Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

Amone: Reviews and Ratings

Finances are a major pain for most working adults. Whether you’re overwhelmed by credit card debt or have aspirations of finally tackling that home renovation, it can be difficult to proceed with a solid plan. This is, unfortunately, a theme for many Americans. While it is difficult to have a solid game plan sometimes to deal with these financial hurdles, there are plenty of lenders out there that can lend a helping hand. With so many options, though, it can be hard to know where to turn. We are going to put a spotlight on Amone Personal Loans to help you in your ongoing journey to find the perfect lender for your finances.

Making the right financial decisions is a huge part of getting out of debt. This means the research does not stop at this article. If Amone sounds like a great option, we’re glad. But don’t let that stop you from researching other lenders.

By the time this article is over, you will be an expert in all things Amone. We will look at facts, comparisons to competitors, and even customer reviews. So sit back, buckle in, and let’s get this show on the road!

Amone’s History and How They Operate Today

Based in Fort Lauderdale, Amone Corp. has positioned itself as a successful facilitator, leveraging technology to create a more efficient way for borrowers to find loan options.

Here’s a breakdown of how Amone works:

- Connecting Borrowers: At its core, Amone’s primary function is connecting individuals seeking personal loans with a diverse network of potential lenders. They make borrowing easty by simplifying the intermediary process.

- Network Power: Amone has a business partnership with many leading banks across the nation. This vast network makes potential borrowers highly likely to find a lender that suits their financial situation and needs.

- Streamlined Application: Instead of the tedious task of filling out applications for multiple lenders, Amone will only have you do it once, and they will let you know who will accept.

- Matching Borrowers: Amone will use their algorithm and database to find the lender who will work with you and be most cost efficient.

- Not a Direct Lender: Amone does not originate loans; therefore, they aren’t a lender. This is an important distinction

- Free Service: Amone is 100% free to prospective borrowers. They generally receive funds from lenders that they refer customers to

Amone: A Connector in the Loan Marketplace

They make the loan process quite a bit less daunting by replacing a lot of the busy application work with an algorithm that will set you up with a trustworthy lender.

Is Amone Worth It? Pros and Cons

Amone has a unique business model, and with that comes a unique set of considerations. To get a more clear picture of how they stack up against other options, let’s compare their pros and cons.

Pros:

- Convenience: You will be saving a lot of time using Amone over surfing around for different lenders.

- Access to a Wide Network: Amone has a wide range of lenders within their network. This will ensure that they will be able to find a good match for you, even if you have subprime credit.

