Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Beyond Finance: Reviews and Ratings

Overwhelming debt can be a crippling feeling that seeps into every part of your life. Making minimum monthly payments while you have medical bills, credit card debt, traffic tickets, among other expenditures swirling around, can feel like you’re endlessly treading water, when all you want to do is get back on solid ground. If this is you, just know you’re not alone. Millions of Americans across the country are feeling stress due to seemingly insurmountable debt.

If you’re in this position, you are likely ready for a more efficient way to make payments. Beyond Finance may be just what the doctor ordered in that case! They position themselves as a partner in helping individuals navigate the convoluted world of debt resolution. Beyond Finance offers a debt resolution program designed to help clients reduce the amount they owe to their creditors. Since reducing your overall debt while consolidating to a single monthly payment will very likely lead to less stress and more financial freedom, Beyond Finance is certainly a company to explore. Their process involves working towards a settlement on your existing balances.

In this in-depth examination of Beyond Finance, we will explore their approaches to debt relief and whether their program will be a fit for your financial situation. The crucial early takeaway is this: making financial decisions requires research. That’s why we will be looking at Beyond Finance reviews and comparing them to their competitors. This article aims to provide a comprehensive overview to help you make the best possible decision for your future. Let’s explore if Beyond Finance is the solution you’ve been looking for!

Beyond Finance: History and Overview

Founded in 2016, Beyond Finance has rapidly become a major presence in the debt relief industry, specializing in debt settlement and consolidation services for clients with significant unsecured debt such as credit cards, personal loans, and medical bills.

Headquartered in Houston, Texas, with additional offices in Chicago and San Diego, the company employs between 1,000 and 2,000 people and has raised over $800 million to support its growth and operations. Led by CEO Tim Ho and founder Benjamin Schwan, Beyond Finance is recognized for its transparent, client-focused approach, offering personalized financial solutions tailored to individual circumstances. This is an appealing facet to many people.

The core focus of Beyond Finance is their debt resolution program. This involves working with clients to understand their unique financial situation and then negotiating with their creditors on a settlement for a lower total amount than what is currently owed. This negotiated settlement offer has the potential to save clients huge amounts of money over time.

Part of their program involves the creation and usage of a dedicated account. Clients make monthly payments into this one account, and these funds are then used to facilitate the settlement agreements with creditors. This system aims to simplify the repayment process for clients, consolidating multiple bills into a single, more manageable payment.

Beyond Finance acts on your behalf by taking over communication and negotiation with your creditors. Their team utilizes their expertise and knowledge to try to secure favorable settlement terms. They excel at keeping clients informed throughout the process and effectively answer all questions that may arise. It is important to the company that they provide helpful and knowledgeable support.

The first step for those interested in their services is typically a free consultation. This allows potential clients to go in-depth on their financial situation with a Beyond Finance representative to determine if the program aligns with their needs. It’s important to understand that the debt resolution program will often require the client to stop paying your creditors directly, which can impact your credit rating. This aspect of the process should be clearly explained during the initial talk. It is a very important factor to consider when using any debt settlement service.

Pros and Cons of Beyond Finance

Choosing a debt relief company requires careful consideration of where the company excels and lags. If their strengths are things you value and their weaknesses are negligible to you, then they will likely be a good choice for you. Let’s go ahead and take a look at the pros and cons associated with Beyond Finance:

Potential Pros:

- Debt Reduction Potential: A successful debt resolution program with Beyond Finance could lead to a significant reduction in the total amount of money you ultimately pay on your enrolled debt. Achieving a settlement for half or even less is a potential outcome.

- Simplified Finances: The one account system for monthly payments can streamline your finances and reduce the stress of managing multiple bills.

- Expert Negotiation: Beyond Finance handles the often-challenging task of negotiating with your creditors on your behalf.

- Path to Financial Freedom: For those feeling overwhelmed by debt, their program can offer a structured route towards becoming debt-free.

