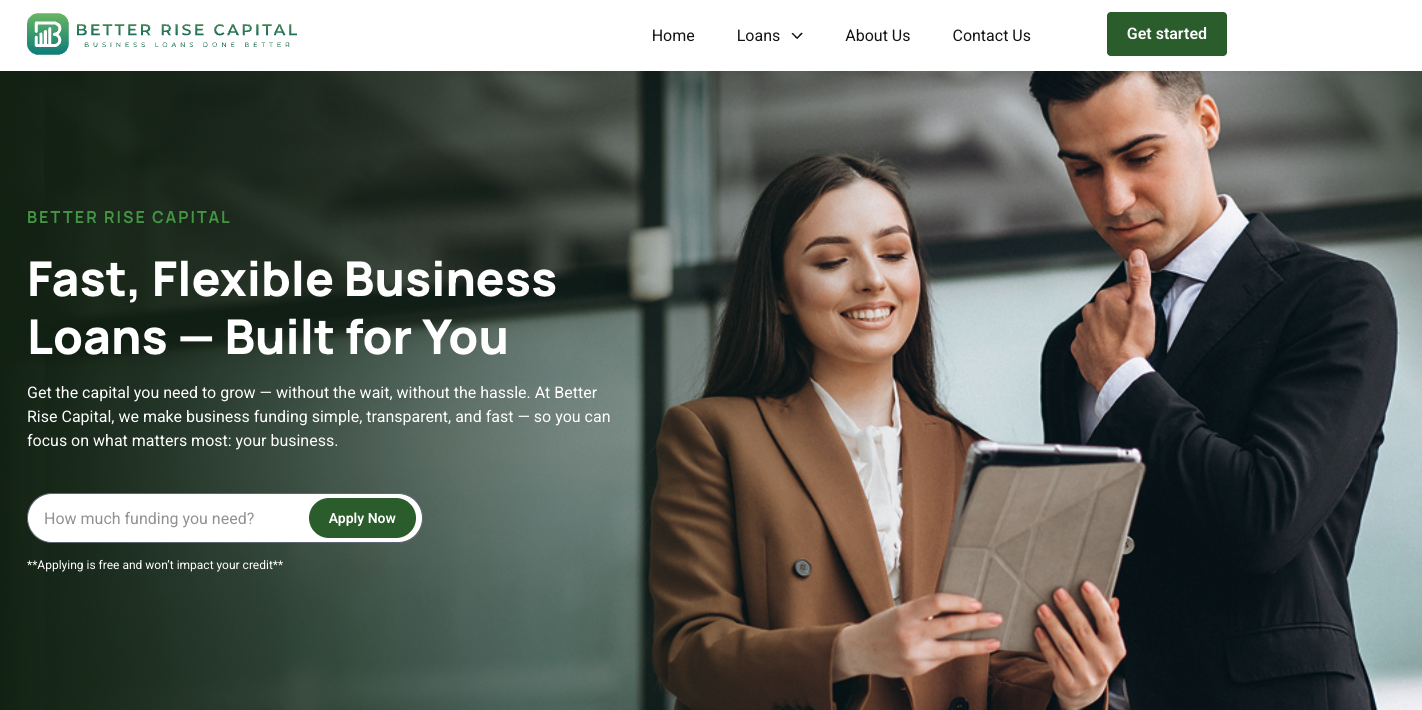

Better Rise Capital: Reviews and Ratings

Securing business funding today can feel like walking through a maze. From sky-high interest rates to sluggish approval times, the journey to securing working capital often leaves entrepreneurs stuck in limbo when they need fast, reliable solutions.

That’s where Better Rise Capital steps in.

Positioning itself as a modern alternative to traditional lending institutions, Better Rise Capital is catching attention for all the right reasons. Whether you’re a small business owner looking to expand or an investor diving into multiple asset classes, this lender is all about helping you move forward—quickly, smartly, and strategically.

But what makes them different? Is Better Rise Capital as flexible, reputable, and opportunity-driven as reviews claim?

In this review, we’ll explore what makes this company stand out. We’ll dive into customer testimonials and ratings and take a closer look at their unique approach to capital investments, including real estate investments and other financial strategies geared toward building financial freedom.

With a growing reputation in the world of rising capital investments, it’s time to see if this is the funding partner your business has been waiting for.

