The rise and fall of Bitcoin price

The bitcoin price crashed once again, sending the entire crypto marketing tumbling down. This time, it’s because of the recent crisis unfolding in Kazakhstan. In response, you can find various online resources spelling the end of the digital currency. Once you’ve seen the negative statistics and remarks, it’s easy to think that it’s all over for cryptos.

If you look deeper into the crypto space, you will find crypto and its blockchain technology continues to grow. Despite the naysayers, major investment firms are offering more ways to invest in this digital asset. What’s more, stocks connected to blockchain and crypto are soaring in value. More countries are adopting cryptos as well!

First, I will explain the reason behind the bitcoin crash and the world’s response to it. Then, I will explain the other side of the doom and gloom by going through the positive crypto news happening behind it. Later, you’ll see that this volatility is just par for the course for cryptocurrency. Also, you will see whether or not you should invest in bitcoin.

Why did bitcoin crash recently?

The price of bitcoin crashed significantly because of the ongoing protests in Kazakhstan. I’ll talk a bit about this issue, then I will go through its impact on the crypto market.

People started going to the streets on January 2 in Zhanaozen, an oil hub in the country. The government removed the price cap on liquified petroleum gas (LPG).

If you’ve heard of this fuel, it’s often used for lighting stoves. LPG can also be a cheaper alternative fuel for cars. That’s why many Kazakhs converted theirs to use this type of fuel.

Sadly, the government said the price cap was causing LPG shortages and it could no longer afford to increase supply. As a result, it removed the limit, so LPG prices nearly doubled.

Eventually, the protests spread across the country, so Kazakh president Kassym-Jomart Tokayev asked Russia to send troops and help stabilize the country.

At the time of writing, the Russia-led troops have started withdrawing from Kazakhstan. Yet, this national issue affected the crypto market as it’s the second-largest producer of Bitcoin.

After China cracked down on cryptocurrencies, many of the miners went on with their operations in Kazakhstan. Unfortunately, they didn’t consider its outdated power grid.

Crypto mining added an 8% jump for domestic electricity consumption in 2021. As a result, the nation is now having trouble with power cuts and blackouts.

Kazakhstan will ration power to registered miners and unplug them in case the grid came under stress. Worse, the current weather could freeze both the power grid and bitcoin mining rigs.

What’s the result of the bitcoin crash?

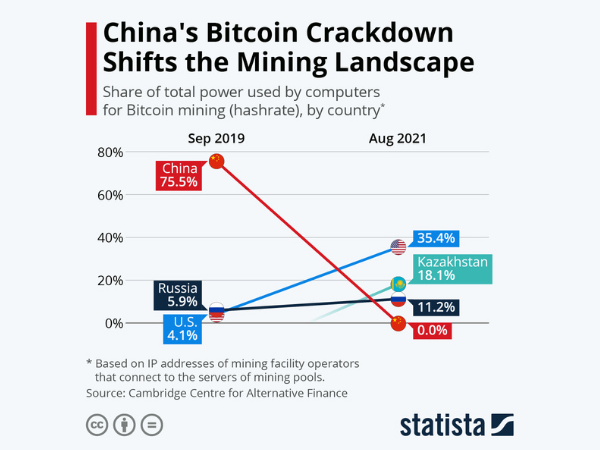

Photo Credit: www.statista.com

On January 4, 2022, the price of bitcoin was $47,383.65. The Kazakh issue pulled down the bitcoin price to $40,814.58. This is a long drop from its all-time high of $68,789.63!

Because of China’s crypto crackdown, Kazakhstan represents 18.1% of the mining landscape. The United States leads the way at 35.4%. Now, many people are doubting crypto’s future.

Some have even started pointing to other events that could worsen the bitcoin crash. For example, US Federal Reserve chief Jerome Powell admitted that current inflation isn’t “transitory.”

This means the central bank might increase interest rates. As a result, more people might doubt bitcoin’s ability as an inflation hedge, triggering a sell-off that may further pull down the market.

