Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Speedy Cash: Reviews and Ratings

When you’re in a financial bind and need cash fast, finding a reliable lender can be challenging. Whether it’s an unexpected medical bill, urgent car repair, or rent due before your next paycheck, payday loans often seem like a quick solution. If you’ve searched for short-term loan options, you’ve likely come across Speedy Cash, one of the most recognized names in the payday lending industry.

But how does it compare to other lenders? Are the interest rates fair? Do customers find their services reliable? Before applying, it’s crucial to understand real customer experiences, loan terms, and potential risks.

Since its founding in 1997, it has served borrowers, offering payday loans, installment loans, title loans, and lines of credit. This article breaks down their loan offerings, customer reviews, legal compliance, and overall reputation, so you can decide whether it’s the right financial solution for you.

We’ll examine real customer feedback, competitor comparisons, and repayment flexibility, ensuring you have all the information you need before borrowing.

Loan Offerings: Types of Loans Available from Speedy Cash

Photo Credit: Speedy Cash

Speedy Cash offers several loan products designed to accommodate different financial situations. However, loan availability, terms, and interest rates vary by state. Before applying, borrowers should check their state’s regulations to understand which options are accessible.

1. Payday Loans

- Loan Amount: $50 – $1,000 (varies by state)

- Repayment Term: Due on your next payday (typically within 14 – 30 days)

- Fees & APR:

- $10 – $30 fee per $100 borrowed

- Effective APR: 150% – 600% or higher, depending on state regulations

- Best For: Short-term financial emergencies such as unexpected medical bills or urgent car repairs

Payday loans are meant to be repaid in full by the borrower’s next paycheck. Due to their high interest rates and short repayment terms, they can be difficult to manage if not used responsibly.

2. Installment Loans

- Loan Amount: Up to $5,000

- Repayment Term: 3 – 24 months

- APR Range: Typically 100% – 300%

- Best For: Borrowers who need a larger loan amount with a structured repayment plan

Unlike payday loans, installment loans are repaid over an extended period, allowing borrowers to make fixed monthly payments instead of paying back the full amount in one lump sum.

3. Title Loans

- Loan Amount: $1,000 – $25,000 (varies based on the vehicle’s value)

- Repayment Term: Varies by state

- APR Range: Typically 100% – 300%

- Collateral Required: Yes – The borrower must use their vehicle’s title as loan security

- Best For: Individuals who own a vehicle and need access to a higher loan amount

Since title loans use a borrower’s vehicle as collateral, failing to repay the loan could result in the lender repossessing the car. Borrowers should carefully assess their ability to repay before choosing this option.

4. Line of Credit

- Credit Limit: Up to $5,000

- Repayment Term: Revolving credit (borrow and repay as needed)

- Interest Charges: Borrowers only pay interest on the amount withdrawn, not the entire credit limit

- Best For: Those who need flexible access to cash over time rather than a lump sum

A line of credit allows borrowers to withdraw funds as needed, making it a more flexible option than payday or installment loans.

5. Loan Eligibility & APR Ranges

Before applying, borrowers should understand eligibility requirements and APR ranges for each loan type.

General Requirements (for all loan types)

✔ Must be at least 18 years old (19+ in Alabama)

✔ Must have verifiable income

✔ Must be a U.S. resident with a valid ID

✔ Must have an active checking account

Loan APR Ranges & Credit Check Requirements

| Loan Type | Max Amount | APR Range | Credit Check? |

| Payday Loan | Up to $1,000 | 150% – 600%+ | No hard check |

| Installment Loan | Up to $5,000 | 100% – 300% | Yes, but lenient |

| Title Loan | Up to $25,000 | 100% – 300% | No hard check |

| Line of Credit | Up to $5,000 | 35% – 400% | Yes, but flexible |

Loan terms and eligibility criteria may vary based on state regulations and Speedy Cash’s underwriting policies. Borrowers should check their state’s specific loan terms before applying.

6. How to Apply for a Loan

They provide three application methods for borrower convenience.

