Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Beagle 401k Reviews and Ratings

Beagle 401(k) Company Logo

If you’ve switched jobs over the years, you may have lost track of 401(k) accounts — and potentially thousands of dollars in retirement savings. Beagle 401k is a fintech platform designed to help you find those lost accounts, understand hidden fees, and roll over funds into low-cost investments. But is it worth paying for?

This guide reviews Beagle’s features, pricing, pros and cons, and who it’s best for so you can decide with confidence.

What is Beagle 401(k)?

Beagle homepage.

Beagle 401(k) is a digital platform that finds old retirement accounts using your Social Security number and employment history. Once located, Beagle helps you consolidate those accounts into a single managed IRA or external account. You also have the option to invest through a robo-advisor or take a loan from your balance.

The company is based in San Alto, California, and was founded in 2020 by Cyrus Ghazanfar, Jeffrey Tha and Shuo Jiao. Beagle is a registered investment adviser with the Securities and Exchange Commission (SEC), which means it has fiduciary obligations to act in your best interest.

How Beagle Works

Beagle’s online form.

Beagle helps users in five key ways:

- Find forgotten 401(k) accounts: Beagle uses your personal and work history to search for accounts across multiple financial institutions and databases — even those not listed in government registries.

- Analyze hidden fees: Beagle breaks down the investment management and administrative fees being deducted from your account, helping you understand long-term cost implications.

- Guide the rollover process: Beagle offers an optional rollover service that lets you consolidate multiple 401(k)s into a single retirement account, like an IRA, without a minimum deposit.

- Manage your investments: Through Beagle’s robo-advisor, you can invest in a diversified portfolio of low-cost ETFs based on your retirement timeline and risk tolerance. The platform automatically rebalances your portfolio.

- Borrow from your own account: Beagle facilitates loans from your 401(k) or IRA at a net 0 percent interest rate. You pay a 9.25 percent rate, but the interest is returned to your own retirement account. A one-time processing fee of 1 percent (up to $99) applies.

Beagle 401(k) pricing and fees

Beagle charges a one-time fee depending on how many accounts it finds and what services you choose. These plans include:

- Starter plan: $19 if fewer than three accounts are found, or $25 if three or more accounts are located.

- Standard plan: $39 or $45 depending on the number of accounts found. Includes rollover support and early fund access.

- Premium plan: $45 billed every three months. Includes coaching, account monitoring and optimization features.

- Robo-advisor account: $3.99 per month, billed separately.

Other potential costs include wire transfer fees, paper statement charges and a $75 outgoing transfer fee if you close your account. Beagle does not display pricing until you begin the onboarding process.

Beagle 401(k) success rate and results

Beagle typically locates forgotten 401(k) accounts within three to 10 business days, based on user-reported timelines and company claims. Many customers recover between $1,000 to $10,000 in long-lost retirement funds — often from jobs held years or even decades earlier.

For example, one verified user on Reddit found a $3,400 account and another worth $800, after paying Beagle a one-time fee of $40. Another reported finding an $8,000 account and saving $120 per year in hidden plan fees after consolidating.

While results vary depending on your employment history and plan custodians, Beagle’s recovery process is described as fast, straightforward, and high-yielding in the majority of Trustpilot reviews, where the company maintains a 4.8 out of 5 star rating.

That said, some users have found zero-balance accounts or experienced delays, especially if their employment records were incomplete. As with any financial service, your outcome will depend on the accuracy of your data and the number of retirement accounts tied to your name.

