WeWork Files for Public Listing at a Valuation of $47 Billion

WeWork, the fast-growing office-sharing startup, said Monday it had filed documents for a stock market listing to help fuel further expansion. The New York-based firm valued at some $47 billion by private investors and operating in some 600 cities worldwide, said it filed its registration confidentially in December with the Securities & Exchange Commission.

The confidential filing allows the company to begin the listing process before divulging key financial and business information.

https://twitter.com/amuse/status/1122959920104710144

“This process will enable WeWork to make the decision to become publicly traded, subject to market and other conditions,” WeWork said in a statement.

WeWork has taken the lead in the co-working space and in the process is disrupting the office and real estate market with smartly designed offices, often with free-flowing beer and coffee.

Started in 2010, WeWork has hundreds of thousands of customers from individual entrepreneurs to Fortune 500 companies needing temporary or permanent office space.

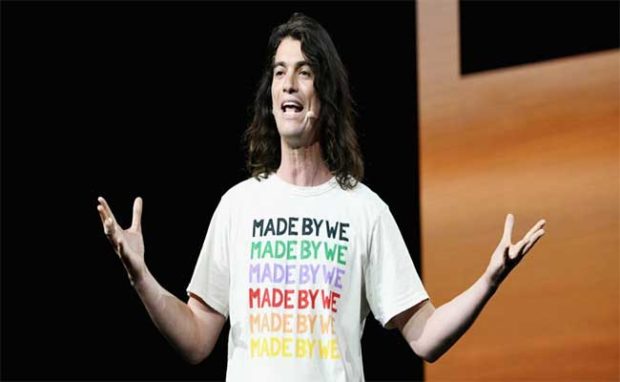

Photo: Getty Images

The monthly deals can be particularly attractive to independent workers who don’t want to make a long-term commitment. But WeWork also rents to employees of large firms such as IBM where regional offices are less convenient.

In January, Japanese tech giant SoftBank invested some $2 billion in the company as it rebranded itself as “The We Company.”

Related Articles

Lawsuit: Apple vs. Qualcomm With Billions at Stake

Uber Sets Sights on $10 Billion IPO

WeWork offered no details on how much money it would seek to raise, its valuation or the timing of its offering.

But the news comes amid a wave of listings from Silicon Valley “unicorns,” or startups worth at least $1 billion, including Lyft, Pinterest, Slack and Uber.

In 2017, WeWork agreed to buy the Lord & Taylor flagship store on Fifth Avenue in Manhattan in a sign of the disruption of the real estate market.