GameStop Effect Puts Global Bets Worth Billions at Risk

Global bets worth billions of dollars could be at risk as amateur share traders challenge the bearish positions of influential funds by buying Gamestop shares. This is inflating stock valuations and leaving the professionals looking at potentially hefty losses.

Gone are the days when bruised retail investors fled after prominent hedge funds bet against a stock — the GameStop effect is rippling across U.S. markets and spreading to Europe.

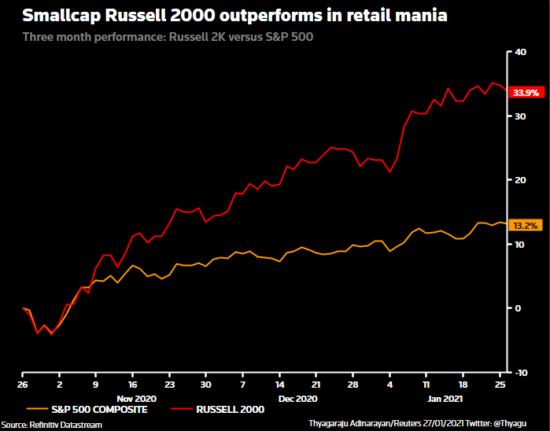

Shares of the 20 small-cap Russell 2000 index companies with the biggest bearish bets against them have risen 60% on average so far this year, easily outperforming the rest of the market, a Reuters analysis of Refinitiv data shows.

Similarly, the best performers in Britain this week have been companies such as Pearson and Cineworld, in which investors also have sizeable short positions.

But share price surges such as the 700% year-to-date jump in U.S. video game retailer GameStop could potentially wipe out billions of dollars of those short bets.

Bets against GameStop alone amounted to more than $2.2 billion as of Monday, FIS’ Analytics data showed, equivalent to more than a fifth of the company’s market value.

GameStop's market cap just passed Etsy. $26 billion! pic.twitter.com/fDomCBcKD6

— Charlie Bilello (@charliebilello) January 27, 2021

However, the company’s share price has quadrupled since the end of last week, reaching as much as $340 in U.S. pre-market trading on Wednesday.

“Most of the short positions are funded on margins. And so when markets run against you, you are stopped out if you are a short seller,” said Kaspar Hense, a fund manager at BlueBay Asset Management, which runs $60 billion in assets.

“A short position can exaggerate your losses if you are not actively managing your position.”

Several traders have told Reuters that one of the reasons for the jump in some shares’ price is short-sellers buying back into the stock to cover potential losses — the classic short-squeeze — drawing in more retail investors hoping to ride the wave.

Short-sellers typically borrow stocks to sell to repurchase them later when the price falls. The premium they pay to borrow the shares reflects the demand for them.

GameStop Shares

All the GameStop shares that would be available to borrow are already out on loan, with traders estimating annual borrowing costs at 25%-50% of the company’s share price.

Short-seller Andrew Left, who runs Citron Research and is one of the big names behind the bets against GameStop, shorted the stock when it traded around $40, expecting it to halve in value. Although he has covered the majority of the position at a 100% loss, he still has a short bet.

Melvin Capital Management also closed out a short position against GameStop at a 100% loss.

GameStop is not the only short bet that has turned sour. BlackBerry, Bed Bath & Beyond, AMC, Macy’s, and Cinemark Holdings have risen anywhere between 100% to 250% so far this year.

In Europe, Evotec, Nokia, and Varta have outperformed the wider market in 2021.

Refinitiv data on the performance of some stocks with high short interest:

- Company RIC YTD rise Short interest

- GameStop 700% 100%

- AMC Entertainment 400% 100%

- Bed Bath 110% 62.8%

- BlackBerry 250% 35.8%

- Dillard’s 100% 82%

- Discovery 35% 34%

(Reporting by Thyagaraju Adinarayan and Saikat Chatterjee; editing by Sujata Rao and Kirsten Donovan)