If you need help with personal finance, technology could expand your options. The best budgeting apps can help you allocate your funds and manage your cash flow. Some apps even help users in building credit, saving money, and starting an investment portfolio.

Fortunately, you can find numerous options nowadays, so you should choose the one that fits your financial needs. Otherwise, you might miss essential features or pay too much for extra bells and whistles. This article will show you the top options for managing capital.

10 Highly Recommended Budgeting Apps

The following list recommends each entry for a specific financial goal and elaborates on its features. Later, you will learn how to choose the right personal finance app. These tools follow budgeting techniques, so we will also discuss the most popular ones.

- YNAB: The best choice

- Mint: Most recommended free budgeting app

- EveryDollar: Top option for zero-based budgeting

- Simplifi: Great for managing cash flow

- Personal Capital: Budgeting app with net worth tracking

- PocketGuard: Ideal for straightforward budgeting

- GoodBudget: Top choice for envelope budgeting

- Fudget: Ideal app for hands-on budgeting

- Digit: App for saving and budgeting

- Stash: Great choice for first-time investors

Let’s take a closer look at each budgeting app:

1. YNAB: The Best Choice

Head to the YNAB homepage, and you may think this personal finance app is simplistic. However, the You Need A Budget app is arguably the most comprehensive mobile tool for financial planning.

The YNAB app follows its proprietary budgeting method it calls the “Four-Rule Method.” Let us take a look at each rule to understand how it facilitates financial planning:

- Give every dollar a job: YNAB believes you must allocate every amount for a specific purpose.

- Embrace your true expenses: Note every monthly expense on your budget to track spending easily.

- Roll with the punches: You will encounter a sudden expense sooner or later, so you must have emergency funds so your budget stays flexible enough to accommodate these unforeseen expenses.

- Age your money: Allocate last month’s remaining budget for this month’s expenses.

You start by downloading the YNAB app and creating an account. After that, you create a budget by setting financial goals on the app. For example, you could name them “Save Money” or “Debt Payoff.”

The YNAB app lets you sync bank accounts and link them to the budgeting goals. The mobile tool will adjust your progress each time your bank account updates.

If you wrote your budget on a digital file such as a spreadsheet, you can also import it on the YNAB app. That way, you won’t have to input your current budget manually.

However, the app lets you become hands-on with budgeting by letting you manually fill in each transaction. More importantly, the YNAB app upholds banking data security and privacy as its top priority.

That is why it uses bank-level software encryption and high-quality password security for client data. YNAB provides excellent value for its $98.99 yearly subscription or $14.99 a month. If you are skeptical about YNAB, you can try it for free for 34 days.

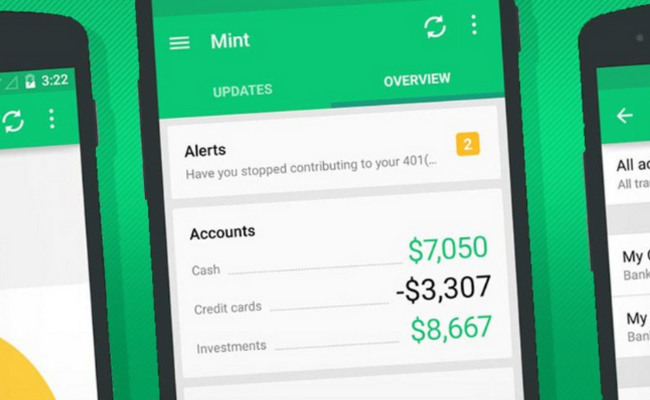

2. Mint – Most Recommended Free Budgeting App

The most well-known tax preparation software now offers one of the best personal finance apps, Mint. What sets it apart is that you can use it for free on the App Store and Google Play.

Mint is a well-rounded personal finance app that lets you monitor financial accounts and daily spending. It automatically organizes your expenditures to show the totals by category.

It also provides monthly bill tracking and payment reminders to avoid late penalties. This free budgeting app also lets you track investments and portfolio fees.

This personal finance app also shares free personal finance blogs and nifty tools. These include a loan repayment calculator and a home affordability calculator.

Mint comes from Intuit, a well-known brand of tax preparation software. Rest assured that it will protect your data with the best features like touch ID mobile access and multi-factor authentication.

This budgeting app shows your cash flows, so you know where your money goes. You will need this feature if you want to control your spending.

Mint is also one of the personal finance apps that provide 24/7 credit monitoring. It will also notify you of any significant changes to your credit report, so you can manage them immediately.

This one is the best free budgeting app, but YNAB still deserves the top spot. Mint offers so many features, but it does not focus on budgeting.

That is the main reason why people look for budgeting apps. The extra features can distract you if you just want to control spending money. Remember that, since it’s a free service, it shows a lot of ads.

