Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Money Messiah: Reviews and Ratings

Being in debt is no fun. That is not a hot take. Especially if you have poor credit, it can be very difficult to dig yourself out of a financial hole. Just know, no matter what situation you’re in, you’ve got this! With a combination of grit and outside-the-box thinking, no amount of debt is insurmountable. An example of thinking outside the box is researching all of your possible options when it comes to getting a loan. While having very low credit can make this difficult, there are alternative lenders out there who could potentially help you out.

Today, we’re gonna put a spotlight on a unique, alternative lender known as Money Messiah. They operate out of the Mohawk Territory of Kahnawake, which is important for one key reason. This is a tribal law zone, meaning they are not held to the same standards as traditional U.S. lending regulations. Money Messiah loans are designed to help borrowers that more traditional institutions often deny. Remember, even if Money Messiah sounds like a good option, do yourself a favor and keep looking at as many useful options as possible to make the best possible decision for your financial situation. So, without further ado, let’s dive right into the world of Money Messiah!

Money Messiah: Overview

How It Works & What It Offers

While there are some legitimacy concerns, which we’ll get to later, Money Messiah claims membership in the Online Lenders Alliance and has GoDaddy verified security, including an SSL site seal click badge on their website. They’re also affiliated with the SpeedyLoan network. Payments are processed through the Bulgarian firm Praeconium EOOD. The company emphasizes that it may review credit information from national or specialized credit bureaus, but it does not perform hard credit checks.

Money Messiah loans operate under the territory of Kahnawake law and are not bound by resident state law. This legal positioning allows them to approve applicants for online loans that more regulated lenders cannot, which could help you cover unexpected financial gaps if you’ve exhausted more conventional options.

Pricing, Fees & Eligibility

Pricing for Money Messiah is a true Instagram vs. reality type of situation. While they officially advertise that their APR (annual percentage rate) is 35.99%, the reality is that the real APR is astronomical. One user documented an APR of 420.40%! In other words, a $1,000 loan resulted in a $4,225 repayment. This is a seriously out-of-control interest rate, but this is the price you may have to pay if you have limited options and need a loan.

Eligibility is the real pull here. Money Messiah is not licensed in many U.S. states, including California. Because of this, they don’t follow the traditional caps on lending, meaning they will allow approvals where others can’t. All you need for eligibility is U.S. residency, a government-issued ID (like your driver’s license number), an active checking account, your address and date of birth, and proof of income. The company may obtain, verify, and record information that identifies you, which is a standard compliance step aimed at helping fight the funding of terrorism and money laundering.

Repayment will be bi-monthly through automatic drafts. This can be dicey if you don’t have the funds available at the time of drafting, and an easy way to stay in debt. These automatic payments may incur nonsufficient funds returned item fees or late fees if your account becomes severely delinquent. There are, however, no origination or early payoff penalties, which can appeal to people who want to pay off their debt quickly and have the means to do so. When approved, the funds come fast, often as early as the same day.

Pros & Cons

If you are in a position where you are seriously considering utilizing Money Messiah’s services, there are a lot of considerations. Here, we will clearly outline what the good sides to using their services are, and what the bad sides are. Keep your current situation in mind, also. Do these positives and negatives align with what you need, when you need it, and what you have access to? If not, you will likely find a better option elsewhere. Here is an in-depth breakdown:

Pros: ✅ Accessible to borrowers with bad or no credit – A main pull of going this route for a lender is that it may be one of your only chances at getting approved for a loan. If you have very bad credit or have not yet built up your credit, you have very few options for loans. This may be one of them.

✅ Same-day funding – If you are in a genuine emergency situation where you need money right away, whether it be to pay a ticket before the price goes up, pay a debtor before legal action is taken against you, or whatever the situation may be, being able to get your money the same day you apply for the loan is a godsend, and not always common for other lenders. This makes Money Messiah unique and potentially a good option.

✅ No hard credit checks – If you have a poor credit history, this will not come into play with Money Messiah. Other companies will often use hard credit checks to review your history and habits with credit to gauge the likelihood that you will be able to pay them back. There is also an impact on credit when going through a hard credit check. Money Messiah does not do this.

✅ No upfront or prepayment fees – According to Money Messiah’s website, they do not charge fees related to paying early or signing up, as other lenders are prone to do. This makes them appealing to people who cannot afford any extra costs right away, or are able to pay off their loan early.

✅ Tribal/offshore lending model – This is a main differentiator from traditional lenders. Being of an alternative legal framework allows Money Messiah to take on clients that are too “risky” for other lenders. This means they are willing to take on these riskier borrowers when others wouldn’t.

