Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Spotloan: Reviews and Ratings

Financial emergencies have a way of showing up unannounced—just when you think you’re in the clear, an unexpected expense lands in your lap. A broken-down car, a surprise medical bill, or an overdue utility payment can throw your budget into chaos.

That’s where Spotloan steps in. This online lender promises fast, flexible loans designed to help when you need cash in a pinch. But is it a reliable financial lifeline, or just another high-cost trap?

In this in-depth review, we’ll break down how Spotloan works, its pros and cons, customer reviews, and how it stacks up against competitors—so you can decide if it’s the right choice for your financial situation.

What Is Spotloan and How Does It Work?

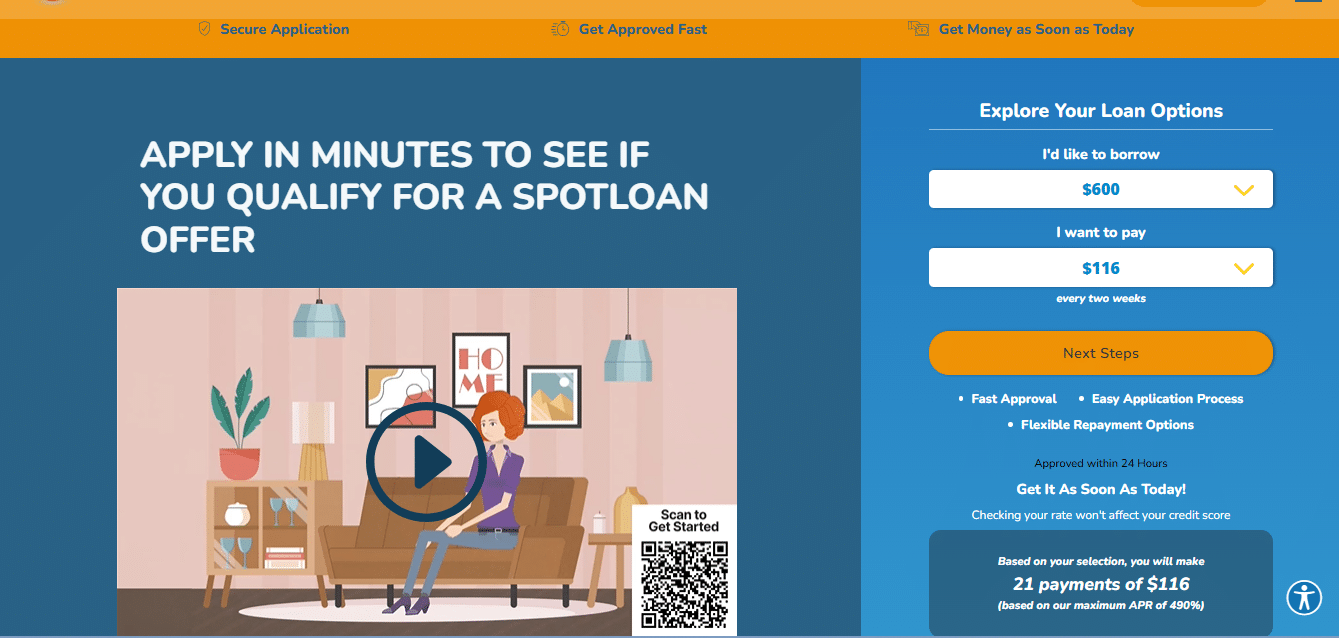

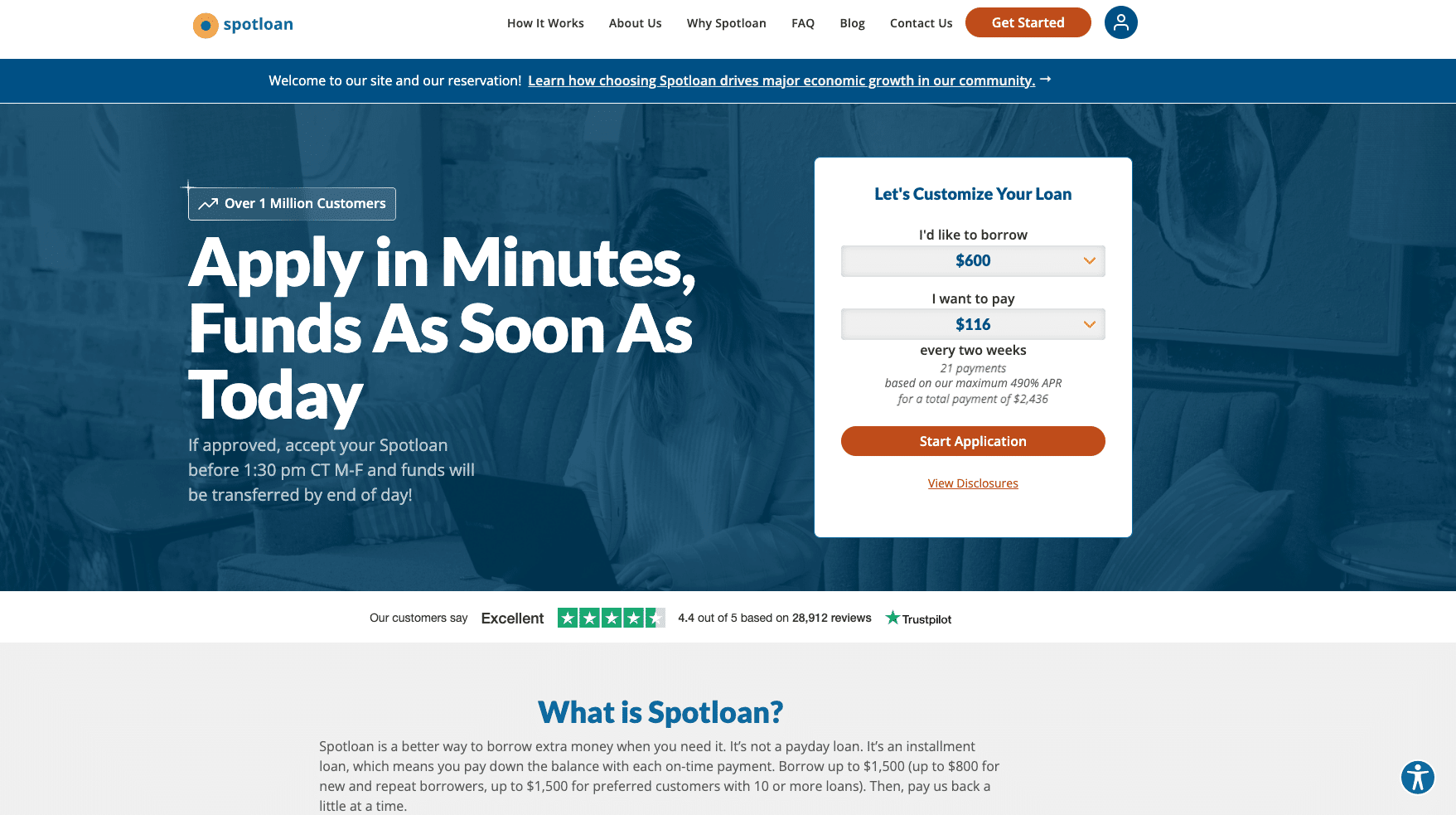

In a nutshell, Spotloan is an online lender that provides short-term loans ranging from a few hundred bucks up to $800 for new and repeat customers. Preferred customers (those with 10+ previous loans) can borrow up to $1,500. It is a more flexible alternative to those dastardly payday loans, with repayment periods stretching several months rather than one single pay period.

Spotloan is designed for borrowers who may have low credit scores, as it typically has less strict credit score requirements. Applying is a breeze – fill out a simple form on Spotloan’s user-friendly website and wait a few minutes to learn your fate. Approval is based on various factors beyond your credit score alone. More on that intriguing detail later!

If accepted, you’ll receive your cash immediately via direct deposit. Timing depends on when you accept the loan terms, but funds usually arrive the same day for approvals before 1:30 p.m. Central. It’s not too shabby when every second counts as your transmission breathes its last puff!

