Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Alleviate Financial Solutions: Reviews and Ratings

Credit card bills, medical expenses, personal loans, tickets…debt can feel like a never-ending cycle of struggle. If thinking about your financial future brings more stress than hope, just know you’re definitely not alone. Debt is a common stressor in America today. If you’re tired of barely treading water, making minimum payments month by month, just know that the solution exists for you out there. That solution just may be Alleviate Financial Solutions.

Alleviate Financial Solutions is there for anyone who is looking to reduce their debt through debt settlement. They get to intimately know your financial situation so that they can effectively negotiate your debt settlement on your behalf. Their approach is an excellent resource for anyone who is struggling with insurmountable debt.

It’s important to recognize, however, that as ideal as Alleviate Financial Solutions sounds, thorough and holistic research and knowledge acquisition is paramount when making any decision regarding finances. Just as you would compare dealership prices, look at carfax, and think about your personal vehicle needs when looking to buy a new car, exploring all possible routes is the correct way to go when deciding which entity to go to for debt relief. This article aims to provide you with a comprehensive overview of Alleviate Financial Solutions – their background, services, what others are saying, and how they compare to alternatives – to help you determine if they align with your personal financial goals. Let’s get started on uncovering a potential path to a brighter financial future!

Snapshot of History and Service

Alleviate Financial Solutions has become a major player in the debt relief industry. Founded in 2018 and headquartered in Irvine, California, Alleviate has grown rapidly-helping over 100,000 clients address more than $700 million in debt and currently employing between 200 and 500 people. Led by CEO Michael Barsoum and a team of executives with extensive backgrounds in financial services, Alleviate focuses on performance-based debt relief, primarily through debt settlement programs. Their significant operational scale, industry partnerships, and client-centered approach have positioned them as one of the fastest-growing companies in the sector.

Based on stats from their website, Alleviate has enrolled nearly $1 billion in gross debt and settled over $300 million, proving the effectiveness of their services. Their mission is centered around helping individuals facing financial hardship get back on their feet and regain fiscal freedom. This means packaging in financial education to compliment their debt negotiation. As they say, give a man a fish, you feed him for a day. Teach a man to fish, you feed him for a lifetime!

Here’s a clear look at their core services:

- Debt Settlement: This is the heart of what Alleviate Financial Solutions offers. They work on your behalf to negotiate with your unsecured creditors (credit card companies, personal loans, medical bills etc) to try and settle your debts for a lower amount than what’s current.

- Customized Programs: Their agents go to great lengths in order to fully understand each client’s individual debt situation. Therefore, Alleviate Financial Solutions is able to provide a highly personalized custom plan for each individual client.

- Client Education: Alleviate provides financial insights and education to all of their clients, to help them not just dig out of a financial hole, but to stay out of it.

- Performance-Based Fees: Alleviate Financial Solutions typically operates on a performance-based fee structure, meaning they generally only charge a fee after they’ve successfully settled a portion of your debt.

It’s vital to understand that debt settlement involves a process that often includes temporarily halting payments to your creditors, which can impact your credit score. So while Alleviate can successfully decrease your debt, there will be repercussions to your credit, which could take years to recover from. This is something important to consider.

Pros and Cons of Alleviate Financial Solutions

In an effort to provide a realistic picture of Alleviate Financial Solutions and what they will do for you, we are going to explore all their strengths and weaknesses. This will be based on their business model and comparison to their competitors.

Potential Pros:

- Debt Reduction: The primary goal of debt settlement is to reduce the total amount of debt you owe, which means big savings for you.

- One Monthly Payment: Often, clients in a debt settlement program will make one monthly payment to the debt relief company, which is then used to negotiate the debt settlement. This simplifies the process in terms of budgeting.

- Potential to Avoid Bankruptcy: Debt settlement can be an alternative to bankruptcy, helping them resolve their debt issues without the more severe and longer-lasting impact of bankruptcy.

- Performance-Based Fees: The fact that fees are often tied to successful settlements can be seen as a benefit, as you’re generally not paying unless they achieve results.

- Focus on Client Support: A large part of Alleviates emphasis in their services is on client comfort and communication. They have a track record of well received customer relations.

Potential Cons:

- Credit Score Impact: Debt settlement typically involves missed payments to creditors while funds are being accumulated for negotiation. This can negatively affect your credit score, sometimes significantly.

- No Guarantee of Settlement: While Alleviate will do everything they can to settle your debt, there will be scenarios where they are unable to help your situation.

