Better Tax Relief: Tax Resolution Services Explained

Better Tax Relief offers a wide range of services to help individuals and businesses manage their tax issues. Their expertise in tax resolution ensures that clients receive the best possible outcomes for their tax problems.

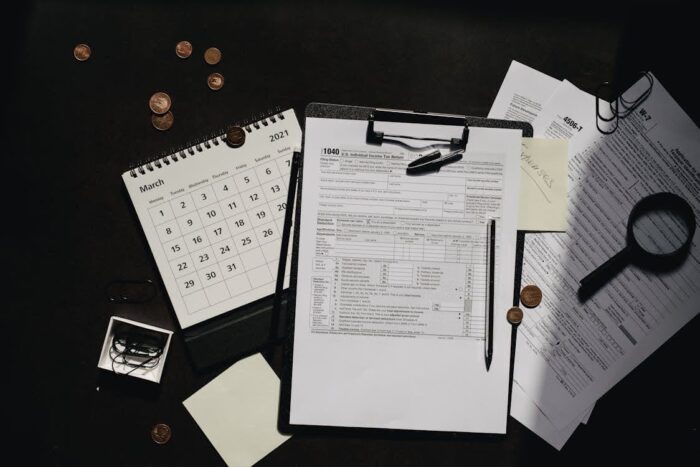

Whether you’re an individual or a business owner, dealing with tax issues can feel incredibly stressful. Between confusing rules and regulations, mountains of paperwork, and the looming threat of penalties or further escalation, taking on the IRS alone is a scary proposition. That’s where professional tax resolution services like Better Tax Relief can make a big difference.

As one of the leading financial services companies and one of the most experienced tax resolution firms in the country, Better Tax Relief has helped thousands of clients resolve complex tax problems for over a decade. Tax relief experts play a crucial role in resolving tax issues by providing specialized knowledge and support.

Their team of Licensed Enrolled Agents, CPAs, and tax attorneys have deep expertise in all areas of tax law. Just as important, they understand the human element. Better Tax Relief’s friendly, caring approach helps relieve anxiety so clients can focus on getting their financial lives back on track.

What Makes Better Tax Relief Unique?

There are a few key factors that set Better Tax Relief apart from run-of-the-mill tax services. First and foremost is their expert team of tax resolution experts. Additionally, all representatives have undergone rigorous training and hold relevant credentials and licenses.

Better Tax Relief tackles every issue manageably and stands out for its lengthy track record of success. Over the years, an intimate understanding of IRS procedures has developed, leading to highly favorable outcomes. Perhaps most valued by customers, though, is the personalized attention they receive. They provide personalized solutions tailored to the unique needs and circumstances of each client.

Better Tax Relief Services

Better Tax Relief’s all-inclusive offerings, including tax resolution services, cover various scenarios that can derail taxpayers. Early intervention proves crucial to avoiding snowballing costs down the line. Let’s examine their specialized assistance in greater depth:

Audit Defense

If you’ve received a notice about an upcoming IRS audit, it’s only natural to feel overwhelmed. That’s where Better Tax Relief’s tax resolution experts and audit defense specialists shine. They meticulously review documentation, identify strategies to maximize allowable deductions, and participate directly in audit meetings to ensure compliance and protect client rights. They also part in examinations to ensure compliance while shielding clients from undue penalties or harassment.

Better Tax Relief Tax Debt Negotiation

A tax resolution firm like Better Tax Relief understands that paying full balances upfront rarely proves feasible. Better Tax Relief’s multi-pronged tactics explore alternatives like Offers in Compromise or Installment Agreements, allowing payment over time at amounts within taxpayers’ means. Their track record of securing discounts of up to 90% motivates struggling citizens to act sooner rather than suffer stress indefinitely.

Back Taxes and Penalty Assistance

Tax resolution experts can help with unfiled returns from years past, which can quickly accumulate fines and interest, causing significant stress and challenges for individuals. Therefore, the trained agents at Better Tax Relief know how to file unsubmitted forms and apply for penalty abatement to wipe out part or even all of the added charges.

Tax Lien and Levy Resolution

A tax resolution firm can help when a tax lien or levy threatens livelihoods through property seizures or paycheck withholding. Wage garnishments or property seizures also quickly disrupt daily life. However, Better Tax Relief swiftly enters battle, requesting the postponement of active enforcement actions. Their rebuttals to tax authority satisfaction leave clients better positioned for ultimate agreement or dismissal of burdensome liens altogether.

Filing Unsubmitted Returns Avoids Heightened Fines

Procrastination on unfiled tax returns incurs unnecessary charges in addition to balances owed. Better Tax Relief’s tax resolution experts proactively prepare and submit missing returns to curtail mounting interest and penalties. With arrears settled properly, clients regain standing with the IRS and move forward financially.

Managing Complex Issues Through Personalized Planning

Free initial consults with tax resolution experts explore all remedy angles comprehensively. Representatives request tax histories directly from IRS data repositories before crafting blueprints tailored to individual needs. Better Tax Relief prioritizes transparency with status updates confirming steady advancement.

Their one-on-one approach gives confidence that no avenue goes overlooked in the pursuit of closure. Better Tax Relief’s services help clients achieve financial freedom by simplifying complex tax issues and providing personalized solutions.

Resolving Cases Effectively Through Expert Intervention

Negotiation remains delicate work requiring nuanced IRS understanding, especially when managing IRS concerns. Better Tax Relief, a tax resolution firm, knows the procedural ins and outs to employ the right strategies persuasively.

Having helped numerous operations escape six-figure liabilities, they know compromise mechanisms yielding taxpayers fair outcomes. Clients feel secure leaving delicate discussions to capable representatives who follow strict procedures and applicable laws.