Some users complain about significant technical issues. Still, Mint is the top choice if you want the best free budgeting app. Just make sure you can use the other features.

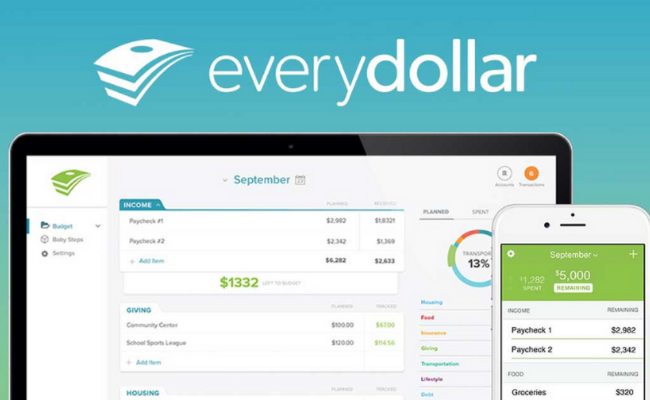

3. EveryDollar: Top option for zero-based budgeting

The number one financial advisor on the radio offers one of the best personal finance apps. EveryDollar comes from Dave Ramsey’s company Ramsey Solutions available on the App Store and Google Play.

It follows the zero-based budget method. This strategy involves using the amount of money available for each spending period. For example, you will only use your monthly salary for monthly expenses.

A zero-based budget requires that you are hands-on with writing a financial plan. As a result, personal finance planning can adjust to unexpected situations. Consequently, you will ensure you do not exceed your monthly budget. This budgeting app has a free version and a paid subscription via the Ramsey+ account.

You fill in your income each month on the free version. Like YNAB, you set monthly financial goals, such as paying recurring bills or video streaming subscriptions.

You could also set savings goals for long-term goals, such as college tuition or a yearly vacation. If you don’t want to update financial data constantly, you could register for Ramsey+.

It lets you sync EveryDollar to all your financial accounts so that it can monitor transactions on your behalf. Also, it tracks debts, submits personal finance reports, and prints transaction records.

Here are the pricing plans for a Ramsey+ membership:

- $59.99 for three months

- $99.99 for six months

- $129.99 for twelve months

EveryDollar is simple to use, but some people think it has insufficient features. If you are looking for comprehensive personal finance apps, EveryDollar might not be for you.

Meanwhile, it is a highly-recommended choice for people who want a capital app that is easy to pick up. EveryDollar is a free app that everyone should try.

You may also like: Budget DIY Home Decor: Affordable Projects That Dazzle

4. Simplifi: Great for Managing Cash Flow

People often make a budget to save money and boost personal capital, but they sometimes forget that it is all about cash flow. The most crucial lession you must learn is how to allocate money from your financial accounts.

Simplifi makes this process, well, simple! You begin by linking your bank accounts so the app can provide a complete picture of your finances. Then, it automatically divides them into various spending categories, monitors upcoming bills, and tracks recurring expenses. You can find these features in other budgeting apps, but Simplifi sets itself apart.

For example, it allows users to create custom watchlists to set spending limits by category. Also, the app tracks cash flow, so you never spend more than you earn.

Simplifi also shares tips while using the app, so you can click them if you need help. Moreover, you can read their blogs about capital management.

This app comes from Quicken, a well-known loan provider since 1984. Rest assured that it will secure your financial data with top-of-the-line features like software encryption and multi-factor authentication.

Simplifi is one of the best personal finance apps, but it is not a free app. It has a free trial period of 30 days. Afterward, you will need to pay $47.99 annually or $5.99 monthly to continue using it.

5. Personal Capital – Budgeting App with Net Worth Tracking

Some budgeting apps help people build wealth as well. The Personal Capital app is mainly an investment tool, but it can help you keep up with spending.

Personal Capital is a well-rounded money management app that lets you set financial goals to increase your net worth. You can even place a monthly spending target to quickly see if you are deviating from your plan.

Like Simplifi, it has a cash flow viewer that lets you see how much money you have received and spent in the last 30 days. Moreover, it sets itself apart from even the best budgeting apps with its Planners:

- Education Planner: Helps college students pay student loans. It lets them estimate how much they should save daily to cover education expenses.

- Retirement Planner: Shows if you have enough funds in your savings account to retire on your target date. It also computes your projected income every month.

- Savings Planner: Shows the annual savings range needed for a 70% chance of achieving your retirement goals. This feature complements the Retirement Planner by providing more details on your savings goals.

As mentioned, this app can also help you calculate your net worth. It deducts how much money you have versus how much you owe. The app will perform calculations based on factors like:

- Checking accounts

- Savings accounts

- Credit card accounts

- Home loans

- IRAs

- 401(k)s

- Other loans

As a result, you can make better decisions on money management and your net worth. Note that this is primarily for managing portfolios. The app may be confusing if you do not want to any investing features or add investment management services to your budgeting app.

