Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Transform Credit Reviews and Ratings

Transform Credit Logo

Struggling to get approved for a personal loan because of bad credit? Transform Credit offers a rare solution: you don’t need a strong credit score, but your cosigner does. This trust-based lending model gives borrowers a chance when banks say no.

But with funding delays, limited credit reporting, and cosigner risk, it’s not as simple as it sounds. Here’s what to know before applying.

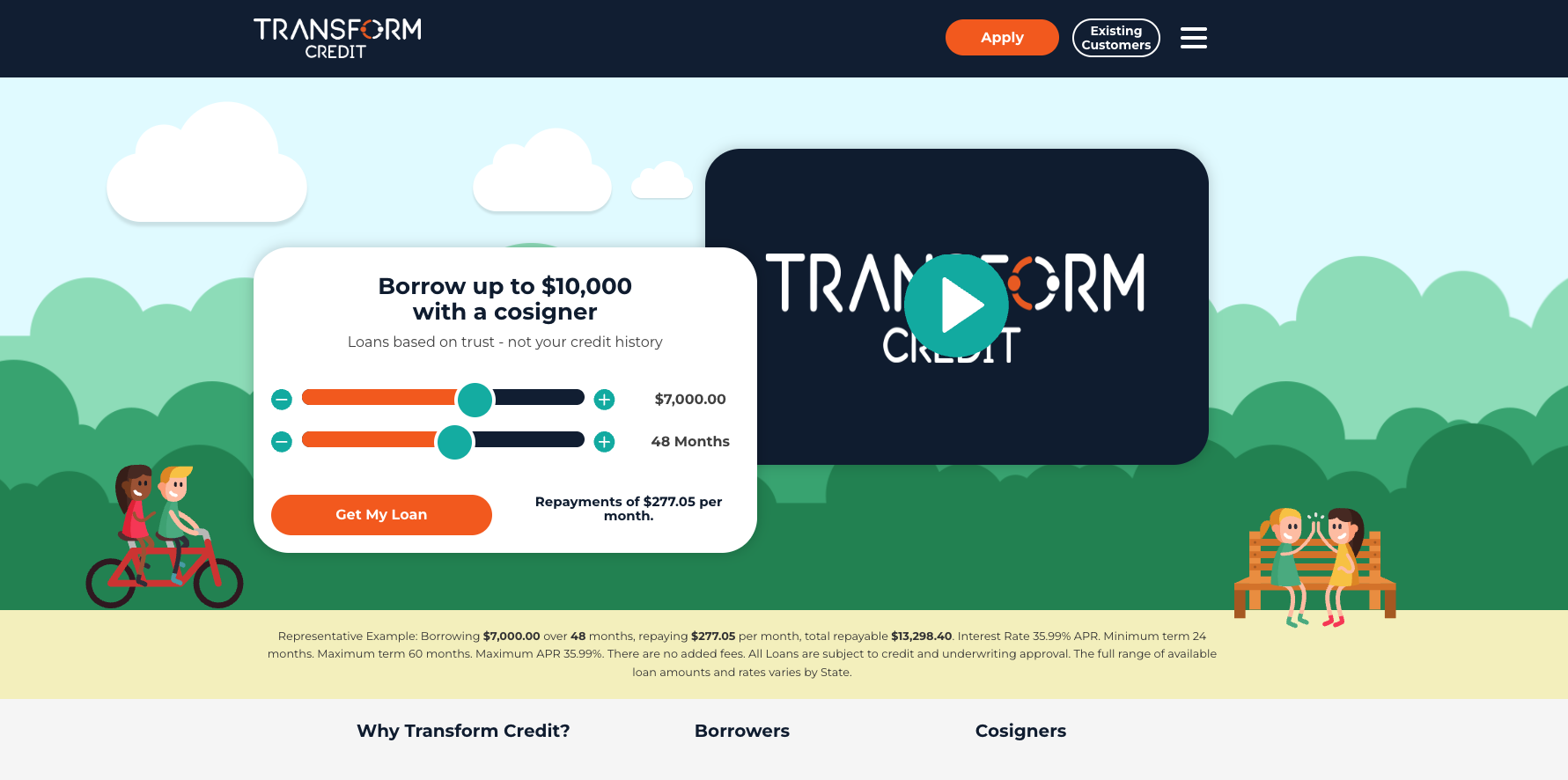

What is Transform Credit, and how does it work?