Of course, quick access to cash comes at a cost. Regular payments chip away at your balance over the agreed-upon term. It starts to slip, and those fees add up faster than gray hairs.

While Spotloan provides fast cash, it’s important to consider that fees apply. In fact, Spotloan’s Annual Percentage Rate (APR) can be as high as 490%, making it one of the more expensive borrowing options. Be sure to factor in the full cost before committing to a loan. Regular payments help manage your balance, but those fees can add up.

For a comprehensive approach to financial health, exploring debt management methods like debt consolidation, credit counseling, or planning strategies to pay off debt may be beneficial in the long run.

Spotloan Features and Benefits

The Spotloan Features and Benefits section highlights key advantages that make Spotloan a standout option for short term loan. From flexible repayment schedules to credit-friendly qualifications and fast funding, Spotloan offers accessible solutions for those needing immediate financial support. Dive in to see how Spotloan’s unique approach can provide both relief and convenience.

Flexible Payment Schedules

Spotloan offers flexibility in payment schedules, allowing borrowers to choose between weekly or biweekly payments. This adaptability provides relief from rigid, short-term repayment cycles typical of payday loans, making it easier to align loan payments with individual financial situations.

Credit-Friendly Qualification

Spotloan evaluates applications using an advanced algorithm that considers more than just credit scores, making it accessible to those with lower credit scores. While Spotloan does not rely solely on traditional credit checks, they assess financial history to determine eligibility.

Opportunity for Second Chances

Spotloan’s flexible approach provides a second chance for individuals who have had credit challenges in the past. This makes it a viable option for those looking to rebuild financial stability while managing immediate cash needs.

Fast Funding for Urgent Needs

Spotloan’s quick funding process is designed for borrowers in need of immediate financial relief. With funds often available on the same day, this feature provides peace of mind to those in urgent situations who require a fast and dependable option.

