Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Finio Loans: Reviews and Ratings

Finio Loans logo.

If you have bad credit and you’re located in the U.K., your options for a loan are limited. Being turned down by a bank doesn’t mean all doors are closed. Finio Loans is one alternative, provided you’re a U.K. resident.

Originally launched as Likely Loans in 2011, the company rebranded to Finio in 2022. Same company, same mission: Get money into the hands of people with shaky credit—just with a new look. They use a unique vetting process that leverages behavioral lending data.

What is Finio Loans?

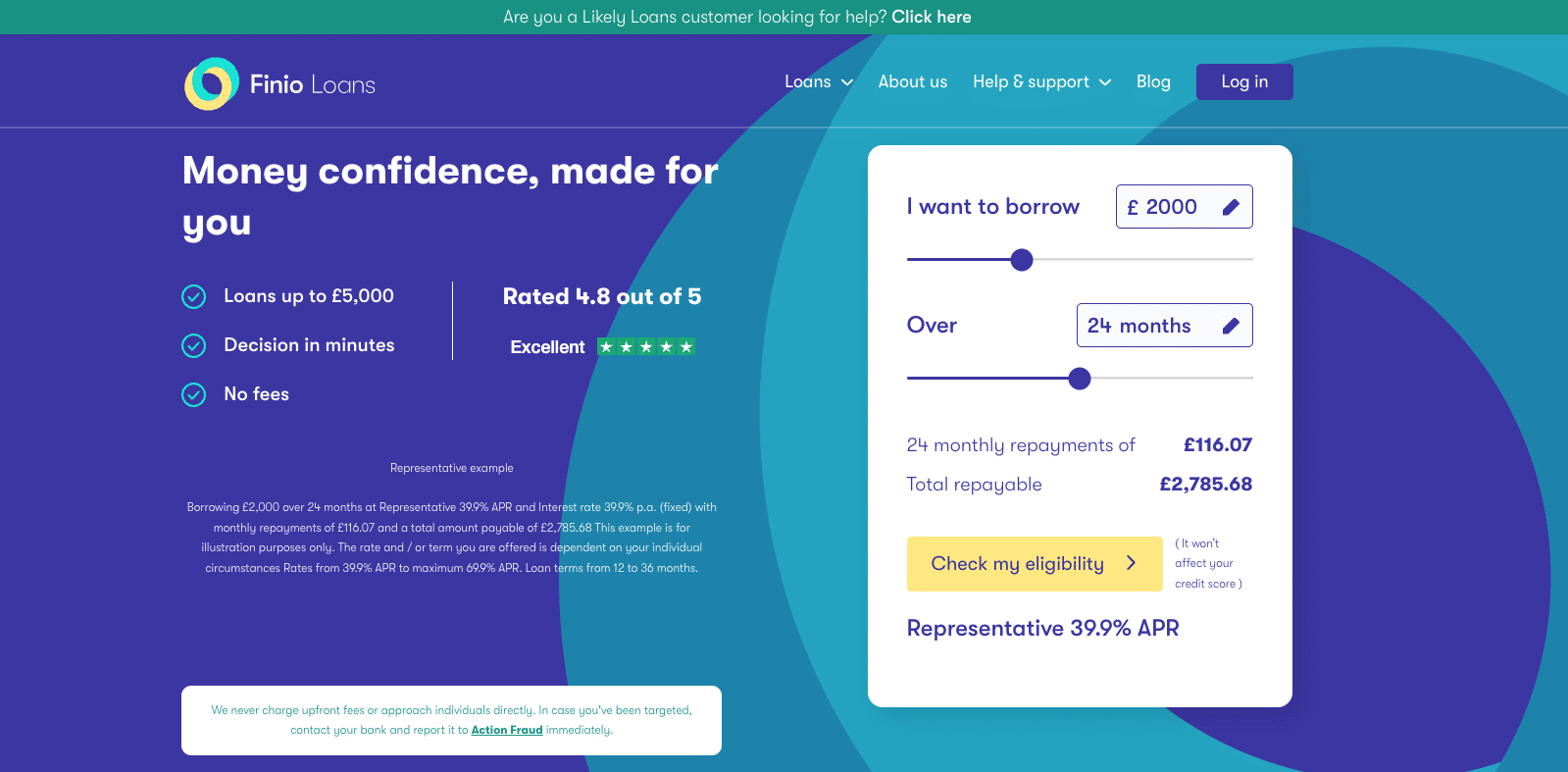

Finio Loans website homepage.

Finio Loans is a U.K.-based lender operated by Oakbrook Finance. It is authorized and regulated by the Financial Conduct Authority, which means consumers have some protections.

The company offers unsecured personal loans between £500 and £5,000, repayable over 12 to 36 months. The process is entirely online. If approved, funds can hit your account the same day—sometimes within minutes.

