Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Reprise Financial: Reviews and Ratings

The year is 2025, and things are expensive! Between credit card debt, home and car upkeep, high interest rates, groceries, tickets, and bills, it’s quite easy to get overwhelmed. Just know there are options out there to help you get a handle on things and right your financial ship. A solid option would be personal loans from accredited lenders. It can be confusing and tiring to know which one to pick, so we are gonna help you out here with this article, putting a spotlight on Reprise Financial.

Now, it’s important to keep in mind that even if you read this whole article and think to yourself, “Oh wow, Reprise sounds perfect! I’m gonna roll with them!” fight your impulses! Reprise very well may be the best option for you and your finances, but part of having high-level financial skills is making the absolute best decision for your situation, whatever it may be. This means thorough research, comparing rates, understanding the lending process thoroughly, etc. By the end of this article, you’ll become an expert in all things Reprise Financial, and along the way, learn a good bit about the lending scene. Without further ado, let’s get right into it!

Reprise Financial: A History and Overview of Their Services

To put it very simply, if you need money, or have too much debt, Reprise will help you out. They offer both debt consolidation and personal loans. That’s a unique combo, most people offer one or the other. Let’s look at their core services.

Debt Consolidation: Simple Payments

This is a very key feature of Reprise Financial that can seriously come in clutch. If you have multiple debts, like medical fees, credit card debts, and expensive tickets, Reprise can help you out big time. They will employ their team to negotiate your debts on your behalf and save you money. You will then be paying Reprise directly instead, which will also be a lot easier. Be aware, though, that Debt Consolidation can take up to two years and will definitely impact your credit score.

Personal Loans: Quick Cash Boost

If you just want some money fast, for whatever reason may be, Reprise will offer you personal loans. These can be for anything, ranging from credit card debt, home repairs, paying a medical bill, etc. All that matters is you are able to make your monthly scheduled payments on your loan you took out. Your loan terms and availability will depend on your credit report, income, and other eligibility criteria.

The Loan Process

We’re gonna explain the process of getting a loan to ensure that you don’t get blindsided by any hidden fees or anything like that. You’re gonna start with an initial inquiry to determine if you can be pre-approved for any loan offers. Pre-approval is not final approval. For final approval, you will have to provide more information, such as income, employment history, and bank account information. At this point, there will be a soft credit report check. All that means is this won’t impact your credit score. However, if they go ahead and offer you a loan, you will likely get a hard check, which will impact you a little bit. But at this point, you have been approved, woohoo! You’ll receive loan terms now, read closely. Just accept after reading, and your funds will go to your bank account. Ka-ching!

Weighing the Pros and Cons

Good luck finding a perfect service of any kind out there. Reprise Financial, just like all other businesses, has areas they are strong in and areas it is weak at. Let’s take a look at them to round out our feelings on them:

Pros

- Single Application: You’re gonna be saving a lot of headache by only filling out one application and letting PDS match you with your options.

- Debt Consolidation: If you have a lot of debt from different places, Reprise can streamline the debt process by negotiating it down and requiring you to only pay them on a monthly schedule.

- Competitive Rates: With a wide network, Reprise can find some pretty competitive rates for you.

- Streamlined Process: The Reprise Financial service is very easy and fast. Compared to traditional lenders like banks, they can make them look quite old fashioned.

- Helpful Resources: They have pretty helpful resources on their website that can answer a wide array of questions, and help you out with the process.

Cons

- Not a Direct Lender: Given that they act as an intermediary, Reprise doesn’t have direct say over the terms, fees, and qualifications required of the loans you are matched with. This will be a case-by-case thing with the lender that you’re matched with.

- Higher Rates: The thing about loans is that the best rates are only available to those with great credit. So while Reprise will help you find loans that are competitive for your credit bracket, the rates will likely be on the higher side.

- Credit Impact: If you employ debt consolidation services from Reprise, you have to be aware of the cost to your credit. You will be paying Reprise, not your creditors. So this means over the life of your debt consolidation program, your credit is prone to getting dinged.

Reprise Financial: Comments, Ratings, and Reviews

To get a better understanding of Reprise Financial, let’s look at what customers are saying on various review platforms. When formulating an opinion of a service as imortant as debt consolidation, leveraging existing customer testimonials is invaluable. Keep in mind that online reviews can be subjective, and rife with troll reviews or emotional outbursts. Nevertheless, the empirical data is helpful.