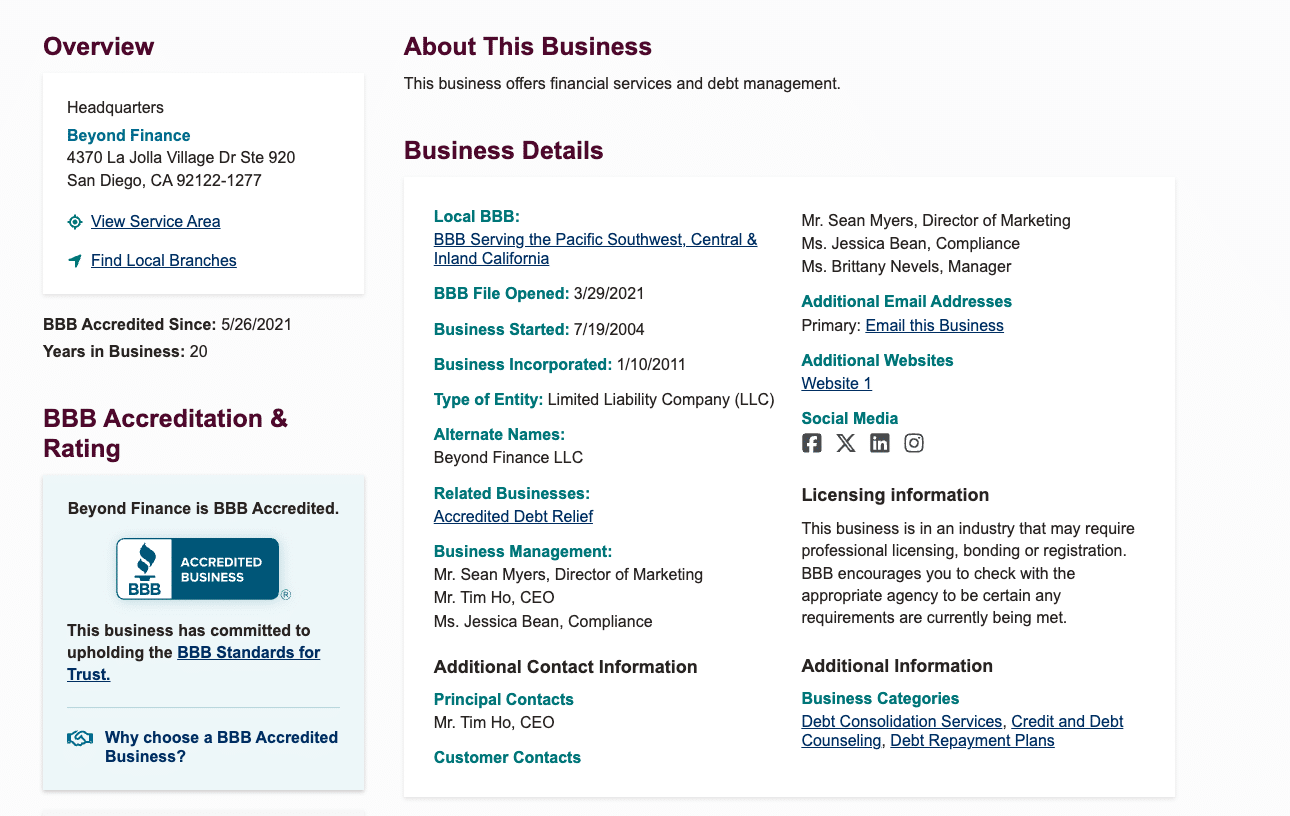

- Accreditation: Beyond Finance’s status as an accredited debt relief company through the Business Bureau can instill confidence in their services.

- Free Initial Consultation: The free consultation allows you to understand their services with zero commitment.

- Alternative to Bankruptcy: Debt resolution is preferable to bankruptcy. Going the route of debt resolution will help you avoid that undesirable result

Potential Cons:

- Credit Rating Impact: Since you will have to stop paying your creditors, your credit score will likely go down until the debt is resolved.

- No Guarantees: While Beyond Finance will try their utmost to resolve your debt, there is no guarantee your debts will be settled, and the amount may not be what you had hoped

- Fees: Beyond Finance charges fees for its services, which are typically a percentage of your enrolled debt or the amount saved.

- Creditor Cooperation: Not all creditors are willing to negotiate.

- Time Commitment: The debt resolution process can take a significant amount of time, up to 48 months sometimes

- Potential Tax Implications: Forgiven debt may be considered taxable income.

Beyond Finance Reviews and Ratings

Existing client testimonials are invaluable for diagnosing a company. After all, what better way to get a measure of what your experience could be than reading existing experiences? To get a real sense of the client experience with Beyond Finance, let’s delve into the ratings and comments found on the prominent review platforms Better Business Bureau (BBB), Trustpilot, and Google Reviews. We’ll look at both the positive and negative feedback to give an impartial perspective for considering your debt resolution program you will ultimately pick.

