The Most Reliable Money-Saving Apps

Smartphones help us daily by making numerous tasks easier and faster. They have become so advanced that we can even use them to reach our financial goals. The best money-saving apps can help you track expenses, maximize your savings potential, and earn cashback from transactions. Moreover, you can download most of them for free on Android and iOS.

Money savings apps enable you to maximize your budget and shop more often. On the other hand, these apps can help those in debt eliminate deferred payments and boost their credit score. Also, you can start an investment account to build your portfolio in the app. Most importantly, they will help you allocate more money into your savings account for an emergency fund.

This article will discuss the most popular savings apps. We’ll discuss Acorns, Chime, and Betterment, among other apps. These are a combination of budgeting, investment, and payment apps that can help you reach your financial goals.

The 10 Best Money-Saving Apps

- Oportun

- Chime

- YNAB

- Mint

- EveryDollar

- Simplifi

- Empower

- PocketGuard

- Acorns

- Stash

Oportun (Formerly Digit)

Photo Credit: oportun.com

This money-saving app was one of the best budgeting apps in 2022. However, it changed its name from Digit to Oportun. Nevertheless, it remains a nifty tool for reaching your savings goals.

Its most convenient feature is its intuitive automated savings feature. This feature allocates money to your savings account based on your spending and income patterns.

Oportun helps you save money and time by removing the hassle of optimizing your budget yourself. Also, the app’s savings limit ensures it does not allocate more than your desired amount.

This money-saving app also automates paying utilities and other routine payments. As a result, you can rest assured its Bills account will cover them on time.

Oportun functions like a savings account because it offers FDIC insurance worth $250,000. However, you link it to your checking account. Fortunately, it offers overdraft protection.

First, you specify a minimum balance required for your checking account. If it falls below that limit, the Opertun app will withdraw funds from your savings account to prevent overdrafts.

Perhaps your linked checking account falls below the balance you specify. Oportun can withdraw funds from your savings account to prevent overdrafts.

This money-saving app lets you use it for free for 30 days. Then you must pay $5.00 to continue this service. Nonetheless, it is one the best money-saving apps for its straightforward features.

Chime

Photo Credit: chime.com

Do you want a bank account without exorbitant fees? You can avoid them by choosing Chime. Its website says you can open a bank account in two minutes!

It is a free app that lets you make a new bank account without undergoing credit checks and depositing a minimum balance. Chime can offer better terms than most traditional banks because it is a digital bank.

Also known as a neobank, it does not have a physical location. You can process everything on the mobile banking app to avoid problematic fees.

You only need an email address and a few other information to get a Chime savings account. Then, wait a few minutes to verify your account and roughly ten days for your online debit card.

Chime’s savings accounts offer a 2.00% annual percentage yield, making them one bank that offers high-yield accounts. Also, it says it charges no overdraft or other monthly fees, unlike traditional banks like Chase and Wells Fargo.

The mobile banking app also works as a digital payment app. You can pay via mobile platforms like Google Pay and Apple Pay.

Chime also offers a physical debit card. Like its online counterpart, it has no fees. Also, you can use it with over 60,000 ATMs in its network.

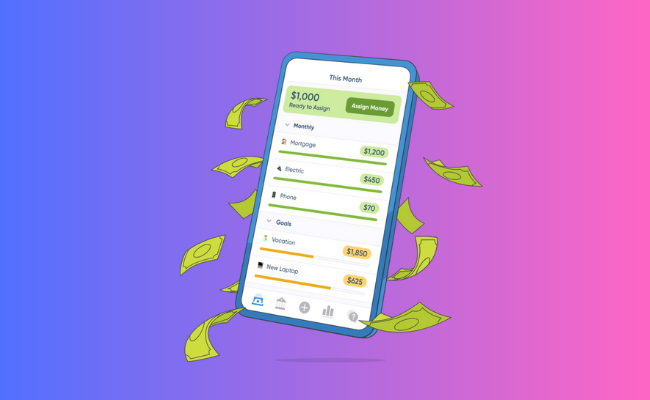

YNAB

Photo Credit: ynab.com

YNAB stands for “You Need A Budget,” which is a specific budgeting method. Let’s discuss its rules so you can understand this savings app:

- Give Every Dollar a Job: YNAB believes you must give a specific purpose for your money.