Better Business Bureau (BBB)

Reprise Financial holds an A-score on the BBB and has been accredited since July 25th, 2022. Customer sentiment is mixed however, with a 3.69/5 average review, based on 271 reviews. Some customers praise the company’s professionalism and helpfulness, while others express concerns about high interest rates, excessive documentation requirements, and potential “bait and switch” tactics. These comments suggest the necessity of thorough review of loan terms and requirements before signing anything.

Positive Review: “They were very professional and knew every detail of my loan no matter who I spoke to, and they were very patient. Thank you guys for everything you have done.”

Negative Review: “WARNING DO NOT USE THIS COMPANY….I received an email to get personal loan offers via [redacted] called a ‘No Ding Decline.’ After I reviewed the possible offers, I decided to pursue Reprise. They gave me options for a secured or unsecured loan. Well, the secured option is a hoax as they try to force you to pay off the vehicle through their outrageously high terms… When you go for the unsecured ‘offer,’ they start asking/requiring you for all kinds of documentation – too much UNNEEDED documentation. … After that, they change the terms completely and say you are not approved or try to give you a 30% loan, which is crazy too high….a classic bait and switch. … I WAS ALSO DINGED ON MY CREDIT REPORT (IT WAS SUPPOSED TO BE A NO DING DECLINE) WHICH WAS ALSO A LIE FROM THE VERY BEGINNING. THE COMPANY IS DEFINITELY A SCAM I DO NOT TRUST THEM WITH MY FINANCIAL DOCS.”