Better Business Bureau (BBB):

- Rating: Beyond Finance has a consistent A+ rating across all of their accredited branches, although some such as the Houston location are unaccredited. Reviews on the site are mixed to positive.

- Positive Comments: Many customers on the BBB highlight the professionalism and helpfulness of the Beyond Finance staff, particularly during the initial free consultation and throughout the process. They often mention feeling that their financial situation was understood and that the program was clearly explained.

- Real Customer Quote (Positive): “I was impressed from the very beginning, the process was explained in great detail, and all questions were answered in a respectful manner! Costs and procedures were explained. I was able to follow directions to the next level and they took it from there and will complete the process. I would highly recommend Beyond Finance.”

- Negative Comments: Some negative reviews on the BBB often express concerns about the length of the process, the anticipated negative impact on their credit rating (which is an inherent aspect of debt settlement), or frustration if settlement offers aren’t achieved as quickly as hoped.

- Real Customer Quote (Negative): “I understood that my credit would take a hit, but it’s still difficult to see. I’ve been in the program for several months and haven’t seen a settlement yet. I’m hoping things start moving soon so I can finally stop paying these high interest rates.”

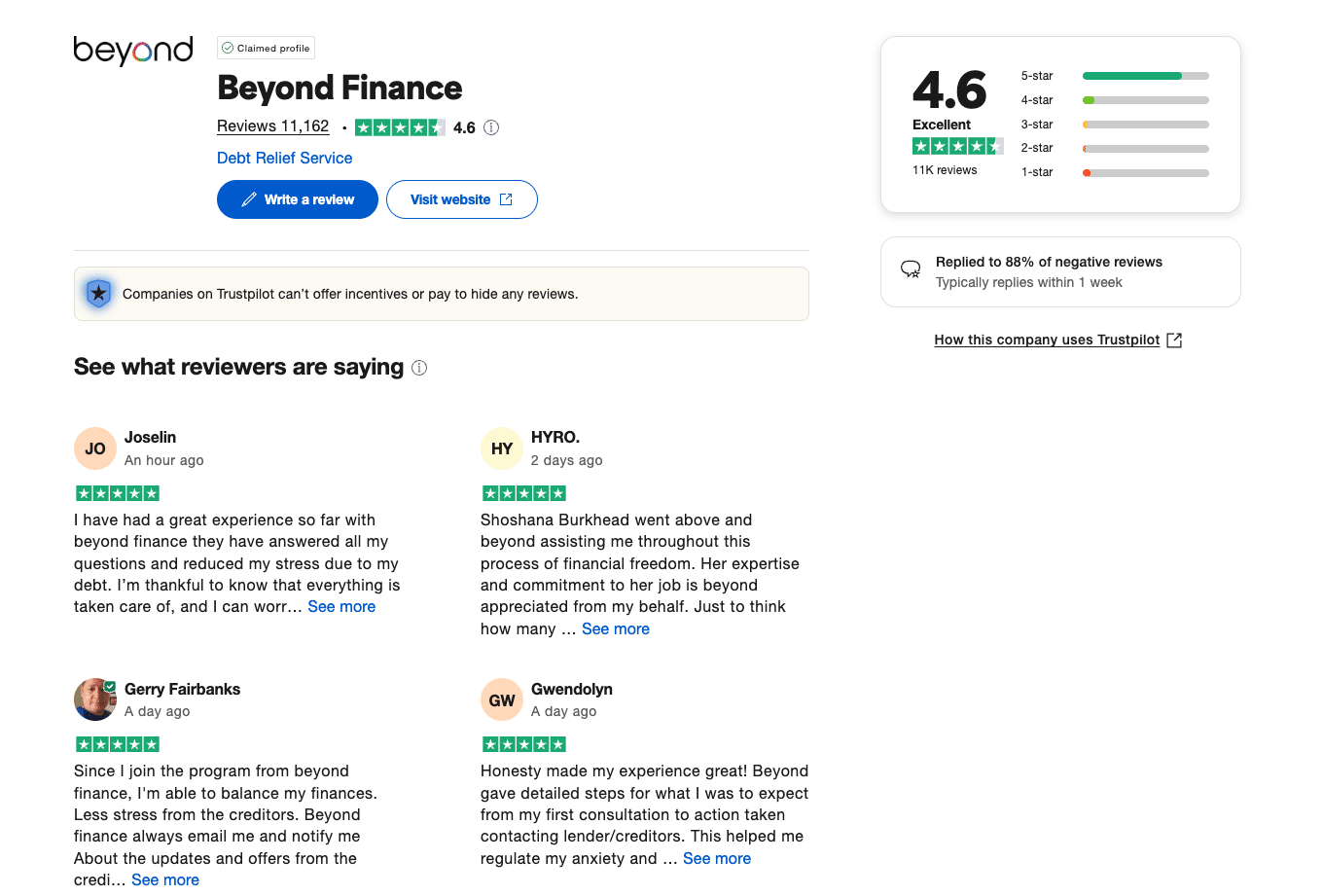

Trustpilot:

- Rating: They hold a 4.6 out of 5 as of july 2023, indicating overall satisfactory service to customers.

- Positive Comments: On Trustpilot, reviewers frequently commend the supportive and knowledgeable nature of the Beyond Finance team. Many appreciate the regular communication and the feeling that the company is truly working on their behalf to negotiate with creditors.

- Real Customer Quote (Positive): “Beyond looked at my balances and chose the ones they felt I could use some help with. I just got my first resolution and saved over $9000! YAY! I definitely recommend working with them. You can’t lose anything but debt. lol”

- Negative Comments: Some negative feedback on Trustpilot mirrors concerns found on the BBB, such as the time it takes to see settlements and the expected drop in credit score. A few reviewers also mention feeling that the fees weren’t as clearly explained as they could have been.

- Real Customer Quote (Negative): “This is the biggest scam company out there. Your credit score never recovers like they say. You pay hidden fees that basically accumulate to your entire debt. I … My financial situation since 8/2024: $16,600 total paid to date, $8,744 paid to creditors, $7,888 paid in fees to Beyond. This is only for 2/4 of my creditors, and my credit score went from 750+ to 630 over 8 mos. This is predatory; they misrepresent how they work, 25% on original debt amount (not resolved), and now I cannot even take out a home equity to get out of this situation because my credit score dropped so badly. They do not advertise or explain the program accurately or in good faith…”

