Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Withu Loans: Reviews and Ratings

WithU Loans logo.

Insurmountable debt and looming payments can be a demeaning feeling. It’s unfortunate that this happens as often as it does to Americans and can leave you desperate for help of any kind. Luckily, the help is out there, but depending on the person, it can be limited. If you have poor credit history, a lot of lenders are likely to reject you. But just know, no matter what your history with money is, there are ways to receive capital—although there will be more serious ramifications for some of these methods.

Today, we’re going to explore the world of tribal loans, particularly WithU Loans. They advertise fast installment loans for people with bad credit—but is there a catch? We will find out all we need to know about tribal lenders and WithU Loans so you can make a well-informed decision on whether your situation warrants the risk. Let’s jump right into it.

What is WithU Loans?

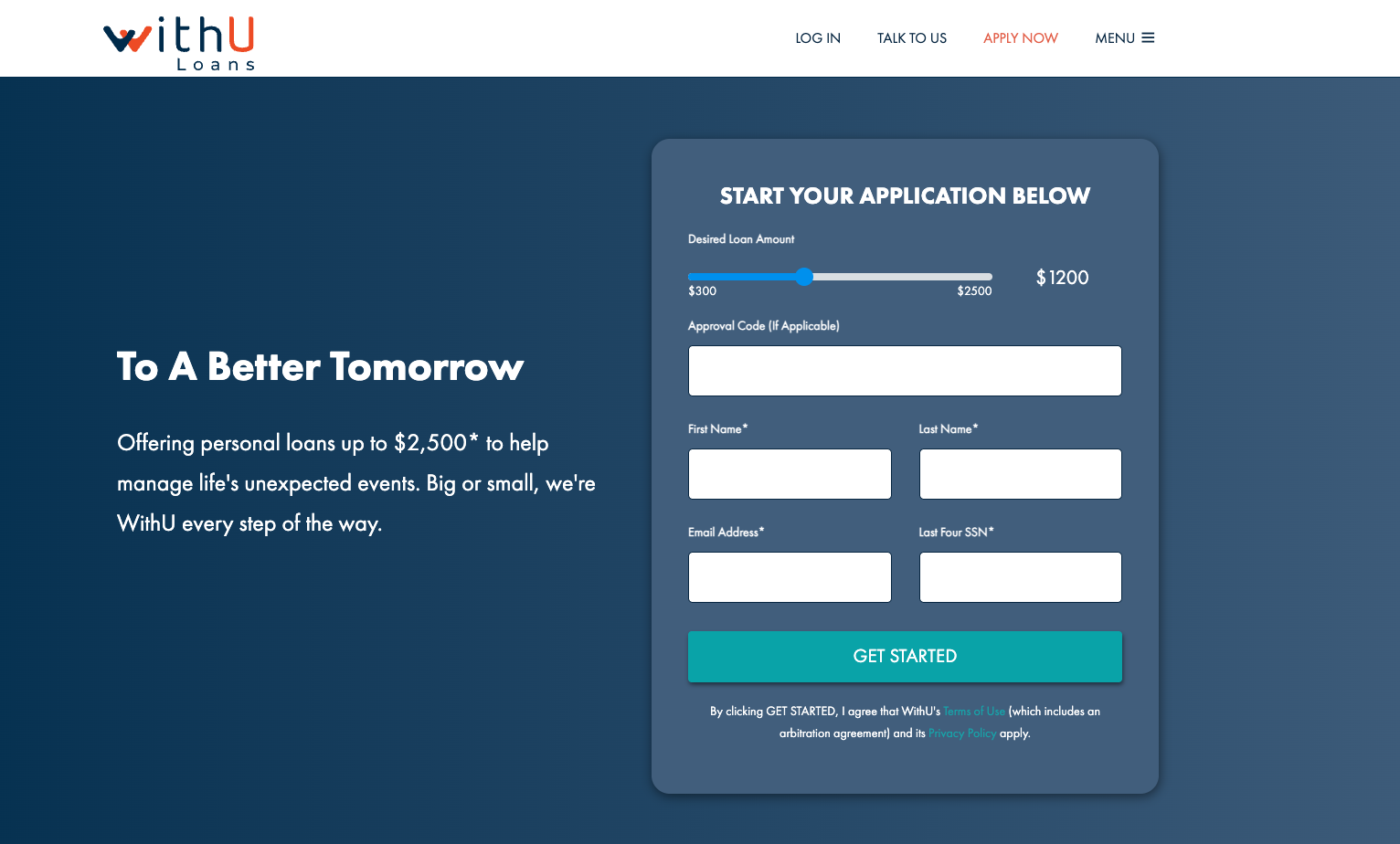

WithU Loans homepage

WithU Loans is an online lender based in Oklahoma City. Launched in June 2021, it’s owned and operated by the Otoe-Missouria Tribe of Indians and regulated under tribal law—not state or federal lending rules. That distinction allows WithU to charge far higher interest rates than traditional lenders.