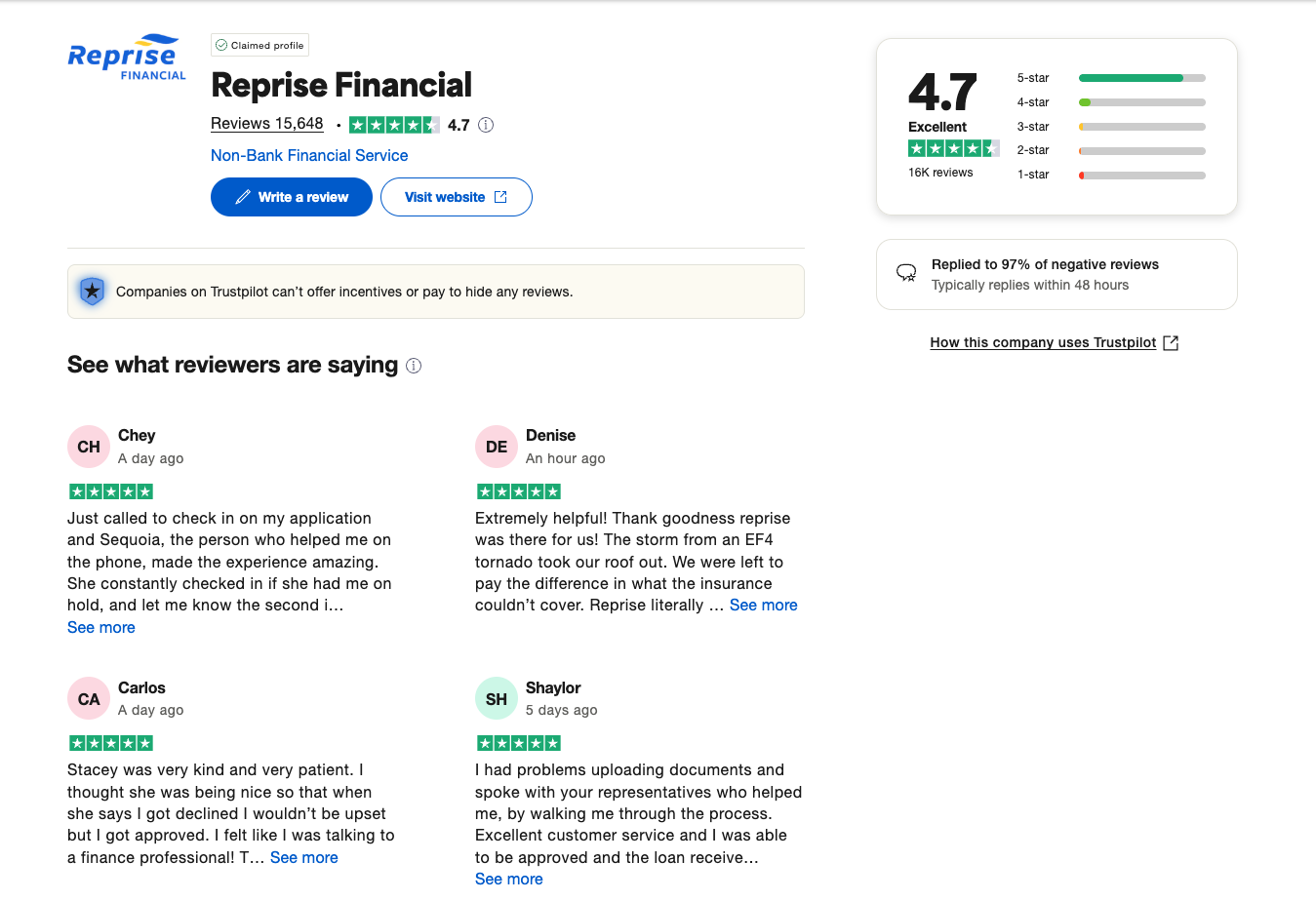

Trustpilot

Positive Review: “Easy approval time and quick funding. Great customer service!”

Negative Review: “The loan process went well but there was an error on my bank account. I’ve called, sent in the required info, it’s 10 days after approval and I have not received funding yet. I’m at wits end and nobody is helping. I keep getting told 24-48 hours. I will have a payment due and not received funding.”

Google Reviews

Positive review: “Very easy process, and I received my funds immediately. [Representative] was extremely helpful and kept me updated. I will definitely recommend their services to anyone! Best company ever!”

Negative Review: “I was a victim of the old bait and switch with Reprise Financial. They offered several loan options and I chose one that was at 12% APR. I wasted hours with them answering questions, uploading documents and getting them a payoff on my car only for them to switch the rate to 30% APR at the time of contract completion. Do not fall for this! They are not ethical!”

True value only lies in looking at the full spectrum of reviews while noticing recurring themes, rather than focusing on just one or two isolated incidents. Remember that people are often more likely to leave a review when they’ve had a particularly positive or negative experience.

Reprise Financial: Comparison to Competitors

| Lender | Loan Types | Interest Rates (APR) | Fees | Credit Score Req. | Funding Speed | Direct Lending? |

| Reprise Financial | Secured & Unsecured Personal | 9.99% – 36% | Origination: up to 6% | 560+ | Next business day | Yes (some via WebBank) |

| OneMain Financial | Secured & Unsecured Personal | 18% – 35.99% | Origination: 1% – 10% | None specified | As soon as one hour | Yes |

| Avant | Unsecured Personal | 9.95% – 35.99% | Admin fee: up to 4.75% | 580+ | 1–2 business days | Yes |

| Achieve | Unsecured Personal, Home Equity | 8.99% – 35.99% (est.) | Origination: 1.99% – 6.99% | 620+ | As soon as next day | Yes |

This table highlights that while Reprise Financial offers access to various loan types through its network, the specific interest rates, fees, and credit score requirements will depend on the individual lending partner. This is signalled by the wide range of interest rates. Direct lenders like OneMain, Avant, and Achieve have their own specific ranges and policies.

The takeaway is do not zone in on Reprise Financial right away. Explore options from direct lenders, credit unions, and other online lending platforms to make the decision making process more precise.