Google Reviews:

- Rating: Some google reviewers question if there is astroturfing going on with the reviews of Beyond Finance. Otherwise, they hold the same positive opinions found on other review platforms.

- Positive Comments: Many users on Google Reviews highlight the ease of the initial free consultation and the clarity with which the debt resolution program is explained. The potential for significant debt reduction and a path towards financial freedom are often mentioned as key benefits.

- Real Customer Quote (Positive): “I was blessed to find Beyond Finance. I was struggling badly to keep my head above the water because of the debt I had. It did not happen overnight, but being patient, listening and working the program I have now paid off my creditors and can finally breathe and enjoy life!”

- Negative Comments: Some negative feedback on Google Reviews echoes concerns about the impact on credit rating and the duration of the program. A few users also mentioned feeling pressured during the initial sign-up form. There are also questions over the validity of other reviews.

- Real Customer Quote (Negative): “First. Please do yourself a favor when reading the good reviews and ask yourself if normal, every day people actually talk like that. I promise those aren’t customers. … This company makes you feel like they are doing such a good thing for you, when really they are pocketing your funds over and over for exorbitant fee amounts and you basically have nothing left unless you keep making the monthly payments and just hope that it will go to a creditor and not BF’s pockets. … Do NOT sign up with Beyond Finance!! You WILL regret it! They claim that their agreements are transparent, but they absolutely deceived me and so many others… Do your research and look them up under ‘Beyond Finance complaints’ and you will find many people who have suffered HUGE losses financially, credit-wise and end up in a much worse position.”

Key Takeaways from Reviews:

Overall, the reviews for Beyond Finance suggest that many clients appreciate the support and guidance provided, particularly in navigating the complexities of debt settlement. The potential to reduce their overall debt and work towards financial freedom is a significant draw. However, it’s crucial for potential clients to be aware of the likely negative impact on their credit rating, the potentially lengthy nature of the program, and to ensure they fully understand all associated fees before enrolling. The free consultation appears to be a valuable opportunity for individuals to ask all the questions they have, so they are not blindsided by any operational components.