Online Application (Fastest Option)

- Visit www.speedycash.com.

- Select the loan type and enter personal details.

- Submit proof of income, a valid ID, and bank account information.

- Receive a loan decision within minutes.

Phone Application

- Call 1-888-333-1360 (English) or 1-855-734-0111 (Spanish).

- Speak with a representative to complete the application over the phone.

In-Store Application

- Visit a location in one of the 15 states with physical stores.

- Bring the following:

- Government-issued photo ID

- Recent pay stub (proof of income)

- Bank account details

7. Loan Processing & Funding Time

- Online applications: Same-day funding (if approved early in the day)

- In-store applications: Cash pickup is available immediately

- Debit card funding: Instant in eligible states

For borrowers who need money quickly, Speedy Cash’s same-day approval and funding process make it a convenient option. However, it’s essential to carefully review loan terms and repayment obligations before proceeding.

8. How to Repay Your Loan

Borrowers can choose from multiple repayment options to ensure timely payments and avoid penalties.

Payment Methods

- Automatic Bank Withdrawal (ACH Transfer) – Payments are automatically deducted from your checking account.

- Debit Card Payments – Borrowers can make manual payments online through their Speedy Cash account.

- In-Store Payments – Cash payments are accepted at physical store locations.

What If You Can’t Pay on Time?

If you’re unable to make a payment, they offer some flexibility depending on state regulations.

✔ Due Date Extensions: Some states allow borrowers to request an extension on their due date, but this may require additional fees.

✔ Late Fees: A penalty fee is applied if a payment is missed. The exact amount varies by state.

✔ Payment Plans: Borrowers in financial distress can request an alternative repayment plan to help them stay current.

If you’re struggling to make payments, contact Speedy Cash’s support team immediately to discuss available options and avoid additional fees.

What Customers Are Saying About Speedy Cash

Speedy Cash receives mixed reviews from customers across different platforms. While many borrowers appreciate the quick funding and variety of loan options, others express concerns about high interest rates and customer service difficulties. Below is a breakdown of customer ratings and common feedback.

Customer Ratings by Platform

| Review Platform | Rating | Common Praises | Common Complaints |

| TrustPilot | 4.5/5 (9,996 reviews) | Fast funding, flexible loan options, friendly service | High interest rates, repayment struggles |

