Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Credit Fresh: Reviews and Ratings

Financial needs are a mainstay throughout any person’s life. Sometimes they are planned, sometimes not. It is natural to want to explore borrowing options in specific cases where these needs arise. Just know there are plenty of options if this is the case. Whether it’s covering unforeseen expenses or bridging a gap, exploring different personal lines of credit and credit products can be a godsend in dealing with your finances in an efficient and effective manner.

Always remember, thorough and holistic research is essential to guarantee yourself the best short term and long term outcome for your finances and future. This article aims to provide you with valuable insights into CreditFresh, helping you assess if it could be the answer you’ve been looking for.

CreditFresh is a popular name in the credit line world. If you have been doing any sort of research on the topic, doubtless they have popped up. We are gonna explore all the ins and outs of Credit Fresh, including ratings, overview, history, and much more. By the end of this article, you will have your PHD in all things CreditFresh, so you’ll be able to make an informed decision on whether they are the right option for your financial situation. Let’s get started!

CreditFresh: History and Overview

CreditFresh was founded in 2019 and is headquartered in Newark, Delaware. They primarily function as a digital lending company. Because they are partnered with FDIC insured banks, they are able to provide lines of credit to consumers across the United States. CreditFresh aligns themselves as a company dedicated to using digital platforms to provide customers with lines of credit.

CreditFresh started with offering its services in 15 states. As of 2025, they are now able to offer lines of credit in up to 24 states, including Alabama, Alaska, Arizona, Arkansas, Delaware, Florida, Hawaii, Idaho, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Nebraska, Ohio, Oklahoma, South Carolina, Tennessee, Texas, Utah, Washington, and Wisconsin. The company’s primary target market is consumers with less-than-perfect credit who may have been rejected by more traditional lenders.

CreditFresh is a very modern presence in the lending realm, offering a streamlined and efficient approach with their online services. They have a distinct set of options for their prospective customers.

Here’s a breakdown of their services:

-

Line of Credit: CreditFresh specializes in delivering lines of credit, which is a different concept from installment loans. Instead of receiving money like a loan, you get an agreed-upon amount of credit that is used similarly to a credit card. The amount ranges from $500 to $5,000, depending on which state you’re in and your qualifications

-

Flexible Access to Funds: Like a credit card, you can draw money, pay off, and redraw as you need.

-

Online Management: With their emphasis on online interface, the services are very accessible and easy to use

-

Repayment: Repayment due dates can be aligned with your paychecks, making CreditFresh pretty easy to pay off

-

Credit Reporting: Since your use of CreditFresh is reported to Credit Bureaus, on-time payment can increase your credit score, and late payments can lower your credit score.

CreditFresh: Pros and Cons

CreditFresh, just like most businesses, has a defined set of strengths and weaknesses. Being fully aware of what these are will go a long way in your decision regarding their services, or using lines of credit in general.

Here’s a detailed overview of the potential pros and cons associated with Credit Fresh:

Pros:

- Flexible Borrowing: Draw, pay off, redraw on your own time. Lines of credit offer large amounts of flexibility, compared to installment loans for example.

- Quick Access to Funds: Customers often are able to secure their line of credit on the same day they apply. This is a huge advantage in cases of emergency

- Convenient Online Process: Using the online process to manage accounts, make payments, and draw money is highly easy and convenient.

- Potential for Building Credit: Making payments on time consistently is an effective way to build credit

- Transparency: CreditFresh is very upfront and transparent about any fees and interest rates. This can provide a measure of peace for potential borrowers.

Cons:

- Annual Percentage Rate (APR): Lines of credit often come with annual percentage rates that can be higher than traditional installment loans, depending on your creditworthiness and other factors. APR starts at 65%, but can be much higher.

- Fees and Terms: Even though they’re upfront about fees and terms, they still exist. It is important to be well aware of them before signing off on anything.

- Impact on Credit Score: While responsible use can help build credit, mismanagement, such as missed payments, can negatively impact your credit score.

- Not a Long-Term Financial Solution: Lines of credit are designed for short-term lending needs. They are too expensive to be a viable long-term financial strategy.

CreditFresh: Comments, Ratings, and Reviews

Hearing about other people’s experiences is a very valuable insight when forming opinions and making decisions. To gain a comprehensive understanding of CreditFresh, we’re gonna review what users have to say. Ratings and reviews on trusted platforms like the Better Business Bureau (BBB), Trustpilot, and Google Reviews will offer valuable insights.

