IRS Penalty Relief: Your Comprehensive Guide to Reduce Financial Burden

The Internal Revenue Service (IRS) penalizes taxpayers who fail to meet their tax obligations, leading to a significant financial burden. This can make settling tax debts challenging and cause stress and anxiety. However, the IRS penalty relief offers options to help reduce this burden.

This article guides individuals and businesses grappling with IRS penalties, providing an overview, explaining the different types of penalty relief options, and offering practical tips for avoiding penalties and when to request penalty relief in the future.

Understanding IRS Penalties

The Internal Revenue Service (IRS) penalizes taxpayers who fail to comply with laws. These penalties are not merely punitive measures but are designed to encourage taxpayers to promptly and accurately fulfill their tax obligations.

The Internal Revenue Service (IRS) penalizes taxpayers who fail to comply with laws. These penalties are not merely punitive measures but are designed to encourage taxpayers to promptly and accurately fulfill their tax obligations.

Late Filing and Late Payment Penalties

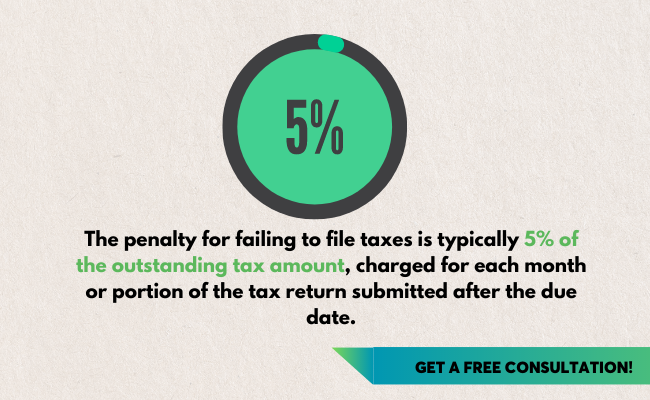

Two of the most common penalties are for filing late and paying late. The penalty for failing to file taxes is typically 5% of the outstanding tax amount, charged for each month or portion of the tax return submitted after the due date.

The penalty for failure to pay is generally 0.5% per month on the taxes you have not paid. This penalty is applicable for each month, including partial months, during which your taxes remain unpaid.

Your penalty accumulates the day after the taxes are due. Fortunately, you can reduce these penalties through penalty abatement if you meet certain IRS conditions.

Failure to Deposit Penalty

The longer you wait, the larger the penalty. You can also apply abatement requests in this case under certain circumstances.

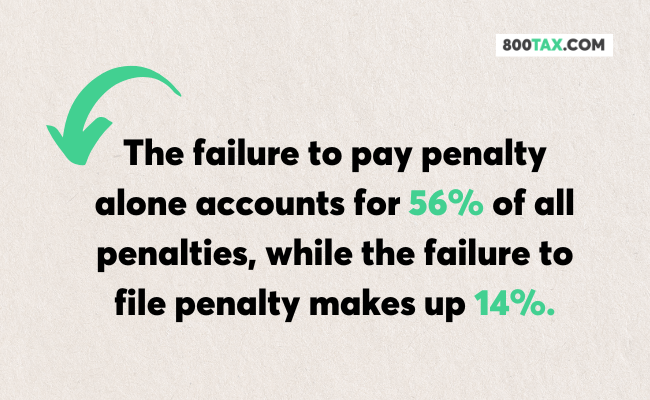

Impact of Penalties

The failure to pay penalty alone accounts for 56% of all penalties, while the failure to file penalty makes up 14%. Penalty abatement can reduce these penalties and alleviate the financial burden.

Reasons for Incurring Penalties

Missing deadlines for filing your tax return or paying your taxes can also result in penalties. Finally, financial hardship can make paying your taxes on time difficult, leading to a failure-to-pay penalty.

Understanding these tax penalties and the reasons you can incur them can help you take steps to avoid them in the future. If you’re struggling, consider seeking help from a tax professional who can guide you through resolving your tax issues and applying for an abatement request.

What Is IRS Penalty Relief?

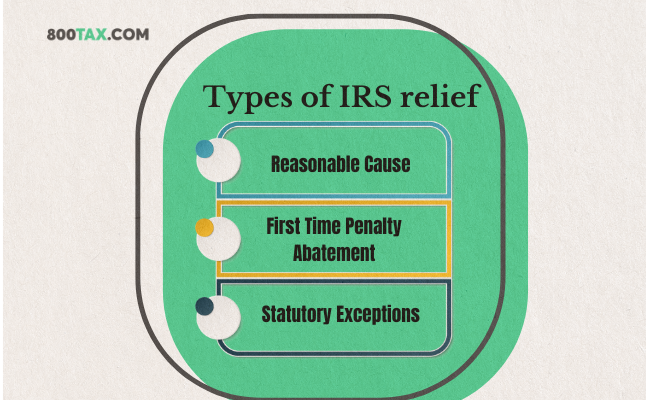

Reasonable Cause

Reasonable Cause is based on the specific facts and circumstances of your situation. The IRS will consider any valid explanation demonstrating your diligent effort and reasonable care in fulfilling your federal tax obligations, even if you encounter difficulties.

