Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Simple Path Financial: Reviews and Ratings

Simple Path Financial logo.

If you’ve been drowning in debt, juggling credit cards, personal loans, and high monthly payments, you’re probably looking for answers and ways to make this mess digestible. It can get even more confusing with all the different entities that pop up when you research, promising different services, and all requiring different qualifications from you.

Lucky for you, there are services that will remove the confusion and choose the best path out of debt for you. Enter Simple Path Financial, one of the financial services that aims to help bring clarity and guidance to struggling customers. On paper, they promise relief: debt consolidation, lower interest rates, fewer payments, and a “simple path” back to stability. But what’s actually behind the name? Is it legit, or just another detour that leaves you stuck?

Let’s break it down – only the essentials that you need to know.

What Simple Path Financial does (and doesn’t) do

Simple Path Financial homepage.

Simple Path Financial isn’t a direct lender in the traditional sense. Think of them more as a bridge – a debt consolidation and personal loan referral service that connects people with potential lenders or negotiates settlement options. You apply, they assess your profile, and then match you with an offer (or route you to debt settlement, if that’s the better fit).

They offer access to personal loans from $7,500 to $150,000, with advertised rates starting at 5.99% APR. But here’s the nuance: not everyone sees that low rate. Your actual offer depends heavily on your credit, income, debt-to-income ratio, and a few behind-the-scenes variables.

Borrowers with at least $20,000 in unsecured debt are the most likely candidates for their consolidation services. It’s not for people looking to refinance a $4,000 balance or take out a quick payday loan. It’s for folks in real debt – often buried – who need a structured way out.

Quick, clean, and… conditional

The appeal is obvious. The application process is online and relatively painless. In fact, a number of customers say they were approved within a day. That fast turnaround is one of Simple Path’s key selling points – along with the soft credit check for pre-qualification, so you can see if you might qualify without dinging your credit score.

But here’s where you have to pay attention. Some users report a classic bait-and-switch: they applied for a personal loan but ended up pushed toward debt settlement programs instead. It’s not a scam, but it may feel misleading if you’re expecting a straightforward loan approval process. If you’re not a fit for their lending partners, you may be rerouted.

This kind of redirect is legal – and even helpful in some cases – but it can surprise customers who thought they were just getting a loan.

Important considerations

Before you get too far down the application road, here are some critical factors to understand.

- Not a direct lender – a referral-based model Simple Path Financial does not originate loans. Instead, it functions as a financial services intermediary, connecting applicants with third-party lenders or debt resolution providers. This means your actual loan or settlement agreement will be managed by a separate company, not Simple Path itself.

- Advertised rates may not reflect reality While they promote starting interest rates as low as 5.99% APR, this rate is generally only available to borrowers with excellent credit, low existing debt, and strong income. Many users report receiving offers with significantly higher rates – sometimes up to 29.99% APR or more – especially if their credit profile is considered high-risk. Always review your loan terms carefully before committing.

- You might not get what you expected Several users have reported that they applied for a personal loan but were instead funneled into debt settlement options. While this isn’t inherently deceptive – and may actually be a better fit in some cases – it can catch borrowers off guard. Always clarify the offer type before proceeding, and don’t hesitate to walk away if it doesn’t align with your goals.

- Debt settlement can harm your credit (at least temporarily) If you are directed to a debt settlement program, be aware that this strategy typically involves stopping payments to creditors for a period of time, which will be reported to credit bureaus and negatively affect your credit score. While this may lead to lower total debt, it also comes with risks: potential collections activity and a score dip that could take months (or years) to recover from.

The real impact – and the risks

Some borrowers report massive improvements. One user, featured in a case study by Ascend, had over $31,000 in credit card debt and was able to reduce their monthly payments by more than 80%. That’s real relief. Others say Simple Path helped them consolidate wedding debt, medical bills, or pandemic-related credit card balances and finally breathe again.

But again, not everyone walks away smiling. Some customers have flagged concerns about communication, transparency, or receiving loan offers with much higher interest rates than expected (sometimes as high as 29.99% APR). That’s within industry norms for high-risk borrowers, but it can feel like a gut punch if you were hoping for 5.99% and get hit with the opposite.