- Embrace Your True Expenses: Track your monthly expenses to easily track spending.

- Roll with the Punches: You will encounter sudden expenses sooner or later, so you must prepare savings accounts for emergencies.

- Age Your Money: Set aside last month’s remaining budget for this month’s expenses.

Download the YNAB for your Android or Apple devices. Then, create a budget by setting savings goals. For example, you could name them “Debt Payoff” or “Save Money.”

This savings app also links your checking or savings account to your budgeting goals. Moreover, this mobile tool will adjust your progress when your bank account updates.

The program automates payments based on your expenses and income by letting you manually fill in your transactions. If you track how you save money on a digital file, you can submit it to YNAB to automatically adjust the app.

Despite being an online bank, it offers encryption and password security on par with traditional banking services. However, this app requires a paid subscription.

You can start using the YNAB app by paying $14.99 monthly or $98.99 annually. If you’re unsure about using it, you could enter the 34-day free trial beforehand.

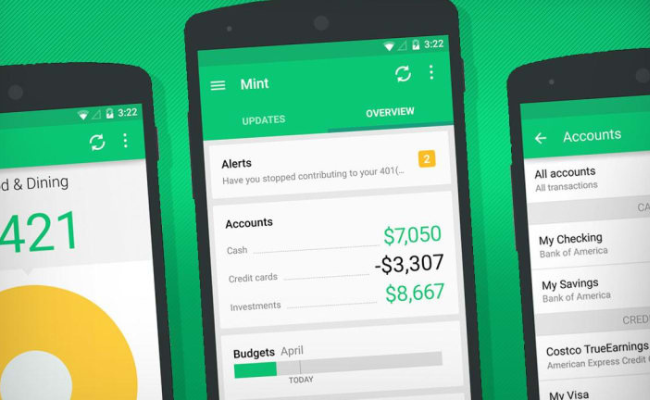

Mint

Photo Credit: thestreet.com

Mint is a well-rounded personal finance app that lets you track financial accounts and daily spending. It automatically organizes your expenses to show the totals by category.

Like most money-saving apps, it also provides monthly bill tracking and payment notifications to prevent late penalties. Unlike other apps, Mint has unique features like a loan repayment calculator and a home affordability calculator.

The former helps you plan to pay your credit card accounts on time. It will become easier to save money if you are debt-free. Eventually, punctual payments help establish a positive credit record and improve your credit score.

Once you have good credit, you are more likely to receive favorable terms for your next home loan. Also, the Mint home affordability calculator helps you budget for a mortgage.

Furthermore, you can allocate your extra funds into an investment account. This budgeting app also lets you monitor investment accounts for your first portfolio.

Mint comes from Intuit, a popular tax preparation software. You can rest assured that your money is safe with this app. It uses powerful security features like multi-factor authentication and touch ID mobile access.

