Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

SunStar Lending: Reviews and Ratings

When you’re standing at the crossroads of borrowing, the decision to pick a lender can feel like choosing between doorways to different futures. Enter SunStar Lending, a beacon in the world of financial lending services.

SunStar Lending is committed to understanding and meeting the diverse needs of its clients. Whether you’re planning a dream vacation, funding higher education, or consolidating debt, understanding reviews and ratings is your first step to financial clarity. So, let’s unravel the buzz around SunStar Lending—what makes it shine and why it’s loved (or not) by its customers.

What is SunStar Lending?

Think of SunStar Lending as your financial co-pilot. Founded with a mission to simplify borrowing, this company offers a suite of tailored loan options to fit diverse needs. From personal loans to travel funding, SunStar brings flexibility, transparency, and an approachable customer-first vibe.

But what truly sets SunStar apart? It’s the company’s commitment to building trust. Their loans are straightforward—no sneaky fees, no ambiguous jargon. It’s as if they’re saying, “Hey, we’ve got your back, financially speaking.”

- Mission: To empower borrowers with accessible, transparent, and personalized financial solutions.

- Services: Personal loans, home improvement loans, travel loans, debt consolidation, and more.

- Standout Features: Lightning-fast loan processing, highly flexible repayment terms, and a user-friendly online application process.

Based in West Jordan, Utah, SunStar Lending has carved out its niche by offering an array of loan options, from personal loans to educational financing, all served with a side of genuine customer care.

Their bread and butter? Loans range from $1,000 to $50,000, with APRs ranging from a modest 4.6% to 35.99%. Think of them as the Swiss Army knife of lending—versatile, reliable, and ready for action.

Detailed Reviews and Customer Ratings

Take Alex M., who praised the “stress-free” application process, or Jordan E., who found the flexible repayment options to be a game-changer. Even when challenges arise, SunStar’s responsive team ensures quick resolution, maintaining its stellar reputation.

When it comes to SunStar Lending, customers have a lot to say. And let’s face it—reviews can make or break a company. So, what’s the word on the street?

Overview of Client Experiences

Reviews reveal a mixed bag, leaning heavily toward the positive. Borrowers frequently praise the quick loan approvals and transparent communication. Many commend SunStar’s interest rates—competitive without feeling like a financial sucker punch. The positive impact of SunStar Lending’s services on customer satisfaction is evident in these reviews.

Some common highlights:

- Processing Speed: Loans are approved in as little as 24 hours.

- Customer Service: Responsive and empathetic.

- User-Friendly Applications: Online and mobile platforms get a thumbs up.

Of course, there are concerns. A few customers mentioned feeling overwhelmed by documentation requirements, while others wished for slightly lower APRs. SunStar seems to address most concerns promptly—score one for accountability!

Read More: Improve Credit Score: Does Paying Off Collections Help?

Why SunStar Lending Stands Out

- Flexible Loan Options: They cater to various financial goals, whether you’re funding a kitchen remodel or consolidating debt.

- Customer Success Stories: Borrowers frequently share testimonials about how SunStar helped turn dreams into reality, such as funding a business or paying for college tuition.

- Tailored Financial Solutions: No one-size-fits-all nonsense here. Loans are customized to your needs.

Benefits of Choosing SunStar Lending

Flexible Loan Options

When it comes to financial solutions, one size definitely doesn’t fit all. That’s why SunStar Lending has crafted a diverse portfolio of loan options that adapt to your unique circumstances, much like a well-tailored suit fits perfectly to your measurements. Let’s dive into each loan type and see how they can serve your specific needs.

Personal Loans: Your Financial Swiss Army Knife

Personal loans serve as your go-to solution for various life events. Whether you’re planning a wedding, handling unexpected medical expenses, or need extra cash for a major purchase, these loans offer:

- Amounts from $1,000 to $50,000

- Competitive interest rates starting at 4.6% APR

- Quick approval process contingent on bank approval

- Flexible use of funds

- No collateral required

Educational Loans: Investing in Your Future

Financial constraints shouldn’t limit education. SunStar’s educational loans help you pursue your academic dreams with:

- Tailored repayment schedules that align with your academic timeline

- Competitive rates designed specifically for students

- Options for both full-time and part-time studies

- Coverage for tuition, books, and living expenses

- Grace periods that consider your graduation timeline

Start your educational journey with SunStar Lending today to secure the funding you need efficiently.

Refinance and Consolidation Loans: Simplifying Your Financial Life

- Combining multiple debts into one manageable payment

- Potentially lowering your overall interest rate

- Simplifying your monthly budget

- Offering terms that match your financial goals

- Providing clear pathways to debt freedom

Home Improvement Loans: Transform Your Space

- Funding for both essential repairs and aesthetic improvements

- No home equity requirements

- Loans can be secured using personal property as collateral

- Quick access to funds for urgent repairs

- Competitive rates compared to credit cards

- Flexible use for any home-related project

Travel Loans: Making Dreams Accessible

- Fund your dream trip without depleting savings

- Cover unexpected travel opportunities

- Plan comprehensive vacation packages

- Handle emergency travel needs

- Budget for both international and domestic travel

Customizable Terms and Transparent Structure

All loan options come with:

- Choice of 3 or 5-year terms

- Clear, upfront fee disclosure

- No hidden charges or prepayment penalties

- Fixed monthly payments for easier budgeting

- Interest rates from 4.6% to 35.99% APR based on creditworthiness

Each loan type is designed with flexibility in mind, allowing you to choose terms that align with your financial situation and goals. SunStar’s loan specialists work with you to understand your specific needs and recommend the most suitable option, ensuring you get not just a loan but a financial solution that truly works for you.