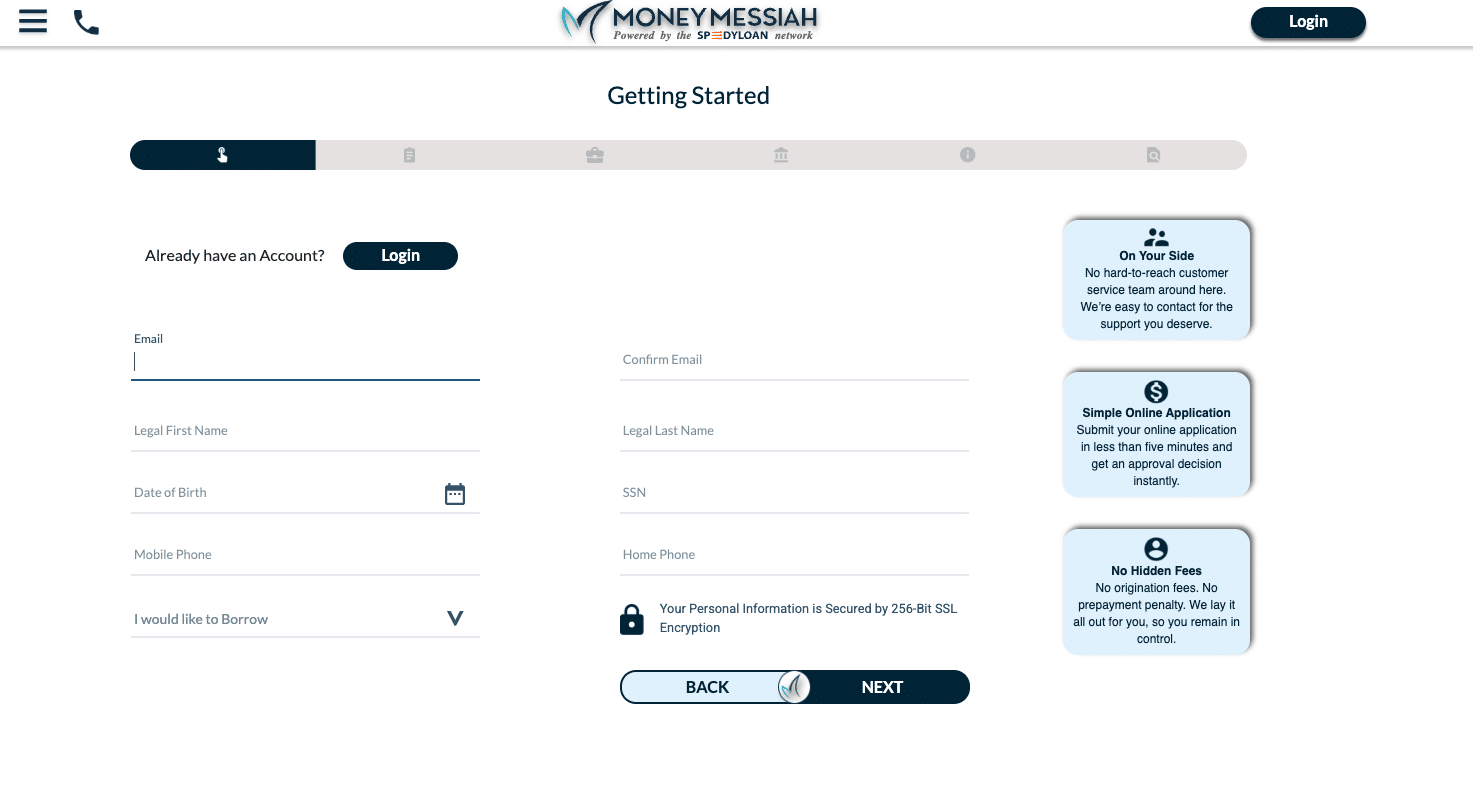

✅ Simple, fast online process – All in all, the application process is extremely straightforward. Several users report that it takes around 5 minutes. When combined with the same day funding, Money Messiah is positioned as a lightning quick way to get an emergency loan.

✅ Works when traditional banks and credit unions say no – All in all, Money Messiah is a last resort that you should only go to if you are in a particular position. You need to be loaned money, but you have few options. In this regard, if you’re rejected by more mainstream lenders such as banks and credit unions, Money Messiah may be worth looking into.

Cons:

❌ APR can exceed 400% – Money Messiah has truly outrageous APR costs. In all honesty, with rates like this, they should be a last resort. It is extremely atypical for a lender to charge you four times the loan amount in interest.

❌ Cease-and-desist order from California regulators – Due to their illegal operating procedure that skirts around established lending regulations, they are currently in legal trouble in the state of California, a possible red flag for those who may want to use them.