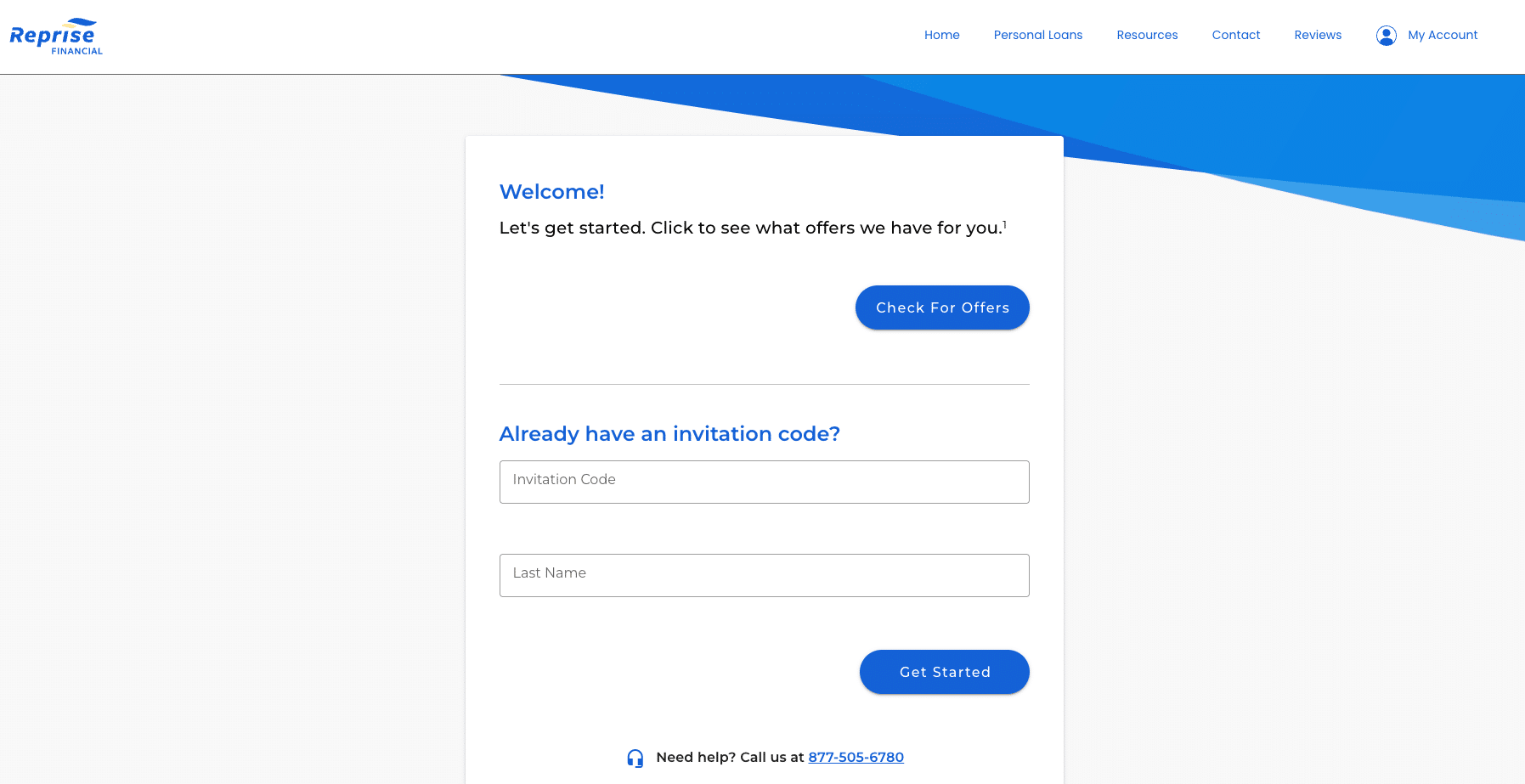

How to Apply for a Loan Through Reprise Financial

- Visit the Website: Go to the Reprise Financial website. Take some time to navigate and understand the information they provide about their services.

- Initial Inquiry/Pre-Qualification: You’ll likely start by filling out a short online form with basic information such as your name, contact details, the purpose of the loan (e.g., debt consolidation, personal loan), and the desired loan amount. This step often involves a soft credit pull to see if you qualify for any pre-approved offers without impacting your credit score.

- Review Potential Offers: Based on your initial information, you may be presented with a list of potential loan offers from different lending partners within the Reprise Financial network. Carefully review the terms of each offer, including the interest rate, repayment period, fees, and monthly payment amount.

- Select an Offer and Proceed with Full Application: If you find an offer that seems suitable, you’ll typically proceed with a full application. This will require providing more detailed documentation about your financial situation.

- Provide Documentation: You’ll likely need to provide information and documents to verify your identity, income (e.g., pay stubs, tax returns), employment history, and possibly bank account details. The specific documents required will vary depending on the lending partner. You may need to give consent for them to access your financial information.

