Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Cura Debt: Reviews and Ratings

When you’re overwhelmed with debt, the last thing you want to do is spend hours researching different debt relief companies. That’s where reviews and ratings come in—they provide insights into real customer experiences beyond the marketing claims.

In this in-depth review, we examine CuraDebt, one of the leading debt settlement companies. We analyze customer feedback, compare CuraDebt to competitors on fees, success rates, and customer service, and evaluate whether this company is the right choice for you.

What is Cura Debt and How Does It Work as a Debt Settlement Company?

Cura Debt Overview

CuraDebt has been providing debt relief services since 2001, assisting individuals and small businesses in settling their debts. The company was originally founded in 1998 by Eric Pemper as a DBA of Pemper Companies, Inc. in San Diego, California. In 2008, CuraDebt was reincorporated in Nevada as CuraDebt Systems, LLC, and its headquarters moved to Hollywood, Florida.

With over 23 years of industry experience, CuraDebt specializes in helping clients reduce unsecured debts, including credit card debt, medical bills, personal loans, tax debt, and business liabilities.

CuraDebt is a member of the American Association for Debt Resolution (AADR) (formerly the American Fair Credit Council) and is accredited by the International Association of Professional Debt Arbitrators (IAPDA).

RELATED READING: Best Personal Loan Companies: Top 7 Lenders to Consider

How Cura Debt Helps with Debt and Tax Debt Relief

Debt Settlement & Debt Negotiation

Debt Settlement & Debt Negotiation

CuraDebt negotiates with creditors to settle debts for less than what is owed, sometimes as low as 30-50% of the original balance. This involves stopping payments on enrolled debts and saving funds in a dedicated account until there is enough for negotiations.

CuraDebt also provides debt negotiation services, which help reduce interest rates, waive fees, and lower monthly payments without requiring full settlement.

Tax Debt Relief

CuraDebt offers tax resolution services for individuals and small businesses facing IRS and state tax issues, including:

- Unpaid taxes

- Tax levies and liens

- Wage garnishments

- Unfiled tax returns

- IRS audits

CuraDebt’s tax team includes CPAs, attorneys, enrolled agents, and tax preparers who work directly with the IRS and state tax authorities to resolve outstanding tax debts.

DIG DEEPER: Tax Relief Programs: Your Essential Guide to Financial Reprieve

Business Debt Relief

CuraDebt offers business debt relief solutions for small business owners struggling with unsecured business debts. This service focuses on negotiating with creditors, restructuring payment plans, and reducing business liabilities.

Cura Debt Reviews: What Customers Are Saying

Positive Customer Reviews

CuraDebt has received mostly positive reviews on platforms such as TrustPilot and the Better Business Bureau (BBB). Customers highlight:

✔ Professional and knowledgeable representatives who guide them through the process. ✔ Significant debt reduction, with some clients saving $50,000 or more. ✔ Completion of the program within 24-48 months.

One client stated: “CuraDebt helped me resolve my tax debt and credit card balances, saving me over $30,000. Their team was responsive and made the process easy to understand.”

Critical Customer Feedback

Like any debt relief company, CuraDebt has received some negative reviews. The most common complaints include:

❌ Lack of transparency on fees – CuraDebt advertises that fees are 20% or less, but reports indicate they range from 15-25% of the enrolled debt. ❌ Not available in all states – CuraDebt only operates in 26 states and Washington, D.C.. ❌ No mobile app – Unlike some competitors, CuraDebt does not offer a mobile app for account management.

However, CuraDebt is responsive to complaints and works to resolve issues.

Cura Debt Ratings: How it Stacks Up Against Competitors

Now that we’ve analyzed what clients say directly, let’s look more objectively at Cura Debt’s ratings from third-party sources than those of other industry leaders.

Cura Debt’s Industry Ratings

On sites like TrustPilot and the BBB (4.78/5), Cura Debt has an average rating of 3.3 stars with 12 reviews. For context, their two biggest competitors—Freedom Debt Relief and National Debt Relief—fall in the 3.5-4 range.

Similarly, groups like the Online Business Bureau rate Cura Debt in the top 1% of debt relief companies. They have zero complaints on file compared to competitors, with dozens or hundreds of complaints left unresolved.

Independent research clearly shows Cura Debt as a cut above much of the pack in terms of consistent client satisfaction. Their longevity in business also speaks volumes.

Cura Debt vs Competitors: A Side-by-Side Comparison

Let’s break down how Cura Debt compares to the top two competitors on measurable factors:

Fees:

- Cura Debt: $50-99 enrollment, 10-15% of total debt settled

- Freedom Debt Relief: $0 enrollment, 15-20% of debt settled

- National Debt Relief: $0 enrollment, 15-25% of debt settled

Debt reduction success rate:

- Cura Debt: 82% of clients see 30%+ debt reduction

- Freedom Debt Relief: 78% see 25%+ reduction

- National Debt Relief: 74% see 20%+ reduction

Client services:

- Cura Debt: 99% client satisfaction, multi-lingual support

- Freedom Debt Relief: 95% satisfaction, high phone wait times

- National Debt Relief: 90% satisfaction, mixed web reviews

So, while Cura Debt isn’t always the absolute cheapest, its high success rates and client care translate to higher overall value compared to competitors.