It is worth noting, however, that user reviews should best be taken with a grain of salt. There are many troll reviews and frustrated borrowers who lash out due to financial hardship by leaving bad reviews. These reviews should be weighed heavily with this in mind. In fact, most lender companies have low reviews due to this behavior.

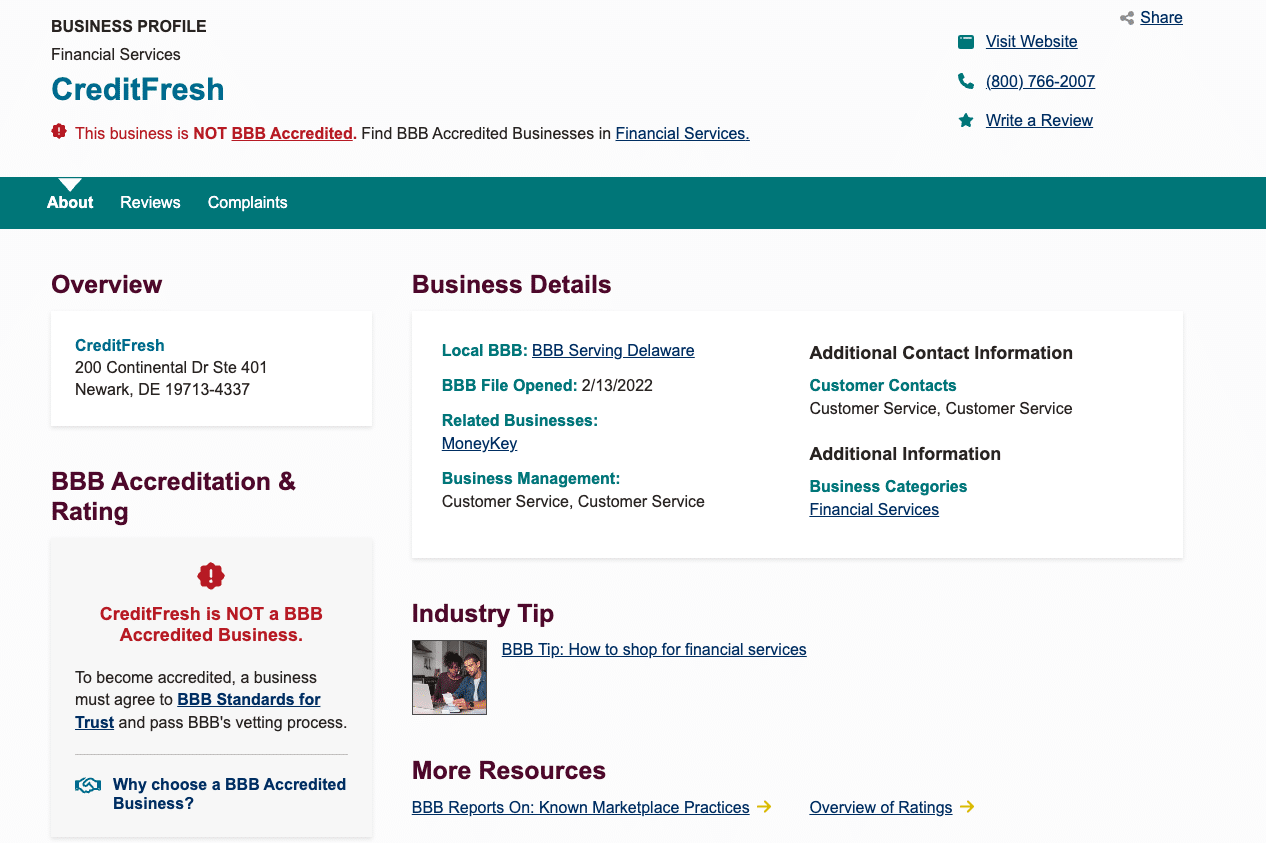

BBB- Unaccredited:

CreditFresh is currently unrated and unaccredited by the BBB. They have an F rating due to various customer complaints, meaning they are under evaluation from the BBB. There is limited data to get an inclusive opinion on the matter.

Negative reviews tend to focus on high fees, payments going primarily to interest, and difficulty reducing principal. Positive reviews are generally regarding the company responding to complaints and resolving specific issues.