That speed is enabled by behavioral lending, powered by open banking.

How it works

Finio Loans homepage.

The application starts with a soft eligibility check, so your credit score won’t take a hit just to see if you qualify. If you move forward, a full credit check is conducted.

Unlike traditional lenders that rely solely on your credit file, Finio uses open banking to analyze your real-time spending and income. They build a profile of your financial behavior—how you manage your money today, not just what happened years ago.

If approved, you’ll receive a digital offer. Sign online and receive the funds, often within hours.

What makes Finio different

Here’s what separates Finio from other subprime lenders:

- Soft credit check first: You can check your eligibility without hurting your credit score.

- Behavioral lending: Approval is based on real-time financial data, not just your credit report.

- No guarantor required: These are solo loans.

- Early repayment allowed: You can repay early, though Finio may charge up to 28 days’ interest.

- Individual applications only: No joint loans allowed.

Behavioral lending: A closer look

This is Finio’s core differentiator.

Behavioral lending combines traditional credit data with real-time financial behavior. That includes how often you pay bills on time, how consistently you spend, and even how often you interact with their platform.

Machine learning handles the analysis. Finio’s system scans your bank transactions for consistency, flags irregular spikes (like unexpected splurges) and evaluates your income flow. It’s a forgiving model for people whose credit scores don’t reflect their current habits.

The result? Fast decisions and faster funds—but not without cost.

The price of convenience

Finio’s representative APR ranges from 39.9 to 69.9 percent. That’s high, but common for subprime lending. Rates are fixed for the loan term, which helps with budgeting.

Example: A £2,000 loan over 24 months at 49.9 percent APR would result in payments of about £130 per month and total repayment around £3,120.

There are no promotional periods or interest-free windows. If you miss a payment, the interest continues to accrue. Finio’s rates are steep—but not unusually so for this lending category.

Who it’s for

To be eligible for a Finio loan, you must:

- Be a U.K. resident between 18 and 73 years old.

- Have a personal U.K. bank account.

- Have a U.K. credit history.

- Be employed (income is assessed for affordability).

- Not have declared bankruptcy in the past 12 months.

No guarantor is required. No co-applicants are accepted. If your income and budget support repayment—even with bad credit—you may qualify.

Built-in protections

As a regulated lender, Finio offers borrower safeguards:

- 14-day cooling-off period: Cancel the loan without penalty.

- Affordability checks: Finio evaluates your financial situation, not just your credit score.

- Regulatory oversight: You can escalate complaints to the Financial Ombudsman Service.

These protections place Finio well above unregulated or gray-market lenders.