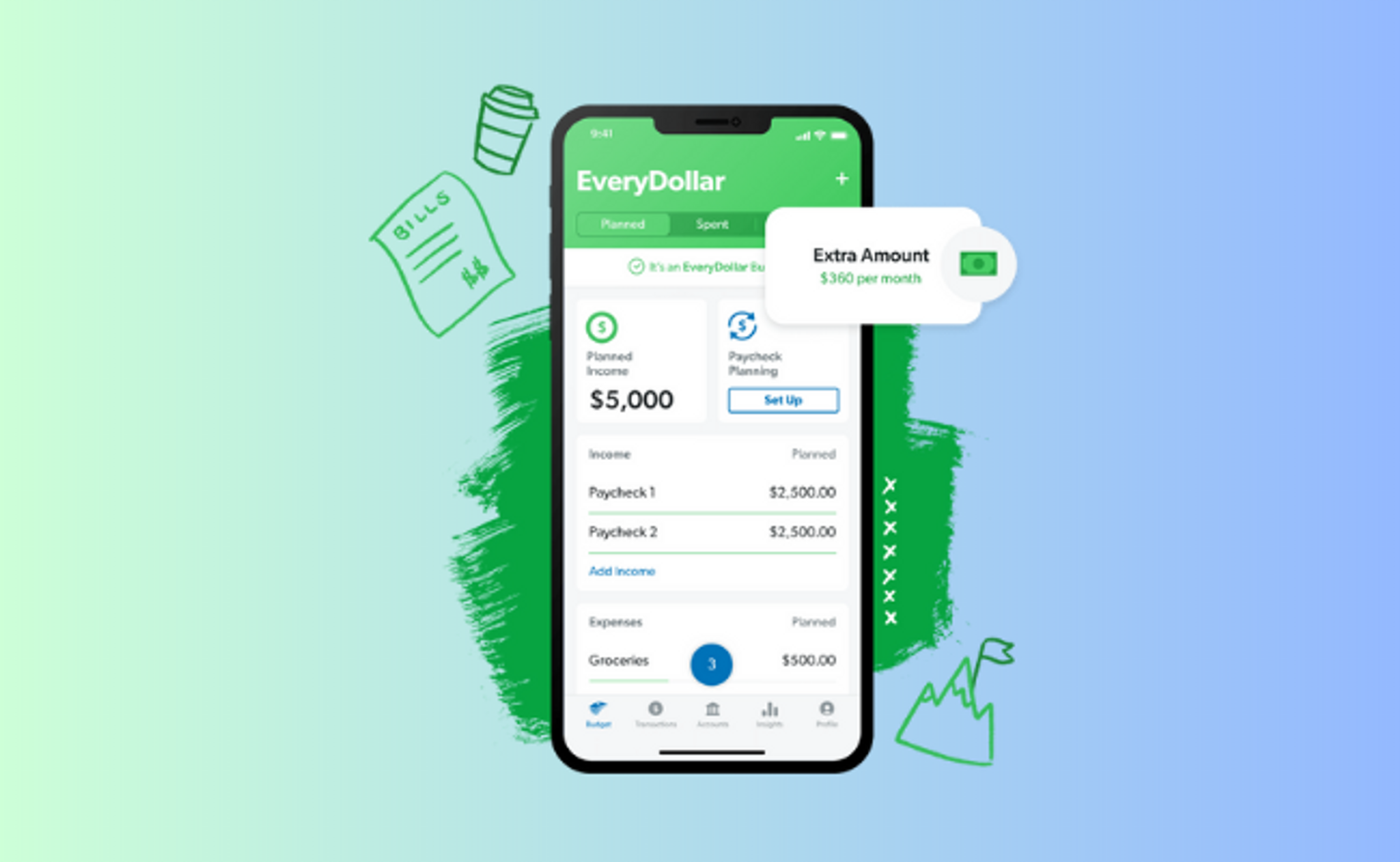

EveryDollar

Photo Credit: ramseysolutions.com

One of radio’s most popular financial advisors offers one of the best money-saving apps: EveryDollar. Similar to YNAB, it follows a budgeting method called the zero-based budget method.

It involves using the amount of money available for each spending period. For example, you will only use your monthly salary for monthly expenses.

A zero-based budget requires you to be hands-on with your financial plan’s direct deposit and payment. As a result, you can adjust your financial planning to unexpected situations.

That will ensure you stay within your budget and save money. Moreover, you can link your savings and checking account so that app can monitor transactions on your behalf.

This program tracks debts, sends personal finance reports, and prints transaction records. EveryDollar offers a 14-day free trial. Then, you must pay $12.99 monthly or $79.99 annually.

Simplifi

Photo Credit: quicken.com

Saving money means making a budget, but people sometimes forget it is all about cash flow. You must measure and put a purpose behind every direct deposit to your financial accounts.

Simplifi makes this process more convenient by linking your bank accounts to offer a complete picture of your finances. The app automatically divides them into various spending categories, tracks upcoming bills, and monitors recurring expenses.

You can find these features in other budgeting apps, but Simplifi has unique features. For example, you can set custom watchlists to assign spending limits by category.

This app comes from Quicken, a reputable loan provider that started in 1984. You can rest assured Simplifi will protect your financial data with top-notch encryption and multi-factor authentication.

Simplifi offers a 30-day trial and a discount for its monthly and yearly subscriptions. At the time of writing, it costs $2.39 monthly or $28.73 annually.

Empower (Formerly Personal Capital)

Photo Credit: empower.com

Some budgeting apps help people build wealth as well. The Empower app is mainly an investment tool, but it can help you keep up with spending.