Another caveat: if you go the debt settlement route, your credit will take a temporary hit. Debt settlement typically involves stopping payments for a while so that creditors are willing to negotiate. That pause gets reported — and your score drops. It can rebound over time, but it’s something you need to go into eyes wide open.

Customer service: high marks, mostly

Service is huge in the financial world, and there is plenty of social proof in Simple Path’s favor. They have very solid scores across the accredited review platforms: 4.9/5 on Trustpilot, 4.8/5 on Google Reviews, and a 4.69/5 on BBB. Particular praise is given to the reps for their professionalism and compassion. That’s exactly what you want and need with such a sensitive and difficult matter.

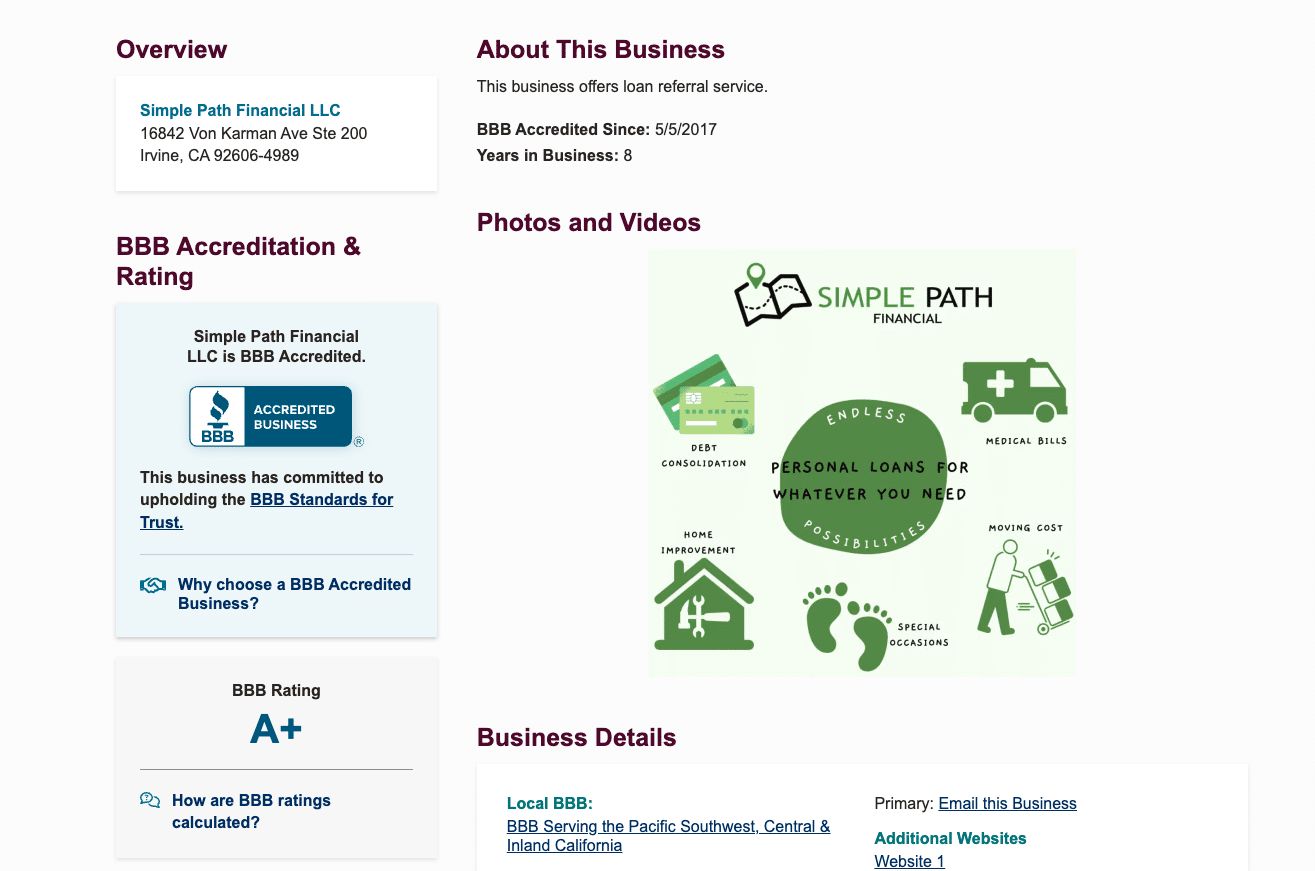

Simple Path Financial holds an A+ rating with the Better Business Bureau.