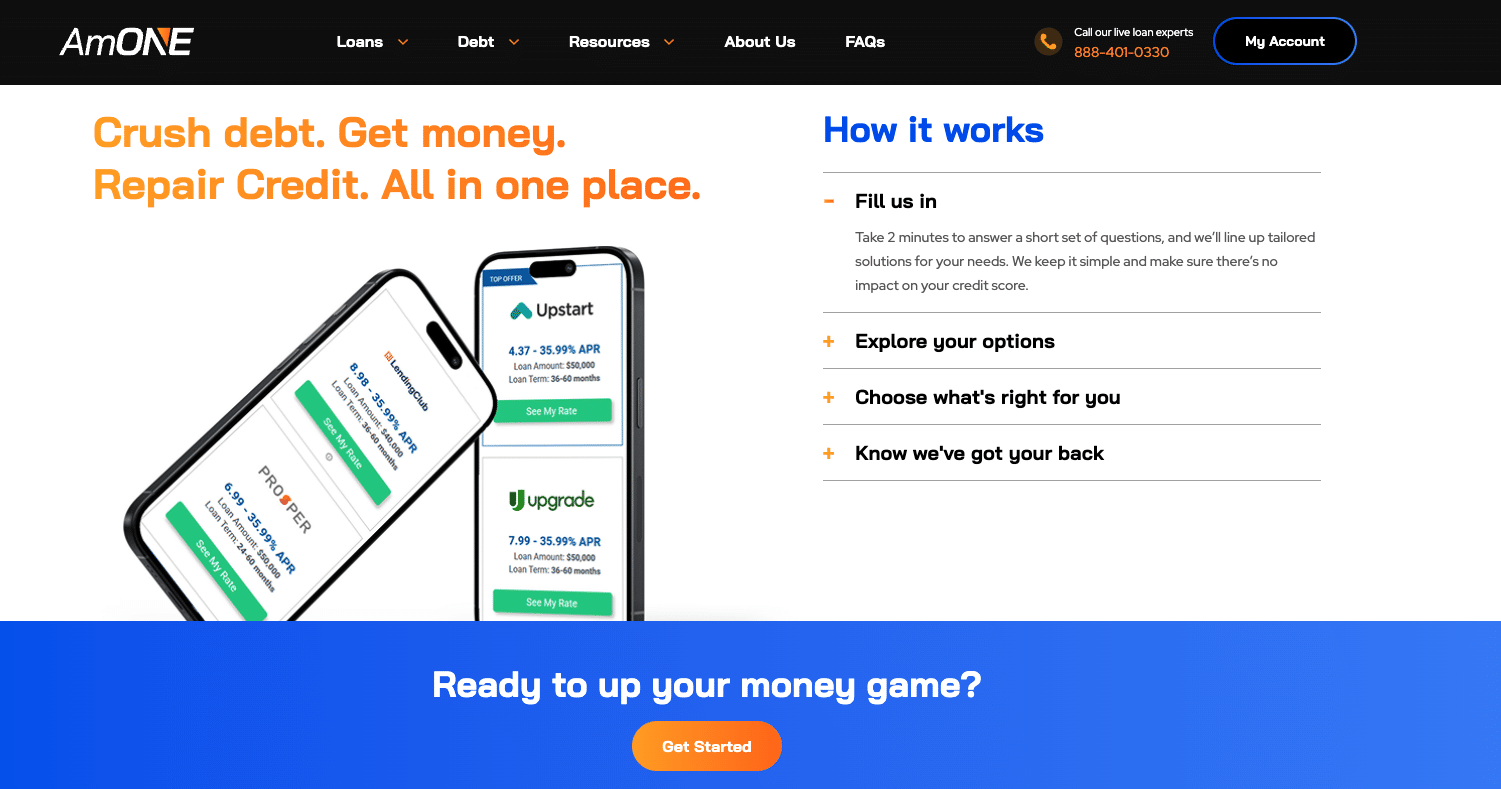

- Comparison Shopping: Comparing different loan offers is easy peasy with Amone. They have an intuitive comparison chart that allows you to visually discern between different offers and pick one that appeals to you

- Potentially Competitive Rates: Competition can be a good thing. When it comes to lenders, competition drives down interest rates. You will find the most competitively priced interest rates with Amone

- Exploring Options Beyond Traditional Banks: Amones network can allow customers to potentially circumvent the more selective lending process of traditional banks.

Cons:

- Not a Direct Lender: Amone is only a stepping stone to the loan. This means they have zero direct say in any terms or fees.

- Reliance on Lender Policies: You will be entirely at the mercy of the policies of the lenders in Amones’ network as far as approval odds.

- No Guarantee of Approval: Even if Amone connects you with a lender, this doesnt mean you are guaranteed to get approved by that lender.

- Limited Transparency in Lender Selection: There is a bit of smoke and mirrors when it comes to the matching criteria, and what lenders will pop up for you to pick from.

- Potential for Varying Customer Service: With dealing with different companies, comes different customer services. These can vary from lender to lender.

Amone Reviews, Ratings, and Comments

In order to get a real-world representation of Amones’ reputation, let’s put a magnifying glass on their reviews from existing customers. Using Better Business Bureau (BBB), Trustpilot, and Google Reviews, we will be able to accrue a diverse set of data from user comments to help us with our diagnosis of Amone. These are trusted and accredited platforms. Keep in mind that online reviews can be subjective, rife with troll reviews and customers who “lash out” due to financial stressors by leaving bad reviews. Nevertheless, they offer valuable insights into what your experience with the lender could be.