This could include situations such as serious illness, natural disasters, or other disruptions beyond your control. It’s important to provide as much detail as possible when making a reasonable cause argument, including any relevant documentation that supports your claim. If the IRS accepts your argument, you may be granted IRS penalty abatement.

First Time Penalty Abatement

This type of IRS relief is an administrative relief granted by the IRS to taxpayers with a clean compliance history. To qualify for this type of relief, you must not have any penalties for the past three years and must comply with all filing and payment requirements.

This means you must have filed all required tax returns or extensions and paid, or arranged to pay, any tax due. If you meet these criteria, you may qualify for first-time tax penalty abatement request under this provision. This form can be a significant relief for first-time offenders.

Statutory Exceptions

These exceptions apply when the taxpayer receives incorrect written advice from the IRS, leading to penalties. You must submit several documents to the IRS to qualify for a statutory exception.

These documents include a copy of the incorrect written advice you received, the written request for advice, and the report of tax adjustments. The report should identify the penalty or addition to tax and the specific tax item to which the penalty request abatement or addition applies. If the IRS recognizes the error, you might be eligible for it.

Applying involves submitting a written request to the IRS, explaining the circumstances that led to the penalties, and providing any supporting documentation. This process can be complex, but it’s a crucial step toward a request for penalty relief or reduction.

You may also like: Tax Relief Programs: Your Essential Guide to Financial Reprieve

How to Apply for Penalty Relief

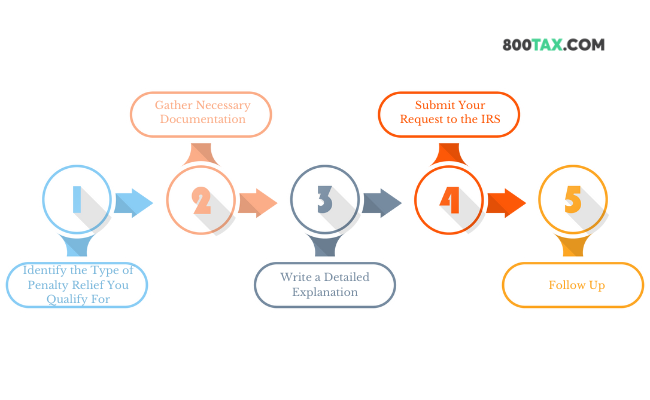

Step 1: Identify the Type of Penalty Relief You Qualify For

You need to understand each option and identify which applies to your situation. For instance, Reasonable Cause is based on circumstances beyond your control, like a natural disaster or serious illness.

First Time Penalty Abatement applies if you have had no penalties for the previous three years and have filed all required returns or extensions. Statutory Exceptions apply if you received incorrect written advice from the IRS. Identifying the correct form is the first step toward relief.

Step 2: Gather Necessary Documentation

Depending on the type of relief you’re applying for, you’ll need to gather different types of documentation. For Reasonable Cause, you might need medical records (if you were seriously ill, for example) or documents related to a natural disaster.

Most importantly, you must show your tax records for the past three years. For Statutory Exceptions, you’ll need a copy of the incorrect advice you received from the IRS. Gathering the right documentation is crucial for a successful penalty abatement application.

Step 3: Write a Detailed Explanation

Once you have your documentation, explain why you believe you qualify for penalty relief. This should include a clear description of the circumstances that led to the penalties, how they were beyond your control, and how they affected your ability to comply with laws.

Be as specific and detailed as possible. This explanation will be a key part of your request.

Step 4: Submit Your Request to the IRS

After you’ve gathered your documentation and written your explanation, you can submit your request to the IRS. You can complete this step by mail or using the IRS’s online services. Remember to include all your supporting documentation and your written explanation with your request. This comprehensive submission will strengthen your case.

Step 5: Follow Up

After submitting your request, following up with the IRS is important. You can check online or contact the IRS via phone to inquire about your request’s status. If the IRS rejected your request, there is an option to initiate an appeal process to contest the decision. Persistence can be key in achieving penalty abatement.

Remember, applying for a penalty abatement request can be complex, and seeking help from a tax professional may be beneficial. They can guide you through the process and help you maximize your chances of success.

