Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

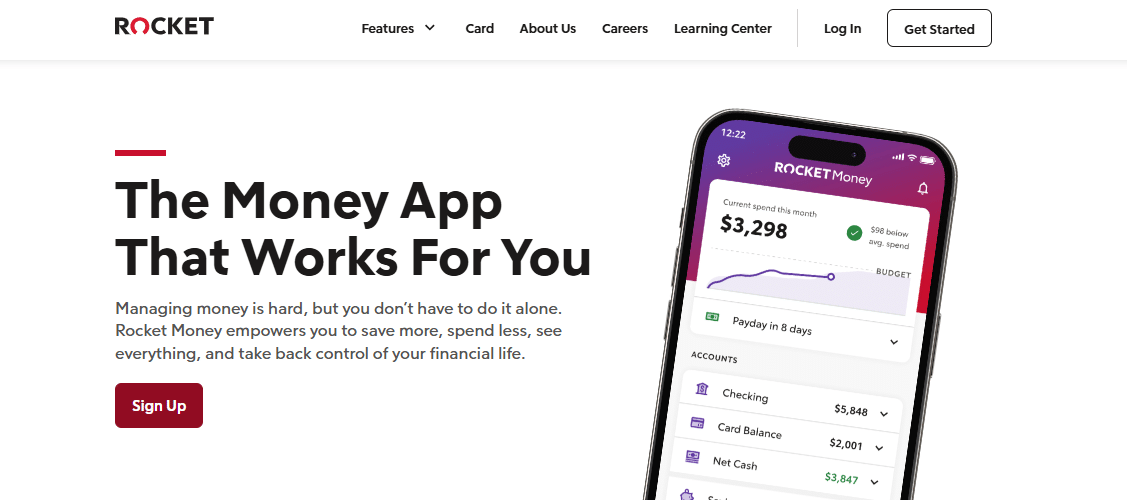

Rocket Money: Reviews and Ratings

Rocket Money is a personal finance management app designed to help users track subscriptions, monitor spending, and negotiate bills. By automating these financial tasks, the app aims to simplify budgeting and reduce unnecessary expenses.

But does Rocket Money truly deliver on its promises? In this review, we’ll explore its key features, costs, user feedback, and how it compares to other budgeting apps to help you determine whether it’s the right financial tool for you.

What Is the Rocket Money App?

Rocket Money is a personal finance management app that helps users track spending, manage subscriptions, and negotiate bills. By linking a bank account, the app identifies recurring expenses, offering insights to reduce unnecessary costs and improve budgeting.

With features like automated savings, bill tracking, and financial goal setting, Rocket Money aims to serve as a comprehensive financial management tool for users looking to streamline their finances.

How Does Rocket Money Work?

Rocket Money is a budgeting app designed to simplify your financial life. It automatically imports your transactions by linking your bank and credit card accounts through Plaid, a trusted financial networking company.

This seamless integration allows the app to track your income and spending, categorize transactions, and provide a comprehensive view of your financial situation.

But Rocket Money doesn’t stop there. It offers a suite of features to help you stay on top of your finances, including bill negotiation, net worth tracking, automated savings, and even credit score viewing. Whether you’re looking to save money, manage your budget, or keep an eye on your credit score, Rocket Money has you covered.

Key Features of Rocket Money

Ever been shocked to find out you’re still paying for that streaming service you haven’t touched in months? Linking a checking account is necessary for Rocket Money to track and manage subscriptions effectively.

Subscription Tracking & Cancellation Services

Rocket Money’s subscription tracking feature helps users identify recurring charges, manage payments, and track due dates to avoid unnecessary expenses. The app also provides a concierge service to cancel unwanted subscriptions on behalf of users, eliminating the need for customer service calls.

However, while tracking subscriptions is free, the cancellation service may require a premium subscription. Some users have reported inconsistencies in cancellation effectiveness, so it’s important to verify that unwanted subscriptions have actually been terminated.

Budget Management and Savings

Rocket Money has a robust budgeting tool that allows users to set financial goals based on their spending habits. By categorizing your spending, Rocket Money offers insights into where your money is going so you can make adjustments that lead to real savings.

Effectiveness and Premium Options

While the basic budgeting tools are available for free, many advanced options are accessible only through a premium membership. User feedback suggests that these tools are effective but may not be necessary for everyone—especially if your finances are relatively simple.

READ MORE: 5 Best Finance Apps for Entrepreneurs in the US

Bill Negotiation Services: How Effective Is It?

