Twitter’s Dorsey pushes $29 billion buyout of lending pioneer Afterpay

Square Inc, the payments firm of Twitter Inc co-founder Jack Dorsey, will purchase buy now, pay later pioneer Afterpay Ltd for $29 billion, creating a global transactions giant through its biggest-ever acquisition.

The takeover, also the biggest buyout of an Australian firm, underscores the popularity of a business model that has upended consumer credit by charging merchants a fee to offer small point-of-sale loans which their shoppers repay in interest-free installments, bypassing credit checks.

The pandemic has also fueled the boom in the buy now, pay later (BNPL) sector as tech-savvy consumers, stuck at home, spend money online to buy everything from coats to expensive phones.

Over the past year, Melbourne-based Afterpay signed up millions of users in the United States, which is now among the fastest-growing markets for the sector.

The deal also locks in a remarkable share-price run for Afterpay, whose stock has surged from A$10 in early 2020 to over A$100 in less than two years.

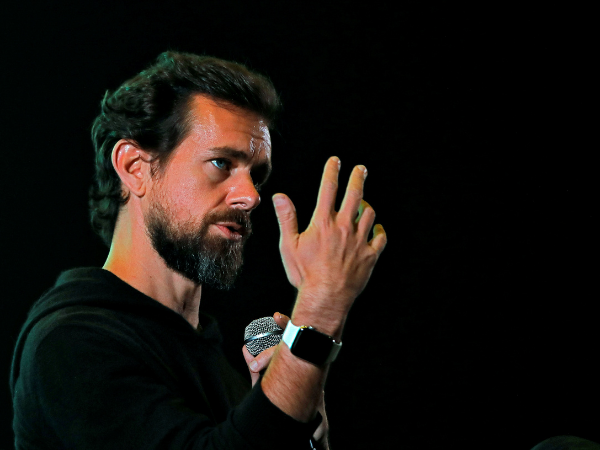

Twitter CEO Jack Dorsey addresses students during a town hall at the Indian Institute of Technology (IIT) in New Delhi, India, November 12, 2018. REUTERS/Anushree Fadnavis/File Photo

“Acquiring Afterpay is a ‘proof of concept’ moment for buy now, pay later, at once validating the industry and creating a formidable new competitor for Affirm Holdings Inc, PayPal Holdings Inc and Klarna Inc,” Truist Securities analysts said.

“We expect Square will invest heavily to integrate Afterpay and accelerate organic revenue growth.”

The all-stock buyout resulted in a payday of A$2.46 billion ($1.81 billion) each for Afterpay’s founders, Anthony Eisen and Nick Molnar. China’s Tencent Holdings Ltd, which paid A$300 million for 5% of Afterpay in 2020, would pocket A$1.7 billion.

Afterpay’s shares jumped slightly higher than Square’s indicative purchase price before closing at A$114.80, up 19%. Shares of Square were up 6% in early trading.

“We built our business to make the financial system more fair, accessible, and inclusive, and Afterpay has built a trusted brand aligned with those principles,” Dorsey said in a statement.

The Afterpay founders said the deal marked “an important recognition of the Australian technology sector as homegrown innovation continues to be shared more broadly throughout the world”.

STOCK SURGE

The deal, which eclipses the previous record for a completed Australian buyout – the $16 billion sale of Westfield’s global shopping mall empire to Unibail-Rodamco in 2018 – also pushed up shares of rival BNPL player Zip Co Ltd by 7.53%.

Afterpay also competes with unlisted Sweden-based Klarna Inc as well as new offerings from U.S. veteran online payments provider PayPal Holdings Inc.

“Few other suitors are as well-suited as Square,” said Wilsons Advisory and Stockbroking analysts in a research note.

The Afterpay app is seen on the screen of a mobile phone in a picture illustration taken August 2, 2021. REUTERS/Loren Elliott/Illustration

“With PayPal already achieving early success in their native BNPL, other than major U.S. tech-titans (Amazon.com Inc, Apple Inc) lobbying an 11-th hour bid, we expect a competing proposal from a new party to be low-risk.”

Credit Suisse analysts said the tie-up seemed to be an “obvious fit” with “strategic merit” based on cross-selling payment products, and agreed a competing bid was unlikely.

The Australian Competition and Consumer Commission, which would need to approve the transaction, said it had just been notified of the plan and “will consider it carefully once we see the details”.

POPULARITY

Created in 2014, Afterpay has been the bellwether of the niche no-credit-checks online payments sector that burst into the mainstream last year as more people, especially youngsters, chose to pay in instalments for everyday items during the pandemic.

BNPL firms lend shoppers instant funds, typically up to a few thousand dollars, which can be paid off interest-free.

As they generally make money from merchant commission and late fees – and not interest payments – they sidestep the legal definition of credit and therefore credit laws.

That means BNPL providers are not required to run background checks on new accounts, unlike credit card companies, and normally request just an applicant’s name, address and birth date. Critics say that makes the system an easier fraud target.

The loose regulation, burgeoning popularity and quick uptake among users has led to rapid growth in the sector, and has reportedly even driven Apple to launch a service.

For Afterpay, the deal with Square delivers a large customer base in its main target market, the United States, where its fiscal 2021 sales nearly tripled to A$11.1 billion in constant currency terms.

The deal “looks close to a done deal, in the absence of a superior proposal,” said Ord Minnett analyst Phillip Chippindale, adding that it “brings significant scale advantages, including to Square’s Seller and Cash app products.”

Related Articles

Talks between the two companies began more than a year ago and Square was confident there was no rival offer, said a person with direct knowledge of the deal.

Afterpay shareholders will get 0.375 of Square class A stock for every Afterpay share they own, implying a price of about A$126.21 per share based on Square’s Friday close, the companies said. The deal includes a break clause worth A$385 million triggered by certain circumstances such as if Square investors do not approve the takeover.

Square said it will undertake a secondary listing on the Australian Securities Exchange to allow Afterpay shareholders to trade in shares via CHESS depositary interests (CDIs).

Morgan Stanley advised Square on the deal, while Goldman Sachs and Highbury Partnership consulted for Afterpay and its board.

(Reporting by Byron Kaye and Paulina Duran in Sydney, Shashwat Awasthi in Bengaluru and Scott Murdoch in Hong Kong; additional reporting by Niket Nishant and Sohini Podder in Bengaluru and Supantha Mukherjee in Stockholm; Editing by Chris Reese; Christopher Cushing and Saumyadeb Chakrabarty)