Bitcoin Fear and Greed Index – When feelings move earnings

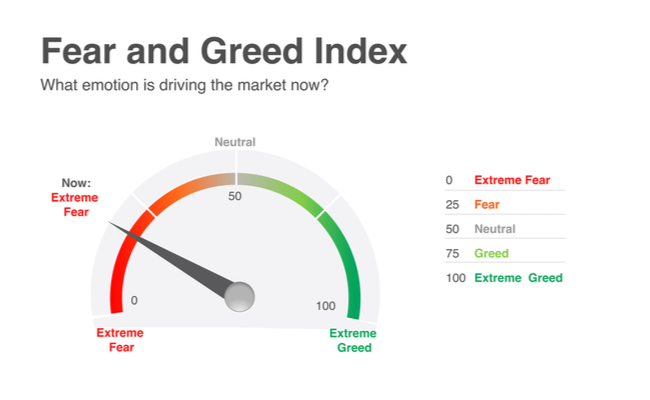

Savvy investors often check the Bitcoin Fear and Greed Index to get a “feel” of the market. It helps them gauge how the crypto market is behaving. Those outside the market don’t understand that emotions set the prices in motion.

Check out crypto updates on social media, and you may feel overwhelmed by the numbers and charts. Behind the cold computers, you can find hot-blooded people boiling with mixed emotions. Understand how the investors think, and you’ll see how the market ebbs and flows.

Let’s talk more about the factors that make the bitcoin price go up and down. Specifically, we will discuss emotions’ role and how the Bitcoin Greed and Fear Index helps measure it. Later, you’ll see how to adjust your portfolio for price volatility.

Why does the bitcoin price change?

Check social media, and you’ll just see how divided people are about bitcoin and cryptocurrencies. Those who dislike them often decry its “high volatility,” but what does this mean?

This means the prices change frequently and significantly almost every second. When the market rises, you may see your cryptos doubling in value within minutes.

Sadly, those values may fall just as swiftly during a downturn. Crypto investors try to gauge these price movements until they find the root cause: themselves!

Prices move up as more people buy a certain cryptocurrency. On the other hand, they decline as the investors sell. As you can see, human behavior drives the erratic movements of the market.

If you can see what makes investors tick, you can figure out how they would move the crypto market. Here are the factors that fuel their greed and fear:

- Supply and demand – You may recall this from school as one of the most basic rules of thumb in economics. If you have lots of a product, demand and price tend to go down. If you have too little, demand and price often go up. All cryptocurrencies have a limited supply, and their quantity affects their prices.

- Lack of regulation – Most countries still don’t have the laws that can rein in the crypto market. This allows the free-for-all behavior of most investors.

- Speculation – Investors estimate how the crypto market will behave based on available news reports and past price movements. For example, the recent Kazakhstan issue caused many people to sell off their cryptos, causing a major Bitcoin crash.

- Public acceptance – Cryptocurrencies are more than just “internet money” as they provide various functions. As more people use them, their prices are more likely to increase.

- Scalability – Cryptos are made possible by computer networks called blockchains. However, these networks may have trouble expanding, so their quality decreases. Once this happens, more people may sell their coins and pull down the prices.

- Whales – People in the crypto space use this term to describe the investors that buy and sell millions of dollars worth of cryptos in one transaction. Like real whales, their movements send huge waves in the market, causing prices to soar or crash.

It would be a chore to look at each one every time you invest. Instead, people use the Bitcoin Fear And Greed Index for an overall view of the market.

Read More: What Is The Possibility Of A Bitcoin Crash?

How is the Bitcoin Fear and Greed Index calculated?

This is a measurement tool created by Gregor Krambs and Victor Tobies. It analyzes the emotions of the overall crypto market by looking at various factors.

It may seem strange to use abstract feelings to measure tangible assets. As I said, this makes sense because human behavior and market movement affect each other.

The makers of the Bitcoin Fear and Greed Index know this. They know that people are greedy when the market rises, which results in a buying frenzy.

On the other hand, people often sell during a fearful market. This is not easy to measure, though. That’s why the index checks the following factors to get a close estimate:

- Volatility (25%) measures the current price movements with the corresponding average values over the last 30 days and 90 days. If this goes up, it may point to extreme fear.

- Volume and Market Momentum (25%) compares the current market momentum and volume. A high buying volume over a long time could point to extreme greed.

- Social media (15%) counts the Twitter hashtags related to cryptos. Too much public interest could be driving a greedy market if there are too many.

- Survey (15%) uses the public polling platform strawpoll.com. It gets responses from 2,000 to 3,000 crypto investors to check how they feel about the market. At the time of writing, the surveys were paused.

- Dominance (10%) refers to a crypto’s share of the crypto market cap. This crypto fear and greed index focuses on Bitcoin because most people see it as the safest coin. If it goes up, this could mean people are too afraid to trade other cryptos. On the other hand, it goes down when people buy more altcoins.

- Trends (10%) looks at the Google Trends search volumes. If many people are searching for a “Bitcoin buying opportunity,” this could mean a greedy market. If more negative search queries appear, this could point to a fearful market.

Is the Bitcoin Fear and Greed Index reliable?

Bitcoin Fear and Greed Index is 46 ~ NeutralCurrent price: $42,678 pic.twitter.com/KXrjciIrHa

— Bitcoin Fear and Greed Index (@BitcoinFear) February 14, 2022

The next thing you may ask is whether or not you can trust this tool. However, it only measures market sentiment, not the future. Yet, you can find so many news reports that use it this way.

See if this sounds familiar to you. Breaking news will flash “extreme fear” over the crypto market. Then, the reporter will start going on and on about how this could be “the end of bitcoin.”

Yet, that’s not the case for most investors. Contrary to popular belief, many of them see this as a “sale” for the crypto market. This is their chance to grab more cryptos while they’re cheap!

Going against the overall mood of the market doesn’t always work out, though. Sometimes, the market is fearful because there is a real reason to be careful.

The Bitcoin Fear and Greed Index can help you make investment decisions. That doesn’t mean you won’t make mistakes ever again. More importantly, you shouldn’t depend on just one tool.

How can I adjust to crypto fear and greed?

Past wisdom can help you manage the asset of the future. Stock investors often swear by diversification as a rule of thumb. It’s when you invest in several assets instead of one.

Warren Buffett is the most successful investor of the 20th century, but he doesn’t approve of this method. He says it “makes little sense if you know what you’re doing.”

Which one should you follow? You could look at it as being selective when diversifying. Buying all the hyped-up coins is a bad idea. Most of them crash after the initial trend.

On the other hand, choosing good coins with solid use-cases are more likely to provide steady long-term growth. This is like when stock investors avoid junk bonds and invest in S&P 500 index funds instead.

Even better, you could balance your portfolio by placing volatile coins there. Volatile doesn’t always mean you’ll just lose money. Choose the right coin, and you may see huge gains!

Related Articles

Final Thoughts

The Bitcoin Fear and Greed Index is a handy tool, but proper planning is still important. Learn all you can about an asset before investing, whether it’s cryptocurrencies or stocks.

What’s more, you must have clear investment goals. That way, you can stay on course despite the sharp price movements. Otherwise, you’re more likely to be swept by extreme fear and greed.

Note that this article is not meant to provide investment advice. If you’d like to learn more, read the other articles from Inquirer USA. They’re a great source of crypto news and info!