READ MORE: Eligibility for IRS Innocent Spouse Relief: A Detailed Overview

Expected Costs and Savings

- Fees: CuraDebt charges 15-25% of enrolled debt, but fees are only applied after a successful settlement.

- Expected Savings: Clients typically save 50% before fees and around 30% after fees.

- Timeframe: Most clients complete the program in 24-48 months.

Lowest-Fee Guarantee

If a competitor with a BBB A+ rating offers a lower settlement fee, CuraDebt will match or beat it.

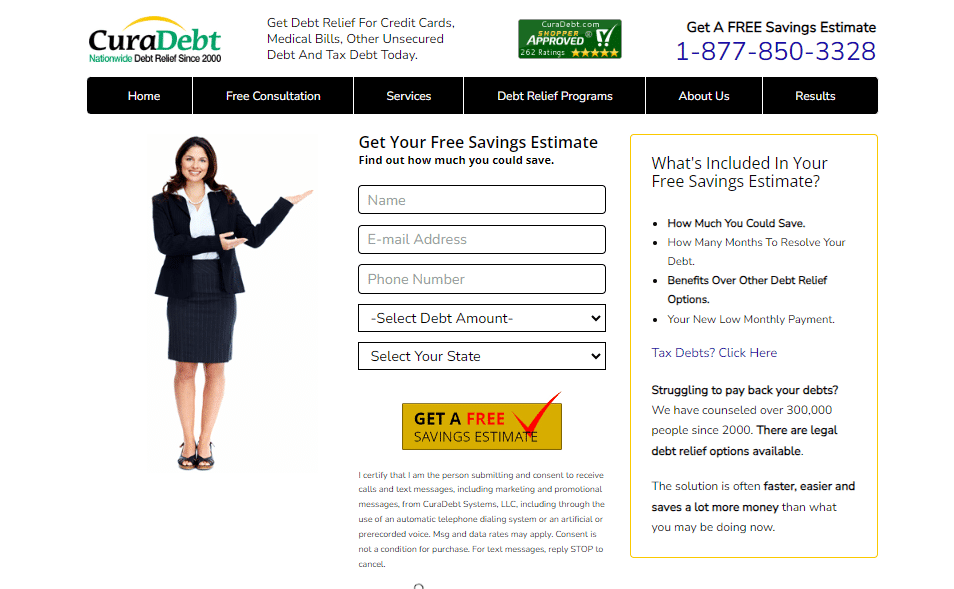

How to Enroll With CuraDebt

To start, request a free consultation by calling (877) 850-3328 or filling out an online form. The consultation will assess:

✔ Debt amount (Minimum: $5,000) ✔ State of residence (Available in 26 states + D.C.) ✔ Best debt relief strategy based on your situation

Once enrolled, clients deposit money into a special account until enough funds accumulate for debt settlement negotiations.

Final Verdict: Is CuraDebt Right for You?

CuraDebt is ideal for:

✔ Individuals with at least $5,000 in unsecured debt ✔ Those seeking both debt settlement and tax relief ✔ Small business owners needing financial assistance ✔ People who want a lowest-fee guarantee

You may need to look elsewhere if:

❌ You live in a state where CuraDebt is unavailable ❌ You prefer a company with a mobile app ❌ You are looking for a debt management plan rather than a settlement

Conclusion

CuraDebt is a strong choice for individuals and businesses needing debt or tax relief. Its competitive fees, creditor violation reviews, and lowest-fee guarantee make it a solid option, though availability is limited to certain states.

For a free consultation, call (877) 850-3328 or visit CuraDebt’s website today.

FAQs about Cura Debt

What types of unsecured debts do Cura Debt help with?

Cura Debt generally focuses on unsecured consumer debts like credit cards, medical bills, personal loans, and tax debts. They do not assist with secured loans or debts like federal student loans.

How long does it take to see results with Cura Debt?

Most clients see initial debt reduction results within 6-12 months as negotiations start. However, the full program typically takes 2-3 years for debt settlements to be legally complete and documented.

What are Cura Debt’s fees?

Enrollment fees range from $50-99 depending on your debt amount. Once enrolled, Cura Debt charges 10-15% of total debt settled as a program fee deducted from settlements.

Is Cura Debt a legitimate company?

Yes, absolutely. Cura Debt has been a leader since 2000, with a B rating of BBB. They are licensed in all 50 U.S. states and fully compliant with all federal laws regarding debt relief services.

How does Cura Debt compare to other debt relief companies?

Cura Debt tends to cost marginally more in fees. Still, it has higher success rates and client satisfaction than competitors like National Debt Relief or Freedom Debt Relief based on third-party research.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.

Debt Settlement & Debt Negotiation

Debt Settlement & Debt Negotiation