Beyond Finance vs. the Competition

Comparing Beyond Finance to other debt relief companies is invaluable to create the informed decision we are striving for. Here’s a simplified comparison with direct competitors to the company.

| Company | Primary Service | BBB Rating | Trustpilot Rating (Approx.) | Emphasis | Fee Structure |

| Beyond Finance | Debt Settlement | A+ | 4.6 | Personalized debt relief, fast resolution | 15–25% of enrolled debt |

| National Debt Relief | Debt Settlement | A+ | 4.7 | Broad debt types, low fees, fast process | 15–25% of enrolled debt |

| Freedom Debt Relief | Debt Settlement | Not as high as NDR (lower) | 4.6 | Legal assistance included, mobile app | 15–25% of enrolled debt |

| Accredited Debt Relief | Debt Settlement | A+ | 4.8 | High customer satisfaction, education | 15–25% of enrolled debt |

Important Considerations:

- Each company has a unique approach.

- Client experiences and results can vary.

- It’s invaluable to obtain free consultations from multiple companies to compare their specific programs and fees.

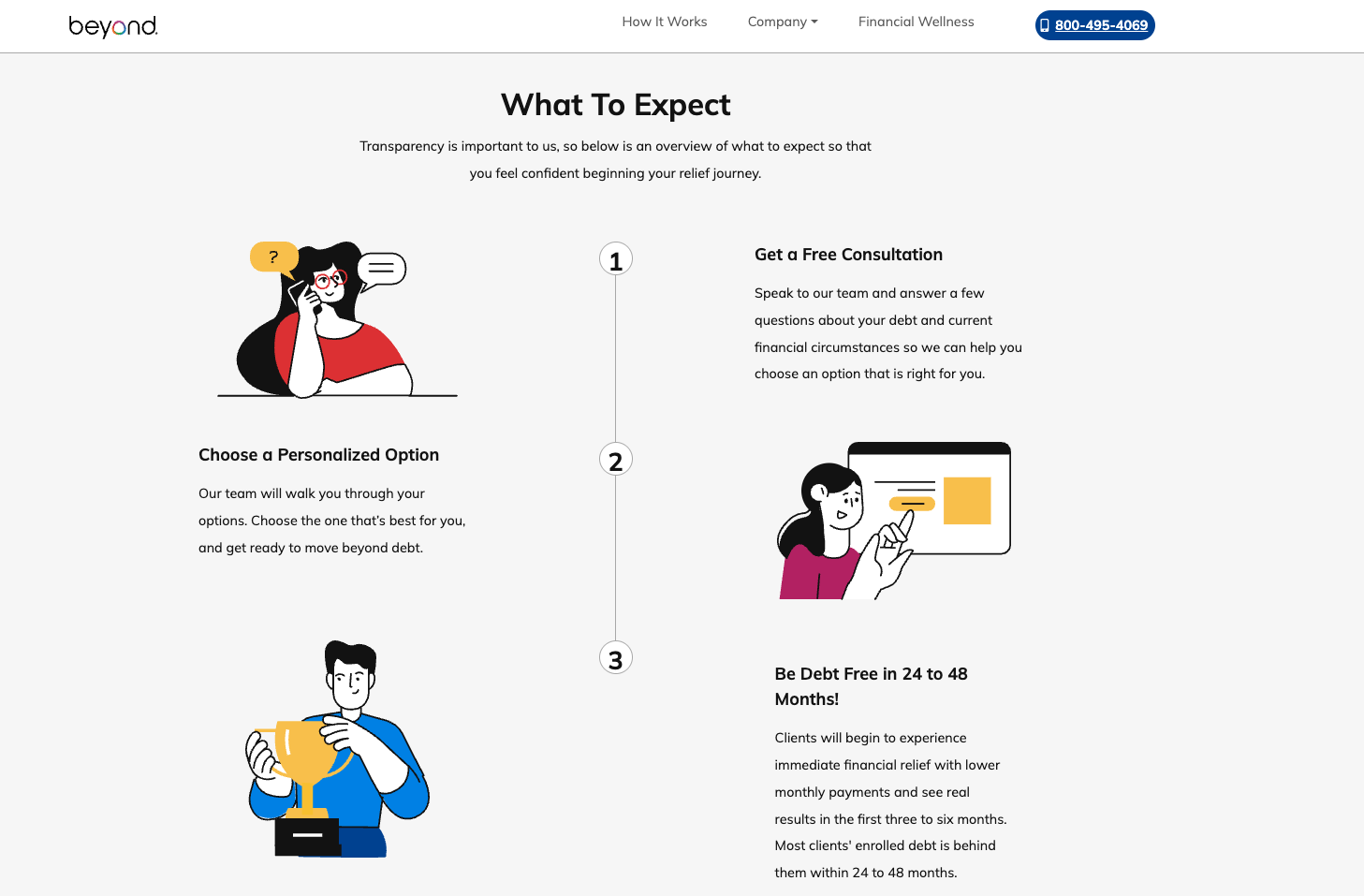

Taking the First Step: How to Apply with Beyond Finance

If you have come this far and are feeling pretty sure you want to roll with Beyond Finance as your debt relief solution, you’re probably wondering how to apply! Worry not, we have you covered. Here’s an in depth, step by step guide to applying with Beyond Finance:

- Free Consultation: Contact Beyond Finance for a free consultation via their website or phone. Discuss your financial situation in depth and freely.

- Financial Assessment: Beyond Finance will evaluate your situation to determine if their program is a good fit. They will explain the process, benefits, risks (including credit rating impact), and fees. Ask away! Now’s the time.

- Enrollment: If you choose to proceed, you’ll complete enrollment paperwork outlining the terms of your agreement. Read it carefully.

- Dedicated Account Setup: You’ll set up your dedicated account and begin making monthly payments. These funds will be used for settlement negotiations.

- Negotiation Phase: Beyond Finance will begin negotiating with your creditors to reach settlement offers. This can take time.

- Settlement Approval and Payment: When a settlement offer is reached, you’ll review and approve it. Funds from your dedicated account will be used to pay the settled amount, and Beyond Finance’s fees will be deducted.

Important Note: During negotiation, you will likely be advised to stop paying your creditors, which will negatively affect your credit rating. This is a huge decision: Is the impact to credit worth the shrinkage in debt? Consider this carefully.

Is Beyond Finance the Right Partner for Your Financial Future?