- Fees Can Be Substantial: Fees are performance based, however, they can amount to a significant percentage of your enrolled debt or the amount saved.

- Creditor Cooperation Varies: Not all creditors are willing to negotiate with debt settlement companies, which could limit the success of the program for certain debts.

- Potential Tax Implications: The amount of debt that is forgiven through settlement may be considered taxable income by the IRS.

What People Are Saying: Comments, Ratings, and Reviews

Existing or past customer remarks are invaluable when diagnosing Alleviate as a good option for you. Please note that ratings and comments can change over time, so it’s always a good idea to check these sources directly for the most current information.

Better Business Bureau (BBB):

- Rating: Alleviate Financial Solutions LLC has an A+ rating with the BBB.

- Customer Reviews: On the BBB, reviews can be mixed. Some customers praise their experience, highlighting the helpfulness of the representatives and the progress made in settling their debts.

- Positive Customer Quote: “Alleviate Financial Solutions made the debt settlement process easy and stress-free. Their team always answered my questions and kept me updated on my progress.”

- Negative Customer Quote: “I was told my debts would be settled quickly, but it took much longer than promised and I still received calls from creditors. Communication could be better.”

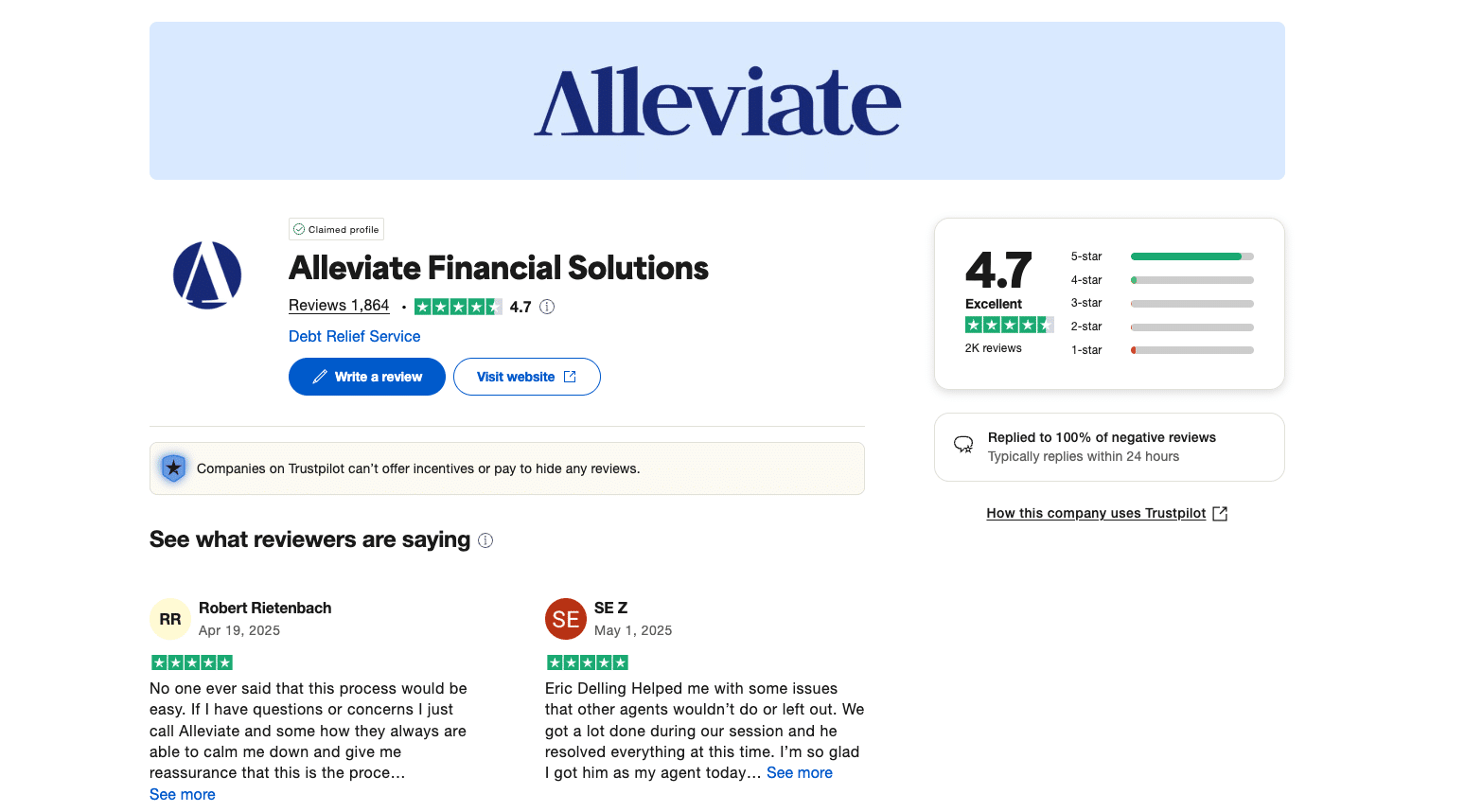

Trustpilot:

- Rating: Alleviate Financial Solutions has an average rating of around 4.7 out of 5 stars based on a significant number of reviews on Trustpilot.