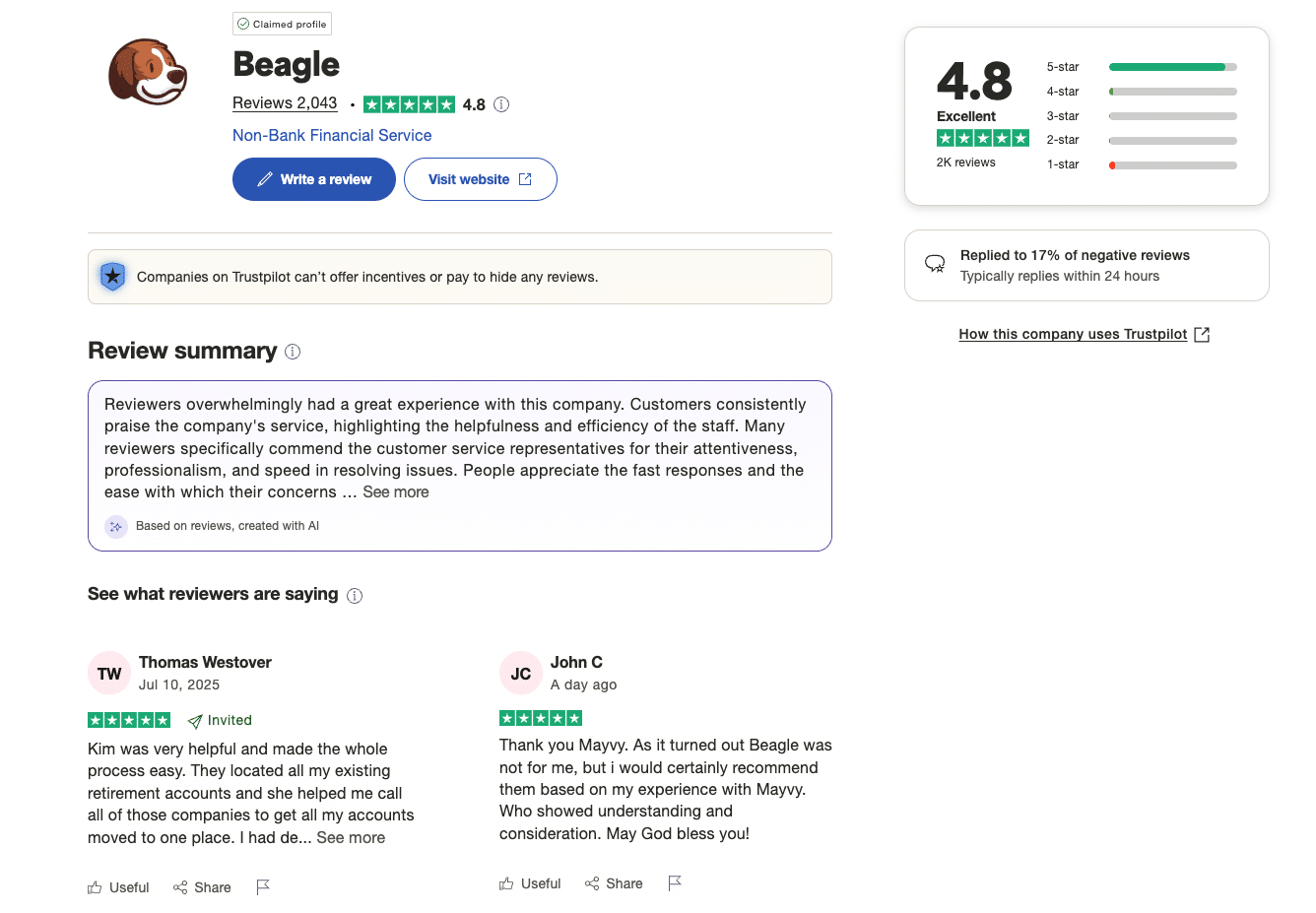

What customers say about Beagle 401(k)

Here’s a breakdown of what real customers are saying:

Trustpilot reviews for Beagle 401(k)

Beagle 401(k) Trustpilot Customer Reviews

Beagle earns a TrustScore of 4.8 out of 5 on Trustpilot, based on more than 2,000 verified customer reviews. The vast majority of feedback is positive, with 91 percent of reviewers giving five stars.

Customers frequently highlight:

- Friendly and responsive customer service representatives

- A smooth rollover process

- Successful account recovery

- Quick resolution of issues, including accidental purchases

Many users mention specific reps like Kim and Mayvy who helped them navigate rollovers, account transfers, and refunds with care and professionalism. Beagle typically responds to negative reviews within 24 hours.

However, a small percentage (5 percent) reported dissatisfaction—usually tied to pricing surprises or refund requests.