Debt consolidation services are not for everyone. Depending on your situation and what you value, there may be better options for you. Here’s a breakdown of what type of person Beyond Financial would be perfect for:

- You have significant unsecured debt.

- You are seeking to reduce your overall debt through settlement.

- You understand and accept the potential negative impact on your credit rating.

- You want a company to negotiate on your behalf.

- The one account system for payments appeals to you.

- You are looking for an accredited company with generally positive reviews.

- You can afford the monthly payments into your dedicated account.

If preserving your credit rating is your top priority, or if you prefer other debt management options, Beyond Finance might not be the best fit.

Final Thoughts: Financial Freedom is in the Palm of Your Hand

Navigating debt is draining–mentally, emotionally, and physically. Beyond Finance offers a debt resolution program aimed at helping individuals regain control by negotiating settlements. While the path may involve a temporary hit to your credit rating, the potential for significant debt reduction and a simpler monthly payment structure can be a godsend.

Remember that thorough research and understanding the process is the most important thing you can do for your future, and something you are in full control of. Compare Beyond Finance with other debt relief options to find the solution that best suits your unique financial situation and goals for achieving financial freedom. Taking the first step towards addressing your debt is a significant move towards a more secure financial future.

Frequently Asked Questions (FAQ) About Beyond Finance

Here are some common questions about Beyond Finance:

Q: What types of debt does Beyond Finance typically handle?

A: Beyond Finance primarily deals with unsecured debt, such as credit card balances, personal loans, and medical bills.

Q: How does Beyond Finance charge its fees?

A: Beyond Finance typically charges a fee that is a percentage of your enrolled debt or the amount of money they help you save through settlement. This will be clearly outlined in your agreement.

Q: Will Beyond Finance help me with all my debts?

A: You will typically enroll specific unsecured debts in the program. Secured debts like mortgages and auto loans are usually not included.

Q: How long does the Beyond Finance program usually take?

A: The duration of the program can vary depending on your individual financial situation, the amount of your debt, and how quickly settlements can be negotiated. It often takes between 24 and 48 months.

Q: What is the first step to working with Beyond Finance?

A: The first step is usually a free consultation where you can discuss your financial situation with one of their representatives to see if their program is a good fit for you.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.