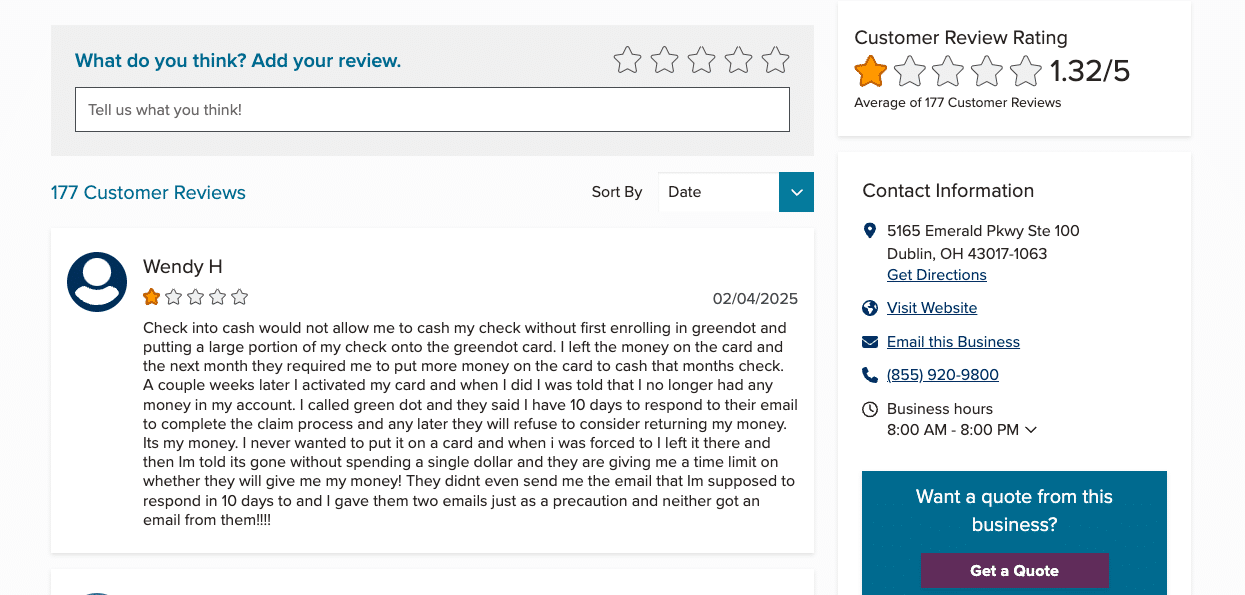

| BBB (Better Business Bureau) | A+ rating (1.32/5 from 177 reviews) | Officially accredited, responsive dispute resolution | Poor customer service, difficulty adjusting payments |

| Google Reviews | 4.2/5 (varies by location) | Quick application process, helpful agents | Website access issues, unexpected fees |

Positive Feedback: Why Borrowers Like Speedy Cash

- Fast Approval & Same-Day Funding – Many customers report receiving their loan within hours after applying.

- Multiple Loan Options – Borrowers appreciate that Speedy Cash offers payday loans, installment loans, title loans, and lines of credit.

- Helpful Customer Service (In-Store & Online) – Some customers praise Speedy Cash for explaining loan terms clearly and offering personalized assistance.

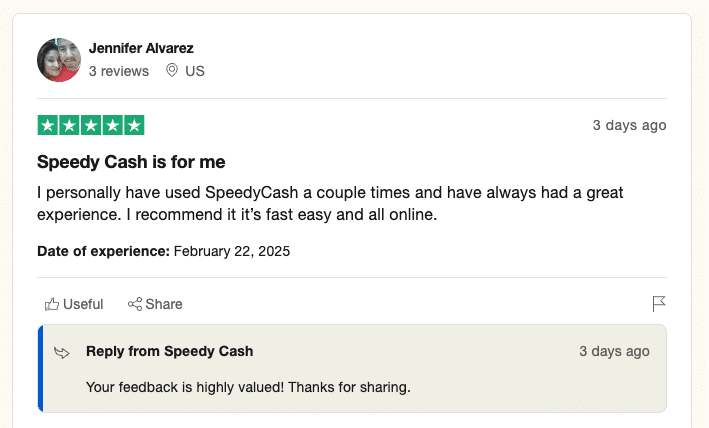

Example Review from TrustPilot:

Negative Feedback: Common Complaints from Borrowers

- High Interest Rates – Many customers feel that the cost of borrowing is too expensive, with APRs far exceeding traditional credit cards.

- Customer Service Issues – Some borrowers have reported difficulty reaching customer support, especially for loan adjustments or payment extensions.

- Website & Account Access Problems – A few users state that they were locked out of their accounts, leading to missed payments and late fees.

Example Complaint from BBB:

Legal Compliance & Scam Awareness: Staying Safe with Speedy Cash

Speedy Cash is a legitimate lender, but borrowers should be aware of state lending laws, scam risks, and potential legal concerns before applying.

1. Is Speedy Cash Legally Compliant?

Yes, Speedy Cash follows state and federal regulations, ensuring it operates legally in 27 states.

- Member of the Online Lenders Alliance (OLA) – This organization enforces fair lending standards and consumer protections.

- State-Licensed Lender – Speedy Cash operates only in states where payday lending is legal and complies with local lending laws.

- Follows the Equal Credit Opportunity Act (ECOA) – Prevents lenders from discriminating against borrowers based on race, gender, or other factors.

- Transparent Fee Disclosures – Speedy Cash publicly displays loan rates and fees on its website based on state regulations.

Some states, including New York, Connecticut, and Massachusetts, have banned payday loans due to high APRs and consumer protection concerns.