Transform Credit Homepage

Transform Credit is an online lender founded in 2018 and based in Chicago, Illinois. It operates in 15 states and specializes in unsecured personal loans for borrowers with poor or no credit. The key requirement: you must have a cosigner with a credit score of at least 750.

Unlike payday or installment lenders that rely heavily on automated credit checks, they base approvals on trust. If your cosigner qualifies and is willing to take on full legal responsibility, you may be approved, even if your own credit history is weak.

However, they send the funds to the cosigner’s account rather than the borrower’s. The cosigner must then transfer the money to you. This is designed to reduce fraud but adds an extra step and potential awkwardness.

Transform Credit personal loan terms and eligibility

Transform Credit page explaining the role of a cosigner

Here’s a breakdown of loan details and eligibility requirements.

- Loan amounts: $1,000 to $7,000

- APR range: 20 to 36 percent fixed

- Terms: 24 to 36 months

- Fees: No origination fee, no prepayment penalty, late fees apply

- Credit bureau reporting: Reports to Equifax only

- State availability: Available in 15 states (Arizona, California, Florida, Georgia, Idaho, Illinois, Iowa, Missouri, New Hampshire, New Mexico, Oregon, South Dakota, Utah, Virginia, Wisconsin)

Cosigner eligibility rules:

- Must have a credit score of 750 or higher

- Must be a U.S. citizen or permanent resident

- Cannot have an existing loan as borrower or cosigner

- Being a homeowner does not substitute for credit score requirements

Transform Credit application process and funding timeline

The Transform Credit loan process is online-only and involves both borrower and cosigner. Here’s how it works:

- Borrower submits an application on Transform Credit’s website

- Cosigner receives a link to register and enter financial and personal details

- A hard credit check is performed on the cosigner

- If approved, both parties e-sign the loan documents

- Loan funds are sent to the cosigner’s bank account within 1 to 2 business days

- The cosigner must transfer the funds to the borrower

Many customers report that the approval timeline ranges from 1 to 5 business days, depending on how quickly the cosigner completes their portion. Delays are common when documents are missing or information must be re-verified.

Transform Credit outcomes and success expectations

Transform Credit does not publish official approval rates or long-term performance statistics. However, based on verified reviews, most borrowers who submit complete applications with a qualified cosigner report receiving a decision within 1 to 5 business days, and funding within 24 to 48 hours after approval.

Because they only report repayment history to Equifax, borrowers may not see score improvements across all three credit bureaus. Those who consistently make on-time payments may see moderate gains in their Equifax score over 6 to 12 months, but results vary depending on other credit factors.

Borrowers seeking faster credit recovery or broader reporting may want to combine this loan with other credit-building tools, such as secured credit cards or rent-reporting services.

Who is Transform Credit best for?

Here’s who may benefit most, and who should consider other options:

Transform Credit loans may be a good option for:

- Borrowers with poor credit who have a strong, reliable cosigner

- Young adults who need help from a parent or guardian

- People seeking a lower-interest alternative to payday or title loans

- Individuals willing to commit to monthly payments over 2 to 3 years

Transform Credit is not recommended for:

- Borrowers without access to a qualified cosigner

- Anyone needing fast, same-day funding

- People uncomfortable involving friends or family in their finances

- Those who want to build credit with all three major bureaus

Pros and cons of Transform Credit personal loans

Here’s a quick look at the pros and cons to help you decide if it’s the right fit for your financial needs:

Pros:

- Accepts borrowers with poor or no credit

- Fixed interest rate and fixed monthly payments

- No origination or prepayment fees

- Cosigner model may allow approval where other lenders deny

Cons:

- Cosigner required — adds emotional and financial complexity

- Reports to only one credit bureau (Equifax)

- Funds are sent to the cosigner, not the borrower

- Not available in all states

- Customer service and communication delays reported

Transform Credit customer reviews and complaints

Customer feedback across multiple platforms reveals a wide range of experiences with them. While some borrowers report helpful service and fast funding, others raise serious concerns about lack of transparency, difficulty reaching support, and questionable credit-builder practices.

