Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Lendvia Financial: Everything You Need To Know

Managing finances is tiring, challenging, and sometimes fulfilling, it’s one big task of being an adult. It’s like a labyrinthine in the world of finances. So, trusting your guts is actually not part of the equation, sorry but no! Budgeting and allocation cannot suffice if one isn’t spending wisely. This kind of behavior can lead to debt, loans, and even mortgages.

Managing finances is tiring, challenging, and sometimes fulfilling, it’s one big task of being an adult. It’s like a labyrinthine in the world of finances. So, trusting your guts is actually not part of the equation, sorry but no! Budgeting and allocation cannot suffice if one isn’t spending wisely. This kind of behavior can lead to debt, loans, and even mortgages.

However, companies like Lendvia Financial Services aim to simplify the journey to financial freedom. As a financial wellness company and a key player in the financial sector, Lendvia offers various loans like personal, home improvement, and debt consolidation loans.

This article will delve into Lendvia’s offerings as it examines its service portfolio, user experiences, and whether or not Lendvia is a reliable company.

Lendvia’s Service Portfolio

Lendvia offers a wide range of financial services that are both diverse and specifically designed to meet your needs. These are some of their services and how it might fit your needs:

Personal Loans

For those who need a sum to finance their financial goals, the easiest route people go to is through personal loans. With this, Lendvia offers competitive interest rates that have flexible loan amounts ranging from $1,000 to $50,000. It has fixed rates for 3 to 5 years, that you can pay off early without any extra costs or penalties.

Home Improvement Loans

Many homeowners hesitate to dive into improvement projects because they do not want to be buried in credit card debt or be burdened by interest payments. A way to avoid it is by availing of a home improvement loan from Lendvia.

With loan coaches to guide you and flexible loan amounts ranging from $1,000 to $50,000, you can finally tackle that kitchen remodel or add that extra bathroom you’ve been dreaming of. Plus, their lending process is transparent, with no hidden origination fees or prepayment penalties.

Travel Loans

Tropical vacation or a long overdue holiday does not have to wait until retirement. You can now finance your dream vacation by availing of a travel loan with Lendvia. With a straightforward application process that considers more than just your credit score, you can secure a loan that fits your travel ambitions and your budget.

Educational Loans

Between tuition, textbooks, and other expenses, the costs can quickly pile up. Student loans often discourage individuals from pursuing higher education. But Lendvia’s educational loans are designed to lift that financial burden. So go ahead, invest in your education and financial future without the stress.

Debt Consolidation Loans

Juggling multiple credit cards and loans can be a real headache, especially when you’re trying to manage your debt-to-income ratio and credit utilization ratio. Not only do you have to keep track of various payment dates, but you’re also likely paying more in interest than you need to. That’s where Lendvia, comes in with their consolidation loan options.

Their hassle-free application process, facilitated by a dedicated loan coach, is designed to assess how much debt you have and offer an installment payment that best serves your needs. Best of all, there are no prepayment fees, allowing you to achieve financial relief and get your debt resolved.

Wedding Loans

For some, planning their dream wedding means a lot. However, it can also be a difficult financial situation and might strain you in the future. From the engagement ring to the venue and the honeymoon, the costs can add up faster than you can say “I do.” That’s where Lendvia’s wedding loans come into play. No need to compromise about the choices for your wedding.

Other Financial Products

Beyond loans and debt solutions, Lendvia also offers a range of other financial products, including investment options and insurance plans. These additional services align well with Lendvia’s business model of being a one-stop shop for financial needs.

Hidden Fees & Fine Print: What Lendvia Doesn’t Advertise

While Lendvia promotes no prepayment penalties, borrowers should be aware of potential origination fees (1-5%), late fees, and lender-specific conditions.

- Origination Fee: Some users report paying between 1% to 5% when securing a loan.

- Late Payment Fees: If payments are missed, lenders may charge additional fees based on the agreement.

- Different APRs & Terms: Since there are multiple Lendvia’s lending partners, your actual interest rate may be higher than expected.