Read More: How Did The 2021 Bitcoin Crash Turn Out?

Why this bitcoin crash won’t take down the crypto market

If you just look at the downer news, you might think this is the end for cryptos. Yet, we’ve seen so many events that should have taken out the market, yet it remained standing.

For example, China’s crypto crackdowns have been going on for years, yet it just caused a short-term market crash at most. Then, statements from celebrities should have dented it too.

Elon Musk used to be a proud fan of Bitcoin. He even called himself the “Dogefather” because he liked the altcoin Dogecoin (DOGE). It dipped for a while, but it went up again!

You can spend bitcoin in more ways

Sadly, he said in May 2021 that his EV company Tesla will no longer push through with allowing bitcoin payments. Fortunately, various car dealers around the world were happy to do so.

Crypto adoption spreads across other industries too. For example, you can now buy your next snack from Subway using bitcoin. Just be wary of the bitcoin price while buying!

PayPal’s vice president for crypto Jose Fernandez da Ponte said PayPal wants to create a stablecoin. Right now, it lets you spend crypto at various stores accepting bitcoin.

Bitcoin now has more investors

You can see the hype among investors as well. Billionaire fund manager Bill Miller said he put half of his wealth into bitcoin investments. Nowadays, you can invest in this asset in so many ways.

You could purchase a share from the Proshares Bitcoin ETF, which grew 549% and became the third-largest ETF. It could also be your retirement plan since there’s now a Bitcoin IRA.

Even better, investors are choosing crypto over gold as they become more worried about inflation. That’s right, more of them see bitcoin as a better hedge than the yellow metal!

More countries invest in it

More countries want to use bitcoin too. Inquirer USA has another article that talks about how El Salvador, Panama, and Venezuela are trying this. Now, more parts of Latin America want to do it too.

For example, Spain saw the recent Kazakh issue as an opportunity to become a safer place for cryptos. Brazil is promoting the use of bitcoin by giving a 10% discount when it’s spent on taxes.

El Salvador made a bold move by building a bitcoin mining center powered by volcanoes. Also, it’s now legal tender in the country, so people can spend it like regular money.

Should you invest?

If you just focused on that one issue, you might have thought it’s the last bitcoin crash. Yet, the earlier trends prove otherwise. Crypto crashing and soaring this often is just normal!

Most people know the cryptocurrency market for these wild price fluctuations. You’ll see this across all the coins, even the major cryptocurrencies like bitcoin and ethereum.

This is why you’ll hear more people prefer older asset classes like stocks and bonds. If you want to learn more about why the bitcoin price and others behave this way, click here.

The question is, should you invest in it too? The answer to that depends on your money goals. It’s not a good idea to pour money into any asset just because of one article, even this one!

It’s easy to feel like you’re missing out when a blog says the price of a crypto coin will hit a record high. Yet, it’s much better to step back and ask yourself why you want to invest anyway.

What do you want from the asset? Do you want to get rich quickly, or do you prefer to have money in your later years? Your answer will change the assets you will need.

You can do both with crypto, but you might want to try other assets instead. For example, dividend ETFs are a low-risk option that lets you make money while you hold it.

If you want quick gains, you might be brave enough to short stocks. Note that this is a better choice if you have experience. Otherwise, this will likely be a quick way to lose money!

It’s a lot easier to invest nowadays because of various mobile apps. They let you buy and sell stocks, ETFs, and cryptos right from your smartphone or tablet.

Even better, they show all the real-time info you will need, 24 hours a day non-stop! Examples include the market price and market cap. In other words, they show more than just the bitcoin price.

Related Articles

Final Thoughts

It’s a lot easier to invest in bitcoin as well because crypto exchanges now have apps too. Still, you should consider things such as your goals and the recent bitcoin crash.

Note that this article is not meant to give investment advice. Have a plan and learn all you can before buying cryptos or other assets. Good thing you can start now!

Read more Inquirer USA articles to get the latest on crypto trends. See how the other coins are doing, and how cryptos are changing our world as you’re reading this!