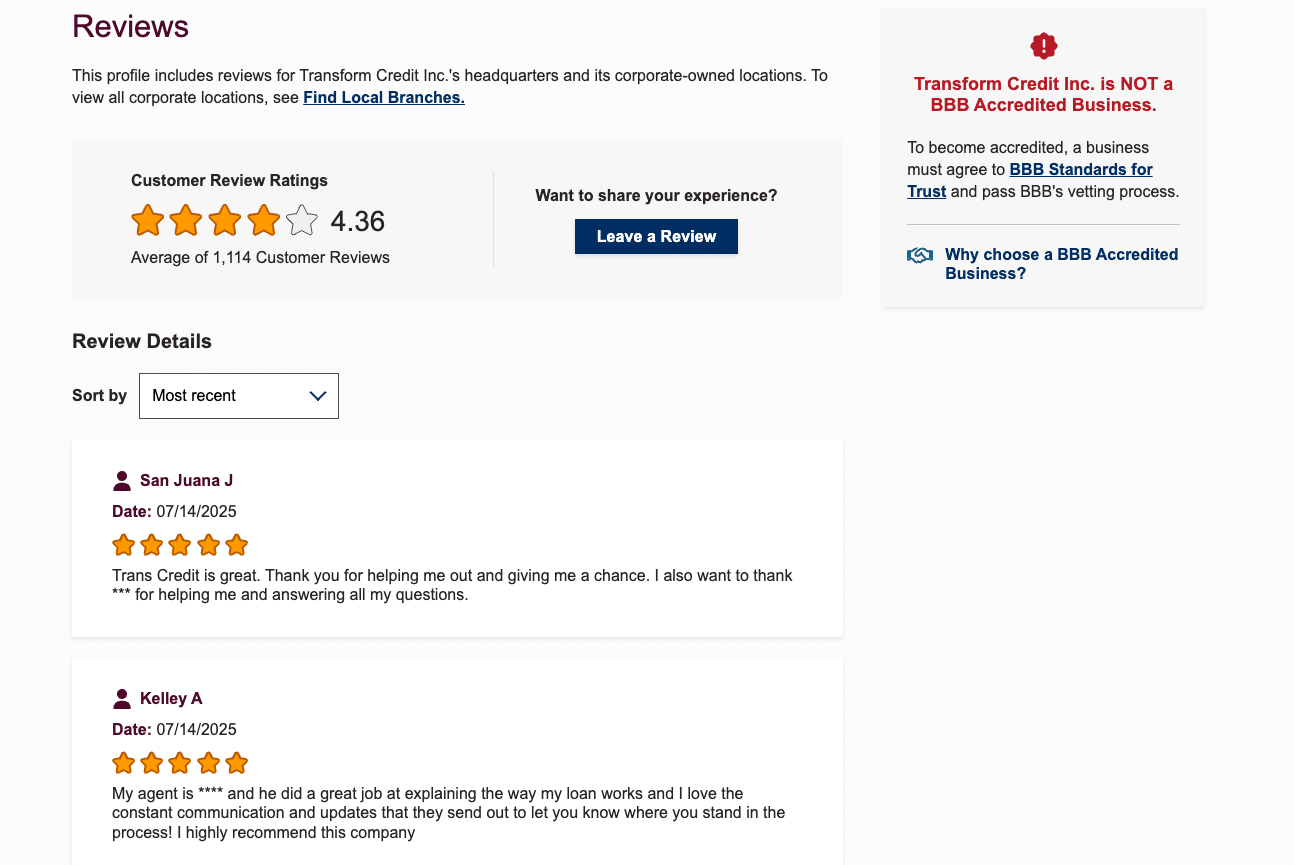

Better Business Bureau (BBB) reviews

Transform Credit BBB Customer Reviews

Transform Credit currently holds a C rating with the Better Business Bureau (BBB) and is not accredited. While the average customer rating is relatively high, the company has an official alert for a pattern of complaints that remain unresolved as of July 2025.