Rocket Money offers bill negotiation, claiming to lower costs for services like phone, internet, and cable. However, not all providers allow third-party negotiations, meaning some bills may not be eligible.

Important Considerations:

- Not All Providers Participate: Some companies require customers to negotiate directly, making Rocket Money’s service useless in certain cases.

- Automatic Charges: Rocket Money automatically deducts 35–60% of the savings they secure, even if users did not actively request negotiation.

- DIY Negotiation May Be Better: Users can often negotiate bills themselves for free, keeping 100% of the savings instead of paying Rocket Money a cut.

User Complaints About Bill Negotiation:

Some users were surprised by charges for bill negotiation they didn’t authorize. Others found that any savings only applied for a limited time, requiring renegotiation later—which Rocket Money would charge for again.

While some users benefit, others recommend calling service providers directly for better control and cost savings.

Rocket Money Cost

Rocket Money’s premium subscription ($6–$12/month) is automatically deducted from linked accounts. Some users report unexpected charges even after canceling, so double-check account settings and confirmations.

For bill negotiation, Rocket Money takes 35–60% of the savings. Some users were charged for negotiations they didn’t authorize, so it’s best to monitor settings and notifications to avoid surprises.

Security & Data Privacy: What You Should Know

Rocket Money connects to bank and credit card accounts through Plaid, a financial data network commonly used for app integrations. While Plaid does not store login credentials, it does have access to transaction history, balances, and account details. This raises privacy concerns, especially for users who prefer more control over their financial data.

Key Security & Privacy Risks:

- Full Account Access: While Rocket Money itself doesn’t store passwords, it requires deep access to financial data, including spending habits and transaction details.

- Data Sharing Concerns: Some users are uncomfortable granting third-party apps ongoing access to their bank information.

- Potential Unauthorized Charges: Users have reported unexpected premium or bill negotiation charges, highlighting concerns about automatic deductions.

- Breach & Data Safety Risks: Although Rocket Money encrypts financial data, any third-party integration introduces security risks compared to manual financial tracking.

Privacy-Focused Alternatives:

For those concerned about financial data privacy, here are safer budgeting options:

- YNAB (You Need a Budget): Offers manual transaction entry, allowing users to track spending without linking bank accounts.

- EveryDollar: Provides budgeting without automatic bank syncing, reducing exposure to data breaches.

- Manual Budgeting (Excel/Google Sheets): The most secure option—full control without third-party access to sensitive financial information.

While Rocket Money provides convenience, it requires financial account access that some users may find intrusive. If privacy is a priority, consider manual or alternative budgeting tools instead.

Credit Score Monitoring

Keeping an eye on your credit score is crucial for maintaining financial health, and Rocket Money makes this easy with its premium subscription. The app provides access to your credit score, credit report, and credit history, allowing you to monitor changes over time and identify areas for improvement.

Rocket Money also offers tools and resources to help you boost your credit score. With features like credit score tracking and alerts, you can stay informed about any significant changes and take proactive steps to improve your credit health.

By monitoring your credit score, you can work towards achieving your financial goals and securing better financial opportunities in the future.

