How to Use a Mortgage Rate Calculator Refinance

Refinancing your home may be something that you are considering as a homeowner. You probably have a few different reasons for researching this mortgage topic.

You may be trying to pay off some of your past debts. Refinancing is an effective way to take care of this. The holdup is that you are not sure about what adjustable rates you are eligible for. You may lack a good idea of what the refinancing process entails. One critical step in determining what you can afford is using the mortgage rate calculator.

Do not be embarrassed. This topic can be intimidating. We have presented several of the best mortgage calculators online that will help you figure out the loan rate you qualify for, and put your mind at ease.

Why Do I Need a Mortgage Calculator?

Mortgage calculators help guide you to figure out how much your monthly mortgage payments will be. You can input different numbers and experiment with different home prices on these calculators to get an idea of what different home valuations may require.

The Best Mortgage Calculators Online

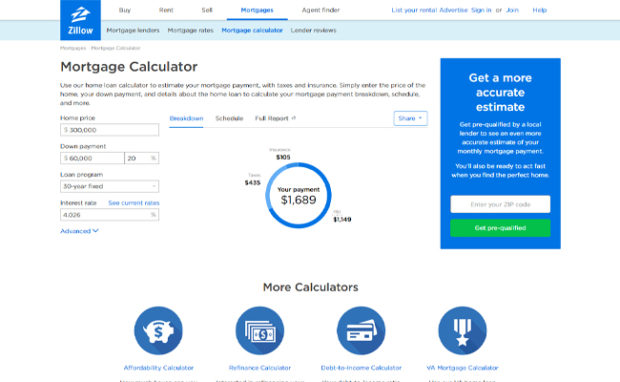

We have picked several of the best mortgage calculators online for you to try out and consider. The first mortgage calculator is from Zillow. One of the reasons why it’s one of our favorites is the simplicity it offers the user. It is very simple to use, has payment details listed, shows schedule, tax amounts, and other essential information.

There is one section where you can enter your zip code. The calculator will pull up an almost exact estimate for your monthly mortgage payment. This is a great way to help you figure out your mortgage requirements easily.

The Zillow mortgage rate calculator will show you the rates, and even provide the interest rates that are attached to the different loan sizes. Then, there is an animation portion of the calculator that will create a graph of your extra payments and payment schedule where it can show you a shorter term or a shorter number of years.

There are other calculators offered on Zillow as well. If you scroll down to the bottom of the page, there’s a section about additional “mortgage calculator help.”

Consequently, this section includes helpful numbers that are important to look at home prices. It also provides information on the current home loan, down payment amounts, loan programs, interest rates, loan type, current mortgage, appraisal fee, closing costs, property taxes, and home insurance options.

Related Articles

Best Mortgage Rates: JP Morgan Chase

2019 and Your New Goals: How Much Mortgage Can I Get?

5 Steps on How to Qualify for a Home Loan

Bankrate Mortgage Calculator

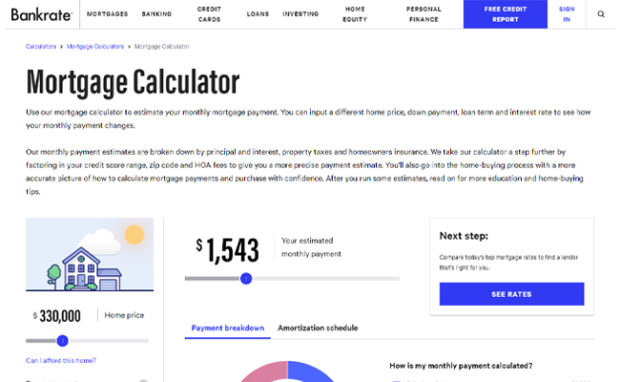

Our next favorite mortgage calculator is at Bankrate. This is a very user-friendly mortgage calculator and has an appealing, colorful interface design. It has an area where you can slide the ticker to adjust the home price. This will help you figure out if you can afford a particular house and estimated monthly mortgage payments.

This calculator data is broken down into different categories. These are credit score, zip code, and HOA fees. These sub-categories further analyze your financial requirements to give you an even more accurate depiction of the house that you can afford. In addition to that, Bankrate wants you to have a better and clearer idea of what you’re signing up for when buying a home.

Once you have been able to use their calculator, Bankrate presents educational articles and additional information. It regards refinancing, mortgages, and the entire home-buying process. Other third-party companies are listed on the web page that can help with your refinancing needs.

Really Simple Calculator

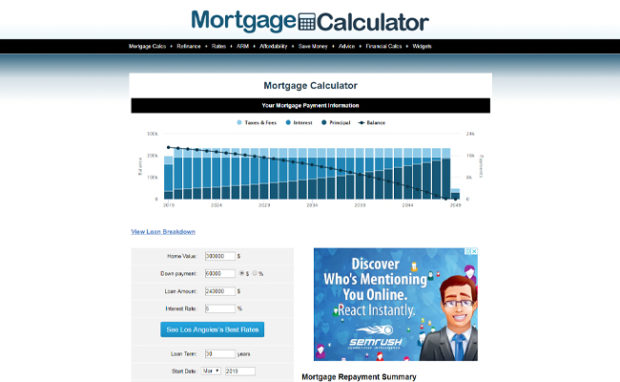

If these mortgage calculators are too much for you, this is the simplest one we can find. This mortgage calculator site is by far one of the easiest calculators to use online. It has different types of calculator categories, giving you some additional details that may prove useful.

Furthermore, it shows you a loan breakdown and how much you would hypothetically need for monthly savings. It will display the best rates in your zip code as well, giving you an idea about local housing requirements, home improvements, title searches, and more. You can enter how much the home is worth, the down payment that you are putting into the home, the new loan amount, the higher or lower interest rate, the term, and when you will begin. The loan calculator will inform you of your payments for that mortgage situation.

After you have entered the information, you’ll get an adjustable-rate mortgage repayment summary. It will list your monthly payment, the expected loan pay-off date, and other details. It is a very simple and extremely useful tool to break down your payments and the options that are available to you. It’s not too busy and gives you a lean summary of your affordable financial situation. Simplicity is key.

This mortgage loan term calculator will provide a list of lenders displayed in the middle of the page, just like other standard mortgage calculators. We recommend this calculator for a quick and efficient snapshot of your financial requirements, or for the interested home buyer who wants to quickly scan their financing options.

Summary

All three of this mortgage refinance calculators offer something to the individual who is considering the process of becoming a homeowner. Whether you want something very simple, or a mortgage calculator with all the “bells and whistles,” one of these calculator options will get the job done.

Mortgage calculators will guide you in the right direction, and soon you’ll be able to make the best decision of base on your home buying and refinancing requirements.