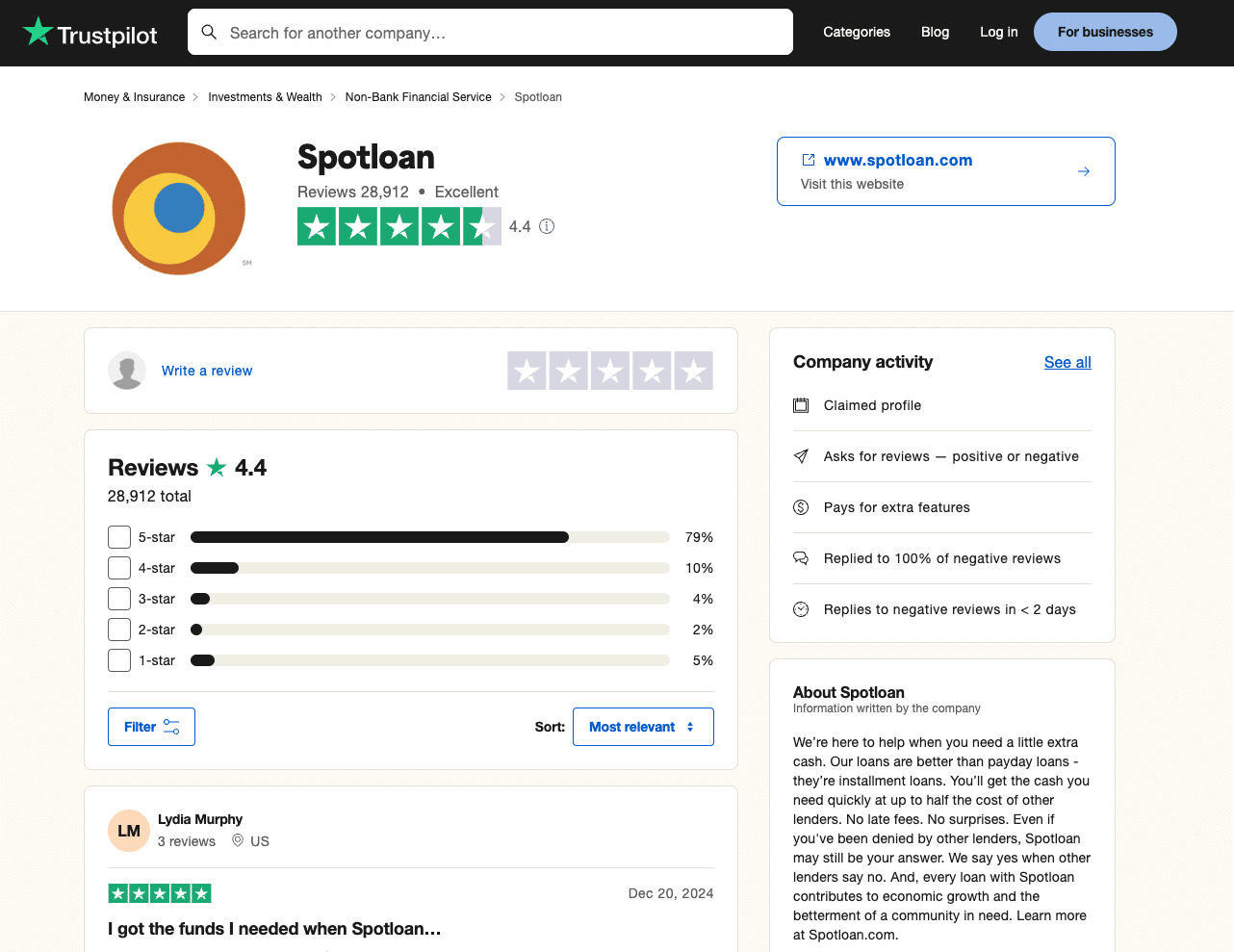

Spotloan Reviews and Customer Experiences

What do real customers have to say about Spotloan? On Trustpilot, the lender holds a solid 4.4-star rating from thousands of reviews. Many borrowers praise the quick approval process, clear terms, and same-day funding. “I received my loan the exact same day, and it helped tremendously,” raves one satisfied customer. Others highlight responsive and helpful customer support, making the borrowing experience smoother.

However, not all reviews shine. The most common complaints revolve around high interest rates, with some borrowers reporting that their actual rates exceeded the quoted maximum—a costly surprise. Others mention repayment difficulties, particularly when struggling to keep up with scheduled payments.

Despite these concerns, positive feedback outweighs the negative for many who need fast cash in an emergency. But as with any loan, the fine print matters—what feels like a financial lifeboat for one borrower might become an anchor for another.

Spotloan vs. Competitors

Now for the main event—how does Spotloan stack up against competitors in the financing jungle? On one hand, payday loans pose a far worse threat. With interest rates verging on usurious and unpaid balances due in one fell swoop, payday loans prey on the financially frail. At least Spotloan spreads payments over months at a time.

In contrast, traditional loans from banks and credit unions offer better basic terms but also stricter requirements. Solid credit and mountains of paperwork make quick access difficult when disaster strikes. Plus, not all traditional lenders serve the cash-strapped.

Other online lenders fall in between these extremes with varying pros and cons. Contenders like OppLoans and NetCredit cut out physical branches but still demand decent credit.

At the end of the day, each person’s situation differs, so shop around if time allows. Spotloan excels for some, but not everyone’s financial fantasy.

Is Spotloan Worth It? Pros and Cons

Spotloan Pros:

- Easy, fast application and funding

- No strict credit check hinders applications

- Flexible repayment schedules accommodate varied cash flows

- Customer service earns praise more than complaints

Spotloan Cons:

- Interest rates significantly exceed most credit cards and personal loans

- High fees and penalties for late or missed payments

- Limited funding caps may not solve all financial woes

- Bad credit results in maximum interest rates

While Spotloan simplifies access to fast cash, its convenient terms come at a high-interest cost. It’s a viable bandaid for short-term needs but not a cure-all.

Those with access to less expensive credit elsewhere should explore alternatives first before relying on Spotloan in the long term.

