How to retire early – should you use the FIRE method?

Do you want to know how to retire early using the FIRE method? You may have seen online influencers praising it as the best way of saving for retirement. Should you follow the footsteps of these trailblazers, or should you look for another way?

We will start by talking more about how the FIRE movement sparked throughout the world. Then, see how you can follow this method of retirement planning. More importantly, we’ll see whether or not you should follow this in the first place.

The internet offers a new way of living your life nearly every day. Your favorite online influencers may have convinced you to follow this technique too. However, you should think carefully before following FIRE or risk getting burned in your later years.

What is the FIRE movement?

This trend started with two people and their book. In 1992, Vicki Robin and Joe Dominguez released “Your Money or Your Life”. It taught readers how to retire early using the following tips:

- Spending as little as you can

- Using extreme methods of saving money

- Using passive investments as income streams

It grew popular among a certain group of people. They possessed the following qualities:

- The need to quit their jobs

- Weariness with the mad rush to buy more stuff

- Aim for achieving financial freedom

- Desire to retire much later

This idea wouldn’t catch on until decades later. Specifically, it became popular during the coronavirus pandemic. One in four people aged 18-34 years old set FIRE as a long-term goal.

How to retire early with FIRE

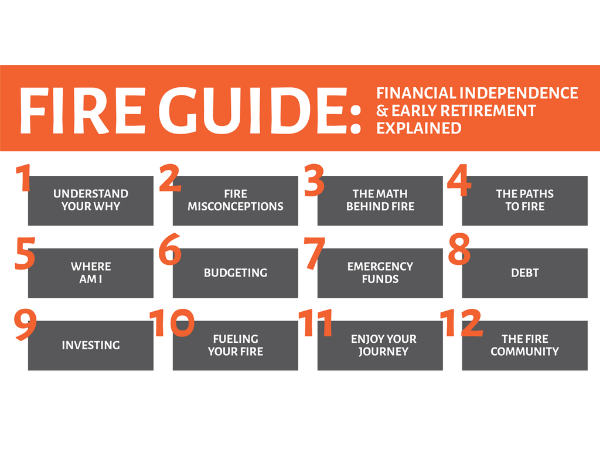

The term stands for “Financial Independence, Retire Early”. Every FIRE plan is fueled by money, and you earn enough by following these steps:

- Save – FIRE savers usually set aside 25% to 50% of their income every month. You may have to follow other savings tips so you can allocate that much. For example, you may want to use credit cards less often. What’s more, you must choose where to put that money.

- Invest – You might be thinking of leaving your retirement money in a bank account. However, inflation could easily erode its value. That’s why FIRE fans often buy stocks with them, and they have a chance to grow in value and keep up with rising prices.

- Earn more – You must also boost your income, and one of the best ways is to get a side hustle. Remote work is also popular nowadays because it lets you earn more at home.

- Spend wisely – Stop buying stuff you don’t need, and leave it in the store if it’s too pricey. As we said, the FIRE is all about spending less, and you might as well get used to it while prepping your retirement plan.

Just how much do you need? It will depend on your retirement plan.

Before planning how to retire early, you should look at the following factors:

- Estimated budget – Yes, we did give you a range of 25% to 50%. Yet, you should set a specific amount. This will depend on various factors, such as your health care needs. Your annual expenses may increase if you have pre-existing conditions.

- Your lifespan – People want to know how to retire early, but they often don’t look at their later years. You may want to be generous with your target number, and you may get in trouble if you only planned for your 60s and live past that.

- Retirement income – You won’t just rely on a pile of cash in your later years. Your investments could be sources of fixed income. For example, you have retirement accounts like Roth IRAs.

What are some issues with FIRE?

As we said, many people want to know how to retire early nowadays. However, they might be doing it for the wrong reasons, and it may have looked cool in an influencer’s video.

If you only look at that, it may seem picturesque. You prepare enough money and cash flow to sit back and relax. You sit at the beach, sipping drinks as the sun goes down.

Then, the credits roll, right? That’s what would happen if this was a movie. However, you can’t lounge around forever, and you’ll soon have to pack up and leave.

Afterward, you’ll have to figure out life beyond your 40s or 50s. Sure, you have money to sustain yourself. But what will you do then? This is a problem with the FIRE movement, along with:

- FIRE may burn your present life – You may say the FIRE uses the present as fuel. It involves working and investing so much now for your later years. You may miss out on things you could only do at a certain age.

- Keeping the FIRE going – We said it’s all about living below your means. You will have to do that forever, without the occasional splurge. All that is saving and investing, and you might not be able to enjoy it.

See if the FIRE movement appeals to you because it goes away from your current job. If that’s your reason, perhaps you shouldn’t be learning how to retire early.

Instead, you might need another job. Fortunately, you can now choose from so many remote work options. Earn money while doing other stuff you like.

Should you retire early?

We’re not against the FIRE movement. Rather, we want readers to think about it thoroughly. This is a major decision that will change a huge chunk of your life. Your life deserves all your care and attention.

Perhaps you should learn more about the usual way of retirement planning. The internet offers so many tips for free. If that’s not enough, perhaps you need a certified financial planner.

They could show you the savings and investment methods you’ll need. Some may recommend health insurance or asset options. Financial advisors could help with other money issues too.

If you’re running out of money now, just imagine your problems in the long run! That’s why advisors are so important, and they can provide personal finance tips and tricks you need now.

Read More: Investing For Dummies 101

Final thoughts

Now that you know how to retire early, it’s your time to do it or not. Either way, you’ll need to be wary about your future, and you may want to start investing now.

You may pick stocks just like early retirees, and there are so many other choices. For example, there are mutual funds, index funds, and even real estate.

Of course, you have to have an idea of what they are first. Fortunately, the other articles at Inquirer USA can help. Warm-up for your investment journey today!

Related Articles

Learn more about how to retire early

Is retiring early a good idea?

Followers of the FIRE movement say that it has helped them follow their passions. The retirement cash flows took care of the financial worries, such as bills. However, you should think carefully before trying this yourself. Read the article above for more details.

Do early retirees live longer?

A study published in the Journal of Epidemiology & Community Health shows no clear connection between early retirement and long life. Other factors may improve and extend your life. Though, you’re likely to live longer if you can afford a healthy lifestyle in your later years.

Can you retire with no money?

Some people have retired without any money, but it is difficult. You may have to delay retirement to work and earn enough money for it. That’s why it’s a good idea to prepare for your later years now. Set aside enough money and buy the right assets, so you have retirement income.

If you are interested in content marketing, please email Anthony@Inquirer.net

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.