World stocks powered by Wall Street hit record high

Global stocks hit record highs on Friday, as tech shares on Wall Street cheered receding U.S. inflation fears, with the lack of inflation pressure keeping bond yields near two-week lows.

Federal Reserve Chair Jerome Powell reiterated late on Thursday that inflation was not a worry, following data showing an unexpected rise in the number of Americans filing new claims for unemployment benefits.

MSCI’s broadest gauge of world stocks set a record high in Asian trading, though it was down 0.1% at 0755 GMT. The index has gained more than 1.5% this week.

“As long as monetary stimulus is easy, as long as fiscal policy is easy, any hiccups in stocks are probably only going to find buyers,” said Giles Coghlan, chief currency analyst at HYCM.

Emini futures were steady after the S&P 500 rose 0.42% to a record high, and the Nasdaq Composite added 1.03%.

Britain’s FTSE 100 hit its highest in more than a year, bringing gains for the week to nearly 3%, helped by the country’s speedy vaccine rollout. [.L]

German stocks dipped 0.22%.

Powell signalled at an IMF event that the central bank was nowhere near reducing support for the U.S. economy, saying that while economic reopening could result in higher prices temporarily, it will not constitute inflation.

Deutsche Bank analysts said the comments “offered fresh reassurance to investors who’d begun to price in earlier rate increases on the back of some very strong economic data in recent weeks”.

Traders piled into megacap tech stocks such as Apple Inc, Microsoft Corp and Amazon.com Inc, which were the main drivers of the S&P 500.

Benchmark 10-year Treasury yields held close to Thursday’s two-week trough near 1.6%.

Yields had surged to the highest since Jan 2020 at 1.776% at the end of March as a string of strong U.S. economic data stoked fears of a spike in inflation that could force the Federal Reserve to raise interest rates sooner than policymakers had so far signalled.

German 10-year bond yields rose 2 basis points, moving away from the previous session’s 10-day lows.

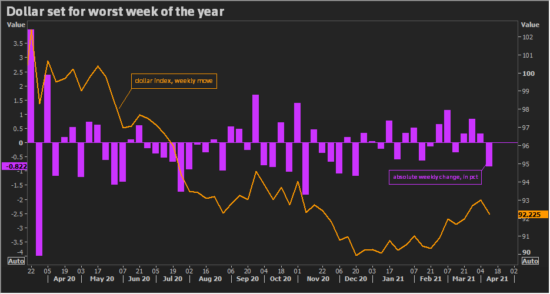

The U.S. dollar index gained 0.2% but was set for its worst week of the year, weighed down by lower Treasury yields. The euro dipped 0.2% after hitting two-week highs in the previous session.

Photo Credit: Reuters

The CBOE volatility index hit its lowest since Feb 2020 at 16.55.

In Asia, Japan’s Topix gained 0.6% and Australian stocks hovered near a 13-month high, while South Korea’s Kospi touched the highest intraday level since mid-February.

Related Articles

Online Trading for Beginners

What are Nio Stocks?

Chinese shares, however, slid 1.5%, as robust domestic inflation data raised worries over policy tightening.

Factory gate prices rose at their fastest annual pace since July 2018 in March.

Oil prices edged down as investors weighed rising supplies from major producers and the impact on fuel demand from the COVID-19 pandemic.

U.S. crude fell 0.35% to $59.38 a barrel, while Brent lost 0.5% to $62.87 a barrel.

Spot gold fell 0.5% to $1,747 an ounce after jumping to a more than one-month peak of $1,758 on Thursday.

(Additional reporting by Dhara Ranasinghe in London, Kevin Buckland in Tokyo and Chibuike Oguh in New York; Editing by Christopher Cushing, Kim Coghill and Nick Macfie)