What Is Better Rise Capital?

Say hello to more innovative business financing.

Better Rise Capital, an Irvine, California-based direct lender, is changing how entrepreneurs access funding. There are no brokers, no inflated fees, just fast, flexible capital delivered with clarity and speed.

Company Snapshot

- 10,000+ businesses funded

- $2 billion+ in capital disbursed

- 24-hour approval window

- 95% approval rate

That’s not hype—it’s traction.

What They Do

Better Rise Capital specializes in business loans that are designed for growth, speed, and real-world impact. Whether you’re managing seasonal swings or scaling up fast, their funding can help smooth out your cash flow and fuel momentum.

They stand out by offering:

- Direct-to-business lending (no middlemen)

- Funding options across multiple asset classes

- Programs designed for lower volatility and potential tax benefits

- Capital solutions tailored to modern investors and operators alike

This isn’t just about quick money. It’s about building smart, long-term investments in your business. With Better Rise Capital, entrepreneurs and investors alike are tapping into strategies that support stronger portfolios, recurring revenue, and potentially higher returns over time.

Reviewing the Key Funding Products

When you’re building a business, not every funding solution fits every season. That’s why Better Rise Capital offers a range of financing products, each designed to help you navigate specific challenges, without getting buried in red tape or unnecessary debt.

Here’s a look at their three standout lending products—and how you can leverage them for smarter growth, better income stability, and long-term success.

The everyday engine behind steady cash flow.

Running payroll, restocking inventory, and navigating slow sales months are short-term needs that can easily sneak up on small companies, especially in fast-moving industries like retail or e-commerce.

Better Rise Capital’s Working Capital Loans are designed for these exact moments. You get:

- Fast access to cash

- No collateral required

- Simple, predictable repayment terms

They’re a go-to for retailers, restaurant owners, and online businesses that need quick liquidity, without compromising future flexibility. It’s all about staying agile while you keep your operations running smoothly.

Big tools. Big tech. No big hit to your working capital.

Need to upgrade your delivery fleet? Add new tech to your lab? Replace aging tools on the job site?

With Equipment Financing, you don’t have to shell out all your income upfront. Instead, Better Rise Capital helps you spread the cost, so you can keep your cash reserves intact while still growing.

This funding option is ideal for:

- Construction firms

- Manufacturing businesses

- Healthcare providers

Plus, depending on your setup, certain types of equipment purchases may come with added tax benefits. It’s a powerful way to invest in essential tools while protecting your business from unnecessary risk.

When you’re planning to rise—big time.

These are your heavy-hitters. If your business is planning a major expansion, real estate purchase, or looking to acquire other properties, Better Rise Capital’s Commercial Loans deliver the firepower.

- Borrow $50,000 to $1 million+

- Choose from flexible terms and competitive rates.

- Built for established businesses with a scalable vision

Think of it as strategic capital designed for long-term wealth building. Whether you’re opening new locations, expanding into new communities, or launching a second vertical, these loans are structured to support your bigger ambitions without compromising your future.

Customer Reviews and Satisfaction Ratings

When it comes to small business lending, speed, clarity, and personalized support can make all the difference. According to real users, Better Rise Capital checks all three boxes—and then some.

Real Business Owners Weigh In

From restaurants to retail shops to construction companies, entrepreneurs across industries are voicing a common experience: Better Rise Capital delivers fast, stress-free funding with a human touch.

David R., a restaurant owner, shared:

“The team at Better Rise Capital really took the time to understand my business. They walked me through my options and helped me secure a line of credit that fit perfectly with my cash flow.”

That kind of individualized support is a recurring theme. Many customers say it’s not just about the money—it’s about being heard.

Jessica M., a retail business owner, said:

“Better Rise Capital made the funding process so easy. I had my approval within hours and the funds hit my account the very next day. I’ll definitely be coming back for future financing needs.”

Others emphasize transparency and reliability—two areas where traditional banks often fall short.

Maria L., from a construction company, wrote:

“I’ve worked with other lenders before, but none were as transparent and fast as Better Rise Capital. No hidden fees, no pressure—just honest people who want to help your business grow.”

The Good—and the Trade-Offs

✔ The Wins:

- Lightning-fast funding, often within 24 hours

- Zero hidden fees and straightforward repayment terms

- Dedicated funding specialists for real-time support

With overwhelmingly positive feedback, Better Rise Capital continues to build a strong reputation for helping businesses rise confidently, backed by responsive service, reliable capital, and a clear commitment to their clients’ success.

