Top States with the Highest Risk of Identity Theft

Identity theft is a severe problem affecting millions worldwide each year. The risk of identity theft varies from state to state, depending on population density, internet access, and the prevalence of financial institutions.

In the United States alone, over 14 million people were victims of identity theft in 2021, based on a Federal Trade Commission (FTC) report. In 2022, for every 100,000 people, over 500 were victims, with credit card fraud being the prevalent type of identity theft.

This type of fraud entails the unauthorized use of an individual’s personal information to steal funds from their credit card account or to establish a new line of credit under their name.

Top US States with the Highest Risk of Identity Theft

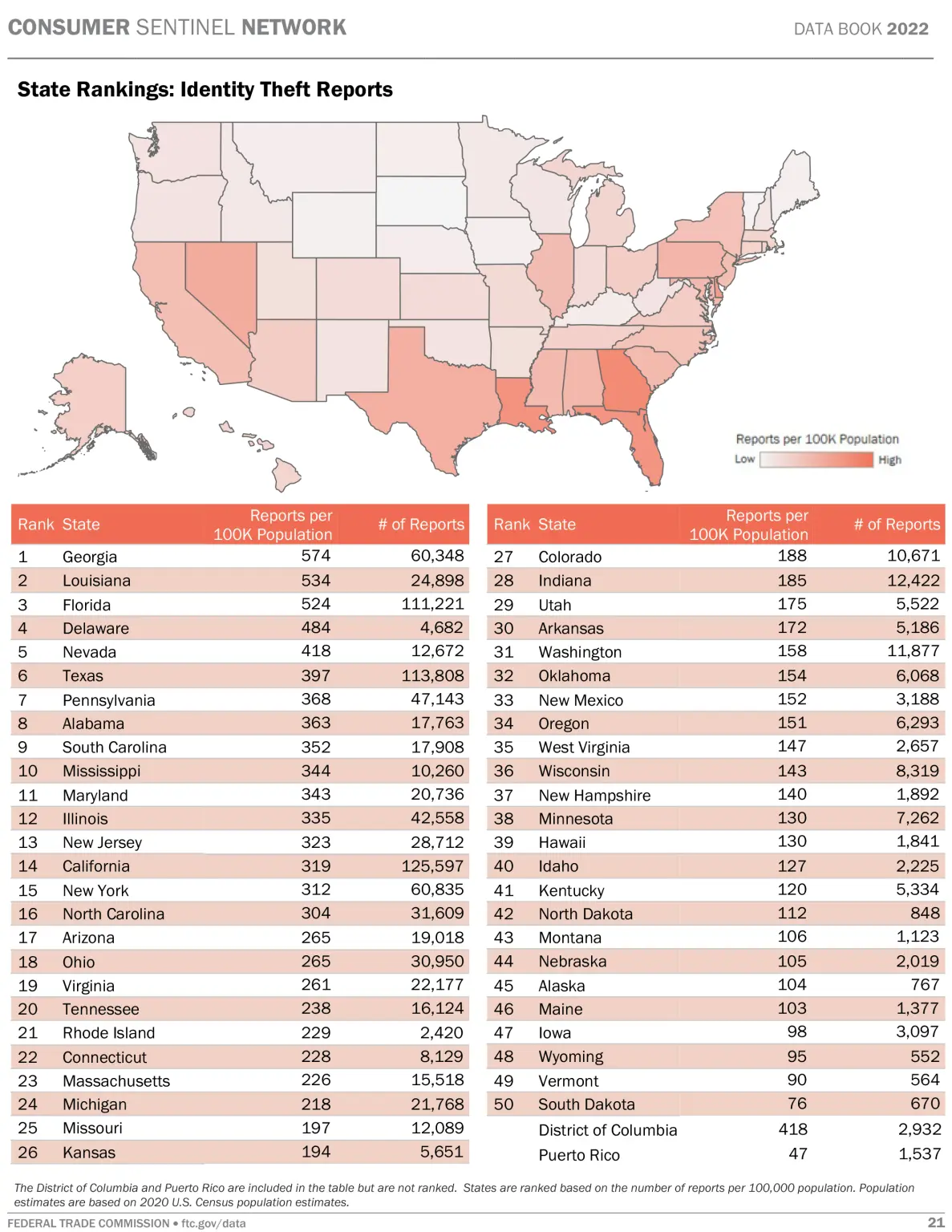

The FTC disclosed that identity theft is increasing, with Florida, Georgia, and California being the top three states where it occurs most frequently.

Photo credit: Federal Trade Commission | ftc.gov/data

1. Florida

Florida is known for its beaches, warm weather, and retirement communities. However, it also has the country’s highest rate of reported identity theft cases per capita.

According to the FTC, Florida had 119,357 reported identity theft cases in 2021. This high rate can be attributed to the state’s large population and many tourists, who often use credit cards for transactions.

You may also like: Most densely populated city in America

2. Georgia

Georgia ranks second among the states with the highest identity theft risk. The state had 74,348 reported cases in 2021, according to the FTC.

One reason for the high rate of identity theft in Georgia is the large number of military personnel stationed in the state. The state also has many financial institutions, making it an attractive target for hackers and identity thieves.

3. California

California has the largest population in the US and also has the third-highest rate of reported identity theft cases. The state had 70,335 reported cases in 2021, according to the FTC.

California is home to many tech companies and one of the states with many internet users. This makes it a target for cybercriminals.

4. Texas

Texas ranks fourth on the list of states with the highest identity theft risk. The state had 54,307 reported cases in 2021, according to the FTC. Texas has many large cities, including Houston, San Antonio, and Dallas. These cities have a high population density, making it easy for identity thieves to steal personal information.