- Positive Comments: Many reviewers on Trustpilot frequently mention the professionalism and helpfulness of the Alleviate team, the clarity of the process, and their satisfaction with the settlements achieved.

- Real Customer Quote (Positive): “I didn’t trust any of these companies until I found Alleviate Financial Solutions, and little by little, they are taking care of my debts. Thank you so much, guys!” – Hector C.

- Negative Comments: Some negative feedback on Trustpilot mirrors concerns found on the BBB, such as the time it takes to see results, the expected drop in credit score, and instances where customers felt communication could have been better.

- Real Customer Quote (Negative): “Do not use this company to help you! … I have paid Alleviate over $2,000 and NOTHING HAS BEEN DONE AT ALL!!!!!! It’s a complete joke and no one, and I mean no one, has ever contacted me – it’s always me calling them and they give me the same runaround answer each time.” – Helen C.

Google Reviews:

- Google Reviews for Alleviate Financial Solutions also tend to be generally positive, with many users highlighting the ease of the process and the support they received. However, as with other platforms, some individuals express frustration with the duration of the program or the impact on their credit.

Key Themes from Reviews:

- Customers often appreciate the support and guidance provided by Alleviate’s team.

- The debt settlement process takes time, and managing expectations regarding the timeline and credit score impact is important.

- Experiences can be colored by prior awareness of the debt settlement process, therefore it’s crucial for individuals to have a clear understanding of how debt settlement works before enrolling.

How They Measure Up: Alleviate Financial Solutions vs. Competitors

The debt relief industry has various players, each with their own strengths and weaknesses. Comparing Alleviate Financial Solutions to other options is a vital step in making an informed decision. Let’s visualize Alleviate Financial Solutions head-to-head with three competitors:

| Metric | Alleviate Financial Solutions | National Debt Relief | Freedom Debt Relief | Accredited Debt Relief |

| Primary Service | Debt settlement (negotiates reductions on unsecured debt) | Debt settlement | Debt settlement | Debt settlement, debt consolidation |

| Fee Structure | 15–25% of enrolled/settled debt; no upfront fees; fees only after settlement | 15–25% of enrolled/settled debt; fees after settlement | 15–25% of enrolled/settled debt; fees after settlement | 15–25% of enrolled/settled debt; fees after settlement |

| BBB Rating | A+ (4.7–4.8/5 customer rating) | A+ (4.7/5 customer rating) | A+ (4.3/5 customer rating) | A+ (4.7/5 customer rating) |

| Trustpilot Rating (Approx.) | 4.8/5 | 4.7/5 | 4.6/5 | 4.8/5 |

| Reported Enrollment Debt | Typically $10,000+ unsecured debt | $7,500–$100,000+ unsecured debt | $7,500–$100,000+ unsecured debt | $10,000+ unsecured debt |

| Emphasis | Personalized plans, client education, and transparency | Large network, high volume, established reputation | Aggressive negotiation, high enrollment volume | Flexible programs, strong customer support |

Important Considerations:

- The best choice depends on your specific needs, the amount and type of your debt, and your risk tolerance regarding credit score impact.

- Some companies offer a broader range of services beyond just debt settlement, such as credit counseling or debt management plans, which might be more suitable for certain individuals.

- Fee structures can vary, so it’s essential to have a full understanding of everything entailed with a debt relief company prior to signing anything.

As you can see, while Alleviate Financial Solutions has a strong BBB and Trustpilot rating and a significant amount of enrolled debt, other companies might emphasize different aspects like speed or offer alternative debt relief methods. Therefore, it’s highly recommended to compare multiple debt relief companies before making a decision.

Taking the First Step: How to Apply with Alleviate Financial Solutions

- Initial Consultation: You’ll likely start with a free consultation. This involves speaking with a representative who will ask you about your current debt situation, income, and financial goals. Be prepared to give details on your debts (types, balances, interest rates).