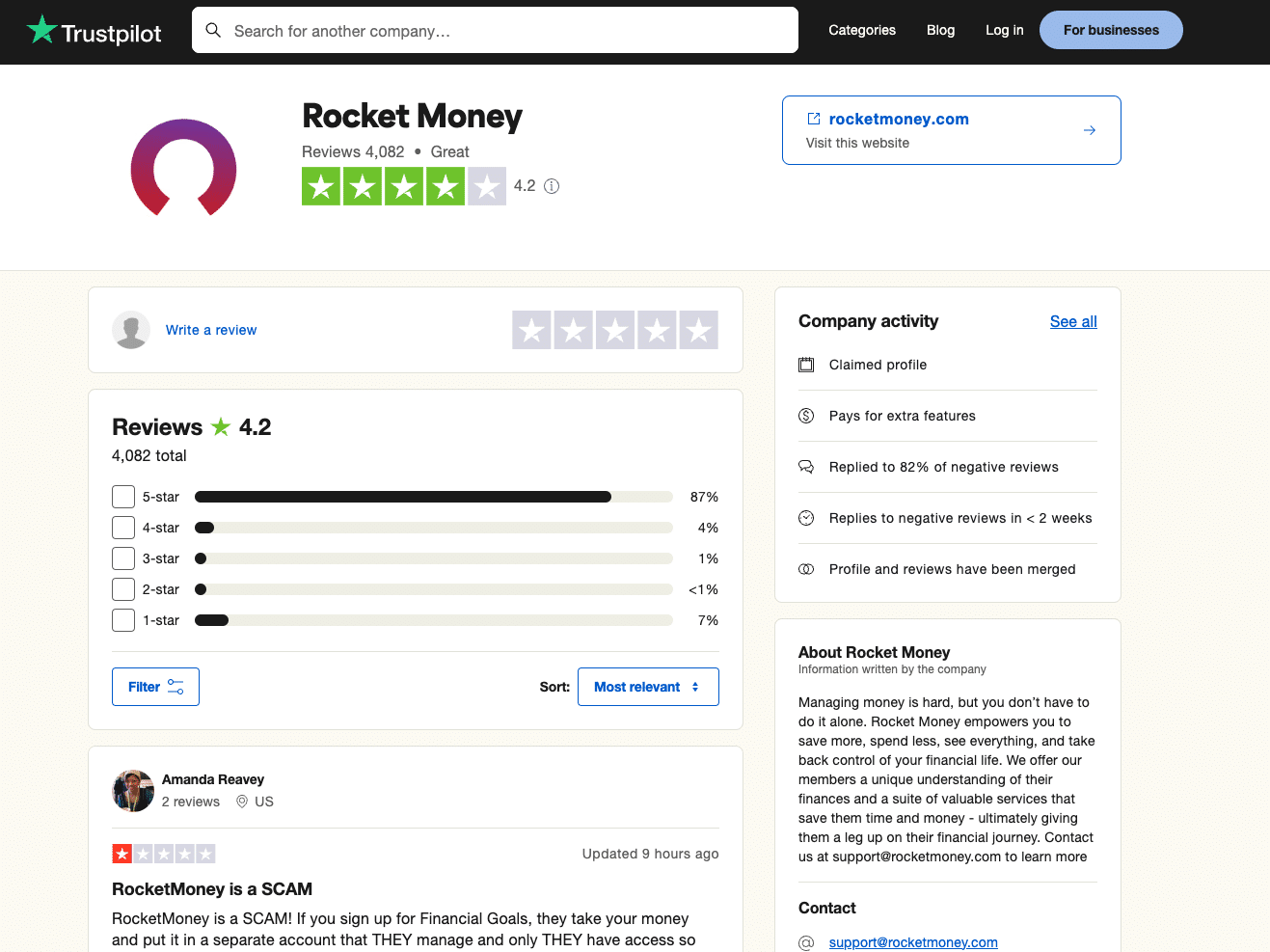

Rocket Money Reviews and User Ratings

Rocket Money has a strong user base, but reviews are mixed, with both praise and criticism.

Positive Feedback:

- Ease of Use: The app simplifies financial tracking and subscription management.

- Convenience: Many users appreciate the automated features for budgeting, subscription tracking, and bill negotiation.

- Highly Rated: It holds a 4.3-star average rating on platforms like Trustpilot and Google Play.