❌ Lack of U.S. licensing – What this means is, if you feel wronged by the company in any way, there is very little that can be done legally, because again, this company operates outside of the U.S. regulatory system. It will be nearly impossible to file a complaint and have legal action taken on your behalf.

❌ Opaque company structure – Being that the company is run through Canada and Bulgaria by unknown or unclear operations and entities, there is definitely a sketchy element to Money Messiah, with all other things considered.

❌ Bi-monthly auto-withdrawals – Upon getting your loan, Money Messiah will automatically draw the funds from your bank account twice a month. This can deplete your money shockingly fast if you’re not prepared properly to pay back the loan on this tight schedule.

❌ May lead to debt spirals – Between the auto-withdrawals and the sky-high APRs, getting a loan from Money Messiah can potentially put you in a spiral of increasing debt if you don’t plan your finances well. Exercise extreme caution and be aware of the heavy immediate toll of using this type of loan.

❌ Marketing doesn’t match real costs – Another component to the sketchy nature of Money Messiah is that the way they present their price points does not add up to the reality of what they charge. This lack of honesty is very atypical of lenders, and perhaps if they were more well regulated they would not be able to get away with it.

Final Verdict / Should You Use It?

Hopefully, by this point, we have painted a pretty clear picture. This is an absolute last resort type of lender to go to for funds. Money Messiah operates in a gray area, legally speaking, and for some borrowers, that’s exactly the point. If you need fast cash and it’s an emergency, they may very well approve you when others would not. But make absolutely sure that it is for a short-term need and not used as a long-term solution. Also, make sure that you have the means to pay off your loan quickly. Or else you may be hurting even worse than you were before getting the loan. Because these APR levels are no joke. They can seriously bury you in debt if you don’t have an actionable game plan. So, to reiterate, Money Messiah is to be used if you are in an immediate crisis only!

If you are in a big enough financial emergency to where you are considering a sketchy, expensive company like Money Messiah, do yourself a favor and do thorough research on all your options. There very well may be a better, cheaper, safer option for you to dig out of the hole you are in, and regain financial freedom. Here are some potential options that would be far superior to Money Messiah that you may look into:

- Credit unions

- Community development financial institutions (CDFIs)

- Nonprofit credit counselors

- Peer-to-peer lending platforms

Here’s the thing. Money Messiah is a “bottom of the barrel” type of lender. There are much more ideal options out there. But there’s also a level of solace that they exist. Because with them being around, you always know that no matter how dire your financial situation, or how poor your credit is, you have a chance to get a loan and right your ship. The key to avoiding the need to look into a company like Money Messiah, however, is to learn from your past mistakes, and educate yourself on finances, i.e. budgeting, saving, etc. No matter what position you are in, fret not. You got this! We hope this article helped you on your path to financial freedom. Good luck!

Frequently Asked Questions About Money Messiah

1. Is Money Messiah a legit lender or a scam?

Money Messiah is a tribal law lender based in the Mohawk Territory of Kahnawake, meaning it operates under applicable tribal and federal law, not traditional resident state law. While it’s not technically a scam, it’s not regulated like a lender you can trust in the U.S. banking system. They obtain, verify, and record applicant info via a web form to request funds and often approve loan applications quickly — but at potentially extreme costs. Always carefully review the terms before signing anything.

2. How fast can I get money from Money Messiah?

If Money Messiah approves your loan, the money could be deposited into your account as soon as today. Many borrowers report getting the money they need through the form to request funds in under five minutes, followed by fast processing. However, some customers note that failure to make timely payments may trigger non sufficient funds returned item fees or involve a 3rd party collection agency if the account becomes severely delinquent.

3. Does Money Messiah perform credit checks?

Money Messiah loans are designed for high-risk borrowers. While they do not perform hard credit checks, they may review credit information from national or specialized credit bureaus or request credit and verification requirements to comply with territory of Kahnawake law. This flexibility allows them to serve applicants for online loans who may not qualify elsewhere.

4. Are there late fees or other hidden costs?

Yes — in addition to high APRs, late fees, NSF or late fees, and nonsufficient funds returned items can all add up quickly. If your account becomes severely delinquent, you may face aggressive repayment measures. These are detailed in their important customer disclosures, which you should sign after you carefully review the terms. Their status as a territory of Kahnawake company means they aren’t required to follow the same fee limitations permitted by applicable law in the U.S.

5. How secure is the Money Messiah website?

Money Messiah’s website displays an SSL site seal, click badge, and offers seal click to verify indicators to help users feel secure. While these suggest a degree of encryption and legitimacy, keep in mind that these seals don’t equate to full regulatory oversight. Any lender that could wire money so fast without oversight should be treated with caution, even if it helps cover unexpected expenses or gives you peace of mind during a crisis.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.