5. New York

New York ranks fifth on the list of states with the highest identity theft risk. The state had 44,068 reported cases in 2021, according to the FTC. The city’s high population density and many financial institutions make it an attractive target for identity thieves.

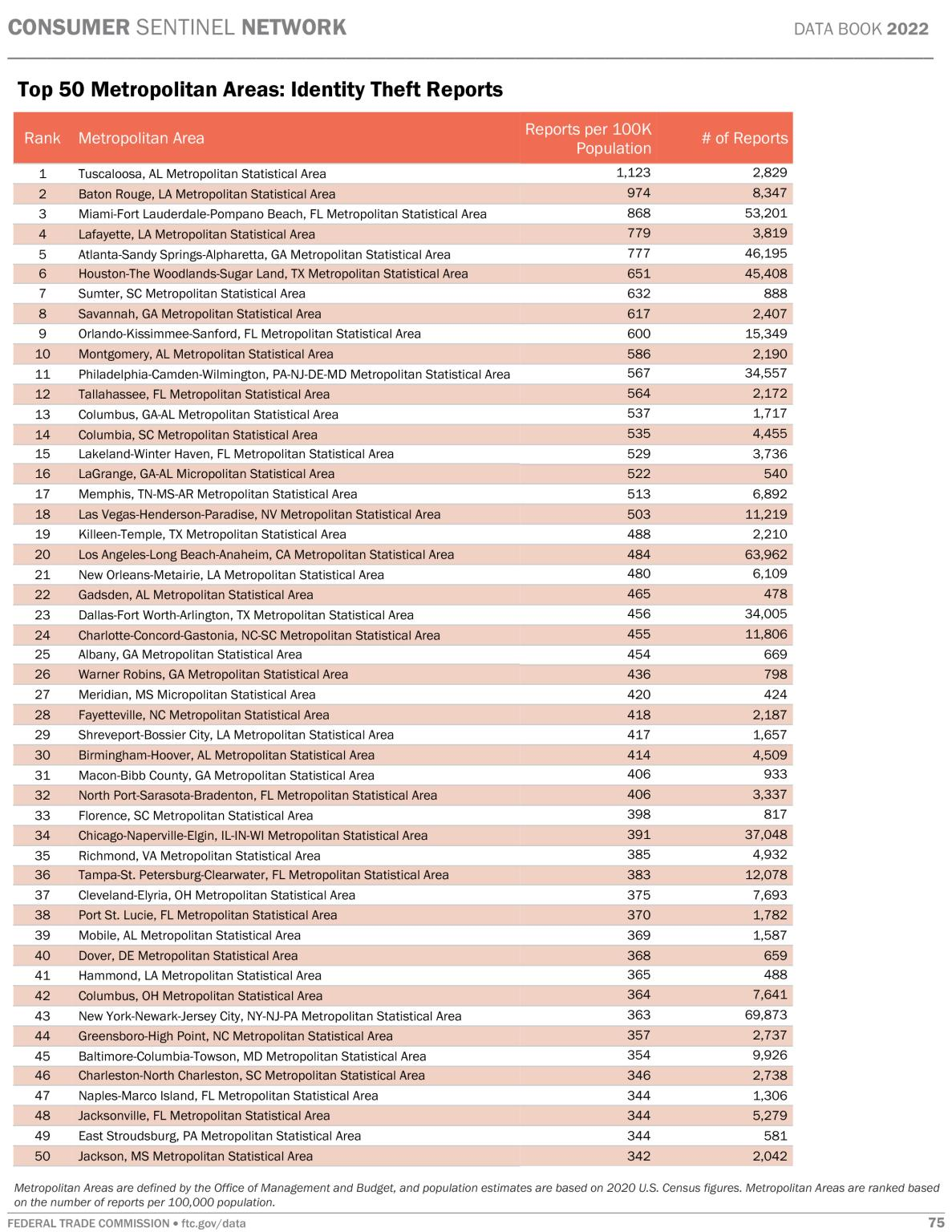

Photo credit: Federal Trade Commission | ftc.gov/data

Other Areas to Note

Apart from states, cities with many residents have also been significantly affected by identity theft. These are metro areas with high population densities.

Tuscaloosa, the biggest college city in Alabama, topped the list as the number one metropolitan area in the United States for identity fraud, with over 1,000 victims for every 100,000 residents.

Following closely behind was Baton Rouge, Louisiana, with 947 victims per 8,347 people. The Miami-Fort Lauderdale and Pompano Beach regions of South Florida came in third, with 868 affected individuals for every 53,201 residents.

Last year, there were 441,822 identity theft cases across the United States. According to the data, Millennials, aged between 30 and 39, were the most vulnerable group, accounting for 25% of all victims. In contrast, individuals aged 80 or older reported the least number of fraudulent activities.

Keeping Secure

The FTC report revealed that the second most common type of scams after credit card fraud were those associated with online shopping and payment accounts, social media, and emails.

Criminals employed various tactics to extract money, including fraudulent activities related to employment, taxes, benefits, loans, utilities, and phone calls.

You may also like: Why crypto theft is spreading worldwide

To safeguard against identity theft, the FTC recommends that Americans keep paper financial records, including Social Security and Medicare cards and other personal documents, in a secure location.

When accessing online accounts, individuals should use a complex password and enable multi-factor authentication for accounts that support it, adding an extra layer of security by requiring multiple credentials to access an account.

The agency also cautions Americans to remain vigilant against scammers who attempt to obtain personal information by calling, texting, or emailing.