How the Process Works (And Why It Gets High Marks)

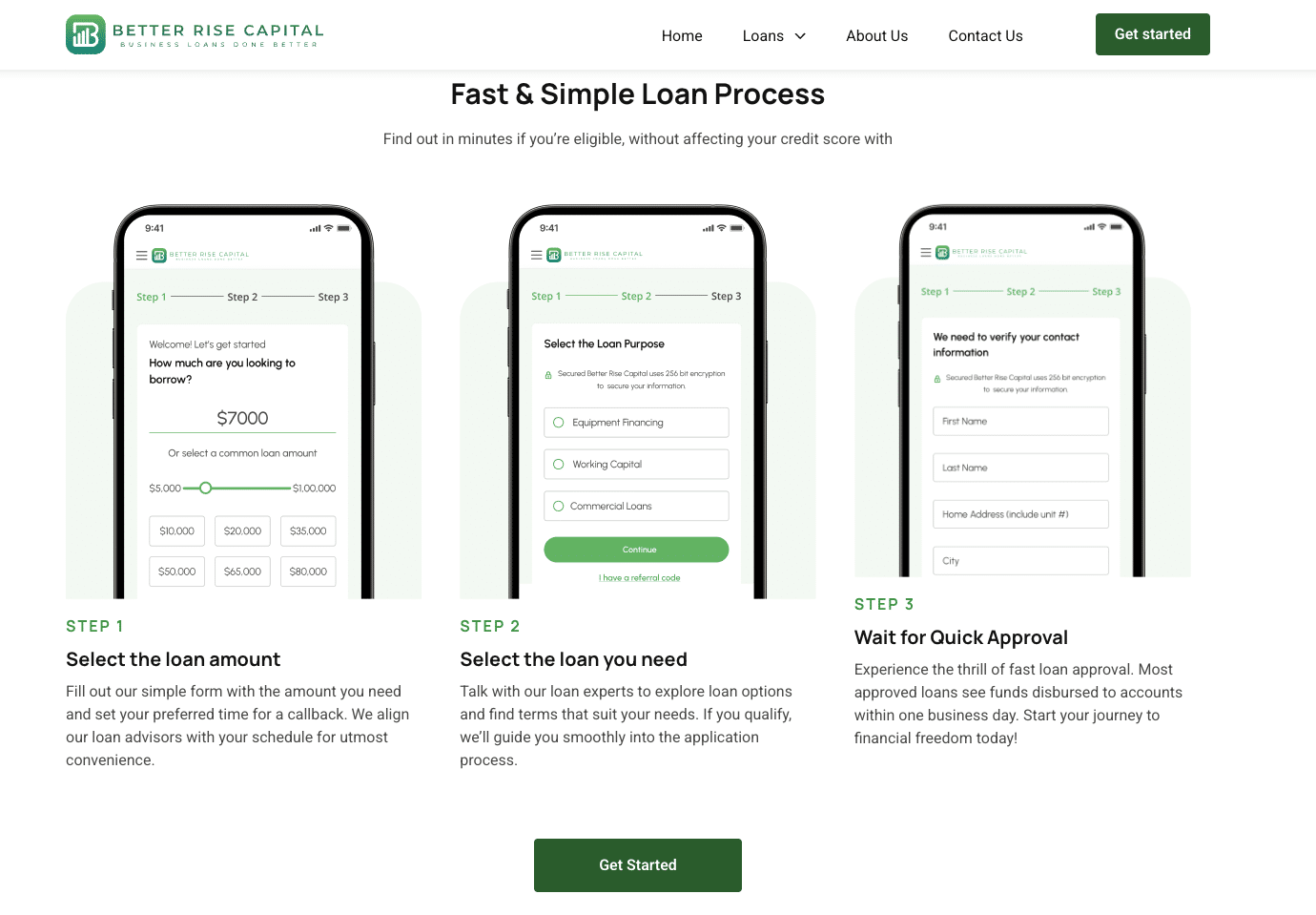

Better Rise Capital is a breath of fresh air. Their 4-step process is designed to get you from inquiry to funding—without the stress, fluff, or fine print.