Their loans can be up to $2,500 and are marketed to people with less-than-stellar credit—basically, people who are struggling to find loan approval elsewhere. And while it’s true that they are fast and accessible, there is a very high price to pay for their services. When you see what that price is, your jaw might drop. Read on to find out.

Services and loan terms

Here’s the core offering:

- Loan amounts: up to $2,500

- Repayment: biweekly installments

- No prepayment penalty: You can pay it off early (and you might want to)

APRs on these loans can soar to 300%–800%. That’s not a typo. By comparison, most personal loans range from 6% to 36%.

A $1,000 loan could cost you more than $3,000 to pay back. That’s not “high”—it’s predatory.

What sets WithU apart—and not always in a good way

- Operates under tribal law: Not bound by your state’s consumer protections

- Accessible to poor credit borrowers: Even with a low score, you may get approved

- Fast cash: Funding often arrives within one business day

These features are attractive when you’re in a bind—but they come at the cost of sky-high interest and limited legal protections.

Real borrower experiences

“I borrowed $1,000 and I’m paying $245 every two weeks … that’s over $3,000.” – Reddit

“I took out a $600 loan. I have paid over $2,000 back. That’s 500% interest.”

“Omg STAY AWAY … I’m paying back $5,000 on a $1,000 loan.”

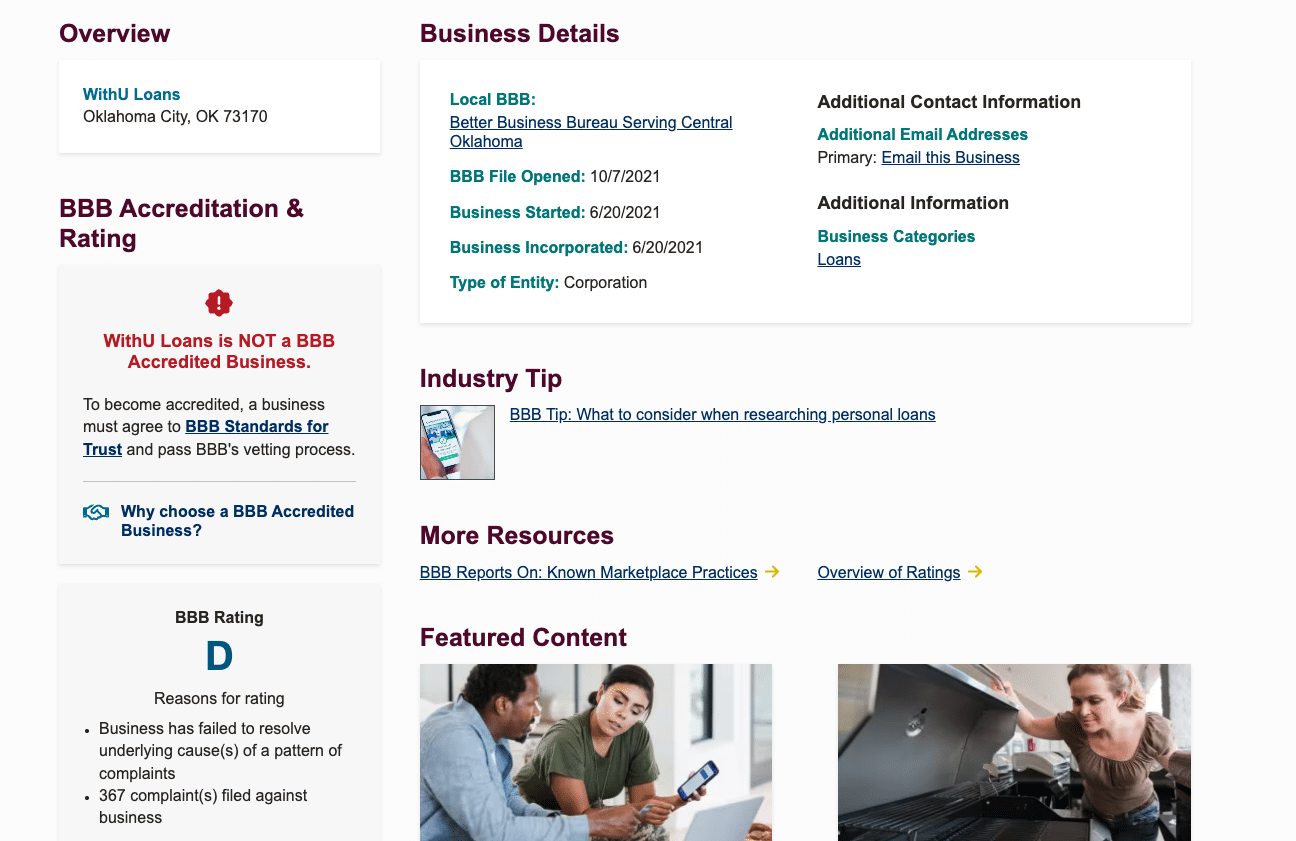

These are not rare outliers—they’re a pattern. The Better Business Bureau (BBB) has given WithU Loans a D rating, citing more than 350 complaints ranging from billing problems to aggressive collection practices.