- Rating: 4.36 out of 5 stars

- Total reviews: 1,100+

- Accreditation: Not BBB accredited

Key complaints:

- Cosigners reported hard credit inquiries without notification or consent

- Borrowers claimed loans were approved without a proper application

- Customers are unable to reach live support for payment-related issues

- Unexpected charges tied to the credit builder program

“I cosigned a loan for a friend. When I tried to pay it off, I couldn’t get anyone on the phone. Weeks of emails and voicemails—nothing. Starting to feel like a scam.” – Leondra S., July 2025

“They charged me a $5 fee every month for a service I never agreed to. No clear way to cancel. Totally deceptive.” – Anonymous, June 2025

Noteworthy themes:

- Inconsistent customer support response

- Miscommunication about loan repayment and credit builder product

- Concerns about transparency and consent during the loan process

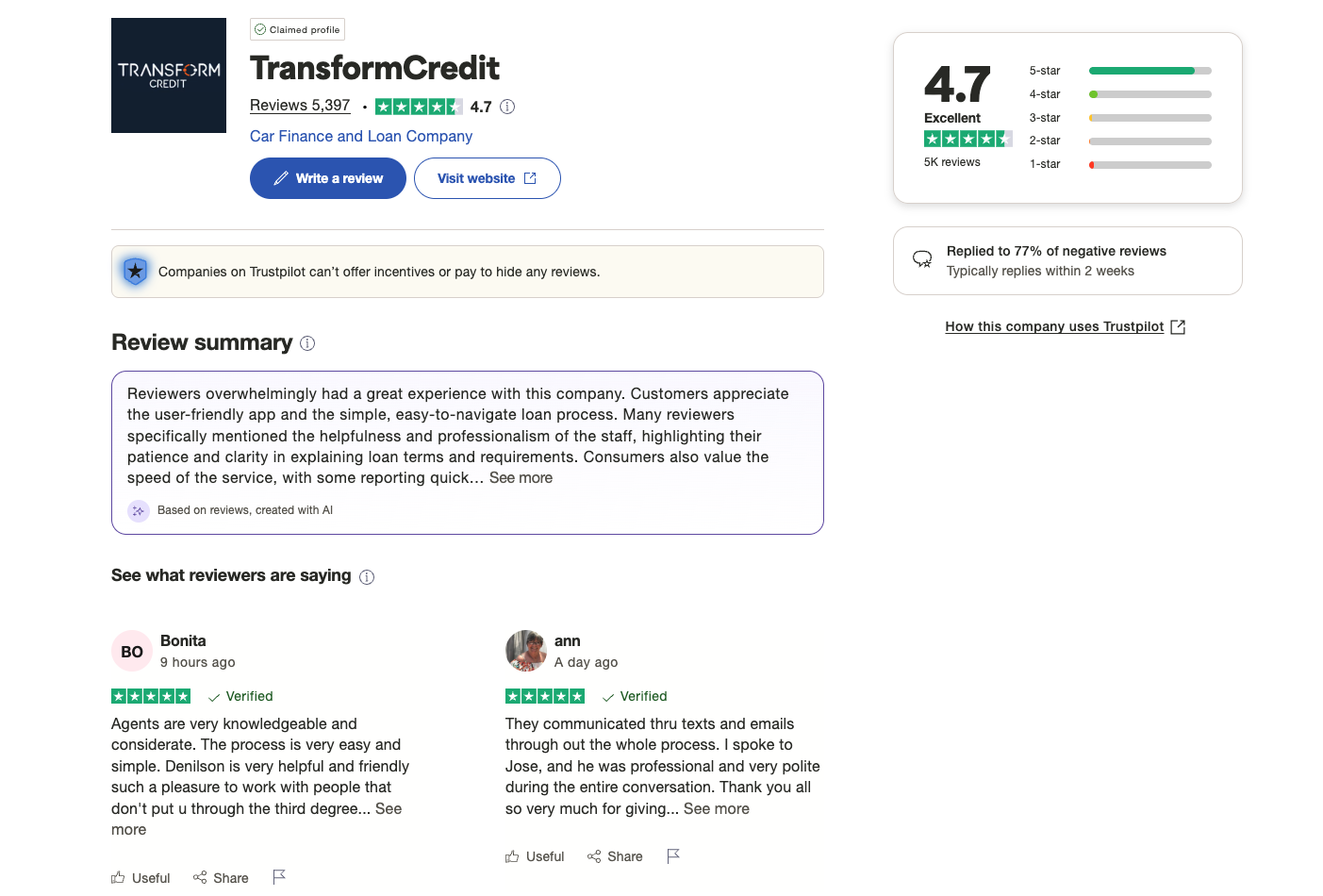

Trustpilot reviews

Transform Credit Trustpilot Ratings and Reviews

Transform Credit maintains a strong Trustpilot presence with overwhelmingly positive feedback, though a small number of 1-star reviews echo concerns about cosigner confusion and payment timing.