- Credit Check (Hard Pull): Once you proceed with a full application, the lending partner will typically perform a hard inquiry on your credit report. This can slightly lower your credit score, so it’s generally advisable to only proceed with a full application for an offer you are seriously considering.

- Underwriting and Approval: The lending partner will review your application and documentation to make a final decision. This process can take some time.

- Loan Agreement and Funding: If your loan is approved, you will receive a loan agreement outlining all the terms and conditions. Carefully read and understand this agreement before signing. Once signed, the funds will typically be deposited directly into your bank account within a certain timeframe. You will be informed of the expected deposit date.

- Repay Your Loan: Once you receive the funds, you’ll begin making regular payments according to the agreed-upon schedule. Ensure you understand the payment due date, the amount due, and how to make your payments.

Throughout this process, if you have any questions or concerns, you should reach out to Reprise Financial or the specific lending partner you are working with. They should have professional staff available to assist you. Make sure to get any and all questions and uncertainties addressed before signing off on anything.

Is Reprise Financial Right For You?

Determining if Reprise Financial is the right choice for your financial needs requires careful consideration of its strengths and weaknesses in relation to your individual circumstances.

Reprise Financial might be a good option if:

- You are looking to simplify multiple debts into a single monthly payment. Their focus on debt consolidation can be particularly helpful.

- You want to explore multiple loan offers with a single application to save time and effort.

- You are comfortable with the fact that they are a platform connecting you with other lenders, and you are prepared to research the specific terms of the offers you receive.

- You have a decent credit report and are likely to qualify for competitive interest rates from their partner lenders.

Why Reprise Financial may not be for you:

- You prefer to work directly with a specific lender and want more control over the lending institution.

- Your credit report is poor, so you might find better options with lenders specializing in bad credit loans (though these often come with higher interest rates).

- You want complete transparency upfront about the specific lenders in the network and their terms before applying.

- You are wary of potential fees charged by partner lenders and prefer lenders with clear and minimal fee structures (like some credit unions).

Ultimately, the decision depends on your individual financial situation, your comfort level with their model, and the specific loan offers you receive. Don’t feel pressured to accept the first offer you see. Take your time to compare all your options.

Final Thoughts

Navigating the world of loans and debt consolidation can feel daunting, especially when you’re already facing financial challenges. It’s crucial to remember that you are taking a positive step by researching your options and seeking solutions. Reprise Financial offers a platform that can potentially streamline the process of finding a loan that meets your needs. Their model of connecting borrowers with a network of lenders can offer convenience and access to various offers.

However, as emphasized throughout this article, thorough research is paramount. Don’t rely solely on the information provided by any single entity. Take the time to check reviews from multiple sources, compare interest rates and fees from different lenders (including those outside the Reprise Financial network), and carefully read all the terms and conditions before committing to a loan. Understanding the entire process, from initial inquiry to final payment, will empower you to make informed decisions and avoid potential pitfalls.

Reprise Financial aims to provide a “clear path to a brighter financial future,” and for many, their services might indeed be a helpful step in that direction. By understanding their role as a connector, weighing the potential pros and cons, and diligently comparing their offerings with other options, you can determine if they are the right partner to help you regain control of your finances and work towards a more secure financial future. Remember, knowledge is power, especially when it comes to your money. Good luck with your finances! We hope this article has been helpful.

FAQ: Common Questions About Reprise Financial

- Will checking my eligibility with Reprise Financial hurt my credit score?

- Initially, Reprise Financial and its partners typically perform a soft credit inquiry to check your eligibility for pre-approved offers. This soft pull does not affect your credit report or score. However, if you decide to proceed with a full application for a specific loan offer, the lender will perform a hard credit inquiry, which can have a small, temporary impact on your credit score.

- What types of loans can I potentially get through Reprise Financial?

- Reprise Financial primarily focuses on connecting borrowers with lenders offering personal loans and debt consolidation loans. These loans can be used for various purposes, such as paying off credit card debt, funding home improvements, or covering unexpected expenses. While they might facilitate vehicle loans, their main emphasis appears to be on unsecured personal loans.

- How long does it take to get funds after being approved for a loan through Reprise Financial?

- The time it takes to receive funds can vary depending on the specific lending partner you are matched with. Once your loan is approved and you’ve signed the loan agreement, many lenders aim to deposit the funds into your bank account within a few business days. You should receive information about the expected deposit date.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.