Here is a real positive review of CreditFresh on BBB: “I had an issue with my CreditFresh account regarding the billing cycle charges and my payment schedule. I contacted customer service through the BBB complaint process, and CreditFresh responded quickly. They explained my payment breakdown and worked with me to clarify my statements. While the fees are high, I appreciate that the company addressed my concerns promptly and provided clear communication. My issue was resolved, and I’m satisfied with how they handled it.”

Here is a real negative review: “I got a loan from CreditFresh; they are a predatory loan scam. Agreement Date started 12-18-24. I have made over six payments, each paid bi-weekly, each of $317.00. Initial loan/line of credit was for $4,750. I have made 6 payments; about $270 goes to fees each bi-weekly payment, only $46.00 to principal. The fees never diminish for the lifetime of the loan. My new amount owed… So my overall balance is increasing. These people need reviewed for predatory lending and need shut down.”

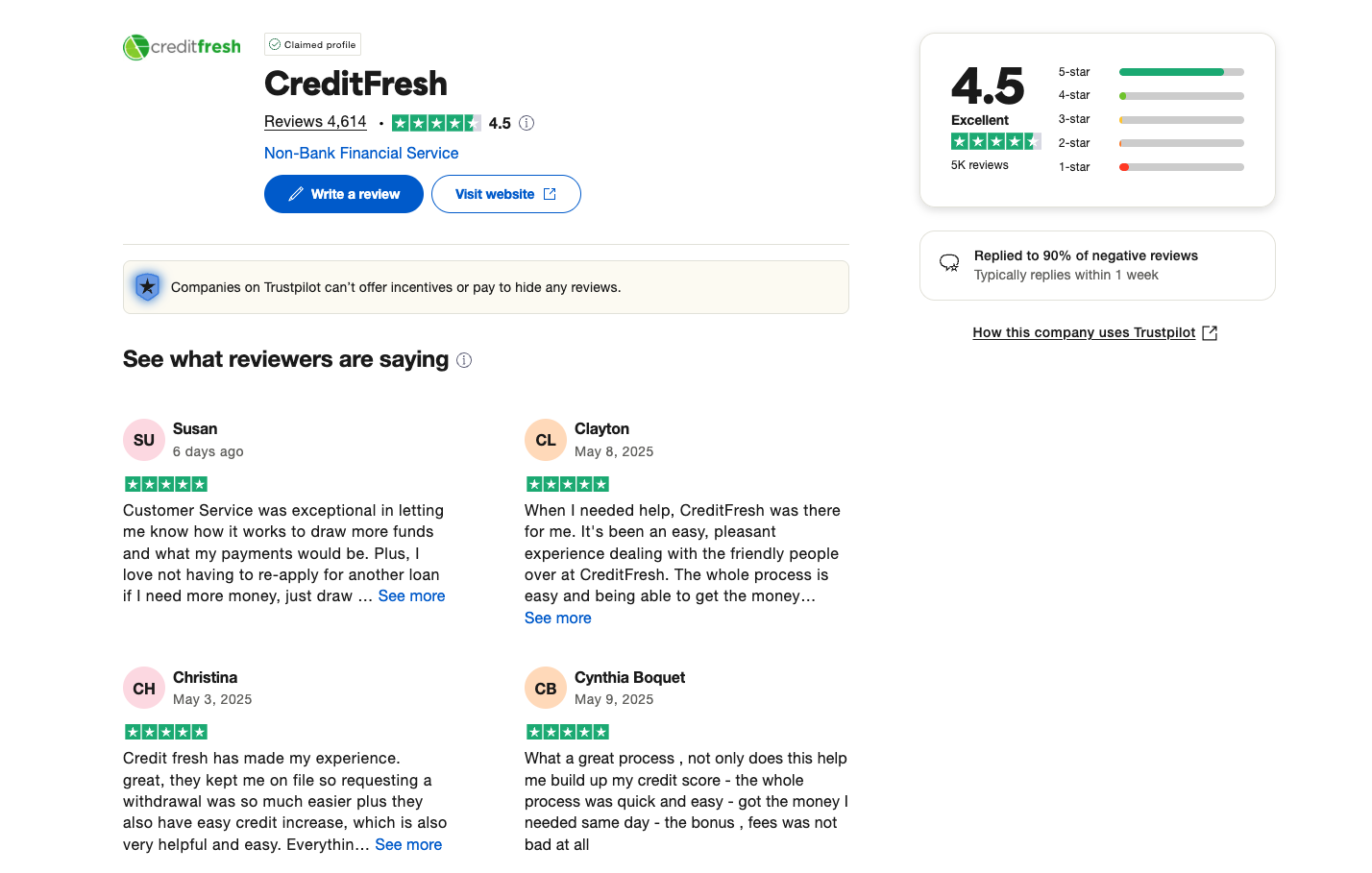

Trustpilot: 4.5/5

Trustpilot reviews and ratings tell a different story altogether. CreditFresh has a strongly positive rating on Trustpilot, with a reported score ranging from 4.5 to 4.8 out of 5 stars based on over 1,000 customer reviews. Customers frequently praise the company for its fast funding process and the ease of obtaining a line of credit, especially for those with less-than-perfect credit. Many reviewers appreciate the straightforward application and quick access to emergency funds.

Here’s a positive review: “CreditFresh has been the peace of mind I have needed. I wish that the rates weren’t so high but other than that, I’m glad that I have availability to funds should I need them.”

Here’s a negative review: “Be VERY cautious of this company…. It’s VERY expensive!!! Credit Fresh will lend you money; however, in the fine print that no one reads are absurd fees. For example, for me, there is a minimum loan processing fee of $400 per month and then $65 payment to the loan principal. So, I am paying $65 towards the loan and $400 per month in loan processing, interest fees to the company. At this rate, the loan will ‘Never’ be paid of, EVER!”

