Asian Stock Market: Top 3 Stocks To Buy In 2019

Because of the positive sentiment being expressed by many financial analysts about the Asian stock market, its top three stocks to buy in 2019 will be examined more thoroughly and are listed below:

- Taiwan Semiconductor Manufacturing

- Melco Resorts & Entertainment

- Meituan Dianping

Taiwan Semiconductor Manufacturing is listed on the Taiwan Stock Exchange and the New York Stock Exchange. Melco Resorts & Entertainment is listed on the Philippine Stock Exchange, and its holding company (which has the same name) is listed on the NASDAQ. Meituan Dianping is listed on the Hong Kong Stock Exchange.

However, before we take a look at each individual stock, let’s examine the overall situation.

Why the Asian Stock Market May be One of the Best Stock Markets in the World in 2019

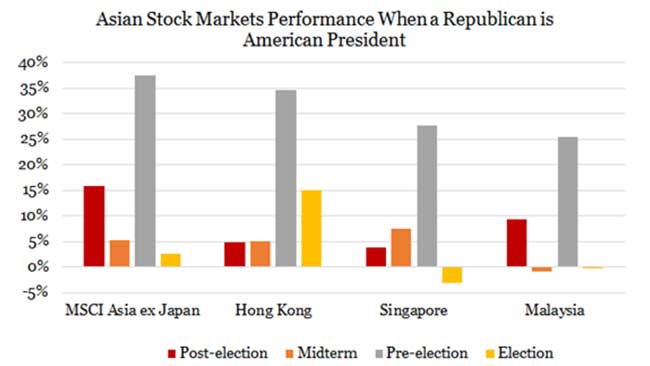

As you can clearly see with the above chart, the Asian stock market performs very nicely in the third year of a Republican president’s administration. When you combine this amazing data with the continued growth of China’s middle class, positive speculation about the Asian stock market is something that demands closer attention.

So let’s examine three of the best Asian stocks in more detail.

Taiwan Semiconductor: One of the Best Asian Stocks

In 1987, this company began operations and was the first dedicated semiconductor foundry in the world. It manufactures and markets integrated circuits and provides several services, including wafer probing, design services, wafer manufacturing, testing, assembly, and mask production.

The company’s integrated circuits are utilized in computers and consumer electronics. They are also used in the automotive and industrial equipment industries. The corporation also invests in solar energy and lighting.

Current Situation

In its results for Q4 of 2018, Taiwan Semiconductor Manufacturing reported that it beat revenue and EPS guidance. The semiconductor giant reported earnings per share of 63 cents, beating estimates by a penny. It reported a revenue of 9.4 billion dollars, which beat estimates by 30 million.

This was welcome news for many shareholders because there have been concerns about the sudden weakening of the smartphone market, especially with the high-end segment. Not only has this sales drop hurt the company’s bottom line, but it has also caused a large amount of excess inventory to accumulate.

However, the company does have large amounts of cash that will help it weather the storm during any hard times that may lie ahead.

Taiwan Semiconductor: The Best Stock in the World’s Best Stock Markets

The company is predicting revenue growth of one to three percent. Although it is lower than last year’s growth of six and a half percent, it is still positive momentum. Revenue guidance is also down to a little over seven billion dollars, which is down from last year’s first quarter.

However, in order to offset this predicted loss of growth and revenue, the company says that it will curb its capital expenditures in 2019 by over a hundred million dollars.

Despite these lower numbers for the first part of the year, there is still a great deal of excitement among many investors about this equity because new smartphones will be launched in the second half of 2019, and this could drastically improve market conditions.

Melco Resorts & Entertainment: Another One of the Best Asian Stocks

Melco Resorts and Entertainment Corporation (MRP) is listed on the Philippine Stock Exchange and is a subsidiary of Melco Resorts & Entertainment (MLCO), which is listed on the NASDAQ and is an owner of casinos and resorts in Asia.

Current Situation

Several investment bankers, including JP Morgan, suggest holding shares of this corporation even though gaming revenue may decrease throughout 2019. Many analysts claim that this downturn is something that is already known by investors and already priced into the stock.

In addition, several financial analysts note that the company’s overall health has been surprisingly resilient despite a challenging macro backdrop.

Best Stock Market Predictions for Melco Resorts & Entertainment

The CEO of Melco Resorts & Entertainment, Lawrence Ho, states that revenue growth this year may fall; however, despite this possibility, he claims that consumer sentiment will continue to remain enormously strong, and this makes the firm’s equity a wise investment.

Meituan Dianping: Yet Even Another One of the Best Asian Stocks

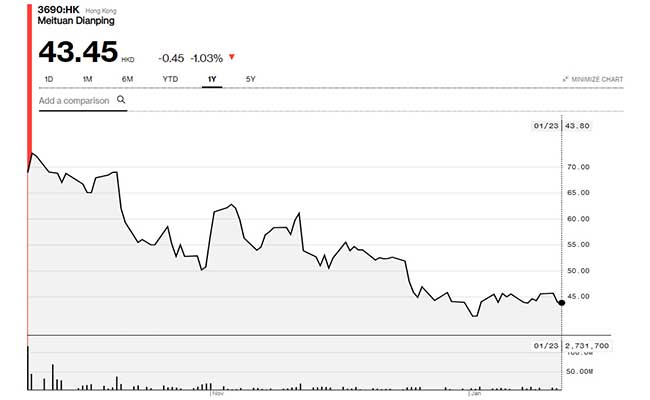

Meituan Dianping went public in Hong Kong a few months ago and is listed on the Hong Kong Stock Exchange. It is an online shopping platform for local consumer products and retail services in China. It offers many kinds of deals by selling vouchers for entertainment, delivery, and dining.

In addition, the firm provides IT systems and services that integrate artificial intelligence and big data to industries like hotels and tourism.

Current Situation

The company’s order volume is well over 18 million per day, and this makes it the biggest on-demand delivery platform in the world. By utilizing artificial intelligence, the firm has created a smart distribution system.

A couple of years ago, it began to examine unmanned delivery and has applied for over 50 patents related to these types of technologies. The company has signed three brand new partners for the creation of its autonomous delivery open platform. These new partners are Nvidia, Icona, and Valeo.

Valeo will provide sensors and engines, and Nvidia’s technology will be utilized in research and development. Icona will function as a partner for vehicles and robots.

The company’s partners in this platform already include Roadster, Uditech, iDriverPlus, and Segway-GX. It is now performing trial operations in several locations.

Future Outlook for Meituan-Dianping

Meituan-Dianping will continue to conduct trials of unmanned delivery in 2019 and will officially begin the service before the end of the year.

The firm also has many new games coming out in 2019 and will look at overseas markets for further growth in this area. It has signed an agreement with Sea, a company based in Singapore, to allow the publishing of their games in Taiwan, Indonesia, Malaysia, Thailand, Singapore, and the Philippines.

In addition, the company will launch a new division that specializes in cloud computing and business services.

Because of these new elements being added to the company’s operations, many investors are seriously considering this company’s stock as a potential area for new growth.

Conclusion

The IMF has projected that growth in Asia is forecast at 5.6 percent in 2019 and has stated that inflation will probably be subdued.

When you consider these two factors together, investment in the Asian stock markets makes a lot of sense. Many financial analysts speculate that there will be some type of positive momentum going forward because consumer sentiment is projected to remain at high levels throughout the rest of 2019.

Therefore, it might be prudent to carefully research many of the options available in these markets to see if there are any that could be profitable opportunities in the mid to long term. This would be especially true if there is some weakening later in the year, which would allow for lower priced points of entry.