Based on consumer reviews and industry benchmarks for subprime lenders, many unsecured loan applicants receive decisions within 24 to 72 hours. Secured loans may take longer due to in-person verification. While official approval rates aren’t published, lenders in this segment typically approve 40 to 60 percent of applications.

- Loan decisions may be issued in as little as 1 business day

- Approval is more likely for:

- Borrowers with steady income

- Those offering collateral

- Applicants in states where Republic Finance operates

- Repeat borrowing is common but may lead to high cumulative interest

Note: No verified data is published regarding loan payoff success, default rates, or credit score improvement.

Who should use Republic Finance?

These loans are often used by borrowers who need short-term cash for car repairs, medical bills or household emergencies, but don’t qualify for traditional bank financing. Republic Finance may also suit those who prefer in-person service and have a vehicle or other asset to use as collateral. Here’s a quick breakdown of who might benefit and who should look elsewhere.

Best for

- Subprime borrowers with limited loan options

- People who need in-person help or a branch presence

- Borrowers who can offer collateral for better loan terms

- Customers in the South and Midwest

Not recommended for

- Borrowers with good or excellent credit who qualify for lower APRs

- People trying to build credit (no bureau reporting reported by some customers)

- Anyone needing full online service and transparency

- Those unable to handle high interest over long loan terms

Pros and cons of Republic Finance

Here’s what to weigh before signing a loan agreement.

Pros

- Accepts fair or poor credit

- Prequalification does not impact your credit score

- Offers secured loans up to $25,000

- In-person support available at over 250 branches

- Some same-day funding available

Cons

- High APRs up to 35.99 percent

- Limited to 15 states

- Does not report to credit bureaus (per customer reviews)

- Mixed customer service experiences

- Potential for aggressive collections

- May not help improve your credit score, since reporting to credit bureaus is not guaranteed

Final verdict: Is Republic Finance worth it?

Republic Finance is a legitimate, long-standing personal loan provider. It may be helpful for borrowers who have exhausted other options, especially if they need in-person support or a secured loan.

However, it is not ideal for borrowers with strong credit or those looking for affordable long-term financing. The high interest rates and negative collection-related complaints are important to consider before borrowing.

Bottom line: Republic Finance is a viable option for emergency or subprime borrowing—but compare your options, read the fine print, and plan your repayment carefully.

Frequently asked questions

Is Republic Finance legit?

Yes, Republic Finance is a legitimate consumer loan company that has served more than 300,000 customers across 15 states since 1952. The business is headquartered in Baton Rouge, Louisiana, and holds an A rating from the Better Business Bureau (BBB), though it is not currently accredited. While Republic’s long history suggests stability, many verified reviews raise concerns around interest rates, customer account handling, and collection strategy. As with any financial services provider, consumers should review all loan terms carefully and seek professional financial advice when needed.

Can Republic Finance garnish your wages?

Yes, they may legally pursue wage garnishment if a borrower defaults and a court judgment is issued. This action is subject to state-specific laws and court approval, and has been reported by customers in Texas and Georgia. Wage garnishment represents a serious step in the lender’s collection strategy, which may impact your overall financial health and future investments. If you’re struggling with repayment, reach out to the company early to explore ways to manage your debt before legal action becomes a reality.

Does Republic Finance have a grace period?

Republic Finance does not publicly list a standard grace period in its loan terms, and the information is not clearly outlined on its official pages. According to customer reviews, late payment penalties may begin almost immediately, and some borrowers report receiving frequent contact after a missed due date. This makes it critical to understand the exact terms of your loan agreement and to ensure your account stays current. If you’re seeking financial services with more flexible repayment options, be sure to compare loan issuers based on grace period policies, customer experience, and state regulations.

Does Republic Finance report to credit bureaus?

There is no official confirmation that they report loan activity to major credit bureaus. In fact, multiple customers on platforms like Trustpilot and Yelp state that their loans were never reported, which limits the potential to build a strong credit portfolio. This lack of reporting transparency reduces the value of the loan as a tool for long-term financial strategy or credit recovery. For consumers hoping to strengthen their credit profile, consider lenders who offer secured loans, guaranteed credit reporting, or other forms of financial support verified by industry experts.

Who owns Republic Finance?

Republic Finance is a privately held company, independently operated and not owned by any major bank, public corporation, or investment issuer. The business structure remains undisclosed on official channels, though its long-standing presence suggests a vision focused on helping consumers meet their financial needs through a variety of loan products and services. While transparency around ownership may be limited, the company’s access to customers across multiple states reflects a well-established strategy in the consumer finance space.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.