It is a well-rounded money management app that lets you set financial goals. You can even place a monthly spending goal to see if you are deviating from your plan.

Like Simplifi, it has a cash flow viewer that shows how much money you have received and spent in the last 30 days. Yet, Empower sets itself apart from even the best budgeting apps with its Planners:

- Retirement Planner shows if you have enough funds in your savings account to retire on your target date. It also computes your projected income every month.

- Education Planner helps college students pay student loans. It lets them gauge how much to save daily to cover education expenses.

- Savings Planner shows the annual savings range needed for a 70% chance of achieving your retirement goals. This feature complements the Retirement Planner by providing more details on your savings goals.

PocketGuard

Photo Credit: clark.com

The extra bells and whistles from other budgeting apps can be troublesome. If you want a straightforward budgeting tool, PocketGuard might be what you need.

You can link bank accounts, loans, investments, and credit cards to it so you know your remaining funds. Also, it can track all your bills to update your budget in real-time.

PocketGuard represents your expenses on a pie chart, so you can see how much they are taking from your budget. Moreover, it marks unnecessary expenses, such as a forgotten gym membership.

Once you see those expenses, you can cancel those subscriptions immediately to have more money every month. As a result, PocketGuard makes sure you are ready for upcoming bill payments.

PocketGuard is also one of the best personal finance apps because it is free! If you have multiple debts, consider paying for the premium version called PocketGuard Plus.

It will compute your remaining balance and monthly installment based on hidden fees and other data. The premium version will also reflect how much you owe on each debt to see your debt payoff progress.

At the time of writing, PocketGuard Plus costs $7.99 monthly or $34.99 annually. The latter charges $2.92 monthly. Also, you could use the app indefinitely by paying $79.99.

Acorns

Photo Credit: marketrealist.com

If you’ve never opened an investment account, try micro-investing apps like Acorns. It lets you allocate small amounts of money into your savings automatically.

The app lets you open investment accounts with no hidden fees, account minimum fees, or overdraft fees. Moreover, its smart deposit feature puts a small portion of your daily paycheck into your Acorns accounts.

You can withdraw your money from the 55,000 free AllPoint Network ATMs. Also, the Acorns investment app lets you claim a personalized, heavy metal, laser-engraved Visa debit card.

Moreover, it lets you make money by inviting friends to use the investment app. Tap the “Invite a Friend” option to discover how much you can earn from helping others improve their finances with Acorns.

Stash

Photo Credit: fintechfutures.com

Investors want nothing less than top-notch security for their assets, and Stash could implement them on your savings. The security features include biometric authentication and encryption.

Like Digit, this app protects users with FDIC insurance. Instead of a $250,000 limit, Stash protects users for up to $500,000. It has no free version, but it offers the following paid subscription tiers:

- Beginner provides investing and banking access for $1.00 every month.

- Growth has all the Beginner features plus the Smart Portfolio and the Retirement Portfolio for $3.00 per month.

- Stash+ has expanded investing, banking, and insurance access for $9.00 monthly.

This tool could be a great budgeting app if you want to start investing. Stash can help direct your cash flow toward a better investment portfolio.

Conclusion

The best money-saving apps help adjust your budget with numerous features. Most are free for a limited time. Then, you must pay for continued use.

Mobile apps are great, but you must couple them with proper money habits. They will enable you to budget wisely, app or no app.

Inquirer USA shows you more financial tools and techniques. Also, it is a great platform for the latest news and trends.

Frequently Asked Questions (FAQs) about the Best Money-Saving Apps

What are the benefits of using money-saving apps?

Money savings apps improve your budgeting and financial planning by helping your track income and expenses. Also, they automate savings, send bill payment notifications, and provide cashback rewards. These tools also share more money-saving tips and lessons.

Are money-saving apps free?

You can download and install money-saving apps for free but only for a limited time. Afterward, you must pay a monthly or yearly subscription to continue using them. Others offer better features behind a paywall. Check an app’s pricing structure before using them.

Is my money-saving app secure?

Most money-saving programs employ the best security measures to protect your financial data. Choose apps from trusted companies and review their privacy policies before registering. Also, use strong, unique passwords and enable two-factor authentication for more security.

Editor’s Note: This post was originally published on Jul 16, 2019, and has been updated on Jun 23, 2023.