Restoring Tranquility and Financial Prospects

Tax resolution experts understand that even minor tax headaches corrode mental wellness over time. Better Tax Relief restores positive outlooks through easy problem-solving. Their guidance helps people save properties, clear credit histories, and refocus on futures less clouded by lingering dues. Freeing clients from liens and levies lifts weights so life’s more meaningful tasks can resume unimpeded.

The Better Tax Relief Process

Better Tax Relief offers comprehensive tax resolution services to help you navigate complex tax issues.

Step 1: Free Better Tax Relief Initial Consultation

During your first meeting, Better Tax Relief tax resolution experts want to understand your situation fully. Expect a discussion of personal details, an audit of past returns, and a Q&A to scope out resolution alternatives.

Step 2: Investigation and Case Review

Next, Better Tax Relief’s experts thoroughly examine your complete tax history through their tax resolution services. This includes obtaining records directly from the IRS to verify balances, payments, penalties, and more.

Step 3: Negotiation and Resolution

Armed with a crystal clear picture of your account, Better Tax Relief’s tax resolution experts initiate discussions with the IRS on your behalf. The end goal? A formal agreement to settle all outstanding issues on favorable terms you can afford.

Why Professional Tax Relief Services Matter

Tax resolution experts can provide invaluable assistance when dealing with complex tax issues. Their professional tax relief services are designed to help you navigate the intricacies of tax laws and regulations, ensuring you achieve the best possible outcome.

Avoiding Common Pitfalls

Tax resolution experts can help you avoid common pitfalls when dealing with the IRS. Tax relief firms shield clients from this danger by catching errors, ensuring on-time filings and payments, respecting procedural protocols, and more. When penalties and interest are at stake, DIY is usually not a strategy.

Peace of Mind and Long-Term Financial Stability

Even seemingly small amounts owed, if left ignored, can balloon quickly due to compounding charges. With Better Tax Relief providing tax resolution services, managing communications, and surfacing smart compromise options, stress fades so you may refocus energy on rebuilding savings, investing in your business, or taking a well-earned vacation! Relief from lingering liabilities also means protecting credit scores and assets from IRS action.

Better Tax Relief’s Proven Results

Hearing relief stories motivates struggling taxpayers to seek help sooner. Better Tax Relief’s tax resolution experts satisfy each unique circumstance, from large corporations to average Joe’s facing audit nightmares or mountains of penalties.

Above all, testimonials emphasize professionalism exhibited through resolving difficult cases within targeted deadlines or shortened estimated durations. Customers feel heard and supported throughout every phase thanks to compassionate associates vowing constant communication and updates, enhancing the experience.

Client Testimonials from Better Tax Relief

Hear directly from people just like you on how Better Tax Relief and their tax resolution experts transformed their situations. Some owed just a few hundred, while others faced tens of thousands. Regardless of size, each case shared the same happy ending – freedom from the taxman at a portion of their initial balance. Positive feedback f

rom clients reinforces the value of Better Tax Relief’s services.

Industry Recognition

Industry recognition acknowledges technical skills and dedication to justice, which have been repeatedly carried out for years through their tax resolution services. The company secures esteemed ratings with an ‘A+’ BBB grade, highlighting consistent client care within intricate regulations. Awards celebrate innovations assisting greater volumes yearly with quality still exceeding expectations. Community members feel assured entrusting complicated matters requiring nuanced handling to a celebrated provider.

How to Get Started with Better Tax Relief

Initial consultations for tax resolution services establish the next steps quickly at no cost or risk. Share recent returns plus related notices for reps to hit the ground running strong. Better Tax Relief then fine-tunes options catering to budgets, objectives, and timetables.

The ride toward finalization may take months, but regular check-ins prevent restlessness. Soon, resolution letters arrive, allowing fresh financial starts ahead worry-free!

Easy Consultation Booking

Have your latest tax filings and any correspondence from tax authorities prepared to arrange an intro call quickly with tax resolution experts. Better Tax Relief guides new customers smoothly through logistics so the real work of solving pressing issues can commence right away.

What Clients Can Expect Moving Forward

Better Tax Relief communicates progress every step of the way through its tax resolution services. Lengthy tasks like offers and compromises might take months, but regular check-ins and quick responses to questions minimize uncertainty. Before long, negotiations wrap up with the prized IRS closure letter.

Conclusion

In summary, Better Tax Relief is here to take the stress out of dealing with the IRS. Whether you’re an individual or a business, their team of friendly tax experts — including CPAs, Enrolled Agents, and tax attorneys — will work closely with you to resolve your tax issues quickly and effectively. From negotiating tax debt to handling audits or filing unsubmitted returns, they’ve got the expertise to get you the best possible outcome. What sets them apart is their personalized approach and commitment to keeping you informed every step of the way.

For instance, if you’re feeling overwhelmed by tax problems, Better Tax Relief offers the guidance and support you need to regain control and move forward with confidence. Let their experienced team take the burden off your shoulders and help you get back to focusing on what matters most in your life!

Frequently Asked Questions

Is a Free Consultation Really Free?

You bet—Better Tax Relief’s initial meeting costs nothing at all. They want new clients to feel comfortable before proceeding to paid representation.

How Long Does the Process Take?

Timeframes vary case by case, but most wrap within 6-18 months. Faster settlements are possible for less complex situations, too. BetteRelief’slief’s expertise frequently reduces typical IRS processing periods.

What Can’t Can’t Afford to Pay?

Financing options through payment plans keep the American dream of tax relief accessible for all. Better Tax Relief crafts affordable terms tailored to individual budgets.

Tax turmoil fosters uncertainty, but seeking counsel provides direction. Better Tax Relief brings certainty and light ahead for anyone facing the IRS as a trusted ally committed to resolution success.