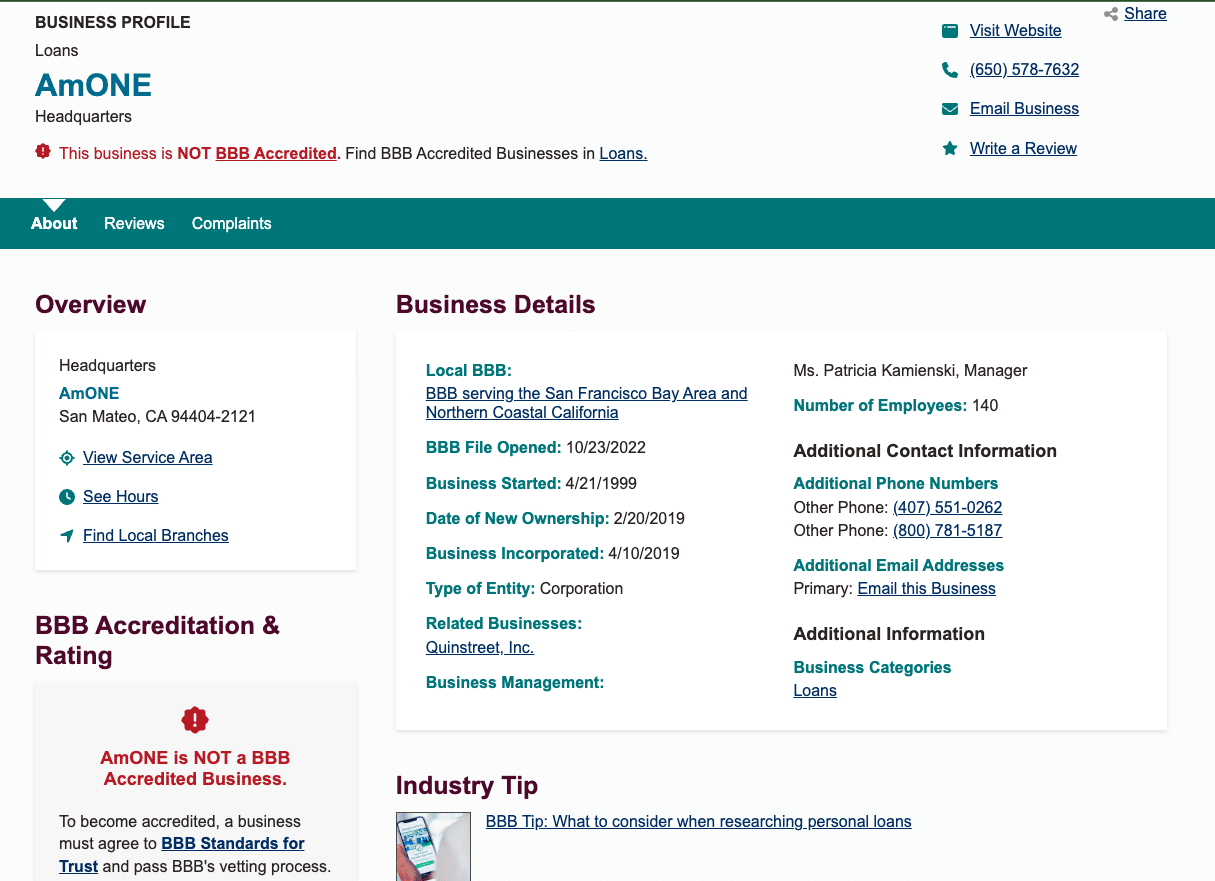

Better Business Bureau (BBB)

- Rating: Not BBB accredited, but holds an A+ rating

- Positive Comment: “Had great customer service. I was well supported and promptly transferred to [a partner] to help with my debt settlement. I appreciate Xavier’s proactivity on my behalf. He didn’t think I would be able to get it but he checked anyway and here I am, on the road to debt freedom once again & keeping good relationship with the banks as I pay the debt off. I’m thankful.”

- Negative Comment: “After reading an article written by them that exactly fit my situation, I decided to go through their process. It was incredibly misleading and they didn’t abide by my situation at all. They said they were connecting me appropriately but only connected me with very aggressive services that were adamant about selling services I didn’t need that were not at all related. They were incredibly pushy, demeaning, and lacking in emotional intelligence on my issue, focusing only on their agenda. It resulted in a lot of time waste and felt brutal.”