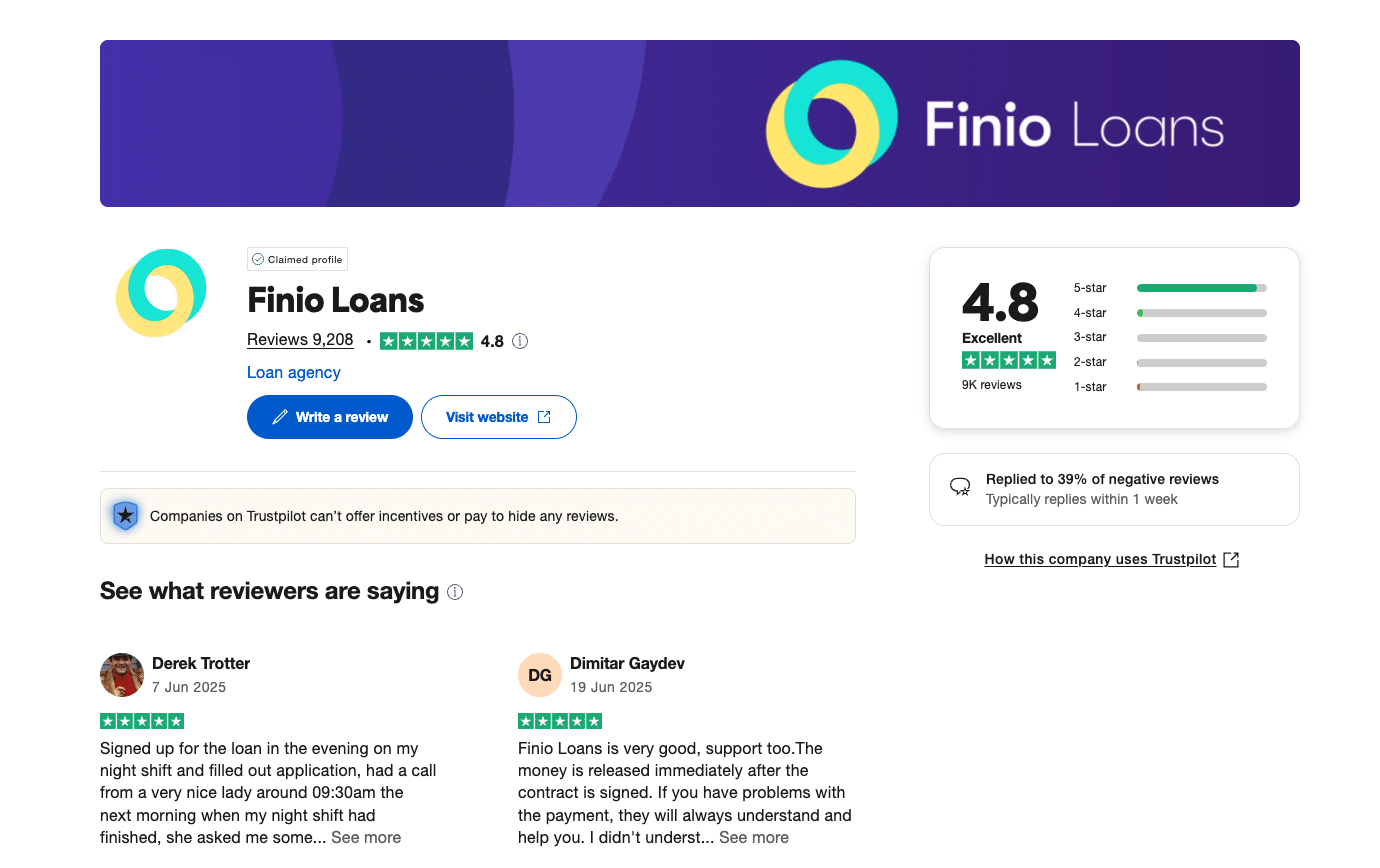

What real borrowers say

Finio has more than 7,000 reviews on Trustpilot, with 92 percent rating them five stars. That’s a strong score in the lending space.

Finio Loans Trustpilot profile.

Common praise includes:

“Quick and easy process, funds received within minutes.” “Helped me when others wouldn’t. Great customer service.”

Some negative feedback focuses on interest rates or repayment terms—standard in this sector—but overall sentiment is overwhelmingly positive.

Final word

Finio Loans isn’t the cheapest option. But for people with poor credit, it may be one of the more transparent and accessible ones.

You’ll pay for the speed and flexibility. Still, the use of open banking, FCA oversight and real-time behavioral lending gives Finio a credible edge over many competitors.

Keep in mind, Finio is a stopgap—not a solution for long-term borrowing. If you qualify for cheaper financing elsewhere, take it. But if your choices are limited, Finio may be a reasonable short-term fix.

Frequently asked questions

Are Finio Loans the same as Likely Loans? Sort of. Finio Loans is the rebranded version of Likely Loans. Both are owned by Oakbrook Finance Limited and built around the same core idea—offering personal loans to people with poor credit. The name may have changed, but the mission hasn’t.

What makes Finio Loans different from other lenders? Finio uses a behavioral lending model powered by open banking. That means they look beyond your credit file and use real-time financial behavior—like how you spend, save and manage bills—to determine if you can comfortably afford repayments. Most lenders still rely strictly on credit scores. Finio’s trying to fill the gap.

What countries can use Finio Loans? Only U.K. residents can apply. You’ll need a U.K. bank account, proof of income, and a financial situation that supports monthly repayments. If you’re not living in the U.K., this one’s off the table.

Do Finio Loans run a credit check? Yes. They start with a soft eligibility check, which won’t affect your credit rating. If you move forward and accept a personalised offer, they’ll run a full credit check before final approval. That hard search will show up on your credit history.

Can I repay my Finio Loan early? You can. There’s no penalty for early repayment, but you may still be charged interest up to your settlement date. Be sure to check your loan agreement or contact Finio Loans directly for all the information.

How fast can I get the money? If approved, funds can hit your bank account the same day—sometimes even within minutes. That speed depends on your bank’s policies, the time of day, and whether it’s a weekend or bank holiday. Either way, the goal is to move quickly.

Is Finio Loans authorised and regulated? Yes. Finio Loans is a direct lender that’s authorised and regulated by the Financial Conduct Authority. That means they’re legally bound to assess your individual circumstances before approving your application and must follow strict rules to protect customers. It’s not a fly-by-night setup—Oakbrook Finance runs a tight ship.

What happens if I can’t make a payment? If you miss a repayment, interest will continue to be charged on the total amount owed. Your credit file could take a hit, and future applications with U.K. lenders might get tougher. If you’re struggling, contact Finio Loans early. Their customer service team can offer further information and help you navigate next steps before things spiral.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.