6. PocketGuard: Ideal for Straightforward Budgeting

The extra bells and whistles from other budget apps can be troublesome. If you want a tool strictly for budgeting, PocketGuard might be what you need.

You can link bank accounts, loans, investments, and credit cards to it, so you know how much money you have left. It can also track all your bills to update your budget in real-time.

PocketGuard represents your expenses on a pie chart, so you can see how much they are taking from your budget. It may even show unnecessary expenses, such as a forgotten gym membership. As a result, PocketGuard makes sure you are ready for upcoming bill payments.

PocketGuard is also one of the best personal finance apps because it is free! If you have multiple debts, you may want to pay for the premium version called PocketGuard Plus.

It will compute your remaining balance and monthly installment based on hidden fees and other data. The premium version will also reflect how much you owe on each debt to see your debt payoff progress.

Simple does not always mean better, especially for budgeting apps. Like EveryDollar, some people may think its features are barebones.

If you need advanced services, you could pay for PocketGuard Plus. This premium version costs $7.99 a month or $79.99 a year. You could get the best value by paying $99.99 for a lifetime subscription.

7. GoodBudget: Top Choice for Envelope Budgeting

People had a way to simplify their budgets before budget apps became popular. They used what many called the “envelope budgeting” method to allocate funds for their monthly expenses.

Each category required a certain amount of money based on the average installments. For example, if you pay roughly $100 for the water bill, you place $100 monthly in the “water bill” envelope.

The GoodBudget app takes this traditional budgeting technique to the modern age. You can assign a specific amount of money for every expense, like utilities and subscriptions.

Like the other budgeting applications, you can use the app from your smartphone or PC browser. GoodBudget also has articles, videos, and other educational tools that teach how to use the app to maximize your household finances. It also has a free version and a paid version. Here’s how the two versions differ:

- Free version: You get one account with ten regular envelopes that you can connect to two devices.

- Paid version: Otherwise known as GoodBudget Plus, it allows unlimited envelopes and accounts for five devices. You can pay the monthly or annual fee, $8 a month or $70 a year.

Unfortunately, this budget app may have followed the old ways too closely. Unlike the others, it does not link to multiple financial accounts. You will have to fill out the budget info every month, regardless of whether you have the free version or the paid app.

That’s fine if you want complete control over your finances. Otherwise, you might want to check the other budget apps instead of GoodBudget.

8. Fudget: Ideal App for Hands-on Budgeting

Speaking of being hands-on, Fudget is one of the best budgeting applications for this approach. This drive for simplicity even shows on its homepage! Here are its features:

- Write down simple lists of monthly bills and earnings.

- It lets you add and edit information in a single tap.

- You can feature a specific expense or income by tapping its star icon so it appears on future budgets.

- Choose whether you prefer a monthly or weekly budget plan.

- You may select any currency symbol.

- Install on your Android or iOS mobile device.

Fudget says it is one of the simplest and fastest budget apps, and these features prove that. What’s more, you could buy the premium version called Fudget Pro with the following features:

- The Pro app lets you save data on Dropbox, so you and your loved ones can track spending categories together.

- You can organize items by name, amount, or date.

- It can calculate values and incorporate them into your budget.

- You could turn Fudget Pro data into a CSV file so that you can open it on a spreadsheet program.

- Fudget Pro offers eight color themes.

- Fudget Pro charges a one-time fee of $3.99, which removes ads.

Fudget Pro does not sync accounts despite the added functionality. Still, it is one of the best budgeting applications that you may want to try.

9. Digit: App for Saving and Budgeting

The next budgeting apps work for specific budgeting goals. Digit is a personal finance app that helps you pursue your savings goals. You can put as many objectives as you like. The app will set aside money based on your upcoming bills, the date, and the savings amount.

Most budgeting applicationss have spending limits, but this one has savings limits. Digit will not allocate more than your desired amount. You may also pause the savings goals at any time.

Financial service and loan company Oportun owns Digit, and it knows that users want utmost control over their finances. Sometimes, you have to postpone a few savings goals for various reasons.

Like many budgeting apps, Digit offers free bank sync for all your bank accounts. It also scans for billing accounts you may have missed out on, so you cover them all in your budget.

Digit also moves funds to your Bills account so there are ready payments for every expense. You may also turn it into one of your bank accounts by getting the Digit debit card. And like any savings account, it has FDIC insurance worth $250,000. It may even be better than your other bank accounts because it charges no overdraft fees.

The free version lasts six months. Then, you will have to pay $5.00 a month to continue using it. However, the other budgeting apps offer more budgeting features than Digit.