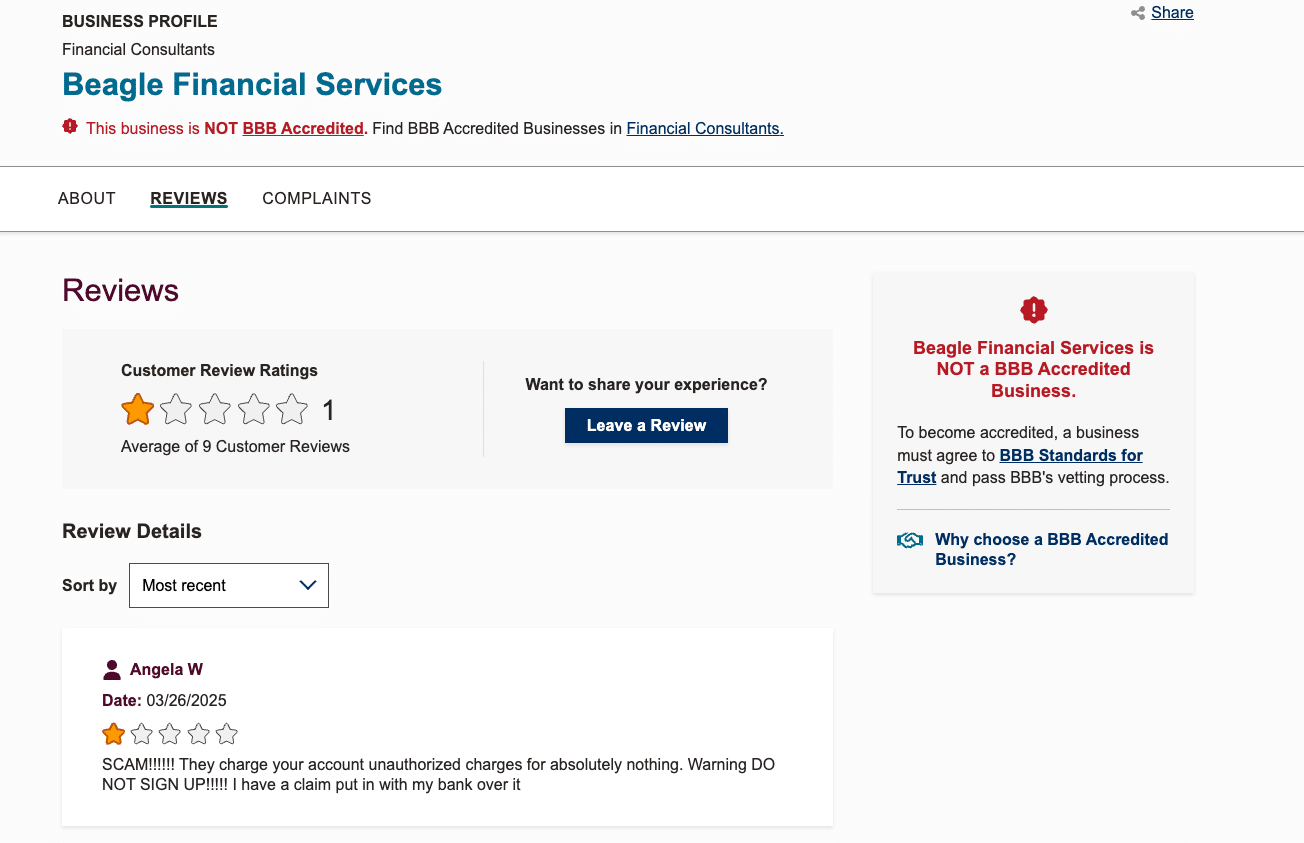

Better Business Bureau (BBB) rating for Beagle 401(k)

Beagle 401(k) BBB Rating and Customer Complaints

Beagle is not accredited by the Better Business Bureau and holds a B- rating with an average customer review score of 1 out of 5 stars, based on 9 reviews as of July 2025.

Common complaints include:

- Unauthorized or unclear charges

- Failure to deliver promised search results

- Lack of follow-up or refund support

- Sending only generic bank login links instead of account-specific access

Many reviewers claim they were charged for results showing zero-balance accounts or links that required credentials they no longer had. Some users reported filing disputes with their banks to reverse the charges.

While BBB complaints represent a small user segment, they point to recurring issues with transparency and refund responsiveness.

Reddit discussions about Beagle 401(k)

Anyone heard of meetbeagle com?? byu/ZombieJes inpersonalfinance

User experiences on Reddit are more mixed but generally candid. In forums like r/personalfinance, users share both success stories and frustration.

Positive mentions include:

- Discovering forgotten accounts worth thousands of dollars

- Successfully locating “safe harbor” IRAs created after job changes

- Efficient search results for users with limited documentation

Is the 401k search platform Beagle safe to use? byu/greeneyelioness inpersonalfinance

However, concerns include:

- Long wait times for account search results

- Accounts found with $0 balances

- Missed known accounts even after providing zip codes and job history

- Persistent outreach from related service providers (e.g., Retirement Clearinghouse)

Redditors often suggest trying free tools or state unclaimed property databases first, but acknowledge Beagle can be worth the cost if even one forgotten account is recovered.

Who Beagle 401(k) is best for

Here’s a look at who will benefit most—and who might want to consider other options.

Beagle is a smart solution for:

- Workers with several former employers and scattered 401(k)s.

- People who want to avoid manually contacting HR or plan providers.

- Users who prefer a set-it-and-forget-it robo-advisor model.

- Individuals comfortable using online-only platforms.

It may not be ideal for:

- DIY investors who want to pick their own funds beyond ETFs.

- Users who prefer phone or live chat support.

- People cautious about entering personal data with fintech services.