2. Has Speedy Cash Been Involved in Legal Issues?

While Speedy Cash operates legally in many states, the payday loan industry has faced regulatory scrutiny due to high APRs and debt cycles. Several lawsuits and investigations have targeted payday lenders, including Speedy Cash, over allegations of unfair lending practices.

- Example: Class Action Lawsuit in California (2018) – In October 2018, a class-action lawsuit was filed against Speedy Cash in California by plaintiffs Cindy Delisle and Robert Dougherty. The lawsuit alleged that Speedy Cash violated California’s Unfair Competition Law (UCL) and Consumer Legal Remedies Act (CLRA) by issuing loans over $2,500 with APRs exceeding 90%, which allegedly violated state lending laws. The proposed class included all California residents who obtained loans from Speedy Cash above $2,500 within a 48-month period prior to the lawsuit. The case sought to challenge the company’s lending practices and recover damages for affected borrowers.

Other Regulatory Actions & Industry Scrutiny

- Texas Payday Lending Restrictions: More than 40 municipalities in Texas have enacted ordinances limiting payday lending practices, affecting Speedy Cash and other lenders. These local laws aim to prevent predatory lending and rollovers that trap borrowers in a cycle of debt.

- California Regulatory Investigation (Settlement Reached): Speedy Cash and its affiliate Galt Ventures settled a dispute with California’s Department of Financial Protection and Innovation (DFPI) over allegations of excessive bank fee withdrawals from over 1,000 customers.

Before applying for a loan, borrowers should review state-specific payday loan regulations to understand potential risks and legal protections.

3. How to Avoid Payday Loan Scams

Fake payday loan companies frequently impersonate legitimate lenders, including Speedy Cash. If you receive an unexpected loan approval notice, it may be a scam.

Signs of a Payday Loan Scam:

- Unexpected Loan Offers – If you didn’t apply but receive a loan approval, it’s a scam.

- Upfront Payment Requests – Speedy Cash never asks for payment before issuing a loan.

- Suspicious Emails or Calls – Scammers may use fake Speedy Cash branding to steal your information.

- Threats of Legal Action – Legitimate lenders do not threaten arrest or lawsuits over unpaid loans.

Official Contact Information for Speedy Cash:

- Website: www.speedycash.com

- Phone: 1-888-333-1360 (English) / 1-855-734-0111 (Spanish)

If you suspect a scam, report it to the Federal Trade Commission (FTC) or Consumer Financial Protection Bureau (CFPB).

Conclusion: Is Speedy Cash Right for Your Situation?

As with any short-term loan, it’s important to assess whether Speedy Cash aligns with your financial needs and repayment ability. Exploring alternative lending options and comparing rates can help ensure an informed decision. Visit their website for more details on loan eligibility and terms.

Frequently Asked Questions (FAQs) About Speedy Cash

1. Is Speedy Cash still around?

Yes, they are still operating and provide payday loans, installment loans, title loans, and lines of credit across 27 U.S. states. Customers can apply online, in-store, or via phone, with funding options including same-day cash pickup or direct deposit.

2. Does Speedy Cash affect your credit?

It depends on the loan type. Payday loans typically do not impact your credit score since they do not report them to major credit bureaus. However, installment loans and lines of credit may be reported, meaning on-time payments can help build credit, while missed payments could negatively impact your score.

3. How long does it take for Speedy Cash to approve a loan?

They offer fast approvals, often within minutes of applying online. For same-day funding, borrowers must complete their application early in the day. In-store applicants can receive cash immediately upon approval, while direct deposit loans may take one business day to process.

4. What payment methods does Speedy Cash accept?

They accepts multiple payment methods for repaying loans:

✔ Automatic bank withdrawal (ACH transfer) – Payments deducted from your checking account.

✔ Debit card payments – Manual payments can be made online.

✔ In-store cash payments – Available at physical Speedy Cash locations.

5. What is the Speedy Cash app?

The mobile app allows customers to apply for loans, check balances, make payments, and manage accounts from their smartphones. It provides a convenient way to access funds and track loan status anytime, anywhere. The app is available for download on the Apple App Store and Google Play.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.