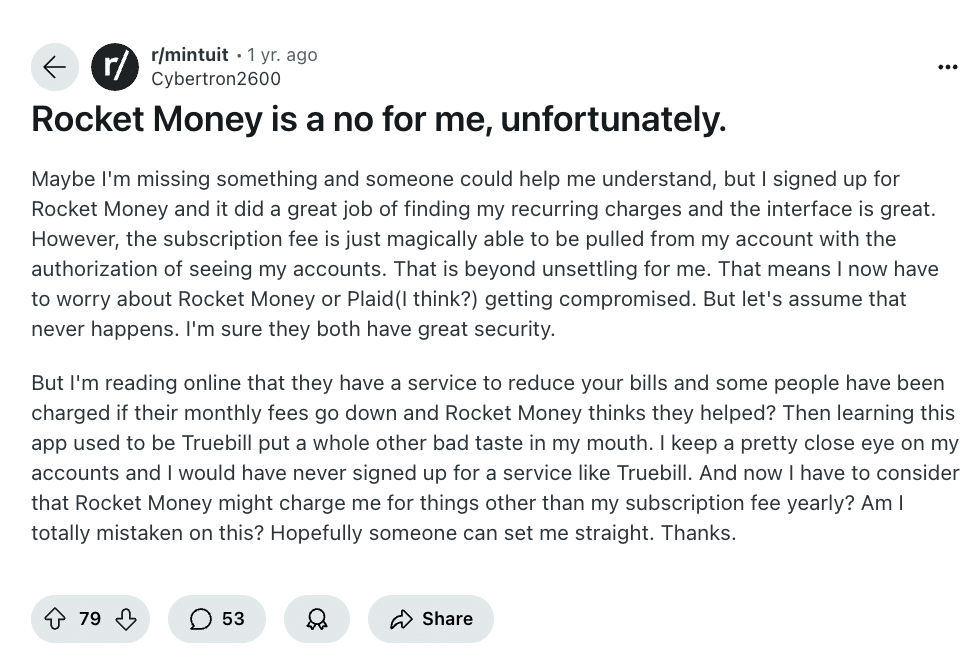

Common Complaints & Concerns:

- Security Worries: Some users feel uneasy linking their financial accounts, even though Rocket Money uses Plaid for secure connections.

- Unexpected Charges: Reports exist of automatic subscription fees and bill negotiation charges being deducted without explicit consent.

- Effectiveness of Services: Users argue that bill negotiation and subscription cancellation are things they could do manually for free.

- Trust Issues from Truebill’s Past: Some remain skeptical of Rocket Money, given its rebranding from Truebill, which had similar complaints.

While some find Rocket Money a useful tool, others feel it’s unnecessary or costly. Those considering the app should review account settings carefully and be aware of potential auto-charges.

Overall User Rating

Rocket Money’s reviews across platforms like Google Play, the App Store, and Trustpilot generally rate it highly. With an average rating of around 4.3 stars, it’s clear that most users are happy with their experience, though a few minor complaints are common across financial apps.

How Rocket Money Compares to Competitors

Rocket Money is unique in that it combines multiple financial tools in one app, which puts it ahead of some competitors. The Rocket Money app offers various features and services, including account linking capabilities, autopilot savings options, and a bill negotiation service.

Apps like Mint and You Need A Budget (YNAB) focus more narrowly on budgeting, while Rocket Money takes a more comprehensive approach by adding subscription management and bill negotiation.

Rocket Money’s all-in-one features may make it a better choice for users who want a one-stop solution. However, those looking only for specialized budgeting tools might prefer apps with a stronger focus on that area.

READ MORE: Manage Your Finances With the Top-Rated Budgeting Apps

Is Rocket Money Worth It? Understanding Its Ownership & Influence

Rocket Money is owned by Rocket Companies, the same parent company behind Rocket Mortgage and Rocket Loans. While Rocket Money operates as a budgeting and subscription management tool, its recommendations may be influenced by its corporate ties.

Potential Conflicts of Interest:

- Rocket Money may promote financial products from its parent company, including loans, credit cards, or mortgage services.

- Users should be cautious of in-app financial recommendations, as they could steer users toward Rocket-affiliated services rather than the best market options.

- While Rocket Money offers valuable tools, it’s important to independently research financial products before signing up.

If you prefer an unbiased financial management tool, consider alternatives like a spreadsheet-based system.

Conclusion

Rocket Money is a useful tool for users who want automated financial tracking and subscription management. However, its bill negotiation fees, security concerns, and mixed customer experiences make it less appealing for those who prefer hands-on financial control.

Before committing, consider whether the premium features justify the cost—or if a manual budgeting approach might work better.

Frequently Asked Questions

Is Rocket money worth having?

If you need an app to help track and cancel unwanted subscriptions or negotiate bills on your behalf, Rocket Money offers those services—for a fee. However, if your main goal is to actively manage your budget and take full control of your finances, this app may not be the best fit.

Can I use Rocket Money with multiple bank accounts?

Yes, Rocket Money allows users to connect multiple bank accounts for a comprehensive financial view.

Does Rocket Money cost anything?

Rocket Money offers free basic features without any charges. However, accessing the Premium Plan requires a monthly payment ranging from $6 to $12, which users can set using a sliding scale. Additionally, the Premium Plan includes a 7-day free trial for new users.

Does Rocket Money cancel subscriptions for free?

Rocket Money detects recurring payments in your transactions and compiles a list of your active subscriptions, along with their due dates, to help you avoid late fees or overdrafts. One of its key features is the concierge service, which assists in canceling duplicate or unwanted subscriptions on your behalf.

Does Rocket Money actually lower bills?

Rocket Money can negotiate lower bills for some users, but results vary significantly, and there are risks involved. While some customers report successful savings, others, like the Reddit user, have experienced no actual reduction—or even an increase—in their bills after using the service

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.