- Program Evaluation: Based on your consultation, Alleviate will evaluate whether their debt settlement program is a suitable option for you. They will explain how the program works, potential timelines, and their fee structure.

- Enrollment: If you decide to move forward, you’ll complete enrollment paperwork. This will outline the terms of your agreement with Alleviate Financial Solutions. Make sure to read this document carefully and ask any questions you may have.

- Dedicated Account: You’ll typically set up a dedicated savings account where you’ll deposit a monthly amount. These funds will be used for negotiating settlements with your creditors.

- Negotiation Phase: Alleviate will then begin the process of negotiating with your creditors to settle your debts for less than the full amount owed. This phase can take some time.

- Settlement Approval: When a settlement is reached with a creditor, Alleviate will present it to you for your approval. You’ll need to authorize the settlement before it’s finalized.

- Payment and Fees: Once you approve a settlement, funds from your dedicated account will be used to pay the settled amount. Alleviate’s fee for that particular settlement will also be deducted at this stage (depending on their fee structure).

Important Note: During the debt settlement process, Alleviate may advise you to stop making payments to your enrolled creditors. It is imperative to understand that at this point, you credit will likely take a large hit, so proceed with caution.

Is Alleviate Financial Solutions the Right Path for You?

Let’s overview everything we know to this point to get a definitive perspective as to whether Alleviate is the best choice for you:

Alleviate Financial Solutions Might Be a Good Fit If:

- You are struggling with a significant amount of unsecured debt (like credit cards and personal loans).

- You are looking for a way to potentially reduce the total amount of debt you owe rather than just consolidating payments.

- You understand that the debt settlement process will likely have a negative impact on your credit score in the short term.

- You are looking for a company that emphasizes customer support and has a generally positive track record based on customer reviews.

- You prefer a performance-based fee structure where fees are typically tied to successful settlements.

You Might Want to Consider Other Options If:

- You want to preserve your credit score.

- You have the means to manage your debt through options like balance transfers or debt consolidation loans.

- You prefer a more structured approach like credit counseling or debt management plans.

- Your debt is primarily secured (like a mortgage or auto loan), as debt settlement typically focuses on unsecured debt.

Ultimately, the decision of whether Alleviate Financial Solutions is right for you depends on your individual financial situation, your goals, and your comfort level with the debt settlement process and its potential consequences.

Final Thoughts: Charting Your Course to Financial Freedom

Facing overwhelming debt can feel incredibly isolating, but remember that there are paths forward. Alleviate Financial Solutions presents one such path through debt settlement, aiming to help individuals regain control of their finances by negotiating down their debt. Their focus on customer care and performance-based fees can be reassuring for those that don’t know how to handle their debt.

However, know that debt settlement is a significant commitment. Understand the intricacies of debt settlement, including its potential impact on your credit score and the fact that there are no guarantees. Compare Alleviate Financial Solutions with other debt relief options to find the strategy that best aligns with your unique circumstances and financial goals.

Confronting your debt head on and coming up with a solution takes great courage. By equipping yourself with knowledge and carefully considering your options, you’re already on the path to a more secure and optimistic financial future.

Frequently Asked Questions (FAQ) About Alleviate Financial Solutions

Here are some common questions people have about Alleviate Financial Solutions:

Q: What types of debt does Alleviate Financial Solutions typically work with? A: Alleviate Financial Solutions primarily focuses on unsecured debt, such as credit card debt, personal loans, and medical bills. They generally do not handle secured debt like mortgages or auto loans.

Q: How does Alleviate Financial Solutions get paid? A: Alleviate Financial Solutions typically operates on a performance-based fee structure. This generally means they earn a fee only after they have successfully negotiated and you have approved a settlement with one of your creditors. The specifics of their fee structure will be outlined in your agreement.

Q: Will using Alleviate Financial Solutions hurt my credit score? A: Yes, debt settlement generally involves stopping payments to your creditors while funds are accumulated for negotiation. This will likely lead to negative marks on your credit report and a decrease in your credit score. This is a mainstay of the debt settlement process.

Q: How long does the debt settlement process with Alleviate Financial Solutions usually take? A: The length of the debt settlement program can vary depending on your individual debt situation, the amount of debt you have, and how willing your creditors are to negotiate. It can typically take anywhere from 24 to 48 months to complete a debt settlement program.

Q: Is Alleviate Financial Solutions accredited? A: Alleviate Financial Solutions LLC is BBB Accredited with an A+ rating, which indicates they meet certain standards of customer service and ethical business practices as defined by the Better Business Bureau.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.