Who Should Consider Spotloan

Spotloan is owned and operated by BlueChip Financial, a lending entity governed by the Turtle Mountain Band of Chippewa Indians. Because of this, Spotloan is regulated under tribal law rather than state lending laws, which can impact consumer protections. Borrowers should be aware that legal disputes may fall under the jurisdiction of the tribal court system rather than state courts.

Now that the warts are out in the open, who truly stands to benefit? Generally speaking, Spotloan fits those in brief binds who:

- Need quick cash but have imperfect or low credit scores

- Face an unexpected expense too large for savings to swallow

- Commit to the full repayment period to minimize total costs

- Lack of options for quicker help from banks, credit unions, or friends

On the other hand, Spotloan likely isn’t the best fit if:

- You’ll struggle to make higher monthly payments as interest accrues

- The loan period extends longer than the underlying problem

- Alternative credit exists at lower rates elsewhere

- Multiple late fees seem inevitable based on cash flow

At the end of the day, only you know your full financial story. Hopefully, this analysis offers sound guidance on whether Spotloan offers a prudent patch or an expensive mistake. Your money, your call – now you’ve got informed insight!

How to Apply for a Spotloan

Ready to take the plunge? Here’s a quick run-through of the Spotloan application process. However, note that Spotloan is not available in certain states, including Arkansas, Connecticut, District of Columbia, Illinois, Maryland, Minnesota, New York, North Dakota, Pennsylvania, Vermont, Virginia, and West Virginia. Be sure to check eligibility before applying.

Eligibility Check:

- Be 18+ years old

- Earn at least $800 monthly from job/benefits

- Have a valid checking account in your name

Application Steps:

- Visit Spotloan.com and provide contact/income info

- Provide bank account and ID verification details

- Review and accept the loan agreement

- Wait a few minutes for an underwriting decision

Upon Approval:

- Funds arrive via direct deposit usually within 1 business day

- The first payment is due 14-30 days after the funding

Keep documents on hand for proof of income, identity, and residence during underwriting as needed. Spotloan strives to simplify each step so financial help is hassle-free. Just remember to read the fine print closely before pressing “accept.”

Read More: How to Qualify for a Loan: Step-by-Step Guide to Qualifying with Confidence

Conclusion

With that, we’ve reached the grand finale of our wide-ranging Spotloan review. In summary, this online lender makes quick cash convenient for some situations. However, high-interest costs warrant exploring cheaper options first.

Going in eyes-wide-open prevents frustration later. Only you know if Spotloan serves as a short-term savior or a long-term financial albatross. This breakdown offers clarity to guide your decision. Best of luck with getting your finances shipped!

Frequently Asked Questions

1. Is Spotloan legit?

Yes, Spotloan is a legitimate online lender that offers short-term installment loans. It is operated by BlueChip Financial, which is owned by the Turtle Mountain Band of Chippewa Indians. However, Spotloan loans come with high interest rates (APR up to 490%), so borrowers should carefully consider the total cost before applying.

2. Is Spotloan a payday loan?

No, Spotloan is not a payday loan. Unlike payday loans, which require full repayment by your next paycheck, Spotloan offers installment loans that can be repaid over several months. However, its interest rates can still be very high, so it’s important to compare with other lending options.

3. Does Spotloan report to credit?

No, Spotloan does not report monthly payments to the three main credit bureaus. If you’re seeking a loan to help build or improve your credit, you may want to consider other lenders that report payment activity to credit agencies.

4. Who owns Spotloan?

Spotloan is owned and operated by BlueChip Financial, a lending entity governed by the Turtle Mountain Band of Chippewa Indians. Because of this, Spotloan operates under tribal law rather than state lending regulations.

5. How quickly can I receive funds from Spotloan?

Approval and funding times depend on when you accept the loan terms:

- Weekdays before 11:30 a.m. CT: Funds are typically deposited the same day.

- Monday through Thursday after 11:30 a.m. CT: Funds are usually deposited overnight.

- Fridays after 11:30 a.m. CT through Sunday: Funds are generally available by the end of the next business day.

Please note that actual availability may vary based on your bank’s processing times.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.