You may also like: Get Top Schooling on a Budget: 15 UC Berkeley Free Online Courses

10. Stash: Great Choice for First-time Investors

This Stash app is an investment tracking app that offers budgeting features. Stash lets you track spending, set savings objectives, and automatically set aside money.

Why did Stash make it on this list? A budget can help build funds for a portfolio. You can invest in stocks to build wealth or save for your retirement account. However, you will need to allocate funds for assets.

Investors want nothing less than top-notch security for their assets, and Stash can implement them on your savings. The security features include biometric authentication and encryption.

Like Digit, this app protects users with FDIC insurance. Instead of a $250,000 limit, Stash protects users for up to $500,000. It has no free version, but it offers the following paid subscription tiers:

- Beginner: Provides investing and banking access for $1.00 every month.

- Growth: Has all the Beginner features plus the Smart Portfolio and the Retirement Portfolio for $3.00 per month.

- Stash+: Has expanded investing, banking, and insurance access for $9.00 every month.

This app has the potential to be a great budgeting tool for investing. Stash can help direct your cash toward a better investment portfolio. Otherwise, you may want to try the other apps instead. The additional investment features might get in the way of your budgeting experience.

How to Choose the Best Budget App

We had a lengthy discussion about the best budgeting apps. You will notice that each one corresponds to a specific financial goal. Similarly, you should follow personal finance objectives.

Let’s say you only have a single bank account. The YNAB app earned the top spot on the previous list due to its budgeting tools. However, you may not use them all if you only have one bank account.

Instead, you might want to use Fudget over YNAB. You will have to input the budgeting info manually. It will not take long, though, because you only have one bank account. You get the budgeting tools you need without spending on monthly fees.

Most of these apps appear on both the App Store and Play Store, so they work regardless of your device. Remember that most apps have similar features, such as free bank sync, cash flow management, and bill tracking. You may not need to upgrade to the paid version if you only need the basics.

Other apps like Digit and Stash let you build savings on their platforms. That’s why you have to verify that they offer FDIC insurance. You may want to use an online financial institution instead, depending on your needs.

More importantly, make sure the budgeting app fits your budget. You might affect your budget adversely if you spend too much on the app’s monthly subscription.

Types of Budgets

You may recall that some budgeting apps follow specific techniques. For example, EveryDollar adheres to the zero-based approach, and GoodBudget follows the envelope strategy.

Learning about these methods will help you choose the best app. Choose the tactic that fits your goals, then find the app that uses it. Here’s a quick rundown on each budgeting strategy:

- Traditional: You subtract your income from your expenses. This simple approach works if you do not mind taking the time to compute each expenditure. However, this can become complicated if you have several debts.

- Pay yourself first: As the name suggests, you place a specific amount of money in your savings account before paying debts. Note that your budget may change as your debts accrue interest and penalties.

- Envelope system: You designate an envelope for your monthly expenses, such as groceries and utilities. Each one has an estimated amount that you take from your monthly earnings. The strategy lets you focus on the most critical expenses.

- 50/30/20 budget: You spend half your budget on necessary expenses, 30% on discretionary spending, and 20% on debts and savings. This strategy acknowledges that people must spend on themselves as they work for daily needs and debts.

- 80/20 budget – You allocate at least 20% of your earnings for your savings goals. This strategy may work if you can control spending money. Otherwise, you may waste the remaining 80% instead of directing it to more significant objectives.

- Sub-savings accounts – This strategy works like the envelope method. Instead of a paper container, you use multiple savings accounts. Note that this can quickly become complicated as you must keep track of several terms and conditions.

- 60% solution – You spend 60% of your income on essentials and allocate 40% on savings. Like the 80/20 budget, you will need solid discipline for this strategy.

Final Thoughts

Remember that these apps are mere tools. You handle personal finances by shifting your spending habits so your cash flow goes to a specific financial goal. You are in charge of your financial life, not the budgeting app. If you need more help, speak to a financial advisor. The same goes if you want to invest money.

Note that this article does not provide investment advice. It only explains how some investment apps work, but it is up to you whether or not to build a portfolio. This article also discussed the best budgeting apps, but you may find others on the internet. If these recommendations do not work for you, feel free to look for alternatives.

Frequently Asked Questions (FAQs)

What is the best budgeting app?

The You Need A Budget (YNAB) app is arguably the best budgeting app. YNAB has excellent features for a relatively affordable monthly subscription.

What is the Dave Ramsey budget app?

EveryDollar is the budgeting app from Ramsey Solutions. It follows the zero-based budget system that resets the available funds every month based on your regular income.

What are the best free budgeting apps?

Choose the Mint app if you do not want to spend money on a budgeting app. However, other apps like Fudget let you use their free version indefinitely.

Do I need an app to manage money?

You can try most budgeting apps for free before making a decision. Otherwise, you can follow the budgeting techniques manually.