You May Also Like: Lendvia Financial: Reviews & Ratings

User Experiences with Lendvia’s Services

Lendvia has garnered a lot of good reviews. One recurring theme in these glowing Lendvia reviews is the speed and ease of the loan approval process. As Linda, who recently acquired a travel loan, puts it, “I recently used Lendvia for financing my Tulum vacation, and I have to say, the experience was nothing short of amazing. It was quick, straightforward, and gave us the financial flexibility I needed to have my dream summer vacation.”

The fixed rates made budgeting a breeze, and the option for early repayment is a fantastic feature. The customer service was top-notch; they guided us through every step! I highly recommend Lendvia for anyone planning their vacation without the financial stress.”

Another satisfied customer, Jonathan, recently availed of a loan for his debt consolidation. “My experience with Lendvia’s debt consolidation service was a game-changer for my financial history and financial well being. Before Lendvia, I was juggling multiple high-interest debts, and it felt like I was sinking. They streamlined all my payments into one manageable monthly payment with a much lower interest rate. The application process was smooth, and their team was incredibly helpful, explaining all the terms clearly. If you’re struggling with multiple debts, I highly recommend Lendvia’s debt consolidation services. They helped me regain control over my finances, and I couldn’t be more grateful.”

See If You Qualify For a Personal Loan

Lendvia: Customer Concerns & How They Address Them

While Lendvia Financial has helped many borrowers secure personal and debt consolidation loans, some users have reported concerns that are important to consider before applying. Transparency is key when choosing a lender, so here are a few common points of feedback—and how Lendvia addresses them.

1. Loan Type Clarifications

Some applicants expected a personal loan but were instead offered a debt relief program. Since Lendvia has multiple lending partners, offers can vary. To avoid surprises, customers should clarify loan details with a representative before proceeding.

2. Understanding Loan Terms

A few borrowers mentioned that they weren’t fully aware of origination fees (1-5%) or APR variations before signing. Lendvia provides loan estimates upfront, but it’s always a good idea to review all terms and ask about any fees before committing.

3. Customer Support Response Times

While many satisfied customers praise Lendvia’s loan coaches, some have experienced delays in response times during high-demand periods. The company continues to enhance its support services to ensure quicker assistance for applicants.

4. Business Address Accuracy

A Yelp reviewer raised concerns about the listed business address. As with any online financial service, it’s always best to verify contact details and communicate directly with Lendvia’s official support team for the most accurate information.

Final Tip: Lendvia remains a popular choice for borrowers looking for flexible loan options, but as with any financial decision, it’s essential to carefully review the terms, confirm loan details, and ask questions to ensure the loan aligns with your needs.

Is Lendvia Reliable? What Trustpilot, BBB & Reddit Say

When considering a financial service, it’s crucial to evaluate customer feedback from multiple sources. Lendvia Financial has received a mix of positive and constructive reviews, with many customers praising the ease of the loan process, while others have raised concerns about transparency and communication.