Tips and Best Practices for Avoiding Penalties

1. File on Time

Filing your tax return on time is the most straightforward way to avoid it. The IRS imposes a late-filing penalty if you fail to file by the tax return due date or the extended due date if an extension was requested.

Therefore, even if you can’t pay the full amount owed, filing your tax return on time can help you avoid this penalty and the need for a IRS penalty relief.

2. Pay as Much as You Can

3. Set Up an Installment Agreement

Establishing an installment agreement can help you divide your tax debt into manageable monthly payments, thereby reducing the necessity for penalty abatement.

4. Stay Organized

Use a system that works for you, whether it’s a spreadsheet, a financial software program, or a shoebox filled with receipts. The key is to keep track of all your financial information in one place and to update it regularly.

You may also like: Navigating Tax Relief: Understanding Its Importance, Eligibility, and Implications

5. Make Estimated Tax Payments

You can incur an estimated tax penalty if you fail to make these payments or underpay. To avoid this, calculate your estimated tax payments accurately, considering your taxable income, deductions, and credits for the year. This can help you avoid penalties and the need for penalty abatement.

6. Request a Filing Extension If Needed

To avoid interest and penalties, you should estimate and pay any taxes owed with your extension request. Even with an extension, aim to complete and file your tax return as soon as possible to avoid further complications and the need for a tax penalty abatement.

7. Understand the Tax Laws

If you need clarification, consider seeking help from a tax professional like 800tax.com. These professionals can offer personalized guidance based on your unique circumstances, assisting you in avoiding potential pitfalls that may result in penalties and the need for penalty abatement.

8. Seek Professional Help

A tax professional can help you understand complex laws, find tax credits and deductions you might not know, and help you plan for future tax years. They can also represent you before the IRS if you’re facing an audit, need help negotiating a payment plan, or apply for penalty abatement.

Conclusion

IRS penalties can be a significant financial burden, but options are available to reduce or eliminate these penalties. By understanding the types of penalties and the relief options available, you can take steps to alleviate this burden.

If you’re struggling, consider seeking professional advice to explore your options for relief. And remember, the best way to avoid this is to comply with laws. Share this article with others who might find it helpful.

Frequently Asked Questions (FAQs)

What is an IRS penalty?

An IRS penalty is a fine imposed by the Internal Revenue Service on taxpayers who fail to comply with laws. This could include failing to file a tax return on time, failing to pay taxes owed, or making errors on a tax return. Penalty abatement requests can help reduce or eliminate these penalties.

How can I avoid IRS penalties?

The best way to avoid this is to comply with laws. This includes filing your tax returns on time, paying any taxes due, and making estimated tax payments if necessary.

If you need clarification, consider a tax advisor or seek help from a tax professional. They can help you avoid penalties and guide you through penalty abatement if necessary.

What happens if I can’t pay my tax bill in full?

If you can’t pay your tax bill in full, the IRS offers options to help you. You can request an installment agreement, enabling you to make payments toward your bill gradually. Alternatively, you can pursue an Offer in Compromise, a program that enables you to resolve your tax debt for an amount lower than the total owed.

However, remember that penalties and interest will continue to accrue until you pay the bill in full. Penalty abatement can help reduce these additional costs.

What should I do if I receive a penalty from the IRS?

If you receive a penalty from the IRS, you should first verify that the penalty is correct and the estimated tax penalty. If it is, and you qualify for penalty abatement determination relief, you can submit a written request for penalty abatement from the IRS.

In addition, if you need clarification, consider seeking help from a tax professional. They can guide you through the process of applying for penalty abatement.

Editor’s Note: This post was originally published on Jun 23, 2023, and was updated on Jun 30, 2023.

Sponsored Advertising Content:

Advertorial or Sponsorship User published Content does not represent the views of the Company or any individual associated with the Company, and we do not control this Content. In no event shall you represent or suggest, directly or indirectly, the Company's endorsement of user published Content.

The company does not vouch for the accuracy or credibility of any user published Content on our Website and does not take any responsibility or assume any liability for any actions you may take as a result of reading user published Content on our Website.

Through your use of the Website and Services, you may be exposed to Content that you may find offensive, objectionable, harmful, inaccurate, or deceptive.

By using our Website, you assume all associated risks.This Website contains hyperlinks to other websites controlled by third parties. These links are provided solely as a convenience to you and do not imply endorsement by the Company of, or any affiliation with, or endorsement by, the owner of the linked website.

Company is not responsible for the contents or use of any linked website, or any consequence of making the link.

This content is provided by New Start Advantage LLC through a licensed media partnership with Inquirer.net. Inquirer.net does not endorse or verify partner content. All information is for educational purposes only and does not constitute financial advice. Offers and terms may change without notice.