Disney bullish on parks despite Delta, investors cheer streaming growth

Walt Disney Co earnings on Thursday topped Wall Street forecasts for the most recent quarter as its streaming services picked up more customers than expected and pandemic-hit U.S. theme parks returned to profitability.

Shares of the entertainment company rose 5% in after-hours trading. Before the earnings report, shares were roughly flat from the start of the year.

Disney Chief Financial Officer Christine McCarthy said that upcoming theme park reservations at the company’s two U.S. parks, including the flagship Walt Disney World, remained strong, even as COVID cases surge.

“We are still bullish about our parks business going forward,” CEO Bob Chapek said on a call with analysts. Reservations are currently outpacing attendance for the quarter that just ended, executives said.

Disney character Mickey Mouse is seen above the entrance of Disneyland Paris, in Marne-la-Vallee, near Paris, France, March 9, 2020. REUTERS/Benoit Tessier

Florida, home to Walt Disney World, is the epicenter of the latest U.S. COVID outbreak, posting record cases and hospitalizations in recent days.

Disney was more optimistic than some other companies about the Delta variant’s impact on operations. Southwest Airlines both warned that the surge in cases could hurt their businesses.

For April through July 3, Disney posted earnings per share of 80 cents, excluding certain items. Wall Street had expected 55 cents, according to the average projection of analysts surveyed by Refinitiv.

Disney’s theme parks welcomed more visitors as pandemic restrictions eased. Theme park revenue rose for the first time in five quarters, hitting $4.34 billion.

Net income for that division, which includes consumer products, reached $356 million, compared with a loss of nearly $1.9 billion a year earlier when many Disney parks were closed. The U.S. parks eked out a profit of $2 million, while international parks lost $210 million.

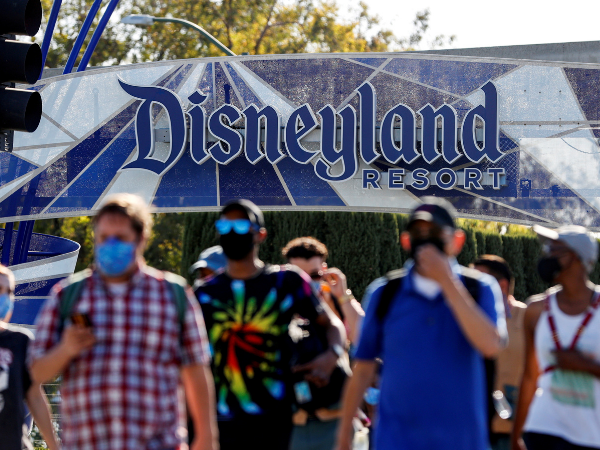

People leave the Disneyland Resort on Disneyland Park and Disney California Adventure’s reopening day amidst the coronavirus disease (COVID-19) outbreak, in Anaheim, California, U.S., April 30, 2021. REUTERS/Mario Anzuoni

“We think Disney’s U.S. parks breaking even this quarter is an important turning point for the entertainment giant,” Nicholas Hyett, equity analyst at Hargreaves Lansdown. “It has weathered the storm, and strong results from the parks have helped it beat analyst expectations.”

Disney has staked its future on building streaming services to compete with Netflix Inc in the crowded market for online entertainment.

Disney+, Hulu and ESPN+ – the company’s three online subscription offerings – gained close to 15 million new subscribers to total nearly 174 million. Disney+ had 116 million paying customers at the end of the quarter, just ahead of the 115.2 million consensus of analysts surveyed by FactSet.

“It is apparent that Disney+ is now an indispensable video streaming service alongside Netflix,” PP Foresight analyst Paolo Pescatore said.

During the quarter, Disney+ featured “Loki,” a series about the shape-shifting Marvel villain, and offered Emma Stone movie “Cruella” on the same day it hit theaters.

At the media and entertainment distribution unit, operating income fell 32% from the prior year, to $2.0 billion, as programming costs rose. A year earlier, cable network ESPN’s bills had been reduced when many sporting events were canceled.

Related Articles

The direct-to-consumer division, which includes Disney+, reported a loss of $293 million as it invested in TV shows, movies and other costs. That compared to a loss of $624 million a year earlier.

The company’s overall revenue rose 45% to $17.02 billion in the third quarter, topping analysts’ estimate of $16.76 billion, according to IBES data from Refinitiv.

Net income from continuing operations was $923 million, or 50 cents per share, compared with a loss of $4.72 billion, or $2.61 per share, a year earlier.

(Reporting by Lisa Richwine in Los Angeles and Tiyashi Datta in Bengaluru; Additional reporting by Eva Mathews and Subrat Patnaik in Bengaluru; Editing by Maju Samuel and Lisa Shumaker)