What Customers Appreciate About Lendvia

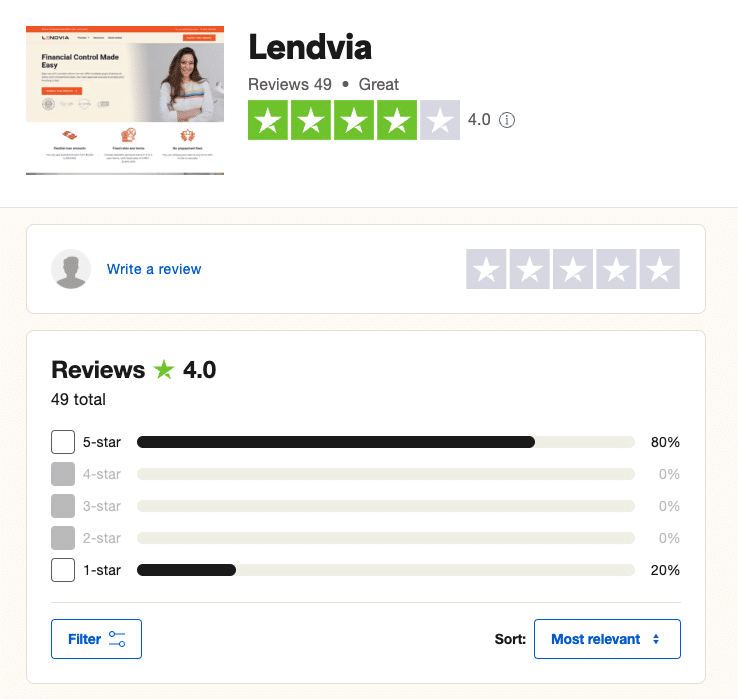

Trustpilot Rating: 4.2/5 – Many users highlight the simple application process, fast funding, and helpful loan coaches. One reviewer stated, “The process was smooth, and I got my loan within days. The loan coach helped me understand my options clearly.”

