Bitcoin steams to new record and nears $1 trillion market cap

Bitcoin hit yet another record high on Friday and moved within sight of a market capitalization of $1 trillion, blithely shrugging off analyst warnings that it is an “economic sideshow” and a poor hedge against a fall in stock prices.

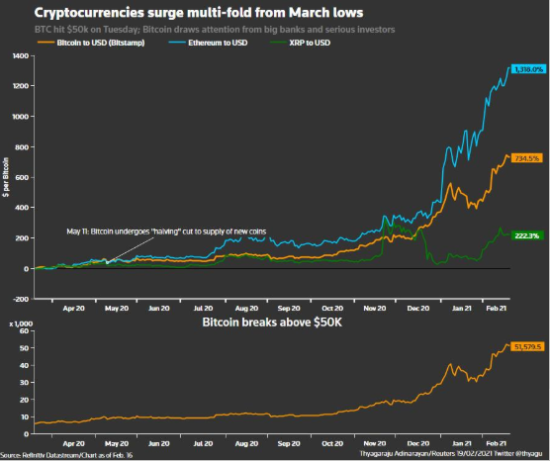

The world’s most popular cryptocurrency jumped 2.6% to an all-time high of $52,932, setting it on course for a weekly jump of over 8%. It has surged around 60% so far this month.

Signs have fueled Bitcoin’s gains. It is winning acceptance among mainstream investors and companies, from Tesla and Mastercard to BNY Mellon.

A representation of virtual currency Bitcoin is seen in front of a stock graph in this illustration taken January 8, 2021. REUTERS/Dado Ruvic/File Photo

Its latest gains took its market capitalization – all the bitcoin in circulation – to about $982 billion, according to cryptocurrency data website CoinMarketCap, with all digital coins combined worth around $1.6 trillion.

Still, many analysts and investors remain skeptical of the patchily-regulated and highly volatile digital asset, which is still little used for commerce.

Analysts at JP Morgan said bitcoin’s current prices were well above estimates of fair value. Mainstream adoption increases bitcoin’s correlation with cyclical assets, which rise and fall with economic changes, reducing benefits of diversifying into crypto, the investment bank said in a memo.

“Crypto-assets continue to rank as the poorest hedge for major drawdowns inequities, with questionable diversification benefits at prices so far above production costs, while correlations with cyclical assets are rising as crypto ownership is mainstreamed,” JP Morgan said.

Bitcoin is an “economic sideshow,” it added, calling innovation in financial technology and digital platforms’ growth into credit and payments “the real financial transformational story of the COVID-19 era”.

This week, other investors said bitcoin’s volatility presents a hurdle for its ambitions to become a widespread means of payment.

The Bitcoin Rally

On Thursday, Tesla boss Elon Musk – whose tweets have fuelled bitcoin’s rally – said owning the digital coin was only a little better than holding cash. He also defended Tesla’s recent purchase of $1.5 billion of bitcoin, which ignited mainstream interest in the digital currency.

Photo Credit: Reuters

Bitcoin proponents argue the cryptocurrency is “digital gold” that can hedge against the risk of inflation sparked by a massive central bank and government stimulus packages designed to counter COVID-19.

Yet bitcoin would need to rise to $146,000 in the long-term for its market capitalization to equal total private-sector investment in gold via exchange-traded funds or bars and coins, according to JP Morgan.

Rival cryptocurrency ether traded down 0.5%, still near a record of $1,951 reached earlier on Friday. It has been lifted by growing institutional interest, and after its futures were launched on the Chicago Mercantile Exchange.

(Reporting by Tom Wilson in London and Stanley White in Tokyo; Editing by Sam Holmes and Pravin Char)