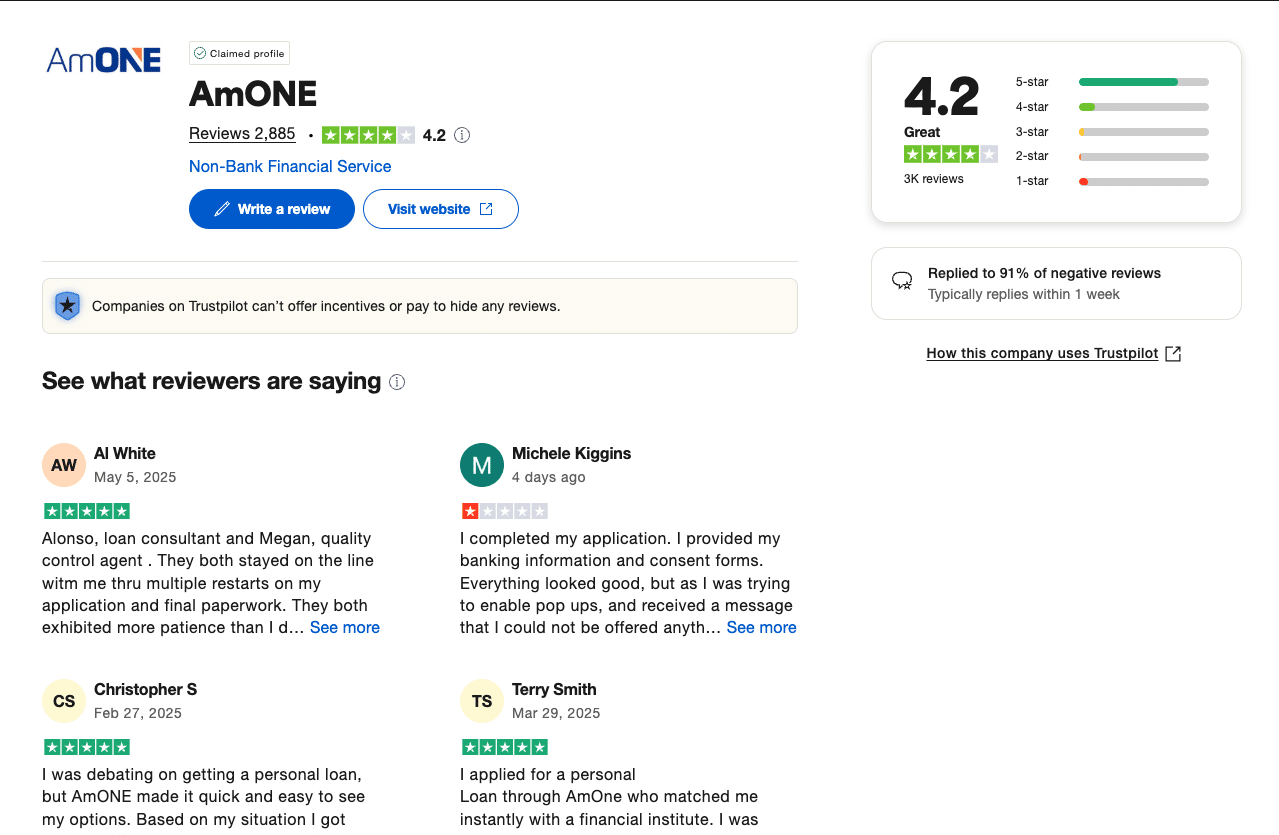

Trustpilot:

- Rating: 4.2/5 with over 900 ratings

- Positive Comments: “I was very impressed with the ease of application and the quick response. In addition, your representative assisted me throughout the entire process and addressed all my concerns and questions. The quick turnaround time was a surprise and a relief.”

- Negative Comments: “I filled out their little questionnaire, which prompted them to start calling me nonstop and leaving the same automated voicemail, sending emails, text messages. Begging me to consider a loan. The rates were bad and the desperation really put me off.”

Google Reviews:

- Rating: 2.9/5 stars

- Positive Comments: “Fast and easy process. I felt relief afterwards that this is the best option for my situation. Thank you again.”

- Negative Comments: “After reading an article written by them that exactly fit my situation, I decided to go through their process. It was incredibly misleading and they didn’t abide by my situation at all. They said they were connecting me appropriately but only connected me with very aggressive services that were adamant about selling services I didn’t need that were not at all related. They were incredibly pushy, demeaning, and lacking in emotional intelligence on my issue, focusing only on their agenda. It resulted in a lot of time waste and felt brutal.”

Overall, you could say that Amones customer reviews lean positive. People clearly appreciate the seamless processes and user accessibility, however some people are critical of misleading expectations and pushy Amone representatives contacting them about Amones services.

Amone and the Competition: How Do They Stack Up?

Now, let’s compare Amone with some competitor brands that exist in a similar lane. This is valuable to illustrate the different points of emphasis, conditions, and lenders in each network.

| Feature | Amone | LendingTree | Credit Karma Loans | Upstart |

| Service Type | Loan Marketplace (Connects Borrowers) | Loan Marketplace | Loan Marketplace | Direct Lender & Marketplace |

| Personal Loans | Yes | Yes | Yes | Yes |

| Small Business Loans | Potentially through network | Yes | No | No |

| Credit Score Focus | Accepts various credit scores | Accepts various credit scores | Focus on good to excellent credit | Considers factors beyond credit score |

| Transparency of Fees | Varies by lender | Varies by lender | Varies by lender | Often more transparent |

| Direct Lender Options | No | No | No | Yes |

As you can see, depending on your individual factors, such as credit score, there may be better options than Amone. But there is clearly a lane for Amone to exist in, and plenty of potential borrowers who could make great use of their services.