Some common terms used in praising the company’s customer service include “non-judgmental,” “patient,” and “helpful.” It’s clear the company does a good job vetting their staff and hiring the right people, who actually care.

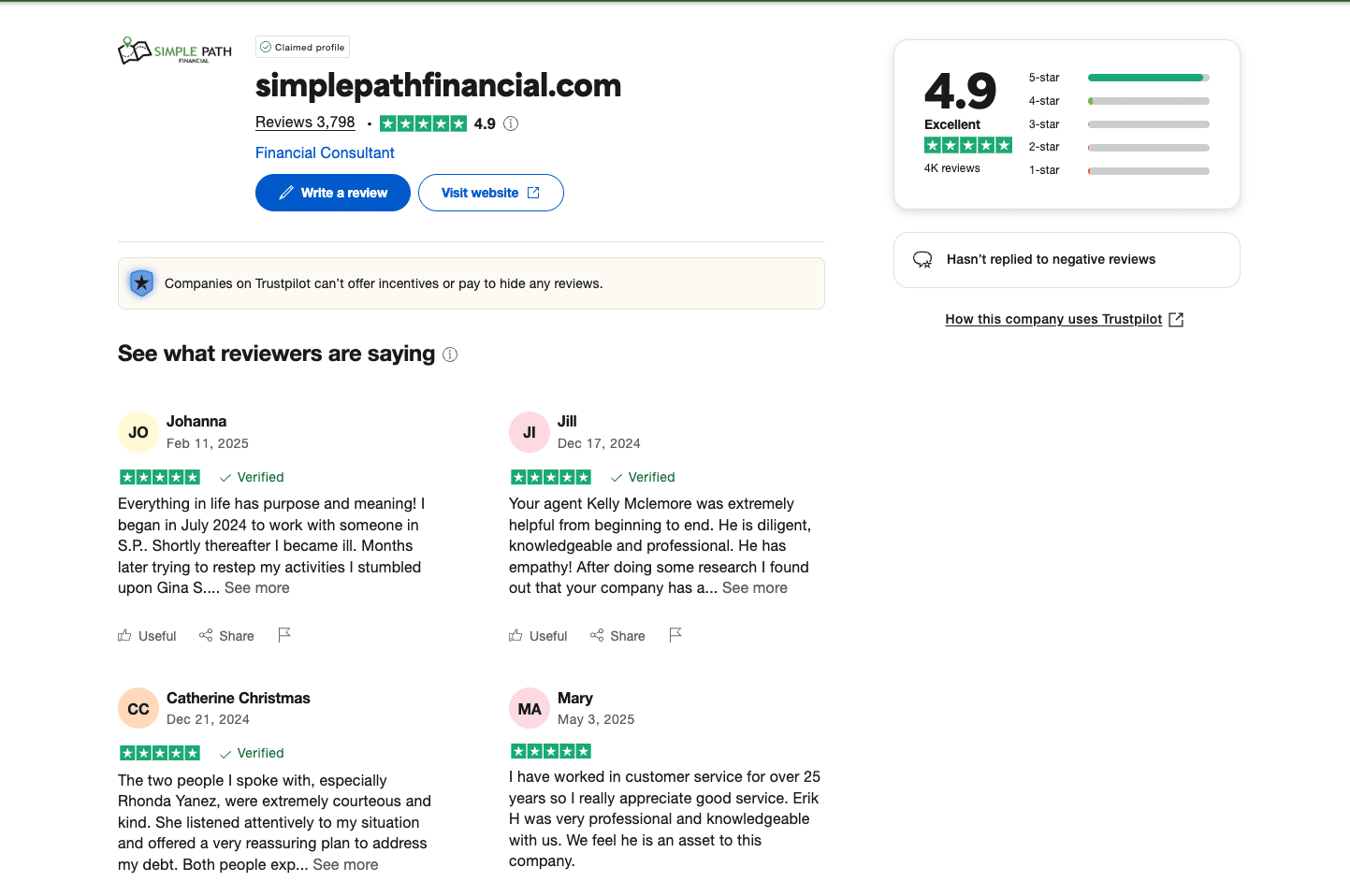

Simple Path Financial earns a 4.9-star average on Trustpilot.