Remember, while the terms are standardized for transparency, the application of each loan type is highly personalized. It’s like having a financial menu where you can mix and match options to create the perfect solution for your unique situation. Additionally, as your business circumstances evolve, you may need to refinance to secure better terms.

Exceptional Customer Support

Dealing with finances can be nerve-wracking. SunStar Lending’s customer support team is like the financial equivalent of a calming cup of tea.

The company’s customer-first philosophy isn’t just a slogan – it’s evident in every interaction. Their loan specialists provide one-on-one consultations, ensuring you understand every aspect of your loan agreement.

This personalized approach has earned them glowing testimonials from satisfied borrowers like Samantha T., who commended their “outstanding service.”

- Availability: Support is just a phone call, email, or chat away.

- Empathy: Agents focus on solutions rather than sales pitches, ensuring you feel heard.

With them in your corner, the borrowing process feels less like a chore and more like a partnership.

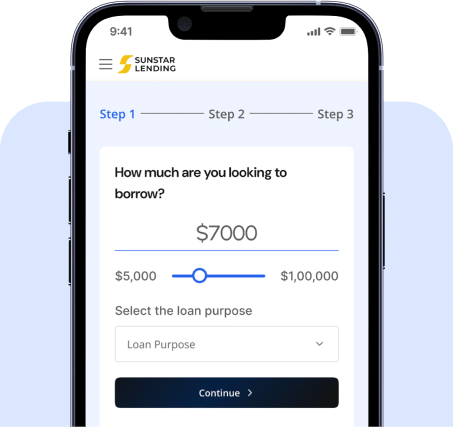

How to Apply for a Loan with SunStar Lending

Step-by-Step Guide

- Visit the Website: Head over to SunStar Lending’s application page.

- Choose Your Loan Type: Personal, travel, or education—it’s up to you.

- Provide Your Info: Fill out the online form with basic details (no need for a novella).

- Upload Documentation: This might include proof of income or ID.

- Review and Submit: Double-check for errors, then click submit.

From there, it’s a matter of waiting (but not for long—approvals often happen within 24 hours).

Is SunStar Lending Right for You?

Making the right choice in a financial partner requires careful consideration of your specific needs and circumstances. Loans aren’t a one-size-fits-all deal, so the question is—does SunStar fit your financial wardrobe?

The type of industry your business belongs to can significantly influence your financing options and how lenders assess your application. Let’s dive deep into who stands to benefit most from SunStar Lending’s services and who might want to explore other options.

Pros and Cons

Pros:

- Flexible loan terms and options tailored for small businesses.

- Transparent rates with no hidden fees.

- Excellent customer service.

Cons:

- Documentation can feel overwhelming.

- Rates might be higher for high-risk borrowers.

Tips for Decision-Making

- Assess Your Needs: Are you after speed, flexibility, or low rates?

- Check Your Credit: Better scores often mean better deals.

- Ask Questions: SunStar’s support team is there for a reason—use them!

If transparency, speed, and customer service are your priorities, SunStar Lending might be your match made in financial heaven.

Conclusion

SunStar Lending is a reliable lender that offers a perfect balance of competitive rates, transparent processes, and customer-focused service. Whether you’re funding education, consolidating debt, or tackling home improvements, their diverse loan options and straightforward approach make them a compelling choice.

Sure, they’re not perfect—no lender is. But when it comes to simplifying the borrowing process, they’re in a league of their own.

So, what are you waiting for? Dive into the SunStar Lending website to explore your options. Whether it’s a dream vacation or a home makeover, SunStar is ready to help you make it happen. Your financial goals are closer than you think!

FAQs

- What types of loans does SunStar Lending offer? SunStar Lending provides a variety of loans to meet different needs, including personal loans, educational loans, home improvement loans, travel loans, and debt consolidation loans. Each option is designed with flexibility and customer convenience in mind.

- Are SunStar Lending’s services available nationwide? Yes, SunStar Lending’s services are available across the United States, making it accessible to borrowers nationwide.

- What credit score is needed to qualify for a loan with SunStar Lending? While SunStar Lending considers the entire financial picture, a credit score of 620 or higher generally improves your chances of qualifying for their best rates. However, borrowers with lower scores are still encouraged to apply as the company evaluates various factors.

- How long does it take for SunStar Lending to process a loan? Loan approvals are typically processed within 24 hours, with funds often disbursed shortly after approval, depending on bank processing times.

- What interest rates can I expect from SunStar Lending? Interest rates range from 4.6% to 35.99% APR, depending on the loan type, your creditworthiness, and other financial factors. SunStar Lending provides transparent rate information during the application process to help you make an informed decision.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.