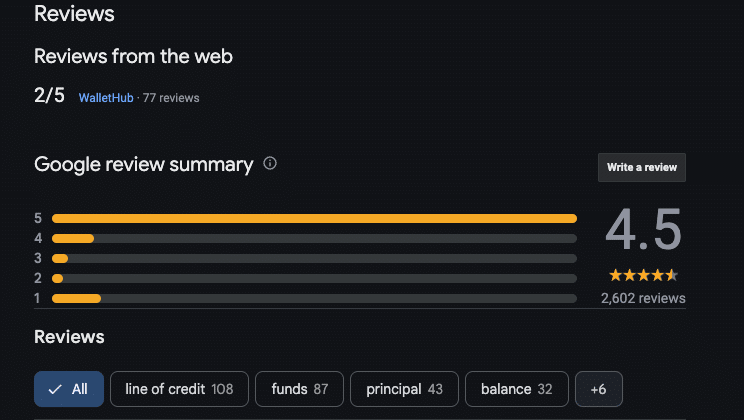

Google Reviews: mixed to negative

There isn’t conclusive data on Google Reviews, but the overall customer sentiment is mixed to negative. Most negative reviews focus on high costs and fee structures, and positive reviews highlight fast access to funds in emergencies.

Positive Quote: “CreditFresh worked out for me when I needed money fast. The interest rates are higher than I’d like, but I expected that with a payday loan.”

Negative Quote: “It is a scam. They add $115 billing and fee’s charge to every payment you make. Make a payment of $150 and $35 only goes towards the debt, wish I had known this.”

CreditFresh: Comparison to Competitors

The financial services landscape offers various options for accessing funds. When considering CreditFresh, it’s essential to compare it to other personal lines of credit and similar products offered by competitors.

When comparing, consider factors such as:

- Interest Rates (APR): Compare how high the annual percentage rate is with CreditFresh competitors.

- Fees: There are various fees, including origination fees, maintenance fees, and late payment fees. Weigh these out between different lenders.

- Credit Limits: Compare the range of credit between $500- $5,000 offered by CreditFresh to the credit limits offered by competitors.

- Repayment Terms: Repayment terms and guidelines can vary from lender to lender. Be sure to weigh them out between each other .

- Accessibility and Application Process: Evaluate the ease and speed of the application process and how quickly funds can be accessed. Consider if you can request a credit limit increase in the future.

- Customer Support: Customer support is important. Some lenders are better than others. Be sure to read reviews to figure out who is good in this category.

- Reporting to Credit Bureaus: Determine whether and how each provider reports your account status to credit bureaus.

