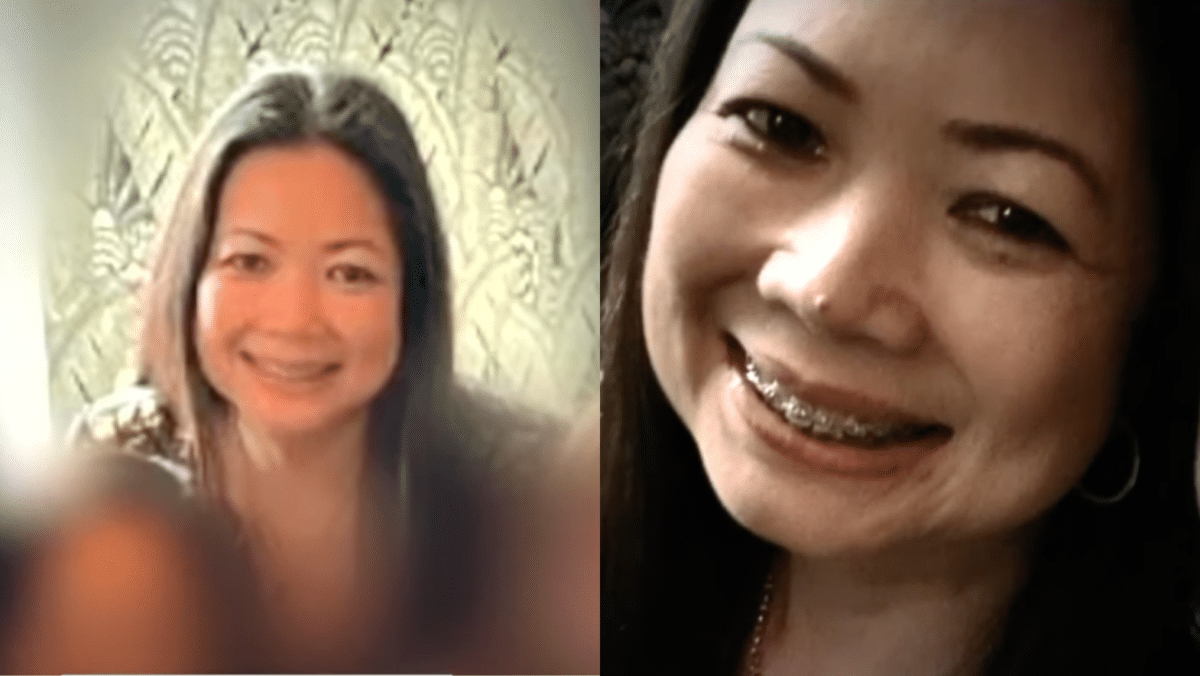

Fil-Am charged in alleged multi-million dollar investment scam

Screencap from ABC 10 News/YouTube

A Filipino American businesswoman from Sacramento is facing federal charges and a complaint from the Securities and Exchange Commission (SEC) after she allegedly defrauded investors in a Ponzi scheme.

Maria Dickerson, 47, also known as Dulce Pino, was charged in a federal indictment on Tuesday with 32 counts of wire fraud, security fraud and money laundering.

Prosecutors said Dickerson was behind a fraud scheme that left approximately 140 investors, including Filipino Americans, in financial ruin.

The SEC filed a separate civil case accusing Dickerson of violating antifraud and registration provisions of federal security laws through her California-based companies, the Creative Legal Fundings and Ubiquity Group LLC.

In addition, the SEC alleged that Dickerson raised around $7 million by deceitfully promising high investment returns to her victims. However, these promises turned out to be part of a Ponzi scheme that preyed on investors in a fake litigation fund for personal injury attorneys.

Investment fraud charges

According to the press release from the US. Attorney’s Office, a federal grand jury has charged Dickerson with 24 counts of wire fraud, one count of securities fraud and seven counts of money laundering.

“Dickerson took money from investors and collected millions of dollars in investment funds solicited with her false promises and representations,” the SEC’s press release stated.

The SEC’s complaint stated that between 2020 and 2024, Dickerson had orchestrated fraud by convincing investors that her shell company Creative Legal Fundings was a legitimate firm.

She assured the investors their money was safe and secure as they were backed by substantial capital. But in reality, Dickerson made Ponzi-like payments, using new investor funds to pay earlier investors while funneling money into her lavish lifestyle, including purchasing a new home in Sacramento and Mercedes Benz vehicles.

However, in May 2023, she ran out of money to continue paying the investors. When her first company Creative Legal Fundings failed, she launched a new business, The Ubiquity Group LLC, where she continued soliciting money under false pretenses.

Monique C. Winkler, director of the SEC’s San Francisco Regional Office, stated,

“As alleged, Creative Legal Fundings’ operations were neither creative nor legal. This was nothing more than fraud perpetrated against retail investors, many of whom were members of the Filipino American community.”

You may also like: Fil-Am police officer killed in fiery crash during pursuit of suspect

Legal repercussions

On top of the SEC’s complaint, the US Attorney’s Office for the Eastern District of California has also filed criminal charges against Dickerson.

If convicted, Dickerson could face a maximum sentence of 20 years in prison and a $250,000 fine for each count of wire fraud.

She could also face an additional 10 years in prison and a $250,000 fine for each count of money laundering.

The securities fraud charge could lead to 20 years in prison and a fine of up to $5 million.