Step 1: Apply Online in Just Minutes

Everything starts with a short, intuitive application on the Better Rise Capital website. They only perform a soft credit pull, meaning your credit score stays untouched during the initial check.

There’s no overwhelming list of documents, no lengthy questionnaires, and no pressure to submit your life story. Just the basics—because they know your time is money.

Step 2: Speak with a Real Funding Specialist

Once your application is submitted, you’re matched with a dedicated funding specialist—a real person who will actually talk to you about your business and your needs.

They’ll walk you through your options and answer your questions in plain English. No scripted answers. No canned responses. Just honest advice from someone who’s invested in your success.

Step 3: Review Tailored Offers Without Pressure

Based on your conversation and business profile, you’ll get one or more customized loan offers. All terms are spelled out clearly—no hidden fees, no vague clauses.

Expect transparent details like:

- Repayment timelines

- Estimated monthly payments

- Total cost of the loan

- Whether early payoff options are available

This is where Better Rise really earns trust. Unlike brokers or platforms that push cookie-cutter loans, these offers are built around you, not a sales quota.

Step 4: Accept and Get Funded in 24 Hours

Once you select your loan, the final step is lightning fast. Many businesses report having funds deposited within a single business day.

Whether you’re covering urgent expenses or capitalizing on a new opportunity, speed matters—and Better Rise delivers.

What Makes Better Rise Capital Stand Out

| Feature | Reviewer’s Take |

| Speed | Among the fastest non-bank funding options available. Many users report approvals within hours and funds deposited as quickly as the next business day. Ideal for businesses with urgent capital needs or time-sensitive opportunities. |

| Transparency | Clear documentation and zero hidden fees make the entire lending experience more trustworthy. The direct lender model helps cut out broker markups and keeps terms digestible and straightforward. |

| Support | Each client is matched with a dedicated funding advisor who provides real guidance, not robotic answers. This hands-on support is invaluable for businesses navigating loan decisions for the first time. |

| Security | Their digital process includes strong privacy protections, ensuring that sensitive financial data, like tax returns and banking info, is encrypted and secure throughout the application and funding stages. |

Who Will Get the Most Value

Better Rise Capital is best for:

- Small to mid-sized U.S.-based businesses

- Owners looking for fast, short- or mid-term capital

- Entrepreneurs are tired of slow banks and opaque lending terms.

- Operators who value speaking with a real person

- Businesses with stable revenue (since approvals depend on that metric)

If your company fits this profile, you’ll likely find the process refreshingly easy—and the outcome financially empowering.

Final Thoughts: Is Better Rise Capital Worth Considering?

For entrepreneurs who value speed, clarity, and real support, Better Rise Capital stands out as a trusted name in business lending. As a direct lender with a proven track record of over $2 billion funded, it delivers more than just fast approvals—it offers a streamlined, transparent, and secure funding experience tailored for today’s business needs.

Better Rise Capital is the go-to solution for U.S.-based businesses that are growing, scaling, and ready to act now. Backed by dedicated advisors, no hidden fees, and next-day funding, it’s a brand committed to helping business owners rise, not just today, but well into tomorrow.

Frequently Asked Questions (Better Rise Capital)

1. Can I repay my Better Rise Capital loan early without penalties?

Yes. Better Rise Capital typically allows early repayment with no prepayment penalties. This flexibility can help reduce your total interest costs if you’re able to pay off the loan ahead of schedule.

- What industries does Better Rise Capital serve?

While Better Rise Capital is industry-agnostic, it frequently works with businesses in retail, healthcare, restaurants, construction, transportation, and e-commerce. As long as you meet the revenue and documentation requirements, your industry is likely eligible.

3. How soon can I reapply after paying off a loan?

If you’ve successfully repaid a loan, you may be eligible for repeat funding—often with higher limits or improved terms. Better Rise Capital encourages long-term relationships and may fast-track returning clients who maintain good payment history.

4. What documents are required to apply?

The initial application is light on paperwork, but you should be prepared to provide basic business information, recent bank statements, proof of revenue, and a valid business license. Depending on your loan type and amount, additional documentation may be requested.

5. Does Better Rise Capital offer funding to sole proprietors or independent contractors?

Yes. Sole proprietors, 1099 contractors, and self-employed individuals are often eligible, provided they meet the company’s minimum monthly revenue threshold and can demonstrate a steady flow of income.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.