How Beagle 401(k) compares to competitors

Unlike free government-run databases, which rely on employers to upload retirement plan data, Beagle actively searches across multiple databases using your employment history. This makes it more thorough than platforms like the National Registry of Unclaimed Retirement Benefits.

Compared to alternatives like Capitalize or Blooom:

- Capitalize offers free rollovers but no fee tracking or robo-investing.

- Blooom provides investment analysis but does not locate old accounts.

- Beagle is the only one of the three offering 401(k) loan facilitation.

If your goal is to find and consolidate lost 401(k)s with guided rollover and ETF investing, Beagle may be the most comprehensive choice.

Is Beagle 401(k) safe and legitimate?

Yes. Beagle is a legitimate financial technology company:

- Registered with the SEC as an investment adviser.

- Uses encrypted connections, firewall protection and data access controls.

- Partners with SIPC-insured brokerages, providing up to $500,000 in protection for securities and cash.

Beagle does not directly hold your money — funds are moved to external custodians under your name.

Beagle 401(k) support and accessibility

Beagle’s customer support is currently limited to the following channels:

- Email support via support@meetbeagle.com

- Online contact forms available through the website

At this time, Beagle does not offer live chat, phone support, or a mobile app. All services are web-based and optimized for desktop or laptop browsers.

To use Beagle, you must:

- Be at least 18 years old

- Have a valid Social Security number

- Be a U.S. citizen or lawful permanent resident with a physical address

While many users praise the support team’s professionalism and responsiveness in reviews, others have expressed frustration with delayed replies — especially when requesting refunds or technical help. If fast, real-time support is a priority, this may be a limitation to consider.

Pros and cons of Beagle 401(k)

Before deciding if Beagle 401(k) is the right solution for recovering and managing your retirement funds, it’s helpful to weigh its benefits against potential drawbacks.

Pros:

- Helps recover lost 401(k) accounts in minutes

- Offers clear breakdowns of hidden plan fees

- Provides robo-advised ETF portfolios with no minimums

- Enables borrowing from your own account

- SEC-registered fiduciary with data encryption and SIPC protection

Cons:

- No mobile app or live customer support

- Pricing not shown until after you sign up

- Refund policy is unclear

- ETF-only investing may feel limited to some users

- Not BBB-accredited

Final verdict: Should you use Beagle 401(k)?

Beagle 401(k) is a smart tool for anyone with old or lost retirement accounts. It offers a rare combination of account discovery, rollover support, robo-investing, and loan facilitation — all under one digital roof.

However, support limitations and hidden pricing may be deal-breakers for some. If you’re tech-comfortable and value simplicity, Beagle offers excellent value for the cost. If support responsiveness is a priority, you may want to explore other services like Capitalize.

Frequently asked questions

How much does Beagle 401(k) charge to find your 401(k)?

Beagle charges a one-time fee ranging from $19 to $45 depending on how many old 401(k) accounts are found using your Social Security number and employment history. This fee covers the search process, investment management fee breakdown, and access to a consolidated view of all your old accounts. While not free, the value often outweighs the cost—especially if you recover retirement money that’s been sitting idle across multiple financial institutions.

Is Beagle 401(k) safe to use?

Yes, Beagle is safe and operates as an SEC-registered investment adviser with strict security standards. It uses encrypted systems and firewall protection to secure your bank account, Social Security number, and retirement account data. Your funds are not held by Beagle but are managed through a SIPC-insured financial institution after the rollover process. You maintain full control of your assets while Beagle acts as a financial concierge, helping you invest your retirement money in low-cost ETFs or mutual funds.

How do I cancel my Beagle 401(k) account?

To cancel your Beagle account, log into the Meet Beagle website and go to your account settings where you can submit a cancellation request. Be aware that customer service issues, particularly related to refunds or delays, have been reported on the Better Business Bureau and Reddit. If you experience problems, contact Beagle via email and make sure to cancel before your next billing date to avoid additional charges, especially if you’re using a paid service tier.

Can I use Beagle 401(k) for free?

Beagle is not a free service; it charges a one-time fee for account searches and a monthly fee if you use its robo-advisor to invest in low-cost ETFs. While some users attempt to locate old 401(k) accounts using free state websites or plan administrator searches, Beagle offers an industry-leading, hassle-free rollover process by identifying hidden accounts using your employment data and Social Security number—making it a more complete solution for recovering forgotten retirement funds.

How does Beagle 401(k) search work?

Beagle’s search begins when you provide your Social Security number and employment history through the Meet Beagle website. The platform scans public and private databases, plan administrator systems, and financial institutions to track down old 401(k) accounts. Once identified, Beagle shows you the associated balances, hidden fees, and investment breakdowns, and gives you the option to roll everything into a new retirement account. This process helps you regain control of your retirement money without contacting every former employer individually.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.