Application Process: How to Apply Through Amone

- Visit the Amone Website: Hop on to Amone.com.

- Complete the Online Form: Fill out a simple form where you will include your personal info, financial status, needs, and what loan amount you would like

- Submit Your Information: Once the form is complete, you will give the info over to Amone by clicking send.

- Review Loan Offers: Amone’s system will get busy matching you to potential lenders that can meet your needs. They’ll provide a comparison of loan offers, with details on interest rates, loan terms, repayment terms, and fees associated with each offer.

- Compare and Select: Now is your opportunity to review each offer. Compare the Annual Percentage Rate (APR) and ideally pick the ones that are lower. Consider the repayment terms and how they fit into your budget.

- Connect with the Lender: Once you find the lender that feels right, you’ll be directed to their website. You are now completely in the Lenders hands now, as Amone has passed you over to them. So you’ll be filling out their application and corresponding directly with them.

- Finalize the Loan: You’ll work directly with the chosen lender to provide any additional documentation they require and complete the loan closing process.

Read all terms and services for the chosen lender. Ask any questions you have before signing off on anything, and keep in mind this is a separate entity from Amone that requires separate correspondence.

Is Amone the Right Choice for You?

Let’s make a definitive decision on whether or not Amone is going to be the answer for you. We’re gonna compile all the data, user comments, and competitor comparisons to answer this question! Let’s take a look:

Amone Might Be a Good Fit If:

- You want a convenient way to explore loan options from multiple lenders without filling out numerous applications.

- You’re looking to compare offers and potentially find competitive interest rates and loan terms.

- You want access to a wider network of reputable lenders, including those that may work with a range of credit scores.

- You value a streamlined online form and a quick overview of available loan offers.

Amone Might Not Be the Best Fit If:

- You prefer to work directly with a direct lender from the outset.

- You have a very specific type of loan in mind that might not be widely available through Amone’s network.

- You are looking for in-person customer service or prefer a more direct relationship with your lending institution.

- You have excellent credit and want to explore options with lenders who cater specifically to prime borrowers.

Ultimately, the decision of whether to use Amone rests with you. Consider your financial situation, your comfort level with an intermediary platform, and your willingness to carefully review offers from potential lenders.

Final Thoughts: Empowering Your Financial Journey

Navigating the world of personal loans can feel overwhelming, but resources like Amone aim to simplify the process by connecting you with a network of lenders. While Amone offers convenience and the potential to compare offers, it’s crucial to remember that they are not a direct lender. The final loan terms and approval depend on the individual lenders within their network.

Thorough research is paramount when making any financial decisions. Take the time to explore different financial institutions, understand the loan process, and carefully evaluate the interest rates, fees, and repayment terms associated with any loan offer. By equipping yourself with knowledge and comparing your options, you can take confident steps towards achieving your financial goals and building a more secure financial stability.

Frequently Asked Questions (FAQ) About Amone

- Is Amone a direct lender? No, Amone is not a direct lender. They are a loan marketplace that connects borrowers with a network of reputable lenders. You will ultimately be borrowing money from one of the individual lenders in their network.

- What types of loans can I find through Amone? Amone primarily focuses on personal loans, which can be used for various purposes such as debt consolidation, home improvements, unexpected expenses, and more. They may also connect borrowers with lenders offering other personal loan products.

- Will using Amone affect my credit score? Checking your potential loan options through Amone typically involves a “soft credit inquiry,” which should not negatively impact your credit score. However, if you choose to proceed with a loan application with one of the individual lenders, they will likely perform a “hard credit inquiry,” which can have a minor, temporary effect on your score.

- Is Amone a free service for borrowers? Yes, Amone generally offers its services to borrowers as a free service. They typically receive compensation from the lenders in their network when a loan is successfully originated through their platform.

- What if I have a lower credit score? Can Amone still help me find a loan? Amone’s network includes lenders who work with a range of credit profiles, including those with lower credit scores. While you may not qualify for the most favorable interest rates, Amone can still be a valuable tool for exploring your loan options.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.