- Rating: 4.7 out of 5

- Review count: 5,300+ (as of July 2025)

- Profile status: Verified and active

Highlighted Trustpilot reviews:

“The process was smooth and the representative was polite and clear. Highly recommend for people who need a second chance.” – Ann, 5 stars, July 2025

“It was easy and non-invasive. They didn’t question why I needed the money, and I had it the next day. So grateful.” – Bonita, 5 stars, July 2025

“They ran the payment through my cosigner’s account even after I rescheduled it. Not cool. Wouldn’t use them again.” – Anonymous, 2 stars, July 2025

Bottom line: Most reviewers praise them for professionalism and efficiency, but some negative reviews point to unpredictable payment handling and limited borrower autonomy.

Reddit reviews

Reddit users in personal finance forums offer mixed opinions, with particular criticism aimed at Transform Credit’s credit builder service. Multiple posts mention confusion about how the product works, who it reports to, and how to cancel it.

- Main concerns:

- $5 monthly charges with unclear value

- No visible credit score improvements after months of use

- Difficulty confirming what’s actually reported to credit bureaus

- Lack of updates or communication from the company

TransformCredit reviews? is it legit? byu/TurnOnTheDevon infinanceonloans

“They advertised it like your credit would jump in a few months. Six months in, nothing changed—and canceling it was harder than it should be.” – MerdeInFrance, April 2025

“The service sounded legit at first, but I never got a clear answer about where my payments were being reported.” – divisionparzero, April 2025

Common themes:

- Low transparency around credit reporting

- Confusion between the loan product and the credit builder program

- Skepticism over marketing claims vs. actual results

What sets Transform Credit apart from other lenders?

They stand out in the personal loan space because:

- It doesn’t require a borrower’s credit score

- It uses a cosigner model rarely seen outside student loans

- It avoids excessive APRs common in subprime lending

- It positions itself as a trust-based alternative rather than a risk-based lender

However, its limited credit reporting and co-borrowing model can also be drawbacks, especially for borrowers hoping to rebuild credit across all three bureaus or avoid financial entanglements with others.

Final verdict: Is Transform Credit a good loan option?

It may be worth considering if you have poor credit and a willing cosigner with excellent credit. It offers a lower-cost alternative to payday lenders, without origination fees or prepayment penalties.

That said, it’s not right for everyone. If you want full credit bureau reporting, solo qualification, or faster access to funds, other lenders may be a better fit.

Before applying, weigh the emotional and financial risks of involving a cosigner. For the right borrower, it can be a stepping stone toward rebuilding credit, but the process comes with strings attached.

Frequently asked questions

What banks does Transform Credit accept?

They do not publicly list specific banks it partners with or restricts. However, to receive or send funds, both the borrower and cosigner must have an active checking account at a U.S.-based bank that supports ACH transfers. Online banks, major national banks, and regional institutions are generally accepted, as long as the account is in good standing.

Is Transform Credit a scam?

No, it is a legitimate lender founded in 2018 and headquartered in Chicago. It is licensed to operate in several states and provides personal loans with the help of a cosigner. However, some customer complaints—especially related to unauthorized credit checks and hard-to-reach customer service—have led to skepticism. The company is not BBB accredited and has received warnings from the BBB about a pattern of complaints.

How long does Transform Credit take to deposit money?

Once a loan is approved and signed, they typically deposits funds into the cosigner’s account within 1 to 2 business days. Delays may occur if the cosigner doesn’t complete their part of the process quickly or if there are verification issues. The borrower must then receive the funds via transfer from the cosigner.

What credit score do you need for Transform Credit?

As the borrower, you do not need a specific credit score to qualify. The cosigner must have a credit score of at least 750. Other borrower qualifications include being a U.S. resident, having a bank account, and meeting income requirements. They focuses on the cosigner’s financial stability over the borrower’s credit profile.

What is the $5 payment on Transform Credit?

The $5 payment is associated with a separate Credit Builder program, which is not the same as their personal loan. This program charges a small monthly fee to report on-time payments to Equifax as a way to help improve your credit score over time. Some users report confusion over this charge, especially if they didn’t realize they had enrolled. If you see an unexpected $5 fee, it may be worth contacting their customer service to verify enrollment and cancellation options.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.