That said, no company is perfect. A few reviews on Trustpilot, BBB and Reddit mention overly persistent follow-ups or emails that feel more like marketing than support. But these complaints are relatively rare compared to the volume of positive feedback.

Is Simple Path right for you?

Here’s the real answer: it depends on your situation. If you have $20,000+ in unsecured debt, steady income, and want to explore either a loan or settlement — it’s worth applying. Just be honest about what you’re looking for, and don’t be afraid to walk away if the offer doesn’t feel right.

Simple Path Financial is best for people who:

- Are overwhelmed by multiple credit cards and monthly payments

- Want to simplify their repayment process into a single payment

- Are open to either a traditional loan or a settlement program

- Have decent income and a real desire to get their finances back in order

It’s probably not ideal if:

- You have a small amount of debt

- You’re not ready to commit to a repayment plan

- You’re expecting the lowest advertised rates without excellent credit

Final verdict

Simple Path Financial isn’t a silver bullet. But for the right person – someone buried in unsecured debt who’s ready to act – it can be a real solution. Just go in prepared, informed, and clear about what you want. And remember: any path to financial freedom takes effort. Simple Path might help clear the brush, but you still have to walk it.

Just make sure that you always remember, knowledge is power. This includes knowledge of all your options. Even if Simple Path Financial seems like a perfect fix, you could potentially save thousands of dollars more by spending just a couple hours finding an even better option. No matter how it looks, we are confident you will get back on track with your finances and live the life you deserve. Good luck and thanks for reading!

Frequently asked questions

- What does Simple Path Financial actually offer? Simple Path Financial offers more than just personal loans. They’re in the business of debt consolidation, debt resolution, and helping customers create a clear path toward managing their personal finances. Whether you’re trying to stabilize your financial standing or pay off multiple accounts, their services are designed to assist people navigating various financial situations. From debt settlement programs to customized loan options, they work to develop strategies that fit the person—not just the numbers.

- How do I know if I qualify for a loan through Simple Path Financial? Qualifying factors typically include your debt load, income, credit score, and your ability to repay. The process starts with a simple online form and soft credit inquiry, which won’t impact your score. From there, an advisor helps you explore loan terms, pay structures, and financial goals tailored to your situation. They accept applicants with a range of credit profiles, so even if you’ve been turned down elsewhere, it may be worth a look.

- Are there fees or hidden costs involved? Transparency is a big part of Simple Path’s brand. Most of their services come with straightforward disclosures, though fees can vary based on the financial product or strategy you move forward with. If you’re exploring a debt settlement program, it’s smart to ask about specific charges up front—just like you would with any company helping you manage debt. According to multiple Simple Path Financial reviews, many customers report that the fees were clear and worth the benefits received.

- How fast can I get funds, and what’s the repayment process like? Some borrowers report receiving funds in as little as 24 hours after approval. Once you’re approved, the repayment terms are based on your selected loan type – typically fixed rates with a single monthly payment that’s easier to manage. If your goal is to consolidate multiple accounts into one, this could simplify your financial journey and help you save over time. Loan terms will depend on your financial data, goals, and the strategy you agree to during your consultation.

- How legit is Simple Path Financial compared to other debt relief companies? Simple Path Financial is accredited by the Better Business Bureau and has strong ratings across Trustpilot and Google. They’re known for their responsive customer service, client-focused guidance, and straightforward advertising. While no debt management service is perfect, the reviews suggest they’re a solid player in the space. If you’re aware of what you’re signing up for—and go in with the commitment to follow through—the difference can be life-changing.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.