Better Business Bureau profile for WithU Loans.

Who qualifies?

The bar is low, which is part of the appeal:

- Must be 18 or older and a U.S. resident

- Must have a checking account

- Must show regular income (even if it’s modest)

Credit checks are minimal, so you can still qualify with a spotty credit history.

Regulatory status: What you need to know

WithU Loans isn’t licensed by your state or regulated by the Consumer Financial Protection Bureau. It falls under the Otoe-Missouria Tribe’s financial authority. That means:

- No state-mandated interest caps

- No guaranteed protections if disputes arise

- Limited recourse if you’re mistreated

In 2022, the BBB opened an investigation following consumer complaints about unauthorized loan deposits and unclear loan terms. Many of those complaints remain unresolved.

What you could end up paying

- $1,000 loan with biweekly payments of $245 = $2,450 total (10 weeks)

- Miss a payment? Fees stack up fast

- Stretch your term? Some borrowers end up paying more than $5,000 for the same $1,000

These loans are structured to get expensive—fast. Missing one or two payments can snowball into long-term debt.

Alternatives to consider

If you’re looking for short-term financial help, here’s how WithU compares:

- MoneyMutual: aggregator with a wider lender pool—but still high-interest

- OppLoans: a bit more transparency and slightly lower rates

- Credit unions and local nonprofits: often provide emergency loans at reasonable rates

You can also explore paycheck advances from your employer or salary-based apps like Earnin or Dave. They’re not perfect, but they don’t charge 800% APR.

Should you use WithU Loans?

If you’re in a financial crunch, it’s easy to justify a quick fix. But WithU Loans is not just another lender—it’s a high-cost bandage that could become a long-term wound.

Yes, it’s accessible. Yes, the money is fast. But the true cost—financially and emotionally—often isn’t worth it.

If you are insistent on going this route, make sure you have a way to pay it off as fast as possible. The damage of the high APR can put you in a worse spot than when you got the loan in the first place if you’re not careful.

If you feel cornered, pause. Call a nonprofit credit counselor. Talk to your bank. Explore other options. Even if you’re stressed now, your future self will thank you for not making a panic move.

Emergencies don’t last forever—but some loans sure feel like they do.

Frequently asked questions

1. Is WithU Loans a legitimate lender or just another scam?

WithU Loans is a tribal lender owned by the Otoe-Missouria Tribe of Indians, operating under tribal law—not state or federal regulation. While they legally offer installment loans, they’ve earned a one-star rating and hundreds of negative reviews on the Better Business Bureau (BBB) website. Many customers report being hit with exorbitant interest rates, unexpected fees, and unauthorized loan deposits. It’s technically a real company, but whether it’s one you want to do business with is another story.

2. Why is the interest rate from WithU Loans so high?

The interest rates on WithU Loans can be extreme—often 300% to 800% APR. Because they’re not bound by state usury caps, they legally charge what many consider a crazy or illegal rate. Their payment schedule is biweekly, and most borrowers end up paying back far more than they borrowed. If you’re offered a loan, make sure to calculate the full cost—not just the monthly or biweekly payments.

3. What happens if I can’t repay my WithU loan on time?

Missing a payment can lead to more fees, damage to your credit, and persistent collections. Some borrowers claim they were contacted repeatedly without giving proper permission, and disputes are difficult to resolve because the lender isn’t subject to standard consumer protection laws. Canceling isn’t always easy either—you may be locked into a high-cost agreement without a clean exit strategy.

4. Is WithU Loans affiliated with the Better Business Bureau?

No—WithU Loans is not BBB accredited. In fact, they currently hold an F rating due to a large volume of unresolved complaints from consumers who claim they were misled, overcharged, or ignored when trying to contact support. While the company legally operates as “DBA WithU Loans”, its business practices have drawn significant criticism from watchdog groups and everyday borrowers alike.

5. How quickly can I get money from WithU Loans after approval?

If your loan application is approved, funds are usually deposited to your bank account by the next business day. However, speed comes at a cost. The entire process—from approval to disbursement—is designed to be fast, but many borrowers later regret not reviewing the documentation more closely. Read every word. One missed detail can turn a short-term solution into long-term debt.

6. Can I dispute a loan or file a complaint against WithU Loans?

You can file a complaint with the Better Business Bureau, but remember: WithU isn’t held to state or federal lending standards. Since they’re regulated by the Otoe-Missouria Tribe, your ability to force a resolution is limited. Many customers have reported difficulty resolving disputes, even when providing proof of error. If you feel you’ve been treated unfairly, you should also consider reaching out to a consumer protection agency or legal aid service.

7. What are the risks of using WithU Loans?

The risks are real: sky-high interest rates, unclear repayment terms, aggressive collections, and a support system that often leaves customers feeling stranded. It’s an expensive form of borrowing, especially for people already struggling with housing, education, or general financial stability. If you’re exploring options, WithU should be a last resort—not your first.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.