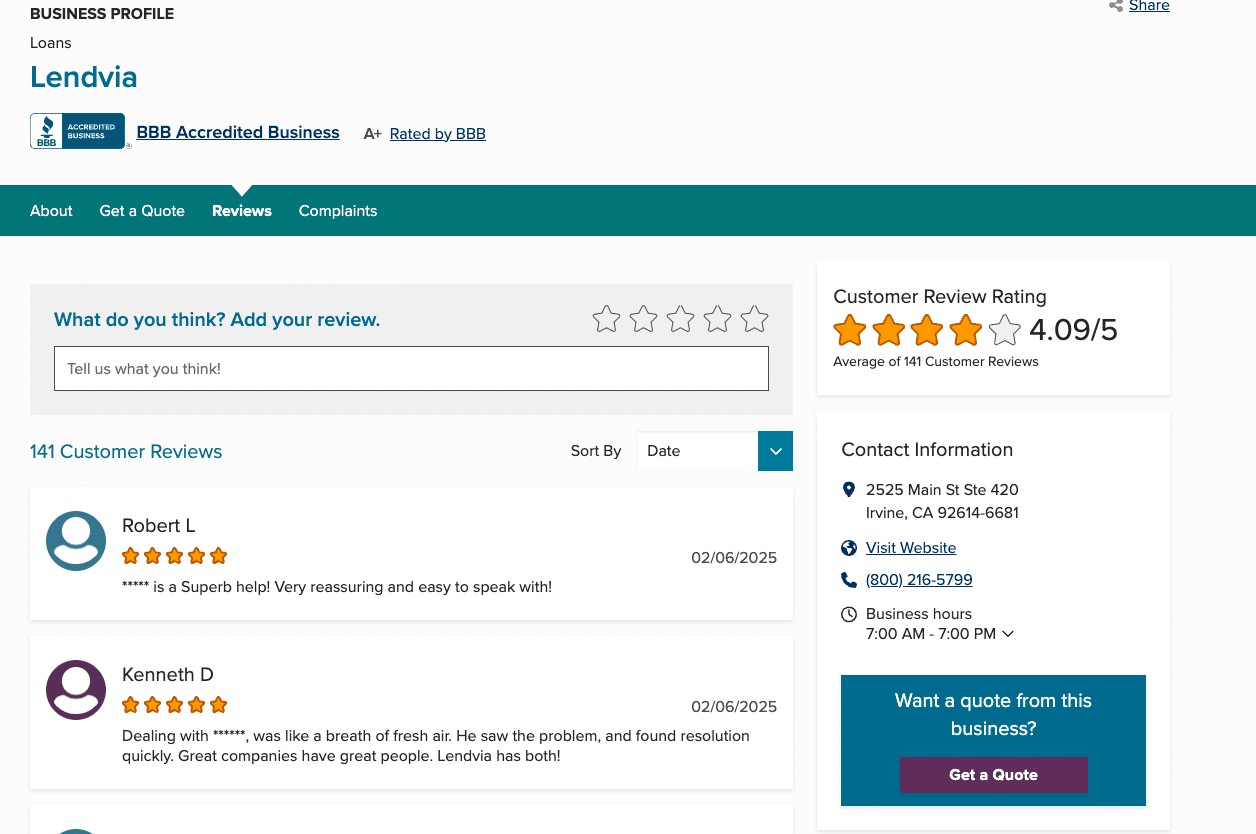

BBB Rating: 4.09/5 – Lendvia maintains a Better Business Bureau accreditation, showing its commitment to business integrity. Several users note positive experiences with debt consolidation loans, particularly the convenience of combining multiple debts into one.

Areas Where Customers Recommend Improvements

- Clarifying Loan Terms – Some borrowers mentioned that fees and APR details were not always upfront. It’s recommended to carefully review the loan agreement before signing.

- Customer Support Response Times – While many report friendly service, others mention delays in getting responses during peak times.

- Loan Offer Expectations – A few applicants believed they were applying for a personal loan but were instead offered debt settlement programs. To avoid confusion, double-check the type of loan you’re being offered before proceeding.

- Yelp Rating: 1/5 – A small number of Yelp reviewers expressed trust concerns, including questions about Lendvia’s listed business address. As with any financial service, it’s always a good idea to verify contact information directly through official channels.

Should You Apply for a Lendvia Loan?

Lendvia Financial offers a range of loan options designed to meet different financial needs, but is it the right choice for you? Here’s a quick guide to help you decide.

Lendvia is a good choice if you:

- Need quick access to funds between $1,000 – $50,000 for personal expenses, home improvements, or debt consolidation.

- Have fair-to-good credit and want a fixed-term loan with predictable payments.

- Prefer flexible repayment terms with no prepayment penalties, allowing you to pay off the loan early without extra costs.

- Want a guided loan process, as Lendvia provides loan coaches to help navigate your options.

Proceed with caution if:

- You’re expecting guaranteed approval—Lendvia’s loans still require a credit review.

- You prefer a lender with no origination fees—some loans may have fees ranging from 1-5% of the loan amount.

- You’re only interested in a personal loan and do not want to be offered a debt settlement program. Some applicants have reported receiving debt relief options instead of traditional loans.

Key Takeaway: Should You Trust Lendvia?

Lendvia is a legitimate company with a solid track record and not a scam, but as with any loan provider, understanding the fine print is crucial. If you’re considering a loan, make sure to:

- Confirm whether you’re applying for a personal loan or debt settlement.

- Review all fees, interest rates, and repayment terms carefully.

- Communicate directly with customer support if you have concerns about your loan offer.

By being well-informed, borrowers can maximize the benefits of Lendvia’s services while avoiding potential misunderstandings. Whether Lendvia is the right choice depends on your financial needs, credit situation, and loan expectations. Before making a decision, take the time to compare offers, read all terms carefully, and ensure the loan aligns with your long-term financial goals, and you could save money.

Frequently Asked Questions (FAQs)

1. What types of loans does Lendvia Financial offer?

Lendvia provides a variety of loan options, including personal loans, home improvement loans, travel loans, educational loans, debt consolidation loans, and wedding loans. They also offer additional financial products such as investment options and insurance plans.

2. How much can I borrow with Lendvia?

Lendvia offers loan amounts ranging from $1,000 to $50,000, depending on the borrower’s financial profile and lender approval.

3. How long does the loan approval process take?

Lendvia’s loan application process is designed to be quick and efficient. Once approved, borrowers can typically receive funds within 1 to 3 business days.

4. What credit score do I need to qualify for a loan with Lendvia?

Lendvia works with a network of lenders that consider various factors beyond just credit score. While having fair to good credit may improve your chances of approval, other factors like monthly income and debt-to-income ratio also play a role in loan eligibility.

5. Does Lendvia charge prepayment penalties?

No, Lendvia does not charge prepayment penalties, allowing borrowers to pay off their loans early without additional costs.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.