Apple Credit Card? New Release of Apple Daily Card

Apple Card is a revolutionary form of credit card offered by the internationally popular tech company, Apple. The new credit card service is built on the efficient platform as has been long established by the brand, and offers many features to cut down spending, save money, earn extra cash, and accurately track your expenses.

Read here to find out the latest on this new Apple daily credit card.

Apple Card – Daily Cash

Among its features, Apple Card offers a significant amount of cash back on your expenses, and this money is made available on a daily basis. This is actual cash made available daily, so you don’t have to wait to get the money after a given period of time, as is typical with traditional banking institutions.

What’s more, these functions are all built on and compatible with other Apple software, so this daily cash can be sent to contacts, stored for use in the iTunes or app store, or reinvested into the Apple credit card balance.

The Apple Card is able to be used through Apple Pay. When used on the platform, users receive 2% of their purchases back as Daily Cash. When the Apple credit card is utilized for other Apple payments, like the app store or iTunes, users receive 4% of their purchases back as Daily Cash.

This is very appealing for many consumers, even those in international territories. Now, transactions made through the Apple platform will garner an additional percent of Daily Cash; this may also provide incentive for third party companies to offer Apple services for their business, in regards to payments and transactions.

Apple Card – Private, and Secure

Apple intends to maintain their company doctrine with this new technology, upholding the values of “simplicity, transparency, and privacy,” while helping customers lead a “healthier financial life.”

The revolutionary credit card ensures solid security by requiring Face ID, Touch ID, and security code to guarantee that purchases are made by the intended Apple customer. Transactions are trackable by GPS, so you can see exactly where the Apple Card was used for any purchase.

Apple maintains complete confidentiality in their transactions, and doesn’t gather information for their use regarding the store name, sale amount, and other transaction specific data; all of this information is protected strictly for the consumer.

Additionally, Apple requires a confirmation after every purchase made. While this may seem excessive, this added security makes it even harder for digital theft to occur on your Apple Pay account.

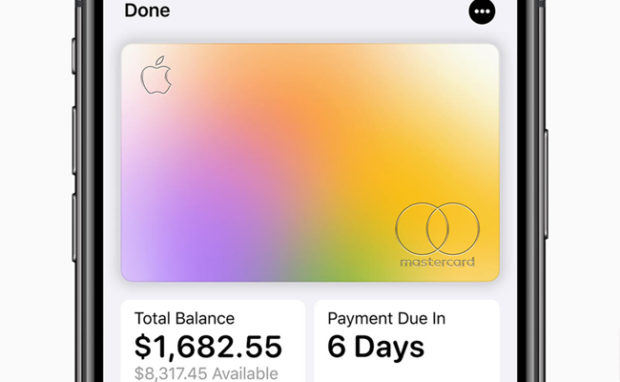

Apple Card – Powered by Goldman Sachs, Mastercard

The in-house Apple credit card is built upon the foundational credit services as offered by Goldman Sachs and Mastercard. This adds significant credibility to the banking claims made by Apple in regards to the revolutionary credit card.

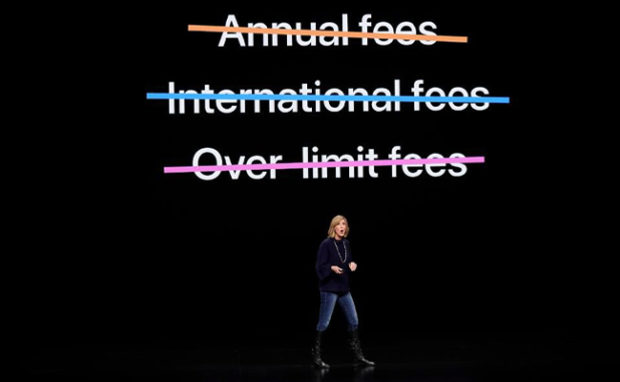

Apple Card and the credit services puts Apple users at the bottom of the interest rate tier brackets. Another great feature of the Apple Card is that no late payment fees or interest increases are made to the account. The user is responsible for the initial interest rate of the credit card, but will suffer no penalty fees or interest rate increases.

Apple Card – Purchase Categories

The Apple Card software automatically sorts your purchases by category, like food, groceries, entertainment, and others. In combination with the GPS, the app lets you see exactly how you have been spending your money, where you have been spending it, and what you have been spending it on.

The weekly and monthly Apple Pay summaries will let you know precisely how your spending habits have been affecting your overall budget, and what changes you can make to save more money.

These are great tools for every consumer, but Apple users can integrate the Apple Pay and Apple credit card system into their digital routine to achieve maximum efficiency and productivity.

Apple Card – Credit Interest

Obviously, paying off your credit balance in full every month is the best way to cut down on interest costs; no interest would be charged. However, Apple understands that this is not a realistic option for most.

Related Articles

Apple Announces Its Long-Awaited Streaming TV Service

Apple Expands Their Reach: Gaming and Video Services

Aiming for Reinvention, Apple Eyes Streaming, Services

Apple Card allows you to enter the amount of money that you are willing to pay each month, then provides you with an estimate of what this sum will accrue in interest over time. The suggestions and interface of Apple Card make it clear how you can maximize your monthly credit expenses.

Apple Card – Other Details

Titanium Design

The sleek titanium design of the Apple credit card makes it an attractive product. The physical card is activated by tapping it to the iPhone with the correct Apple Pay “pop-up” screen present.

Paying Apple Credit Balance

Paying the Apple credit card balance can be done through the Apple Cash balance, which would be earning daily cash on expenses, or through your third-party banking institution. This is a nice way to save, as you can use your Apple daily reward cash towards your credit debt balance.

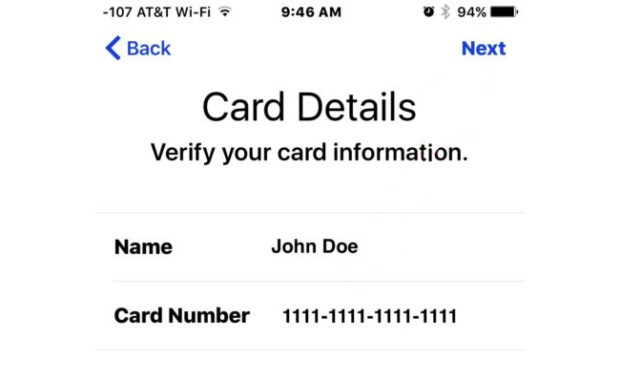

Virtual Card Numbers

Apple Card is able to produce virtual card numbers that can then be used for online purchases that do not fall under the Apply Pay software. This is an interesting feature, as it raises questions regarding the virtual security of the card. If Apple card is able to generate temporary transaction numbers, it may have a stable number used for account identification.

Apple Card – Conclusion

While the Apple Card is still in the “version 1” phase, it has raised a ton of awareness among users of Apple technology and professionals in the banking industry alike. With a new credit system offered to the massive Apple user base, the impact of the new Apple service may be huge.

Prepare for the future as Apple and other companies expand their platforms to offer transaction security, savings, and financial rewards.