Skimpflation and shrinkflation – everything to know

The coronavirus pandemic brings a new problem for the economy called skimpflation. This happens when stores sell shrinking products as their prices increase. Back then, we only looked out for shrinkflation that meant you got less of a product for the same price. Now, skimpflation means we’re getting lower quality as well!

Now that we’re trying to recover from the pandemic, it’s time to face the other problems that it left. Stopping the global economy for two years isn’t normal, so it’s no surprise that we’ll face challenges we’ve never seen before, such as skimpflation. Fortunately, there is always a way you can adjust for unusual price movements.

Before we get into those, we’ll have to talk more about shrinkflation and its new form called skimpflation. Then, we’ll show you how this new problem came about, and how this will affect your daily life. This may seem scary, but you can still do something about this new phenomenon with the tips and tricks we’ll share later.

What is skimpflation and shrinkflation?

On July 6, 2021, NPR’s Greg Rosalsky wrote about long-time consumer advocate Edgar Dworsky’s trip to the grocery store. That’s where he found proof of shrinkflation.

According to Rosalsky’s Planet Money article, Dworsky saw that General Mills cereals reduced the amount contained in its “family size” packs from 19.3 oz. to 18.1 oz.

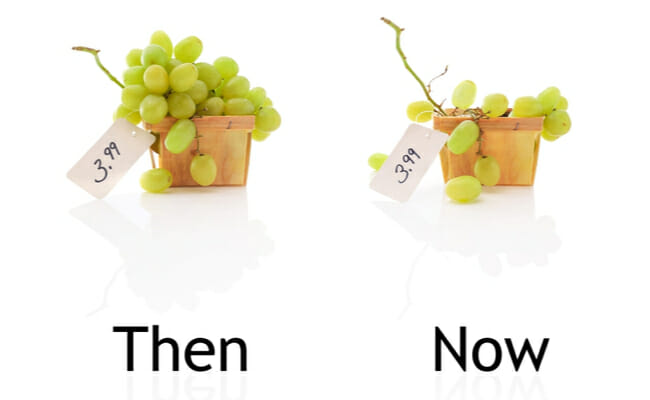

This is shrinkflation in real life when the prices of goods stay the same, but the amount you receive decreases. Sadly, COVID-19 turned it into something worse.

On October 26, Rosalsky coined the term shrinkflation to describe the decline in the quality of goods worth the same price as before. In other words, quality is dropping alongside quantity!

A reporter from The Hustle named Rob Litterst said this may prove that inflation is higher than expected, despite the price increases hitting a 30-year high.

Expect to see this in action at your local grocery aisles. For example, you might notice that your favorite orange juice and candy bars aren’t as tasty as before.

That large tub of ice cream may feel lighter, or that jumbo pack of toilet paper may contain fewer rolls. How did a public health issue bring such a never-before-seen economic problem?

What caused skimpflation?

Countries responded to the COVID-19 virus by imposing lockdowns. This closed their borders, shut down businesses, and fired a lot of workers.

This is the gist of the lockdown’s impact on the economy. However, these led to the factors that brought skimpflation, such as:

- COVID rules – Depending on your country, you may find it harder to travel to other areas. This is especially difficult for delivery trucks that distribute goods, so you can purchase them in stores. This delays transport and increases costs which turn into higher prices.

- Vaccine mandates – Everyone should get vaccinated against COVID, but some people refuse it. This could prevent folks from getting a job, so they can’t help beat the skimpflation.

- Supply chain issues – The labor shortages and business closures made it harder to get raw materials and other goods from overseas. This means local goods may cost more to make, while buyers have to shoulder the extra costs of foreign goods.

- The Great Resignation – People around the world left their jobs after staying indoors for so long. They realized that they need new jobs that let them have a better life. As a result, they left their old ones, causing various sectors to lose a lot of workers. Now, certain industries lack enough people to provide the same quality.

Read More: What Is Hyperinflation?

What are the effects of skimpflation?

The most noticeable effect of skimpflation is rising costs for everything. The price level might be the same, but now you get a lower amount. As a consumer, that’s the only impact you’ll feel.

If you have a job or a business, this is not good. It’s even worse once you consider how it will affect the overall economy:

- Longer waits – Companies don’t have enough staff to handle tasks, so they won’t be able to serve customers on time.

- Fewer options – Sadly, some businesses may not be able to provide altogether. Expect stores to be “out of stock” for many items.

- Lacking customer support – Businesses may not have enough people to fix customer issues. The poor quality of service could mean fewer people will buy from them. If it doesn’t earn more soon, they may let go of more workers again.

- Slower economic recovery – These conditions mean a country will take a longer time to get back on its feet after COVID.

How should I respond?

The US Federal Reserve said that current inflation is transitory. However, people are starting to doubt this statement as the economy keeps reducing the size of goods.

Fortunately, you can still adjust to these changes by adjusting in certain ways. Here are the following steps you could take:

- Write a budget – Jot down all your expenses, and divide your “needs” and “wants.” Then, determine your take-home income by deducting taxes from your salary.

- Spend less – Avoid spending on things you don’t need. This means cutting services you’re not using or buying cheaper alternatives to your usual groceries.

- Earn more – Perhaps you could sell stuff that you’re not using. Also, you could get a side gig to make more money. Try getting a work-from-home job so you can earn in your spare time.

- Get rid of debts – If you owe less money, you have more for the more important stuff. Your new side hustle could help with debt payoff.

- Have an emergency fund – Make sure you set aside money at home or in the bank. That way, you’re ready in case someone gets sick or you get laid off from work.

Personal finance is more important than ever as it lets you survive these big changes. Even better, proper money management can help you thrive during these times!

The previous steps let you have more money, right? This means you can spend on things that could help you or your business adapt to the new normal.

For example, you could spend your extra cash to learn new skills. Perhaps you could enroll in an online MBA, or learn tech skills like Python coding.

Business owners could buy new tools that let them learn more about the market. Some could help them connect with more customers.

Related Articles

Final thoughts

Skimpflation is here, so we should expect higher prices in the coming years. Also, we should adjust our lives to fit this new normal.

This means having enough money to get by in these times. Then, we all have to learn more about the other changes happening. This will help us adapt to them early enough.

As a result, we may even use these changes to our advantage. Start learning more about these trends by reading more Inquirer USA articles.

If you are interested in content marketing, please email Anthony@Inquirer.net

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.