Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

loanDepot: Reviews and Ratings

Buying a home is a core facet of the American dream. Rates for homes only go up over time, so picking the right home lender requires careful consideration; No matter if you’re a first-time homebuyer, refinancing an existing mortgage, or exploring equity options.

We’re gonna take a look at loanDepot, and help you make an informed decision to decide if their services are right for you. You can expect a deep dive into the lending giant’s products, services, rates, and a full review of what real loanDepot customers have to say about their overall experience via authentic reviews and ratings from established platforms.

Discover loanDepot’s innovative digital-first approach that has revolutionized the home purchasing and refinancing process. Customers are going crazy over one feature in particular.

What is loanDepot? Company Overview

Through the use of their comprehensive data verification platform melloTM, loanDepot offers streamlined and easy access to a range of home loan and equity products. loanDepot goes to great lengths to provide excellent customer service, by using their multi-channel approach. Let’s get into the weeds on who exactly loanDepot is and what they offer. The following sections will help you decide if they are the right choice for you.

Brief History

Starting with just two employees in 2010, loanDepot reached $1 billion in annual originations by 2014. By 2018, they had funded over $50 billion in volume. Their excellent digital technology is allowing them to continuously grow across the country.

Mission and Values

As stated on its website, loanDepot’s mission is “to be your lifetime partner through every step of your homeowners’ journey.” Its approach is centered on holistic aid, efficient service, and putting the customer first.

LoanDepot is truly dedicated to providing exceptional mortgage solutions and services that meet customers’ needs.

Market Position

LoanDepot is one of a handful of the top mortgage lenders globally. While companies like Rocket Mortgage and Wells Fargo remain top players, loanDepot stands out for its borrower-centric retail lending approach and full digital capabilities.

Their arsenal of customer guiding digital tools include melloNow, an automated underwriting engine, and mello HELOC, for an application to funding process that takes no more than seven days. All in all, the mello digital tools make the tedious parts of the mortgage process easy, providing end-to-end digital loan processing, document uploads, fraud detection, and real time approvals.

LoanDepot also partners with home building professionals, such as Smith Douglas Homes (Ridgeland Mortgage), and Onx Homes (Onx X+ Mortgage). This allows them to offer tailored financing for new construction.

loanDepot Loan Products and Services

Let’s carefully examine loanDepot’s offerings:

Home Purchase Loans

Whether you’re a first-time buyer, veteran homeowner, or an investor, loanDepot offers financing solutions for purchasing a primary residence, vacation home, or investment property. FHA, VA, and jumbo loans are available with 5% down payment options.

Refinance Options

Refinance your current mortgage to potentially save on interest long-term through a rate-and-term refinance or tap your home’s equity via cash-out options.Improved credit can also make refinancing appealing.

HELOCs and Equity Loans

Access funds with flexibility via a home equity line of credit (HELOC) or as a lump sum with a home equity loan. This is ideal for unexpected expenses, debt consolidation, home renovations, or other large purchases. Rates are often lower than credit cards, though with less flexibility.

Additional Products

Beyond mainstream loans, loanDepot partners with builders and offers specialized programs for construction financing, non-QM options, down payment assistance, renovation loans, ARMs, and automated underwriting tools.

loanDepot’s Fees and Rates

Now that we’re familiar with loanDepot’s products let’s examine what it costs to work with them:

Standard Fees and Rates

While HELOC origination fees are up to 5%, loanDepot does not charge prepayment penalties They do however face allegations of junk fees, including state lawsuit, pay-to-pay-fees, EFTA violations. Rates are competitive for most prime and near-prime borrowers.

Rate Comparison

Third party reviews state rates are competitive, with 2023 data from HMDA mentioning they are slightly below industry average rates. Current rates as of February 2025 align with the national forecast of 6.5-7%. Their refinance and purchase rates reliably outperform national averages. Since loanDepot doesn’t have a built in rate comparison tool, quotes must be manually requested from multiple lenders.

Additional Fees

Appraisal, title, tax services, and mortgage insurance costs are standard. Late payment penalties apply if accounts fall delinquent. LoanDepot is facing a class action lawsuit for 2$ pay-to-pay phone fees.

How to Get the Best Rates with loanDepot

While loanDepot aims for simple, no-hassle financing, a bit of inside knowledge helps optimize borrowing costs:

Rate Influencers

Higher credit scores (740+), lower debt-to-income ratios, larger down payments, and shorter (15-year) terms often lead to lower interest. It pays to ensure that your finances are mortgage-ready.

Rate Locks

Initial locks last up to 150 days when reserving a 6.5-7% rate. Extending past 30-60 days requires a higher rate. Extensions and float-downs protect against future rate hikes. LoanDepot requires a signed agreement to lock.