Here’s a comparison chart to help you understand how CreditFresh stacks up with competitors:

| Feature | CreditFresh | MoneyKey | CreditCube | OppLoans |

| Estimated APR | ~65%–200%+ (varies by state and usage) | ~34%–199% (varies by state, product, and lender) | 36%–779% (varies by state, typically high for installment loans) | 59%–160% (installment loan, varies by state) |

| Potential Fees | No late, NSF, or processing fees; main cost is “billing cycle charge” | May include origination, late, or NSF fees (varies by state/product) | Late fees, NSF fees, possible origination fees | No origination or prepayment fees; possible late/NSF fees |

| Credit Limit Range | $500 – $5,000 (line of credit) | $200–$3,500 (line of credit or installment loan) | $100–$5,000 (installment loan) | $500–$4,000 (installment loan) |

| Online Draw Request | Yes (via account portal) | Yes (for line of credit) | N/A (installment loan only | N/A (installment loan only |

| Reports to Credit Bureaus | Yes (TransUnion) | Yes (TransUnion, sometimes others) | No | Yes (all major bureaus) |

Important Note: All lenders have their own strengths and weaknesses. It is crucial to conduct your own thorough comparison based on your specific financial needs and credit profile.

How to Apply for CreditFresh

The application process for CreditFresh typically involves the following steps, usually conducted online:

- Submit Your Request: Apply online at CreditFresh.com. You will be asked to provide personal info, including your name, address, Social Security number, and contact details.

- Detail Verification: You’ll need to verify your details for security purposes. This can entail additional documentation or allowing CreditFresh to access your bank account information for verification purposes.

- Review and Accept the Agreement: Once your application is reviewed and approved, you will be presented with a loan agreement outlining the credit limit, annual percentage rate, fees (if any), and repayment terms. Before signing your name on anything binding, read and understand the terms carefully. Now is the time to ask any questions.

- Request a Draw: After your account is set up, you can typically request a draw online through your account portal, up to your available credit limit. The lump sum of requested funds will then be transferred to your designated electronic bank account.

Is CreditFresh Right For You?

CreditFresh has very clear and distinct strengths and weaknesses, and it is imperative to think hard as to whether or not your current financial situation aligns with what they can offer you.

CreditFresh might be a suitable option for individuals who:

- Need a flexible way to borrow small to medium amounts of money for short-term needs.

- Appreciate the ability to make draws repay and redraw as needed.

- Prefer the convenience of an online application and account management.

- Are focused on building your credit history through responsible financial behavior.

However, CreditFresh might not be the right choice for individuals who:

- Are looking for long-term financing solutions.

- Are concerned about potentially higher annual percentage rates compared to traditional loans.

- Prefer in-person financial services.

Carefully consider your financial situation, your borrowing needs, and the terms and conditions associated with CreditFresh before making a decision.

Final Thoughts

Navigating your financial options requires intentional research and a willingness to not stop searching at the first appealing option. Credit can be very useful for its flexibility and short-term financial relief. Additionally it is very good at building credit, if paid off correctly. Just be sure to find the best creditline provider for your situation and carefully review terms.

Remember to compare different options available to you and choose the one that best aligns with your individual financial goals and circumstances. Constantly look to improve your financial knowledge. Be a responsible credit user so you can build your credit long term. Good luck on all of your future endeavors, and thanks so much for reading!

FAQ

Here are some frequently asked questions about CreditFresh:

Q: What is a line of credit, and how is it different from a traditional loan?

A: A line of credit is an open-ended credit product that allows you to borrow funds up to a certain limit, repay them, and borrow again. Unlike a traditional installment loan, where you receive a loan is a lump sum that is repaid over a fixed term with scheduled payments, a line of credit offers more flexibility in when and how much you borrow and repay.

Q: How does CreditFresh report my account activity to credit bureaus?

A: CreditFresh status may be reported to major credit bureaus. Responsible use, including making timely payments, can positively contribute to your credit history. Conversely, missed or late payments can negatively impact your credit score.

Q: What is the typical loan amount I can access with CreditFresh?

A: CreditFresh typically offers credit between 500-5,000. The specific loan amount you are eligible for will depend on various factors, including your creditworthiness and financial situation. You may be able to request a credit limit increase in the future, subject to review and approval.

Q: How quickly can I access funds after being approved?

A: Once your account is approved and you request a draw online, the funds are typically deposited into your designated electronic bank account relatively quickly, though the exact timeframe may vary.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.