Negotiation Tips

Use multiple quote comparisons from competitors to kindly ask your loanDepot loan officer for their “best deal.” Being flexible on closing timing rather than demanding 30 days can also save. A float down option is available up to 30 days pre- closing. This requires upfront negotiation.

loanDepot Customer Experience and Support

While no lender nails the process perfectly, loanDepot clearly prioritizes smooth and simple borrower experiences:

Application Process

The mello platform lets applicants upload pay stubs and IDs without faxing or mailing them. eSignatures expedite approvals. Customers say, “It just works,” never getting stuck or confused. There are reviews stating there are communication gaps in underwriting however, along with customer service frustrations.

Customer Support

Team members are responsive via phone, email, and live chat. Knowledgeable advisors manage the process end-to-end. Customer support closes at 10 PM EST and 6 PM Saturdays. Reviews have cited frustrations with customer service, but overall reviews find it more than serviceable.

Reviews and Testimonials

Borrower feedback overwhelmingly praises the streamlined digital process. Customers call timelines “faster than expected” from using mello smartloan, and are able to routinely achieve same day pre approval. loanDepot holds a J.D. Power score of 704/1,000, which is slightly below industry average however. Specific complaints include inconsistent guidance quality and complaints of hidden fees.

Trustworthiness and Reputation

Company Credibility

LoanDepot has firmly established itself as a credible mortgage lender in the industry. With 15 years of experience, the company has refinanced over $100 billion in mortgages. As one of the five leading nonbank lenders, loanDepot has helped a large customer base achieve their financial and homeownership goals.

Trustworthiness is in question however, with complaints about hidden fees, such as $2 pay-to-pay charges.

Overall, LoanDepot’s commitment to providing seamless mortgage solutions and streamlined customer service has earned their reputation as a trusted mortgage lender. Customers consistently praise the company for its reliability and dedication to making the home financing process as smooth as possible. Complaints on radio silence during critical stages, and inconsistent service quality are ongoing, however.

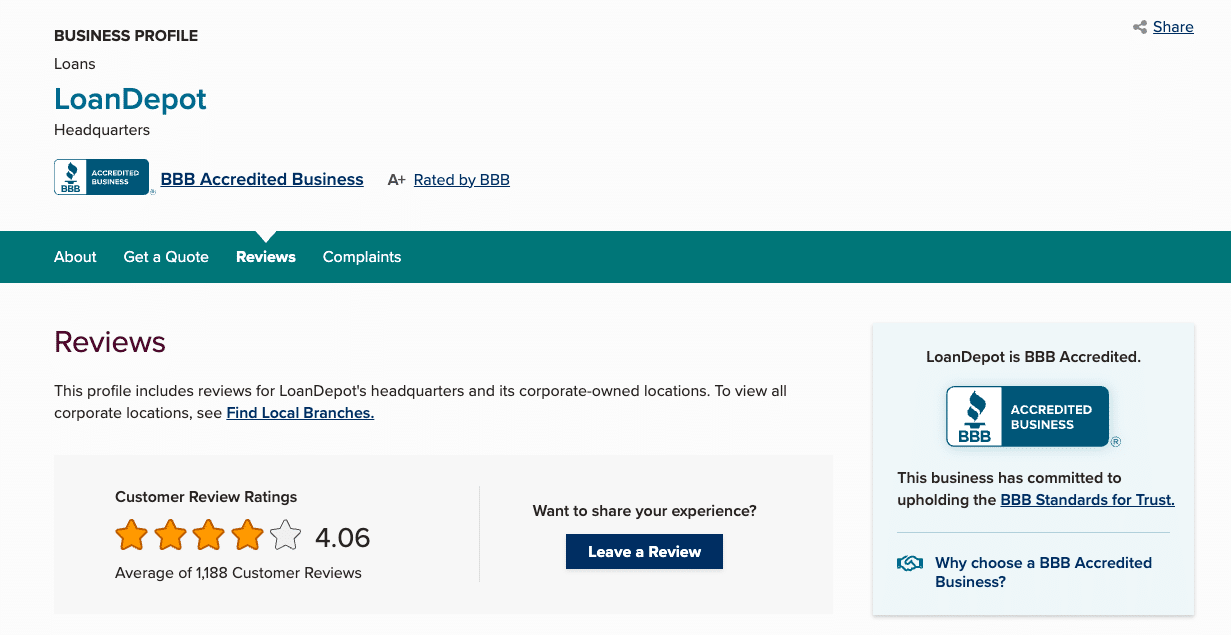

Industry Recognition

LoanDepot’s excellence in the mortgage industry has not gone unnoticed. The company has received numerous industry recognitions and awards for its outstanding performance and customer service. Various publications have ranked it as one of the top mortgage lenders in the country, and the Better Business Bureau has given the vast majority of branches an A+ rating.

This industry recognition is a testament to loanDepot’s dedication to providing exceptional service to its customers and its unwavering commitment to maintaining high standards in the mortgage lending business.

Comparison to Other Lenders

Competitive Analysis

LoanDepot stands out from other lenders in the industry due to its unique approach to mortgage lending. The company’s digital-first strategy makes it easier, faster, and less stressful for customers to purchase or refinance a home. With their trademark mello smartloan, customers can fully digitize the application process, including eSignatures, automated document validation, and 8 day closing.

LoanDepot combines their digital tools with customer access to 200+ local branches, allowing multiple routes for customer satisfaction. This innovative hybrid approach sets loanDepot apart from other lenders.

They also offer a comprehensive range of mortgage options, including VA loans, FHA loans, and home equity lines of credit. The company’s loan officers are knowledgeable and experienced, providing personalized service to each customer. Although there are customer reviews that cite inconsistent customer service quality.

LoanDepot’s competitive interest rates and hybrid approach make them an attractive choice for first-time homebuyers and existing homeowners looking to refinance.

Pros and Cons of Using loanDepot

Potential home loan applicants should weigh these factors:

Pros

- Hybrid business model– customers have holistic service options, with digital and in-person service at their disposal

- Mello smartloan Platform– This innovative tool allows for fast and simple digital onboarding

- Mello HELOC– loanDepot allows for funding against home equity in as little as seven days, with mello HELOC

- Comprehensive Loan Options– loans include conventional, FHA, VA, jumbo, HELOCS, renovation loans

- Partnership With Home Builders– allows tailored loan options on new construction

- VA Programs– renowned veteran assistance programs

Cons

- No Online Rates– Unlike competitors who post their rates upfront, loanDepot requires you to contact a loan officer to get your rate.

- Hidden Fees– loanDepot has been in lawsuits over hidden fees such as pay-to-pay 2$ phone fees.

- Mid-Tier Rates– rates are middle of the pack, with highly qualified customers being able to find better rates elsewhere.

- Inconsistent Service– customers report service quality as being highly branch dependent

How to Apply for a Loan with loanDepot

The essential rundown of application process:

Eligibility Requirements

- Stable employment history for at least two years is generally required

- Minimum credit score requirement is usually 620+, although lower credit can get HFA loans too with higher down payments

- Sufficient income and assets to qualify

Application Process

- Start at the loanDepot website

- Complete the application and upload 1003 docs

- Get prequalified, usually within one hour

- Submit the full package through mello

- Expect 30-45 days from submission to CD

Approval Timeline

- Pre Approval in as little as an hour once all docs are uploaded online

- Conditional approvals within 1 week normally

- Closings scheduled 2-4 weeks from full submission

loanDepot is a compelling choice for borrowers who value digital ease, competitive options, and versatile service above all else. With dedication to customer satisfaction and innovation, they appear poised for continued market domination.

Conclusion

It’s no mistake that most loanDepot branches have an A+ rating from the Better Business Bureau. Their customer-centric approach focused on helping families achieve their homeownership dreams through digital tools and diverse services has earned them high praise.

While no mortgage experience will ever be perfect, loanDepot’s streamlined digital process and hybrid service resources aim to minimize the stress most borrowers face. Their commitment to serving people for life through every step of the mortgage loan journey reflects in the industry recognition and customer reviews.

For individuals seeking an innovative lender that delivers competitive rates, streamlined documentation, and standout personal guidance, LoanDepot proves highly equipped to handle most mainstream scenarios with its renowned expertise. Customers value LoanDepot’s dedication to efficient and easy service through the challenging home ownership market.

Those prioritizing an efficient, versatile loan experience backed by a trusted brand name would be making a good decision by choosing loanDepot. They have a proven track record of helping customers acquire their dream home.

FAQs

What types of loans does loanDepot offer?

loanDepot offers a variety of home loan products, including purchase loans, refinance loans, HELOCs, construction loans, FHA loans, VA loans, jumbo loans, and specialty loan programs.

How does loanDepot compare with other lenders in terms of fees?

LoanDepot offers fees comparable to or lower than those of most major lenders. It does not charge prepayment penalties or excessive junk fees.

Can I negotiate my interest rate with loanDepot?

Yes, it is possible to negotiate rates slightly by offering competing pre-approvals, an excellent credit profile, flexibility in closing timing, large down payments, or other perks to the loan officer.

What are the steps to apply for a loan with loanDepot?

The application process involves starting online, uploading documents through the mello platform, getting prequalified, submitting full documentation, approving/denying, and scheduling the closing, on average, 2-4 weeks later.

How does loanDepot handle customer support and complaints?

LoanDepot prioritizes responsive, knowledgeable customer service, which is available by phone, email, chat, and website. Customers report issues are addressed promptly and satisfactorily.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.